Potential variables in the Bitcoin halving pattern

In the next market (until next year), if the price of Bitcoin is seriously overvalued, I estimate that the four-year cycle will continue at least once more.

JinseFinance

JinseFinance

Author: G. Santostasi; Compiler: Liu Jiaolian

Foreword: On March 25, Jiaolian shared the article "Bitcoin's Time Power Law Model and Its Cointegration Revisited." The time power law model introduced in it was first introduced in the article "Bitcoin's Price Corridor" on July 24, 2021. Later, it was reviewed repeatedly in many articles and used as a price forecasting tool. Some articles were mentioned in the March 25 article "Teaching Chain Press" and will not be listed here.

There is a contradiction here, I wonder if any readers will find it. In essence, the power law model denies S2F. Because in power law space, there is only time dimension but no supply dimension. Borrowing from the science fiction novel "Three Body", the problem that caused the death of many physicists can be applied like this:

Half halving no longer exists.

An old leek once asked in despair: If the halving of output has a decisive effect on BTC, then why does it have no effect on LTC (Litecoin)? Woolen cloth?

Halving and bull market are just false associations. Maybe the halved cow never existed and never will.

If halving does not exist, then we will perfectly solve the problem of header analysis. The answer is simple: neither the halving drives the bull market nor the bull market precedes the halving. The two have nothing to do with each other.

Although it sounds difficult to accept, for those who believe in Occam's razor, the power law theory of halving is indeed more beautiful. .

Today, I will start with a recent (2024.3.20) article "Bitcoin Power Law Theory" by Giovanni Santostasi, the proposer of the power law model ( The Bitcoin Power Law Theory) is introduced to all readers as a basis for further in-depth discussions on related topics.

Illustration: Bitcoin is similar to a natural phenomenon, not an ordinary asset. Credit for this beautiful artwork goes to @BainterSAT

Bitcoin is more like a city and an organism than a financial asset.

I started researching Bitcoin 12 years ago.

I publish my explorations on Reddit rather than in a journal, mainly because I want to reach out to the broader Bitcoin community rather than publish a A paper that non-professional scientists will not read.

My main finding is that Bitcoin is governed by a power law. Its regularity suggests that Bitcoin behaves more like a physical system than an asset. This intuition is based on the striking power law observed in the relationship between Bitcoin price and time.

Bitcoin Power Law Theory.

My power law model has now evolved into a complete theory of Bitcoin's behavior that explains all in a scientifically coherent and falsifiable way The main on-chain parameter and describing the growth of Bitcoin adoption: Bitcoin Power Law Theory or PLT.

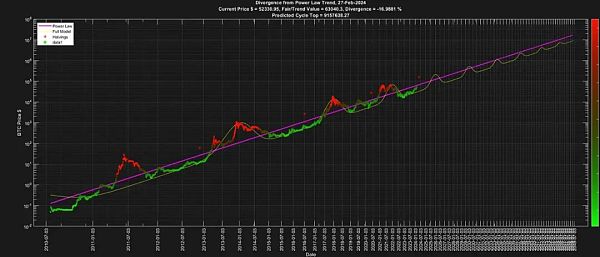

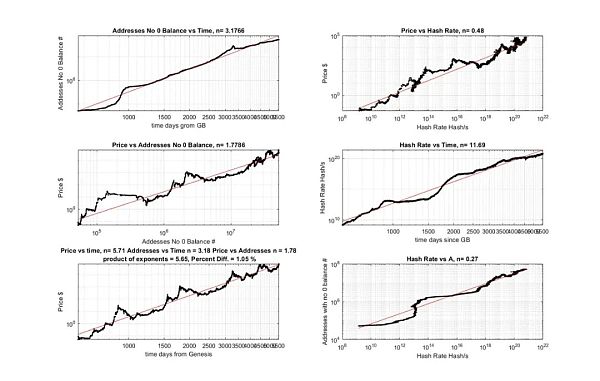

The figure below explains the PTL theory in summary and shows the primary data supporting it. Price, hash rate, and addresses (we use addresses above a threshold to eliminate dust addresses) are all power laws of each other and time.

They interact and influence each other in a continuous feedback loop.

Power law is a mathematical expression of the form y=A x^n, which is ubiquitous in nature, in social phenomena and related to the development of cities or countries. This is also true in many parameters.

