Bitcoin Ecosystem Outlook: Data is the Ultimate Skill for Decision-Making

The BTC halving will, to some extent, promote the development of the BTC chain ecosystem and may become a “catalyst” for accelerating ecological innovation.

JinseFinance

JinseFinance

Author: Austin Carr, Max Chafkin, Bloomberg; Translator: Deng Tong, Golden Finance

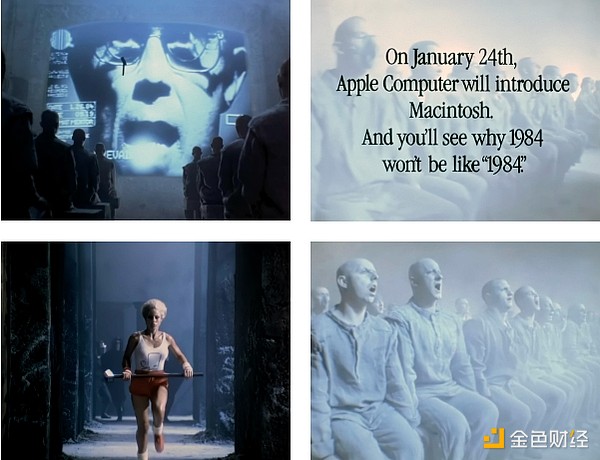

The legend of the 1984 Super Bowl is a story of underdogs, but not of the field. During the third quarter, as 80 million fans watched the Los Angeles Raiders beat the defending champion Washington Redskins, an ad showed a team of uniformed, gray-faced, shaved-headed men marching into the theater. On a huge telescreen, a looming image of Big Brother shouted that society was "gloriously" unified into "a garden of pure ideology." The dictator was speechless until a young woman rushed forward and smashed the screen with a sledgehammer. “You’ll see,” a narrator intones, “why 1984 won’t be like 1984.”

This is a really good ad. Source: Apple

This ad for Apple’s first Macintosh computer went on to become one of the most famous commercials of all time. The ad’s director, Ridley Scott, redefined the computer from a boring business tool to a statement of identity. Co-founder Steve Jobs and other early Apple executives saw themselves as rebels and artists. Steve Hayden, who helped conceive the ad and worked closely with Jobs, said the Mac "should be a device that empowers people," putting technology in the hands of ordinary people rather than corporations and governments. Forty years later, the disruptive power of personal computing has gone from revelation to cliché, with Apple widely credited with helping democratize information by defining the personal computer and its successor, the smartphone.

One side effect of this influence, however, is that Apple is no longer the plucky rebel taking on an evil empire. 1 Now, critics argue, Apple is using technology to consolidate its powerCEO Tim Cook's face appears on the telescreen.

BusinessWeek magazine cover from October 1983.

1. Our 1983 cover announces the victory of Apple’s original nemesis, IBM.

Apple is worth $3.4 trillion, more than any other company in the world. Its 2023 revenues (nearly $400 billion) are the size of the entire economies of Denmark or the Philippines. While much of the business revolves around selling iPhones, as you might expect, it’s also much broader. Last quarter, Apple’s sales from digital services alone reached $24.2 billion, more than the combined revenues of Adobe, Airbnb, Netflix, Palantir, Spotify, Zoom, and Elon Musk’s X.

Surprisingly, these numbers understate Apple’s reach and power. Through its App Store, Apple has a firm grip on a vast platform for digital communications, mobile finance, social networking, music, movies, transportation, news, sports, and pretty much everything else that happens in ones and zeros—everything, that is. This software ecosystem is Apple’s own version of a pure ideological garden, accessible only to those who abide by the company’s strict store policies and associated “human interface guidelines,” content standards, and fee schedules. When money passes through this system, which happens frequently, Apple gets a cut of up to 30 percent. Every time you hold your iPhone or Apple Watch up to a credit card reader in the real world, Apple takes a small cut of those transactions, too.

For companies of a certain size, there’s no way to evade the so-called “Apple tax.” That’s partly because of Apple’s customer loyalty, but also because only Google’s Android platform actually has a smartphone app store left, and it imposes similar fees and restrictions. Even Google pays Apple a share of the ad revenue it generates on iPhones as part of an agreement that makes it the default search provider for Apple’s mobile web browser. Those fees run to $20 billion a year.

There was a time when buying a computer meant paying for a piece of hardware you owned. Now it means buying an extremely expensive device (a state-of-the-art iPhone is at least $1,000) and then spending hundreds of dollars on subscriptions to additional services that, while optional, seem increasingly essential. AppleCare+ has you covered when your screen cracks, and iCloud stores your photos, plus there’s a monthly subscription for songs, workout classes, TV shows, and video games. And the magazine: You can read this on Bloomberg.com, or get it by subscribing to Apple’s news service. 2 After reading this on your iPhone, you might go back to working on your MacBook, streaming an Apple-made movie on your Apple TV player, reading a book on your iPad, or going for a run with your Apple Watch and AirPods. Later, you might even put on a pair of Apple Vision Pro headphones so you don’t have to experience reality without the Cupertino-designed filters.

