Author: Matthew Sigel, Denis Zinoviev Source: VanEck Translation: Shan Ouba, Golden Finance

The halving on April 20, 2024, brings both opportunity and uncertainty to the Bitcoin community. This event, built into Bitcoin's underlying code, changes the rewards for miners and could significantly affect Bitcoin's value and role in the broader ecosystem.

Bitcoin Halving Cycle Explained

The Bitcoin halving is a major event in the Bitcoin world that affects investors and other relevant people. Approximately every four years, the reward for mining a new Bitcoin block is reduced by half. This is done to control the supply of Bitcoin, making it more like a scarce resource like gold. Halving helps keep the value of Bitcoin stable over time by reducing the rate at which new Bitcoins are created.

Bitcoin halving was proposed by its creator Satoshi Nakamoto to control inflation and ensure that the digital currency remains a deflationary asset. Initially, miners received 50 bitcoins as a reward for processing transactions and supporting the blockchain network. After the first halving in 2012, the reward was cut to 25 bitcoins, and subsequent halvings have further reduced the reward each time.

History of Bitcoin Halvings

Bitcoin’s halving history is interesting, showing its growth starting in 2009. Since then, Bitcoin has undergone several halving events, each of which has played an important role in its development.

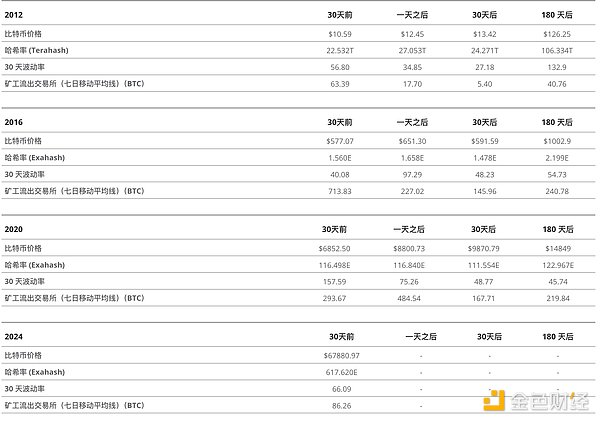

First Halving (November 2012): Bitcoin’s first halving occurred when the network reached 210,000 blocks. The mining reward was reduced from 50 bitcoins per block to 25 bitcoins. The event marked the first test of Satoshi’s theory of controlled money supply and deflationary economics. Despite initial uncertainty, the Bitcoin network remained stable and the price of Bitcoin surged from $10.59 to $126.24 in 180 days, reinforcing the viability of its underlying economic principles.

Second Halving (July 2016): With Bitcoin firmly established in the public consciousness, the second halving reduced the block reward to 12.5 Bitcoins. This period saw the rise of cryptocurrencies as a legitimate investment class, with increasing participation from both retail and institutional investors. After the halving, Bitcoin experienced a significant rally, peaking at over $1,002.92, setting the stage for the 2017 bull run.

Third Halving (May 2020): The final halving reduced the reward to 6.25 Bitcoins per block. The halving has been closely watched by investors around the world amid uncertainty in the global economy due to the COVID-19 pandemic. It has played a crucial role in Bitcoin’s stellar performance from 2020 to 2021, with the cryptocurrency reaching an all-time high of $14,849.09 in 180 days and becoming the focus of discussions around the role of digital currencies in future finance.

Source: Glassnode As of April 10, 2024. Past performance is not a guarantee of future performance. It is not intended as a recommendation to buy or sell any security mentioned in this article. Terahash stands for one trillion hashes per second. Exahash stands for one quadrillion hashes per second. Past performance is not a guarantee of future performance.

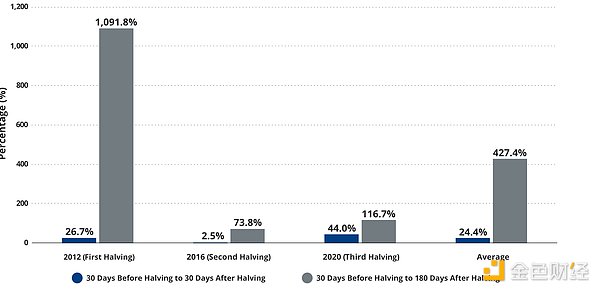

Bitcoin’s most explosive gains are usually after the halving

Source: Glassnode as of April 10, 2024. Past performance is not a guarantee of future performance. It is not intended as a recommendation to buy or sell any of the securities mentioned in this article. Terahash stands for one trillion hashes per second. Exahash stands for one quadrillion hashes per second. Past performance is not a guarantee of future results.

2024 Bitcoin Halving: Looking Ahead

The halving promises to be a watershed event, with rewards set to be reduced to 3.125 bitcoins per block. This moment is expected to profoundly impact the mining landscape, with the potential to reshape profitability metrics and accelerate technological advances in mining efficiency. Historical precedent suggests that an adjustment period is needed as miners cope with the reduction in incentives, with potential impacts on the network’s hash rate and overall security.

Historically, hash rate (the total computing power dedicated to mining and processing transactions) has fallen after a halving as unprofitable miners disconnect, but tends to recover within a few weeks. This is because the halving exacerbates bitcoin’s scarcity, potentially driving up prices and increasing profits for those who are able to continue mining. If the price increase outstrips the reward reduction, as has been the case a year after each previous halving, mining can remain profitable even with a reduced number of coins per block. This is because the survivors gain market share of the network as others exit. In addition, halvings incentivize miners to invest in more efficient equipment to remain competitive. As a result, the hash rate tends to experience a temporary drop, but in the long run, efficiency and overall hash rate rise.

This is why we recommend in our 2024 Forecast article that investors reduce their holdings of Bitcoin miners in the six months before the halving, as the market generally underestimates the first-order effect of rising costs. Miners often issue large amounts of funds during this tricky period. After the halving, some miners may be forced to shut down, resulting in a possible short-term drop in the network hash rate (the combined computing power dedicated to mining).

Impact of Bitcoin Halving on Miners and Markets

That said, the impact on Bitcoin miners will vary. The electricity costs associated with running energy-intensive mining equipment are a miner's largest expense, typically accounting for 75-85% of a miner's total cash operating expenses. The current electricity costs for the listed range average about $0.04/kWh. At this cost, we estimate the all-in cash costs for the top 10 publicly traded miners after the halving to be about $45,000/BTC. Large miners with lower costs per coin will see their profits shrink, but may still remain profitable, especially if Bitcoin prices rise. We believe the halving will likely lead to consolidation within the mining industry, with smaller miners squeezed out and larger miners increasing their market share. However, this trend is already in place, as publicly traded miners now control a record percentage of hashrate.

The Future of Bitcoin After Halving

As mining rewards decrease, transaction fees may become more important to miners' profitability. The halving emphasizes Bitcoin's scarcity, attracting investment and speculation. It reaffirms the principles of Bitcoin as a decentralized, finite, and secure asset, shaping its role in the evolving financial landscape.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coindesk

Coindesk Cointelegraph

Cointelegraph