Ethereum staking wave

After Ethereum entered the 2.0 era, pledging ETH to run nodes has become a new business. Qualified node operators can obtain about 4% of the ETH currency standard income every year. If you are bullish on ETH in the long term, it is a very good financial choice.

But in fact, the threshold for running a node is not low. It requires not only a financial threshold of 32 ETH, but also technical and hardware thresholds that require the node to operate stably. If you accidentally disconnect, you will be fined.

As a result, a number of staking projects such as Lido and Rocketpool came into being to help users solve financial and technical problems.

The number of ETH pledges continues to rise. Currently, there are more than 29M ETH pledged in the beacon chain, with the total locked position value reaching $71B, and the pledge ratio has increased from It rose from 2.4% in January 2021 to 24.4% now.

(Source: https://cryptoquant.com/asset/eth/chart/eth2/eth-20-staking-rate-percent)

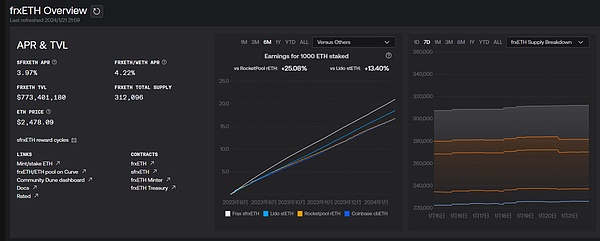

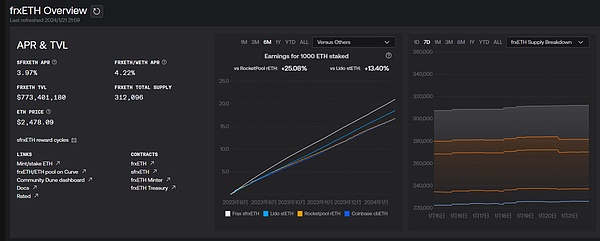

Liquid Staking Token (LST) and LSD (Liquid Staking Derivatives) Fi

When users use a staking protocol, such as Lido, they will receive a liquid staking token (LST), such as stETH.

And LST itself is an ERC20 token, so it is easy to build a liquidity pool to reactivate this part of the locked liquidity and continue Invest in LSDFi projects, such as Frax and Origin, to get more matryoshka benefits.

(Source: https://facts.frax.finance/frxeth)

LSDFi is LST and LST derivatives DeFi projects built on the basis of , such as Pendle, can obtain principal tokens and income tokens after depositing stETH, thus deriving income strategies based on different risk preferences.

From pledge to re-pledge

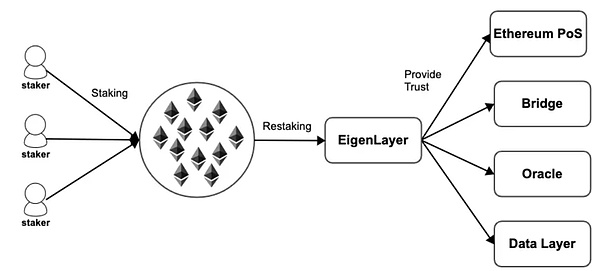

Node staking essentially requires users to pay deposits to run nodes and maintain project security. Nodes that perform their duties conscientiously will receive benefits, while those who fail to perform their duties or commit evil will forfeit their deposits.

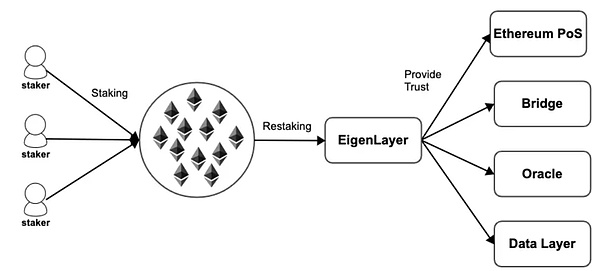

So not only public chains need nodes, but also cross-chain bridges, oracles, DA, such as Chainlink, the Graph, Celestia and other various projects, all require staking. Ensure the stability and security of its nodes.

The number, quality and huge capital investment of Ethereum nodes make it the most reliable public chain.

However, any module that cannot be deployed or verified on the EVM cannot take advantage of the trust of the Ethereum network and requires someone to run the node and provide active verification services ( AVS).