Investors are generally fine with this dominance, as evidenced by Apple’s soaring stock price over the past decade. But regulators have their doubts. In March, the Justice Department filed a sweeping antitrust lawsuit alleging that Apple’s anticompetitive behavior locked consumers and partners into its ecosystem and squeezed increasing profits from both groups. The antitrust complaint is long and complex, but it boils down to a point familiar to the company’s critics. As one former executive said, “They’re starting to become Big Brother.” The former executive, who like other former employees spoke on the condition of anonymity for fear of retaliation, said: “They’re starting to become Big Brother.” As with similar antitrust lawsuits filed in other countries, Apple has denied wrongdoing and said its success comes from creating innovative products that are easy and fun to use, especially when they are used together.

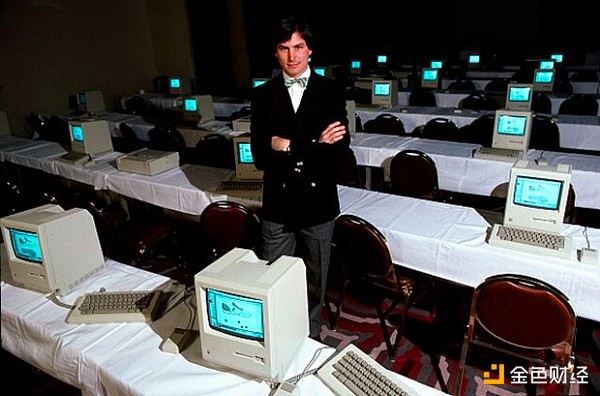

Jobs and the first generation Macintosh computer. Photographer: Michael L Abramson/Getty Images

“We have always been pioneering and adventurous, and we only make products that empower people and enrich their lives,” a company spokesman said in a statement. “People choose Apple products because they love them, trust them, and use them every day.”

The U.S. government’s lawsuit took on more urgency in August after a federal judge ruled against Google in another case that hinged in part on its default search agreement with Apple. (Google has said it will appeal.) Taken together, the two cases raise questions about how we think about some of the world’s most successful technology companies. How did these businesses, once widely seen as equalizers to corporate dominance, find themselves with extraordinary power and influence? How did Apple, which has long considered itself a champion of free speech, come to be accused of using the Orwellian tactics it once derided? Does Apple’s strength come from the power of its widely beloved products or from the way the company has designed those products to squeeze out competitors? The answers to these questions have big implications for Apple shareholders, who are in disputes with a growing number of partners, including banks, filmmakers, automakers, app developers and customers who are beginning to wonder whether Apple is still the same creative force they fell in love with years or decades ago. For the rest of us who are not shareholders, the implications are just as big. We live in Apple’s world more than ever before, and that’s largely by design.

Ironically, Apple’s early success stemmed from its openness. Although the Mac ran an operating system that theoretically limited what outside developers could do, in the heyday of the floppy disk, there were few restrictions and oversight. Aldus Corp. founder Paul Brainerd’s PageMaker software is credited with saving the $2,495 Mac from being dismissed as an expensive toy. He says he doesn’t even remember seeing a copy of Apple’s original Human Interface Guidelines at the time. “An Apple sales rep came into our office with two Macs and said, ‘Take them and do what you want with them,’ ” recalls Brainerd, who soon coined the term “desktop publishing.” 3

Jobs advocated tight control over Apple’s integrated hardware and software4, but he was ousted in 1985, the year PageMaker was released. When he returned to Apple 12 years later, he was desperate for developers to create software for the new iMac, so Apple’s control was loose for a while.In 1998, a month before the iMac was released, Jobs boasted at an Apple event in New York that Apple had amassed 177 third-party apps. By Apple’s standards today, that number is minuscule; but at the time, Jobs called it a “huge” milestone.

As the company’s products became more popular, its relationship with developers began to change. In the early 2000s, Apple blocked attempts by other companies to set up their own digital stores to sell music directly to iPods. This made it easy for customers to buy songs from iTunes for 99 cents a song, and arguably helped make the iPod a huge success. It also ensured that Apple would keep about 30% of sales. The 30% "tax" became the norm in the iPhone era - not just on music, but on any software sold through the App Store. In Apple's view, the commission was very reasonable given the cost of running a huge marketplace. Brainard said that 30% was just a drop in the bucket compared to the commissions that physical retailers took from their packaged software back then.

With this virtual storefront, Jobs was able to enforce more of Apple's guidelines. Starting in 2008, software developers must submit each mobile app and update to Apple's review team before it can be made available to iPhone users, a process that Apple believes is key to maintaining the quality and security of the device. Armies of employees sitting at iMacs would evaluate 30 to 100 apps a day, rejecting those that were bad, fraudulent, obscene, or otherwise objectionable. If they screwed up and approved something Jobs said shouldn’t be approved, the CEO himself would scold the review team, according to Phillip Shoemaker, who headed it at the time. Four former app reviewers who worked at Apple in the 2010s said Apple’s rules seemed arbitrarily enforced and twisted to suit its financial interests. Apple says reviewers’ decisions are based on Apple’s guidelines, not subjectivity, and that the App Store has made it much easier for developers to reach consumers and make money.

