Source: Beosin

We have previously reported that Turkey is increasingly facing some problems in its pursuit of cryptocurrency freedom. The most criticized thing is that some local crypto projects have violated the law, causing huge losses to investors.

On May 30, 2024, the Turkish Minister of the Interior revealed that the authorities conducted a large-scale operation against a cryptocurrency fraud project in Ankara, 127 suspects were detained, and a large amount of assets and several guns were seized.

The project involved is called Smart Trade Coin. Since 2021, Turkish investors have been protesting and condemning the project's practices, which is suspected to be a fraud project. According to the victims' lawyers, the number of users deceived by the project is as high as 50,000, and the amount of losses exceeds 2 billion US dollars.

What is Smart Trade Coin (STC)?

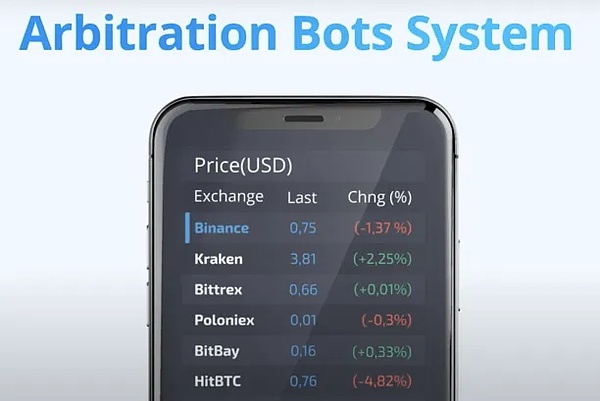

Smart trade coin claims to provide software that connects to multiple cryptocurrency exchanges. It claims to help users manage multiple cryptocurrency exchange accounts with one application, allowing them to:

Use all exchanges through a single interface, configure automated trading robots for automatic trading, and earn income by arbitrage price differences between exchanges, as shown below:

Is Smart Trade Coin (STC) a scam?

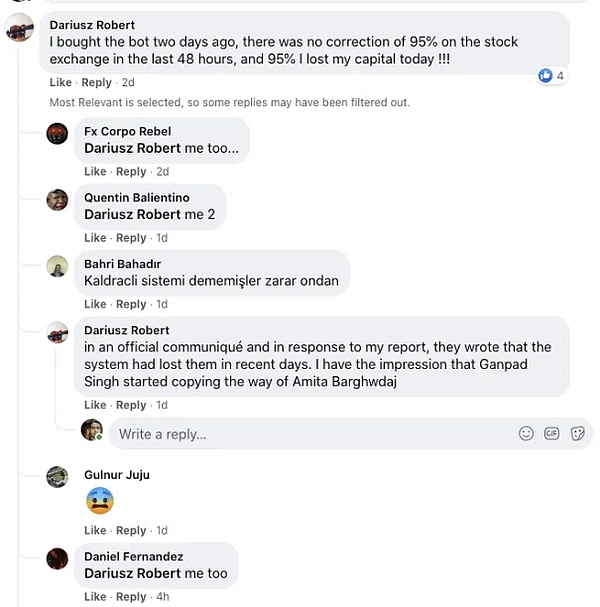

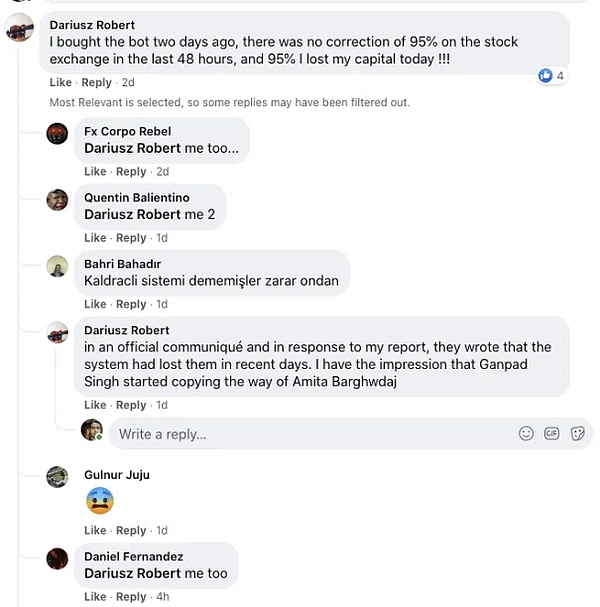

In 2023, AI Multiple's chief analyst Cem Dilmegani shared a research article about the project on the Ai Multiple platform, which repeatedly stated that the project is likely to be a cryptocurrency scam, and belowthere are also many users who said they have been defrauded of a large amount of funds.