And running nodes requires users to shell out real money to ensure safety, which is bound to be difficult under the premise of limited liquidity.

The plan proposed by EigenLayer is to allow other AVS to inherit and share the security of Ethereum through re-pledge.

(Source: EigenLayer)

Essentially, EigenLayer provides a pool security mechanism and a security market , that is, multiple projects can share the Ethereum security pool, and users need to weigh the benefits and risks provided by each project to choose to join or exit the re-staking module built on EigenLayer.

The economic benefits of re-pledge are obvious.

For users, they can eat more with one fish and pledge one Ether. Square, harvesting pledge returns from multiple projects, including airdrop expectations for unissued currency projects (especially EigenLayer);

For For the project side, it reduces the pressure of obtaining pledged funds while inheriting some of the security of Ethereum.

Of course, this is not a completely risk-free win-win outcome.

For the project side, the pledge token is Ethereum instead of Their own tokens add another layer to their ability to capture token value;

Users have one more token in their pledge EigenLayer's trust layer adds a layer of risk.

For Ethereum, it is even less satisfied, which is equivalent to one employee working multiple jobs. And due to the additional staking income, without restrictions, users will definitely be more willing to pledge Ethereum into EigenLayer instead of pledging directly into Ethereum. If the employee is slashed for any reason in another company (perhaps due to a violation of discipline or wrongful punishment by the company), this will in turn affect his or her pledge in Ethereum and even cause the node to become invalid. , shaking the security of the Ethereum network. Therefore, V God previously issued an article stating that not to overload the consensus of Ethereum, just click on EigenLayer.

Liquid Restaking Token (LRT) and LRTFi< /h2>

For users, staking to EigenLayer is a good choice with multiple benefits, but it faces several problems:

< ul class=" list-paddingleft-2">

Pledge does not enter EigenLayer. Because EigenLayer is so popular, the types and amounts of LST that are allowed to be pledged are currently very limited, so it is difficult for users to squeeze in;

After depositing ETH or LST, the liquidity is locked;

The choice of node operators and participation Project risk management, etc., have exponentially increased the complexity of strategic research.

Therefore, the emergence of the LRTFi project mainly solves these problems and lowers the threshold for re-pledge.

LRTFi will return the ETH/LST pledged into EigenLayer in the form of LRT Liquidity to users;

As for EigenLayer’s points, they are either mined by the project itself before the transfer, or mined through EigenPod (EigenLayer allows re-staking directly on the beacon chain, with no quota limit);

Better risk management strategies, such as Puffer Anti-Slashing mechanism (preventing nodes from being slashed).

The income of LRT is built on LST, which will obviously have higher returns. At the same time, LRT projects will also have higher risks. The main risks are as follows.

The contract risks of multiple agreement nesting dolls, so you must choose carefully Audited LRT projects;

LRT projects also involve many assets, so they also include the risk of pledgeable LST;

Participating in more AVS for high returns will lead to an increase in margin penalty risk exposure;

The other is the liquidity risk of LRT itself. Like LST, there will also be de-anchoring and other phenomena. These are the risks of participating in the LRT project.

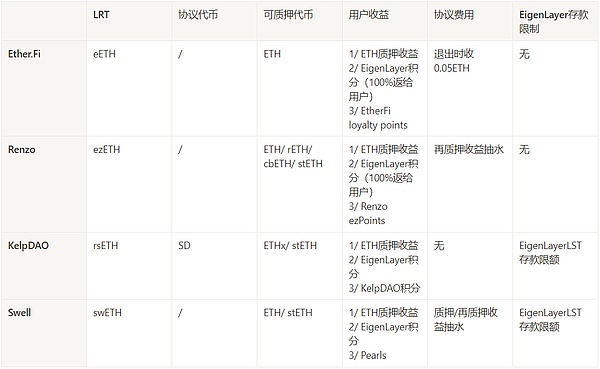

LRT Project

Currently, LRT projects have been launched, including EtherFi, Renzo, Swell and KelpDAO, and nearly ten more are on the test network. There is not much difference in the gameplay of the projects. The main difference lies in the mining of EigenLayer points. In terms of capabilities and exit liquidity, next I will introduce to you the four projects that have been launched.

