Author: Arjun Chand Source: bankless Translation: Shan Oppa, Golden Finance

< p style="text-align: left;">The bull market is in full swing.

Bitcoin broke through an all-time high of $70,000, Ethereum briefly hit $4,000 again, and the total cryptocurrency market cap reached $2.5 trillion. History shows that we are at the beginning of an exciting time.

In a bull market, time is money - every second counts. Every decentralized finance enthusiast follows the principle of “buy first, research later”.

p>

In times like this, when every piece of news affects prices, project parties often use vaguely popular words in order to cater to market enthusiasm.

This glossary from Bankless will be your “secret book” for discerning the authenticity of information and determining whether a project is truly valuable. We hope it becomes a valuable resource as you research and pick winners in this bull market.

Let’s take a closer look!

What are the hottest cryptocurrency investment stories of 2024?

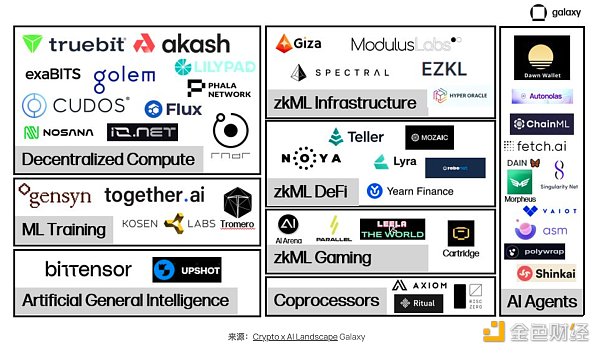

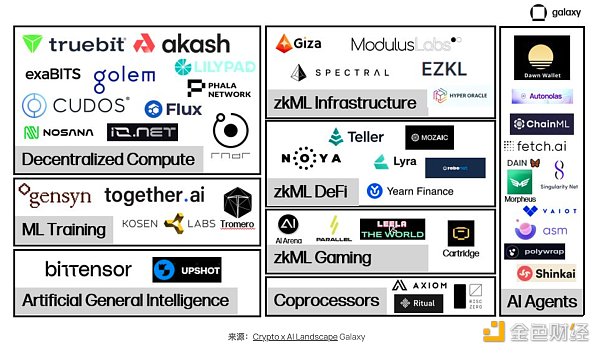

Decentralized artificial intelligence

Go directly to the current hot topic, decentralized artificial intelligence involves distributed networks Open source AI systems that run on a blockchain (e.g. blockchain) rather than under the control of a single organization. This approach leverages the benefits of blockchain technology to democratize artificial intelligence and make it easier for everyone to access and use it.

p>

Example: Projects such as Bittensor, Render, and Grass have created an open market where individuals can train machine learning models, contribute computing resources, and share data. This creates a more inclusive and stimulating environment for AI innovation.

Narrative: The general consensus is that the intersection of artificial intelligence and cryptocurrency will be one of the themes of this cycle, as it is probably the most easily understood investment by the masses Chance.

Recommended reading:

Bankless: AI x Crypto will define the bull market in 2024

Re-pledge< /h2>

Re-staking is a strategy where investors leverage their staked assets to earn additional rewards, effectively compounding returns. This is done by participating in further staking opportunities using staking assets on the secondary platform.

Example: EigenLayer is a pioneer in the re-staking movement, which enables users to re-stake already with various liquidity staking offers The ETH pledged by the merchant. The ETH re-staked on EigenLayer will then be used within its security framework, designed to extend Ethereum’s security guarantees to other applications and blockchains.

Narration: Re-staking is expected to be one of the biggest events in 2024. More than $11 billion has been re-staked on EigenLayer, which will It is positioned as TVL’s second largest application in the cryptocurrency space. An entire ecosystem of applications is being designed on EigenLayer, and this growth is expected to continue.

Recommended reading:

Bankless: Risk Management of EigenLayer

Bankless's five major predictions for the crypto industry in 2024: EigenLayer, airdrops, solana

Bankless: Why EigenLayer is the next billion-dollar airdrop Chance?

Bitcoin L2

Bitcoin Layer 2 Solution (Bitcoin L2 Coin L2) is a network or protocol built on the Bitcoin blockchain (L1). They are designed to extend the Bitcoin network by processing off-chain (outside the Bitcoin blockchain) transactions while inheriting its security and benefiting from its network effects.

Examples: Lightning Network, Stacks, and BitVM are popular Bitcoin L2s.

Narrative: Bitcoin L2 has the potential to follow in the footsteps of Ethereum’s Layer 2 success and free up some of the idle capital on Bitcoin. This could drive wider adoption and bring value into the Bitcoin ecosystem.