In the app store, about half of the reviewers called the app a scam.

Many users reported that they lost 95% of their savings. Users lost their savings and could not verify that the funds were not taken by the Smart Trade Coin (STC) team.

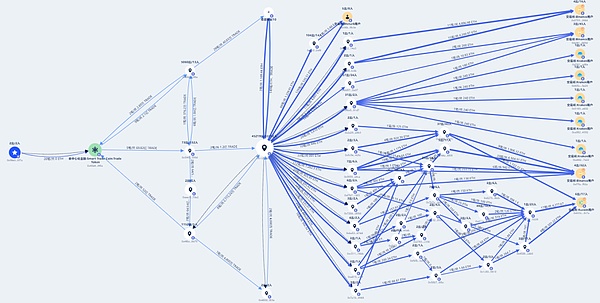

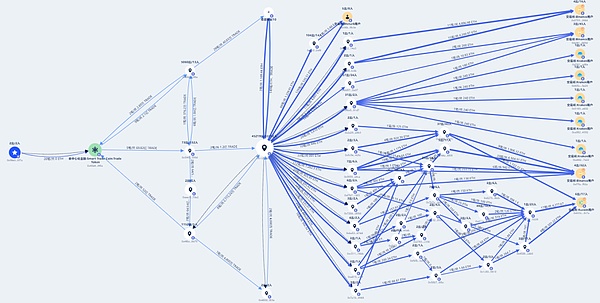

After Beosin KYT on-chain analysis, we locked some addresses used by suspected scammers to save and transfer stolen funds.

Since the flow and address of the stolen funds were not made public, we used Beosin KYT to conduct relevant money laundering analysis and tracking of the stolen funds based on the project name Smart Trade Coin.

From the figure, we can see that the STC token contract distributed the main funds to the 0xc12c address through the 0x5f45 address. According to the way of expanding the transaction, we can see that the address has carried out a large number of ETH one-way outflow transactions, and the funds involved are huge, which is close to the estimated loss amount announced, and the transaction fees of the addresses involved in the outflow of ETH all come from the 0xc12c address, so we have reason to suspect that the address is the address distributed as stolen funds.

The figure only shows a small part of the flow of funds, and the address involves more than 20,000 outflow transactions. According to this small part of the transaction display, it can be seen that after the suspected fraud address distributed funds, some funds flowed directly to various exchanges, and some funds were transferred, pooled and dispersed through multiple layers, and finally flowed into the exchange.

Should the local regulatory framework be established?

The Kocaeli newspaper reported dozens of criminal lawsuits filed against the cryptocurrency trading platform. In 2021, 50 people gathered in front of the Ankara Court to protest Smart Trade Coin and its team.

The victim's lawyer Yagiz Kaya said the company had defrauded more than 50,000 people in Turkey. At the time, the company took no action, despite numerous complaints and an estimated $2 billion in investor losses.

In addition, some victims said they were encouraged to take out loans and sell their homes or cars to earn “36% monthly profits.”

Rather than making huge profits, most clients ended up with nothing and in debt.

AI Multiple lead analyst Cem Dilmegani noted that the company’s claims were unrealistic. The now-defunct website claimed to “provide software that connects multiple cryptocurrency exchanges” and “help users manage multiple cryptocurrency exchange accounts with one application.”

Even if the company had developed technology to generate consistent returns through arbitrage, it would not market itself to retail investors. It would raise funds and conduct large-scale arbitrage.

Finally, the analyst stressed thatthe company’s opaque business practices, deceptive marketing, and lack of information all indicated that the company was a scam from the start.

This incident has made all sectors of Turkish society realize that it is not enough to simply pursue cryptocurrency freedom, and a corresponding regulatory framework must be established. Only in a compliant and transparent environment can the cryptocurrency industry be truly trusted and adopted by the public.

Therefore, on the path of cryptocurrency regulation in Turkey, the government and the industry need to cooperate with each other to seek a balance between safeguarding investor rights, preventing financial risks, and protecting innovative development. Only under the premise of adhering to compliant operations can cryptocurrency truly become a powerful tool for promoting economic freedom and hedging value-added.

JinseFinance

JinseFinance