The reason why they are so common is that it can be proven mathematically and physically that as long as there is some process, the output will become new during the iteration input, they will appear.

This is exactly the case with Bitcoin, for example, where the current hash rate affects future hash rates, creating an infinite loop. Therefore, it is not only surprising that Bitcoin behaves like a power law, but it is also completely consistent with the nature of Bitcoin.

The diagram below supports this interaction, which is well known in the community. I didn't invent this diagram, but I use it to illustrate how the theory works.

The theory is basically a mathematical expression based on feedback loops of logic, physics and mathematics.

1. Initially, Bitcoin needs to be accepted and adopted by the first users in Satoshi Nakamoto’s circle.

2. The "value" (now the "price", available online 24/7) of Bitcoin increases with the square of the number of users (empirically measured values are more Like 1.95, but for simplicity we round all powers below to whole numbers). This confirms the theoretical results of Metcalfe's law.

3. Rising prices bring more resources, especially mining capabilities.

4. Price increases reduce the time to mine a block, but the hash rate required to mine a block changes repeatedly due to "difficulty adjustment" . Since mining is almost unprofitable, the compensation mechanism needs to be proportional to the growth of the price, which is achieved by P=users² and the reward itself, so logically and dimensionally we can derive the hash Rate = Price² (this is exactly what is observed when the empirical value of the power law is close to 2 or Price = Hashrate^1/2).

5. The increase in hash rate will bring more security to the system, thus attracting more users. Now some readers might say that most people don't buy Bitcoin because it's "safe," but they indirectly buy Bitcoin because if it wasn't a secure system, no one would invest huge amounts of value in it. So yes, the security of the system brings in new users directly or indirectly.

6. Over time, the number of users will grow by a power of 3. This is also a new result of this theory. Most Bitcoin adoption models follow an S-curve growth. The S-curve is a typical curve for many technological applications such as televisions, refrigerators, cars, and mobile phones. Bitcoin does not follow an S-shaped curve, it initially was exponential. It follows a power law of 3 in time. It turns out that many phenomena have an underlying S-curve mechanism in their adoption or spread (witness viruses for example), and if they have an inhibitory mechanism, they become a power law. In the case of Bitcoin, the “difficulty adjustment” and risk involved in any type of investment are disincentive mechanisms, which is why we empirically observe that Bitcoin’s adoption growth follows a power law of 3 over time. There is a large literature showing that this inhibitory phenomenon exists in the spread of diseases that involve risk, such as AIDS (Bitcoin is not AIDS), but these studies show that if the spread of a disease involves some kind of decision-making, such as having sex with a partner, then the disease's Propagation will appear as a power of 3 in time, rather than an S-curve or other type of logic curve).

7. This cycle repeats indefinitely. Bubbles are an important and necessary part of this cycle and are discussed separately in the corollary below.

8. This power law increase in adoption, then (along with the power laws explained earlier) explains why we observe other power laws in time :Address=t³, price=address²=(t³)²=t⁶, hash rate=price²=(t⁶)²=t¹².

The diagram below shows all reciprocal power laws and their proposed causal explanations.

Consequences and predictions of power law theory.

This theory explains Bitcoin’s long-term behavior and has many consequences.

The most shocking and relevant of these, and one that is often misunderstood by most average Bitcoin investors, isScale Invariance ).

Scale invariance is a property of an object or law that remains unchanged when the scale of length, energy, or other variables is multiplied by a common factor Change. It is a feature in physics, mathematics and statistics.

Scale invariance is a typical feature of systems governed by power laws.

Essentially, it says that the system will continue to scale as it grows in the same way, which is why we can use scale invariance To make predictions, given that the system has already grown by more than 9 orders of magnitude, it is almost certain that other 1 or 2 orders of magnitude will continue to occur as well (it will take about 10 years to reach 1 million BTC). While this may sound unbelievable, all important factors such as systems, prices, hash rates, and adoption rates are predictable in the long run.

Scale invariance also allows us to understand the role and importance of events such as the recent investment inflows into the Bitcoin system from large institutional ETFs.

Scale invariance tells us that these events do not greatly affect Bitcoin’s price trajectory, rather, they are the reason why the Bitcoin system continues to remain scale-invariant Key events necessary for growth.

This also means that, many people have a hard time understanding that power law trends (plus bubbles) are all you get. No more, no less.

