Author: David Pan, Bloomberg; Compiler: Deng Tong, Golden Finance

About 6,000 old Bitcoin mining rigs in the United States will soon be unused and sent to a warehouse in Colorado Springs where they will be refurbished and resold to overseas buyers looking to profit from mining in a low-cost environment.

Wholesaler SunnySide Digital operates the 35,000-square-foot facility, which receives equipment from mining customers. The outdated machines are among hundreds of thousands expected to be received and refurbished during the Bitcoin blockchain’s major update every four years.

The halving event in late April will significantly cut the rewards that are the main source of income for miners, and miners will try to mitigate the impact by upgrading to the latest and most efficient technology. With electricity being their biggest expense, mining companies including publicly traded giants Marathon Digital Holdings Inc. and Riot Platforms Inc. need to reduce usage costs to maintain positive profits. Their old computers may still be profitable, just less likely in the United States.

SunnySide Digital CEO Taras Kulyk said,"This is a Natural Migration”, with buyers of older machines operating in areas with the cheapest electricity in the world. He has resold U.S. computers to miners in countries including Ethiopia, Tanzania, Paraguay and Mexico. “The halving will accelerate this.”

Bitcoin Mining Growth Market in 2023

Ethiopia is one of the top destinations for mining equipment

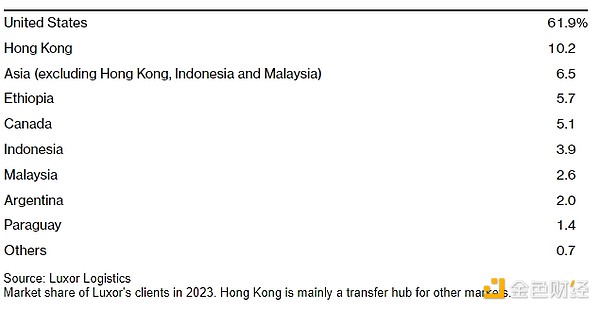

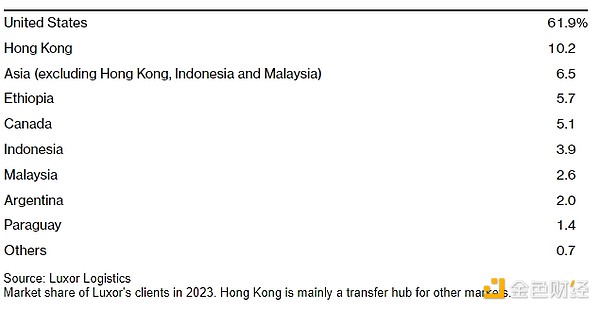

Ethan Vera, chief operating officer of Luxor Technology, a Seattle-based cryptocurrency mining services and logistics provider, estimated that, About 600,000 S19 series computers are currently being moved from the United States to Africa and South America, which account for the majority of computers currently in use.

In Bitcoin mining, specialized machines are used to verify transactions on the blockchain and earn the operator a fixed reward of tokens. Anonymous Bitcoin creator Satoshi Nakamoto proposed halvings every four years to maintain a hard cap of 21 million coins. Next month's halving event, the fourth since 2012, will see the reward drop from 6.25 Bitcoin now to 3.125 Bitcoin.

Bitcoin has surged about 50% this year to around $63,500, but remains below its all-time high of $73,798 set on March 14. With the halving just weeks away, getting more efficient machines online becomes even more urgent, as continuing to use older equipment could mean power The cost will approach or exceed mining revenue.

Jaran Mellerud, CEO of Dubai-based Hashlabs Mining, said, While the S19 series and similar models may not be profitable to run in the United States after the halving, they "can still generate significant profits and extend their lifespan" if hosted in parts of Africa, the company said in a statement Ethiopia leases data center space and provides hosting services to Bitcoin miners.