Recommended reading: Bankless: 8 Bitcoin L2s You Should Pay Attention to

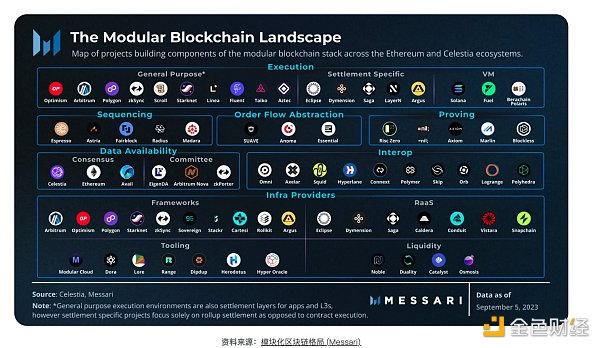

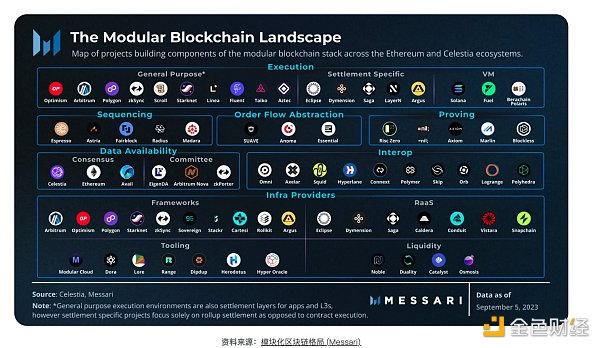

Modular

Modularity refers to the design approach to building blockchains and applications in cryptocurrencies, where the system is built using separate specialized components or modules. This design philosophy aims to make the technology stack more efficient and scalable by isolating the functionality of each module from other modules.

p>

Example: In blockchain development, modularization often involves dividing the architecture into three main layers: execution, settlement, and data availability . The goal is to make blockchain cheaper and more scalable through specialization.

Different projects focus on different parts of the stack. The term is largely popularized by Celestia, which focuses on the data availability aspect of the stack, while Ethereum is recognized for its strong settlement layer and Solana is widely praised for its execution capabilities.

Narrative: One of the most prominent narratives surrounding modularity is the concept of "modular currency"; Celestia is in the modular block The forefront of chain movement. This narrative combines several others mentioned on this list, such as the Alt L1 narrative and the DA layer, among others.

Recommended reading: Bankless: Taking stock of the new tool of modular Rollup

Data availability

Data Availability (DA) guarantees that all data required to verify transactions on the blockchain is accessible to anyone who needs it.

This is crucial for validating transactions and maintaining the transparency and security of the chain, as anyone can use this data to reconstruct the entire state of the chain if needed .

p>

Example: Traditionally, aggregation has relied on Ethereum to meet its data availability requirements. However, with the introduction of more cost-effective options such as Celestia, EigenDA, and Avail, we are witnessing a shift as projects begin to adopt these new platforms for their data availability needs.

Narration: The DA layer provides a new way to extend the blockchain and will become the blockchain to publish data center of.

Recommended reading:

Dismantling the Data Availability Layer: The Overlooked Lego Bricks of a Modular Future

DePIN

The Decentralized Physical Infrastructure Network (DePIN) is built based on blockchain technology Decentralized networks to manage and coordinate systems for real-world physical infrastructure.

DePIN aims to increase efficiency and reduce infrastructure costs by distributing control and ownership to individuals who are incentivized to participate in the network.

p>

Example: Helium is recognized as a DePIN initiative, creating a decentralized wireless network that rewards contributions using Helium network equipment Coverage individuals. Other notable DePIN projects include Hivemapper, which focuses on global map networks, and Filecoin, which provides decentralized file storage solutions.

Narrative: DePIN represents a real-world use case for cryptocurrency and blockchain technology. Synergies with emerging trends, such as the integration of cryptocurrencies with artificial intelligence, further enhance DePIN’s relevance. The rise of AI agents is likely to increase demand for resources that the DePIN project can provide efficiently and cost-effectively.

Recommended reading:

Is Helium Mobile the new Ponzi with the dual narratives of Solana and DePIN and the dual flywheel currency price rising model?

Alt L1

Alt L1

Alt L1 Layer 1 (alt L1) is a blockchain that positions itself as a competitor to mainstream blockchains. These blockchains aim to address the limitations of existing blockchains by employing different technological approaches to optimize unique features.

Example: During the last bull run, Solana and Avalanche became famous as Alt L1, challenging Ethereum as the market leader leading position. Solana focuses on high throughput, scalability, and low transaction costs, while Ethereum continues to emphasize security and decentralization.

Narrative: Alt L1 trades were the defining theme of the last cycle, with Solana, Terra, and Avalanche (often grouped as SolLunaAvax") is at the forefront. The general consensus is that Alt L1 trading will never go away and will remain a key theme every cycle.

In the current bull market, Solana remains the favorite, while we also have newcomers like Celestia gaining traction. The abbreviation “Solestia” has become a buzzword on cryptocurrency Twitter, representing the Alt L1 narrative of the cycle.