This is the theory's most shocking prediction.

All theories are falsifiable, and this is one way to falsify the theory (at least in its current form).

Future theories can be modified to add slope changes or phase changes, but the current theory is that Bitcoin’s price path is already determined, unless a catastrophic event occurs. Otherwise nothing will change, especially on the order of 1 or 2, which is a fraction of Bitcoin's overall historical growth. If Bitcoin stays scaled for 15 years, it’s likely Bitcoin will stay scaled for the next 10 years (the next order of magnitude).

In terms of scale, by the way, the next 10 years are incompatible with the previous 15 years because it's just another order of magnitude. For most people who are unfamiliar with these concepts, it takes some time to understand how logarithmic scaling works.

There's more to the theory (e.g. why we see such a consistent bottom following a power law), but we'll get into that in a follow-up article Elaborate.

Inferences from the theory.

How do bubbles arise?

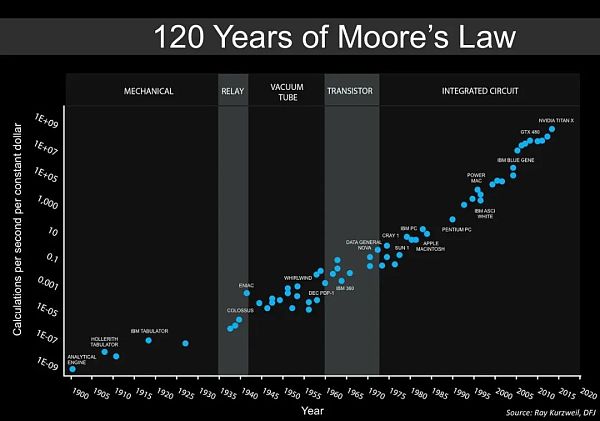

It has nothing to do with scarcity and everything to do with Moore's Law.

Satoshi Nakamoto knows Moore's Law. This is a heuristic law that states that computing power doubles every two years. The "difficulty adjustment" mechanism ensures that you need to spend a lot of money and effort to earn some extra Bitcoins.

But Moore's Law gives you an unfair advantage. In 4 years you will have 4x the hashing power for basically the same energy cost as a machine from 4 years ago (roughly the same). Because of wear and tear, you'll need to replace it anyway, and the cost of the machine is only part of the operating costs. It turns out (in the way I explained in theory) that, both logically and empirically, we can conclude that price (or reward as it is commonly called) = hashrate¹/2. So basically 4x the hash rate only gives 2x the benefit. But after the halving, the income is halved, and the increased income is zero. This is all designed to keep miners on the edge of profitability and never allow for a free lunch. This is too perfect to be an accident and I think Satoshi planned it this way.

4 years instead of 2 years or continuous reduction of rewards is because this is also a good idea in terms of supply chain, because the update and progress of the chip industry takes time , and also gives miners time to plan updates and allow the equipment to depreciate naturally. This is pure genius, and anything to do with Bitcoin is extremely pragmatic and to the point. Bubbles are the result of a cycle of “security attracts more adoption.” I didn’t invent this cycle, someone else did, and it has been used to explain cycles of Bitcoin adoption.

This makes sense because directly improving security will attract more people and give you more confidence in Bitcoin's ability to store value. Without this, there is no value. The best analogy I have is that when people move to a developing city (as Thaler (founder of MicroStrategy) said, Bitcoin is a shining city in the digital world), There will be a burst of activity. You want to move in because there are bridges, houses, roads, etc. You don't necessarily think about these things directly, but you are attracted to these activities. All the new and good things happen there. This creates a temporary "FOMO" (fear of missing out), and this "FOMO" is good "FOMO" because it is based on fundamentals, not some stupid guess, maybe "FOMO" " is not the best word, so you can help me find a better word. But you know what I mean.

Image: kuntah ⚡ is the author of this divine picture.

Prices are rising rapidly, almost exponentially. This is the only time prices do this, rather than growing according to a power law. In fact, as you can see from the chart below, it's almost perfectly symmetrical, with prices falling just as fast as they rise (sometimes faster). After the bubble bursts, it returns to equilibrium. This is a point-like evolution that is necessary for Bitcoin’s growth.

"The so-called point equilibrium means that evolution occurs in the form of pulses, rather than the slow and steady evolution that Darwin said. In species Long periods of lull with little activity in terms of extinction or emergence of new species, punctuated by intermittent bursts of activity."