Price drops

Luxor business development director Lauren Lin said some buyers waited until the event was over to purchase used computers, thinking their prices will drop even more. According to Luxor, which operates a used machine trading desk, a used S19 model sold for about $7,030 in March 2022. A year later, as the price of Bitcoin fell, falling to around $900, it fell to around $427 this month, and after the price halving, it is expected to sell for around $356 in May this year.

Some miners in the United States are choosing not to sell their hardware and instead move equipment to places with lower electricity costs Regional and third-party data centers. Nuo Xu, who owns two sites in Texas, will travel to Ethiopia, Nigeria and several other countries this month to locate some 6,000 old computers.

"My machines are more at risk in Africa, but I have to move them there," he said. “Cheaper electricity outside the U.S. means the time it takes to recoup overhead costs is much shorter,” and labor and building materials are also much cheaper.

Hosting Fees

Miners around the world who do not have their own facilities need to pay hosting fees, which often include electricity, labor and third-party operators. According to Xu's experience, electricity costs in the United States are about 7 cents per kilowatt-hour. In Ethiopia, the country has relaxed regulations on cryptocurrency mining, according to Hashlab’s Mellerud And increased power generation, the rate is about 5 cents. The difference of two cents is huge for miners.

Hiwot Eshetu, Marketing and Business Development Director of Ethiopian Electric Power Company said, Ethiopia’s Electricity prices are approximately 3 cents per kilowatt hour. In the United States, this price range is about 3 cents to 6 cents, according to Luxor estimates .

SunnySide’s Kulyk said: “Ethiopia is indeed becoming a digital mining ecosystem A major player in . ” He added that his company was negotiating a deal to help move 20,000 to 40,000 machines to the East African country.

Not all US equipment is leaving the country. The process can be more difficult for public companies because they must account for risk-averse shareholders. There is also some hesitation about moving machines abroad due to shipping costs, breakage and safety concerns.

Old-generation computers of publicly traded Bit Digital Inc., one of the largest Bitcoin miners, lie dormant in a warehouse in Houston.

“These machines basically collect dust from time to time,” said CEO Sam Tabar. But he said the New York-based company holds the computers because they can be brought out of retirement and still be profitable when Bitcoin prices are high.

Big Orders

Miners have been preparing for the halving for years and spending a lot of money to replace old hardware. Thirteen major public Bitcoin mining companies, including Riot Platforms and CleanSpark Inc., have placed orders for machines worth more than $1 billion since February 2023, according to cryptocurrency mining research group TheMinerMag.

Consumption boom

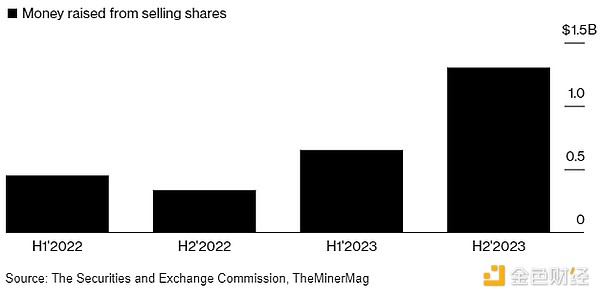

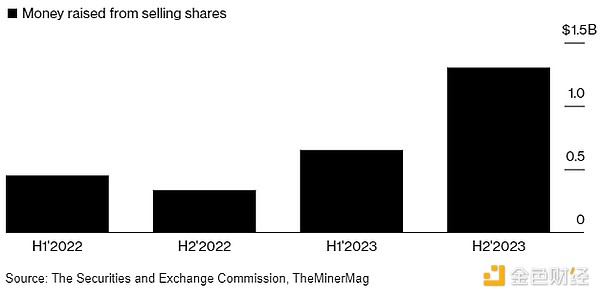

Five major Bitcoin miners have been raising funds to buy new computers

In the two years to December, the five largest Miners have raised more than $2.7 billion through stock sales. According to researchers, these miners have made an additional $840 million since the beginning of the year.

JinseFinance

JinseFinance