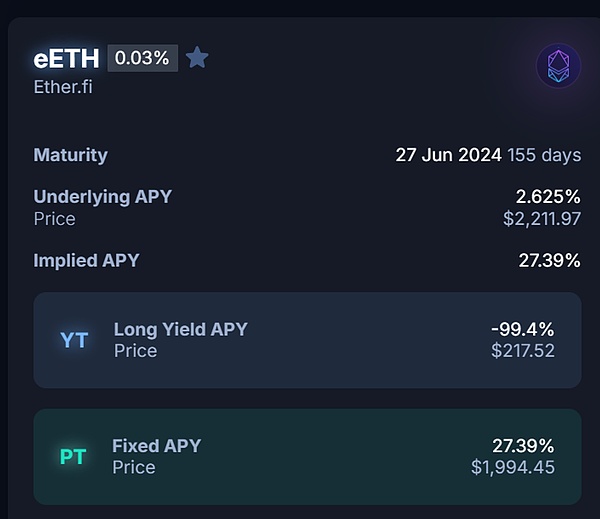

Ether.Fi

EtherFi completed a US$5.3 million seed round of financing in February last year, and its current TVL exceeds US$330 million.

Users can get $eETH by depositing ETH. By participating, they can get EigenLayer points and EtherFi's own loyalty points at the same time, which are both reference standards for subsequent airdrops. It is also very convenient to withdraw from liquidity. The unstake function is now online and the friction of withdrawal is small.

(Source: https://defillama.com/protocol/ether.fi)

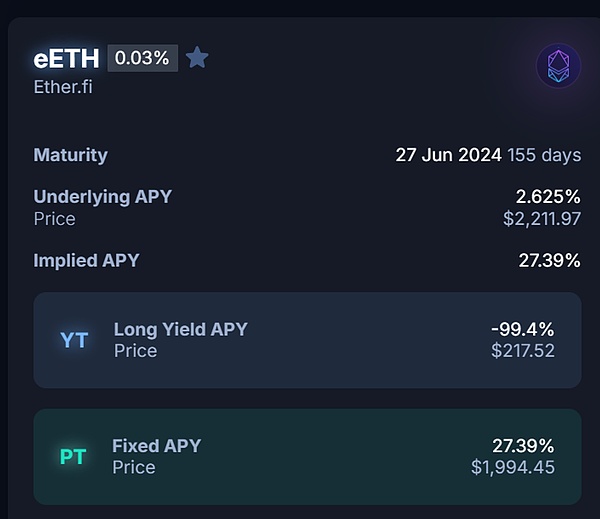

Further, you can change $ Deposit eETH into Pendle to split PT and YT. Currently, YT has a high premium. If you sell it immediately, you will get a 10% profit. The remaining PT can be redeemed for the full principal after maturity.

Please see the detailed operation:

One fish and three meals: Use Pendle to get ten times EigenLayer Points tutorial

https://mirror.xyz/0x30bF18409211FB048b8Abf44c27052c93cF329F2/X6_C9xgM2-t0fbjCSDtLBwxkXDPVf2rXF-JoKQVwRJg

( Source: https://app.pendle.finance/trade/markets)

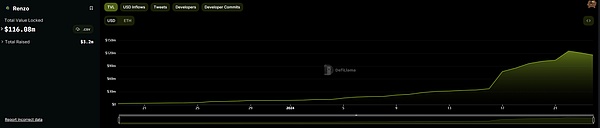

Renzo

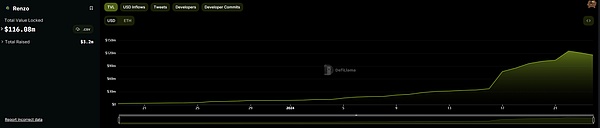

Renzo has previously disclosed less information. After announcing a 3.2 million seed round of financing led by Maven11 last week, TVL rose in response. It currently reaches US$100 million.

In addition to ETH, Renzo also supports LSTs, such as rETH, cbETH, stETH. Renzo’s LRT token is $ezETH, and it has launched the points program Renzo ezPoints. The way to obtain points is to mint $ezETH. There is currently no way to withdraw from liquidity.

(Source: https://defillama.com/protocol/renzo)

KelpDAO

KelpDAO is launched by the old project Stader. Similarly, if you get LRT $rsETH after staking, you can get KelpDAO points.

After EigenLayer opens deposits on January 29, all coins currently deposited will be transferred to EigenLayer and double points will be obtained.