Bubbles are therefore also the Bitcoin story a part of. They are not the main thread of the entire power law growth, but they are an important and necessary part of it.

I think this perfectly explains the growth both outside the bubble (~2 years) and inside the bubble (~2 years) throughout the cycle. Please tell me what you think and whether this makes sense.

This paper by the well-known physicist D. Sornette takes a very similar position on the origin and nature of foam.

Note

Scarcity plays no role in this theory at all. Scarcity has no mechanism or explanatory power.

Appendix

Some models confirm my findings. Bitcoin Power Law Theory (BPLT) predates these efforts by several years, but it's reassuring that other researchers have found similar results:

https://stephenperrenod.substack.com/p/bitcoins-lindy-model

Stephen is another astrophysicist with a PhD from Harvard University.

Q&A

I don’t understand What is a power law?

Power law is a simple concept. It is a relationship of y=A x^n.

Although this equation is simple, it represents many phenomena in nature and man-made phenomena.

But since Bitcoin is created by human interaction, how can a power law appear in Bitcoin?

First of all, Bitcoin is not created solely by human interaction. After all, Bitcoin is a code with a precise algorithm that operates through precise mathematical formulas. "Difficulty adjustment" is one of the many feedback loops present in a system that acts like a thermostat, so it can be studied as a physical system. Miners' energy needs are also pure physics. However, more physics based on social interaction, such as the adoption of new Bitcoin users, can also be modeled with equations similar to those in physics and biology, such as the spread of a virus.

Single individuals may have free will and act independently, but when you consider large numbers of agents, patterns emerge that we can use for Tools developed to understand natural phenomena are studied. We call this "universality," meaning that we can find similar patterns in nature that are independent of the particular properties of the phenomenon being studied.

Scientists have applied these methods to the growth of social networks, how cities develop, how companies survive, and many other aspects. These social or economic phenomena often follow power laws. Even terrorist attacks follow a power law.

What are scarcity, demand and supply?

It plays zero role in Bitcoin’s power law theory, which we will elaborate on in a future article.

Why not use a currency other than the US dollar?

The U.S. dollar remains stable compared to most currencies in the world. While inflationary, this is only a minor correction for Bitcoin. When we study physics, we first simplify, excluding possible complications such as friction or air resistance. We can add to that later, but first, let's understand the nature of the phenomenon and not get distracted.

Does power law work for inflationary currencies?

I don’t know, why should I try? What information can we get from it? I could do that, but I have 300 things I want to explore about Bitcoin and it seems like a waste of time, as much of a waste as these currencies are.

However, generally speaking, BTC's power law is associated with stable inflation. If your inflation rate is too high (i.e. inflation is rising rapidly), then the problem is not the power law, but the inflating currency.

This is like me telling you that gravity will cause objects to move downward. And then you ask, what about in a hurricane? Yes, pigs can fly in hurricanes, and so can you and your house. This does not violate the law of gravity.

Do you see the logical fallacy here?

What will the price be in 2060?

10²⁹⁹⁹¹²³⁵, are you satisfied now? Power law theory cannot be used to predict conditions beyond 2040. Ray Kurzweil’s “technological singularity” is coming next, and all predictions are wrong. There is a literal singularity in history, so no one knows what will happen.

It can’t go up forever

1. We don’t Know, because we don’t know how much value will be transferred to Bitcoin in the future. We might start mining asteroids or invent nanotechnology, ushering in a new era of abundance and wealth, and Bitcoin would rise forever (see question above).

2. This model can be easily adjusted to include a reduced section. A power law is basically an approximation of this model. By the way, these models do not lead to exponential behavior, but in fact they are milder than the power law itself. For now, there is no need to add this component, which would make the model more complex but would add no real benefit to our understanding.

You said price = hash rate^(1/2), but the dimensions of the equation are wrong.

For the sake of simplicity, we mean that the relationship is proportional in nature, the correct equation is of course price = A ha The hash rate ^(1/2), where A is a constant with the correct units, makes the equation dimensionally valid.

Prices are autocorrelated, so the power law is false

This is one of the favorite arguments of statisticians and economics "experts". Price is of course autocorrelated, but we claim it to be deterministic. So you're supporting our hypothesis? Anyway, there’s a lot more to be said about this ridiculous argument, which you can read in the article linked below, where we debunk the debunker’s lie.