Recommended reading: Why Alt L1 is Bullish

Intention

Intent in the context of blockchain refers to the outcome or final state that a user wishes to achieve on the chain (e.g., executing a transaction, borrowing or lending an asset). The actual implementation work is delegated to a third-party agent, rather than the user performing these operations directly. These agents often compete in an auction-like environment for the right to fulfill the user's intent in the most efficient way.

p>

Example: The DeFi ecosystem hosts a variety of intent-driven projects, including basic protocols such as Anoma, Suave, and Essential, Cowswap, Applications such as Across and third-party agents such as Propellerheads and Barter.

Narrative: Intent-centric protocols are at the vanguard of DeFi, generating billions in order flow. They provide significant opportunities to capture value through fees, MEV, and more. These projects also have the potential to greatly enhance the DeFi user experience, serving as an abstraction layer that simplifies interactions in increasingly complex multi-chain ecosystems.

Recommended reading:

Wanzi Research Report: Design principles, required elements and 4 related solutions of the "Intent" central architecture

Interoperability

< p style="text-align: left;">Interoperability refers to the ability to seamlessly communicate and exchange data and assets between different blockchains. This feature unlocks the ability for users to move assets across chains and for applications to run on multiple chains.

Example: Projects such as LayerZero, Axelar, and Wormhole focus on facilitating data transfer between chains. Applications such as Across, Stargate, and Connext focus on asset transfers. In addition, there are liquidity aggregators such as LI.FI.

Narrative: The multi-stranded thesis is being played out in real time. Today, many different blockchains have billions of dollars of value locked in their DeFi ecosystems, serving millions of users. There is a clear need to move data and value across these chains, and this need will only increase as the number of chains increases. Projects that facilitate the exchange of data and value between chains are valuable tracks for multi-chain ecosystems.

Recommended reading: Consensys Report: Mechanisms, Importance and Risks of Cross-Chain Interoperability

Inscription

Inscription is a technique for writing arbitrary data directly onto a single satoshi (the smallest denomination of Bitcoin) (1 Bitcoin = 100,000,000 satoshis). These inscriptions, often referred to by the public as "Bitcoin NFTs," create unique digital assets on the Bitcoin blockchain. They can also be used to mint BRC-20 tokens based on the experimental BRC-20 standard.

Example: Collections of Bitcoin NFTs such as NodeMonkes, Quantum Cats, and Bitcoin Puppets are well-known examples of inscriptions. These can be traded on platforms such as OKX’s Ordinals Market and Magic Eden. Leading BRC-20 tokens by market cap include ORDI, SATS, and MUBI.

Narrative: NFTs have become one of the most popular and valuable assets in cryptocurrency. Bitcoin holders now have the opportunity to expand their investments into new Bitcoin-based applications such as NFTs and BRC-20 tokens, which offer potentially significant opportunities.

Recommended reading: Bankless: Ordinals Series Question Guide

Parallel EVM

Parallel EVM is an innovative blockchain architecture designed to overcome the scalability challenges faced by standard EVM. It does this by executing transactions in parallel (processing multiple independent transactions simultaneously rather than sequentially), thereby increasing throughput and improving user experience.

Imagine a trading platform on Ethereum where each transaction is processed one after another. In contrast, parallel EVM will allow transactions independent of each other to execute simultaneously, significantly speeding up transaction processing time.

Example: Projects such as Monad and Sei are leading the way in parallel EVM development. Other well-known projects, such as BNB Chain and Scroll, also include parallel EVM capabilities in their future plans.

Narrative: The field of parallel EVM is particularly promising because it leverages the established network effects and developer ecosystem of EVM while also Incorporates parallel processing technology that contributes to Solana's fast execution speed. These platforms have huge potential by offering a mix of EVM compatibility and high-speed transaction processing.

Recommended reading: Bankless: Why does Monad have the potential to replace Ethereum?

RWA

RWA, real world assets, covers a wide range of tangible and intangible assets such as gold, real estate, commodities, stocks, and fiat currencies such as the U.S. dollar, whose intrinsic value exists outside the blockchain ecosystem. Tokenization of these assets brings them to the blockchain, providing innovative ways for their trading, management and valuation.

Example: The best examples of tokenization of real-world assets are stablecoins like USDC and USDT, which represent the U.S. dollar on-chain. While stablecoins are the basic application of RWA, there are many projects, such as Ondo, Parcl, and Mattereum, that are extending the concept to a variety of assets, including real estate, treasury bills, gold, art, and more.

p>

Narrative: The RWA protocol has the potential to tokenize nearly every asset in the world and bring it to the blockchain, thus Access a multi-billion dollar addressable market. As more asset classes are tokenized, the scope of the RWA narrative is expected to expand significantly.

Recommended reading: Bankless: Tokenizing US Treasury Bonds and the RWA Revolution

JinseFinance

JinseFinance