Compared with other projects, there are fewer airdrop expectations, and Stader’s token $SD is already available. Moreover, KelpDAO's pledge is through EigenLayer's LST open pledge, so there is an upper limit on the funds that can be accommodated, but it cannot be withdrawn temporarily.

(Source: https://defillama.com/protocol/kelp-dao)

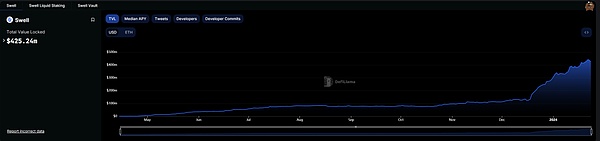

Swell

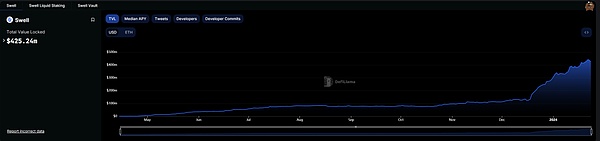

Swell is an LST project and has joined the LRT ranks. Users can deposit ETH can be used to earn staking income, and swETH can also be used to participate in projects such as Pendle.

Its Super swETH product allows users to deposit ETH or stETH to obtain annualized returns of up to 18%. In addition to staking income, you can also obtain Pearls (pearls, similar to a point certificate), which may be exchanged for Swell tokens during TGE.

The current TVL of the protocol exceeds $425M. Depositing swETH will not be able to obtain EigenLayer points until EigenLayer opens mining on January 29. rswETH that will launch LRT in the future can directly It is also very convenient to participate in dual mining and withdraw liquidity. There is a trading pool where you can directly swap to ETH.

(Source: https://defillama.com/protocol/swell)

Puffer

Puffer is based on the liquidity staking protocol on Eigenlayer. It is a very technical re-staking project and received Ether early. Funding from the Fang Foundation will be used to develop Secure-Signer technology to reduce the risk of slashing and maximize the number of independent operators to achieve network decentralization.

Puffer's node is both a verification node of Ethereum and a native node on EigenLayer, so it can obtain Ethereum rewards and Eigenlayer re-staking rewards at the same time. Puffer received $5.5 million in seed funding from investors including the founders of EigenLayer.

Ethereum and EigenLayer both have penalty mechanisms. The private key security and anti-penalty issues of the Puffer node are jointly protected by Secure-signer, RAV software and TEE hardware. Effectively reducing the risks of LSD and LSDFI assets.

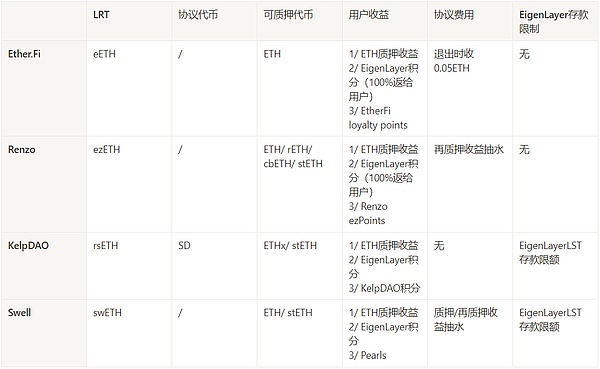

The summary table of projects that have been launched is as follows:

LRT projects based on EigenLayer are relatively complex and involve all aspects of details.

For example, the types of tokens that can be pledged (ETH, LSTs), the token of the protocol itself (LRT), the source of rewards distributed, the protocol charging model, the pledge to EigenLayer's path (whether through LST staking or EigenPod staking, which determines the upper limit of the protocol's capital cap).

Similar to the LST project, under the premise of contract audit security, the earlier the LRT project goes online, the easier it is for the agreement to have a first-mover advantage and build its own brand and network. effect.

The funds on the market are limited, so it is crucial to seize the opportunity and lead the market. However, LRT has its complexity, and how to manage risks is also a major competitiveness of LRT projects.

The LRT project will be the same as the LST project. In order to ensure the stable operation of the nodes, it will seek cooperation with DVT technology projects, such as Obol, SSV; LRT-based lending , dex, and derivatives will gradually appear; in addition, providing support for multi-chain projects will also be one of the development directions of the LRT project.

JinseFinance

JinseFinance