Also, please note the following peer-reviewed article on Bitcoin, which makes a similar argument in a more polite and professional manner, namely If you start by saying that you claim causation is due to a plausible mechanism, then you can ignore these more formal tests of causation, because if causation exists and the data are partially deterministic, then the data are clearly relevant .

All power laws we observe claim to arise from causal processes, such as Metcalfe's Law, "difficulty adjustment," power laws, such as social The dissemination of information and interactions among users of the Bitcoin network.

So, in the context of studying Bitcoin as a natural process (based on principles and mechanisms similar to those in biology, network theory, and physics) , we will apply the same argument below to argue for the omission and inappropriateness of these tests.

Moreover, Sinz gave some explanations:

p>

What about S2F or other pricing models?

S2F is full of mathematical and conceptual errors, see our previous discussion on this topic. Basically, it's nonsense. No autocorrelation or cointegration can kill this vampire. The underlying concepts and the mathematics used in model building are key.

What happens if the dollar experiences hyperinflation? Will the model crash?

This is one of the most common and annoying problems. What is the questioner trying to imply? Will he become a millionaire soon?

1. How far does it go up? Or even more worthless dollars? Have you ever dreamed of such a scene? You will become a millionaire in worthless currency. happy?

2. Did you know this could lead to civil war or even nuclear war? What to do with your Bitcoin?

3. In that case, the Bitcoin (price) chart will be your last problem.

All "models will be destroyed"

(MicroStrategy founder) Saylor was not referring to the Bitcoin model at all, but to some general economic model. I had to go back and listen to that interview. Totally irrelevant. Let's stop thinking and let people think for themselves, me included. you can. I love Thaler, to death, but I don't believe he ever charted Bitcoin himself, and if he did, he didn't spend several years studying it. When he was gushing about Bitcoin, I was trying to understand it. Well, let's compromise, all models will be destroyed, power law theory is a theory, not a model. Okay?

Are we at the beginning of an S-shaped curve?

No, for several reasons (which we’ll discuss shortly).

If knowledge really becomes ubiquitous, will value skyrocket because people will price based on future prices?

No, this violates one of the main predictions and fundamental principles of power law theory. Any form of manipulation can cause prices to rise or fall in an instant. But this won't last, and generally speaking, trends will be respected.

This is a difficult concept to understand. You can realize the relationship between patents and city size, it's a power law, but you can't change it or change it too much, it's a fundamental property of the system. Its existence is no accident. It is the nature of the system.

The power law we observe in Bitcoin is the essence of Bitcoin.

We can't change Bitcoin without fundamentally changing them.

This is the most powerful and influential part of the theory, and over time it can be falsified, or more observations will Support it.

In the next market (until next year), if the price of Bitcoin is seriously overvalued, I estimate that the four-year cycle will continue at least once more.

JinseFinance

JinseFinanceBitcoin is more like a natural phenomenon than an ordinary asset. Bitcoin is more like a city and an organism than a financial asset.

JinseFinance

JinseFinanceOnly those who have a stronger belief in BTC during the decline are eligible to hold discounted BTC.

JinseFinance

JinseFinanceNVIDIA co-founder and CEO Jensen Huang delivered a keynote speech at Computex 2024, sharing how the era of artificial intelligence will boost a new global industrial revolution.

JinseFinance

JinseFinanceBitcoin’s time-based power law, originally proposed by Giovanni Santostasi in 2014 and reformulated by us in 2019 (as a corridor or three-parameter model), describes the relationship between Bitcoin price and time.

JinseFinance

JinseFinanceThe current status of the Bitcoin ecology industry, my views on the Layer 2 definition proposed by Bitcoin Magazine, and my own evaluation method for Bitcoin Layer 2.

JinseFinance

JinseFinanceBitcoin’s time-based power law model is as effective, stable, and powerful as ever.

JinseFinance

JinseFinanceFacing the end of a new halving cycle, what should we expect, and what new variables have emerged in the market?

JinseFinance

JinseFinanceThe latest Q2 report also details how energy efficiency among Bitcoin miners is on the rise.

Cointelegraph

CointelegraphChina Still Has About a Fifth of Bitcoin's Hashrate

Ftftx

Ftftx