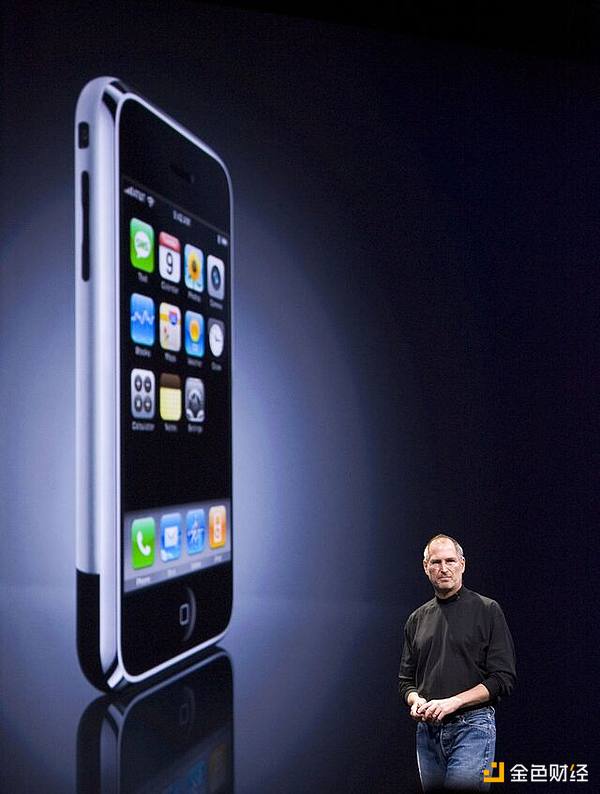

Jobs at Apple’s 2007 Worldwide Developers Conference in San Francisco. Photographer: Kim Kulish/Corbis/Getty Images

The training of new reviewers sometimes stretched to two months or more as Apple’s list of rules grew longer. The rules became extremely precise in some ways (the company once banned “fart, burp, flashlight, and Kama Sutra” apps, citing an oversupply of apps) and vague in others (it would not accept “complex or not-so-good” apps). Apple also banned novel ways to add in-app purchases or subscriptions that allowed developers to circumvent its 30% fee. Rejection emails sent to developers were often opaque, with little information on how to correct problems with the software. Apple says its review team receives more than 1,000 calls a week from developers to help them with compliance issues, and there is an appeals process for those who feel they have been unfairly rejected.

Jobs's exacting standards and flair for showmanship, exemplified by his use of the sarcastic phrase "one more thing" to preview the biggest news at product launches, paid off handsomely.By the time of his death in 2011, the App Store had become a sprawling economy, listing more than 500,000 apps for iPhones and iPads. That year, Apple sold 72 million iPhones and 32 million iPads, and its market value rose to about $400 billion, nearly twice that of Microsoft. If you’re under 40, it might be hard to comprehend what a dizzying turnaround that was. For a generation, Apple computers had been the underdog, a niche market for kids, graphic designers and Bill Gates haters. Five years before Jobs died, on the eve of the iPhone, Microsoft was still worth four Apples. Now the underdog is king.

Jobs chose his successor to lock in those gains. Tim Cook is no design guru and is not thought to have much interest in the creative side of the business. He also apparently doesn’t share Jobs’s aversion to the cookie-cutter uniformity of ordinary PCs. Cook is a process expert and a cost-cutter. He had run Apple’s hardware supply chain, a position that was the result of his training at Compaq and before that at IBM, the computing superpower that Apple implicitly called Big Brother in its “1984” ads.

To Jobs and his lieutenants, Cook’s output was somewhere between genius and miracle worker. He cut warehouse inventories from a month’s worth of inventory to a day’s worth, eliminating the costly risk of overproduction. He transformed Apple’s supply chain into a build-to-order powerhouse that rivaled Dell, then the gold standard for efficiency. He negotiated with Taiwanese manufacturer Foxconn to have Apple assemble devices in China at a fraction of the cost of having them made by Apple workers elsewhere.

All of this was good for Apple, which was able to produce high-end phones on the cheap while effectively gobbling up most of the profits in the global smartphone industry. The company’s suppliers, on the other hand, experienced something like the “Wal-Mart effect” — a term coined to describe the dislocation caused by dumping large amounts of business on small companies or communities, sometimes with disastrous consequences. Foxconn’s workers, mostly young migrants, decried extremely low wages and long hours, and they and human rights advocates said the factories resembled labor camps, with workers sleeping 10 to a room. In the first half of 2010, at least 10 Foxconn workers committed suicide. “I’m empty inside,” one worker told Bloomberg News at the time. “I have no future.”

Foxconn raised wages, set up a hotline, installed a suicide prevention network, and Apple declared the crisis resolved. In the years that followed, however, criticism from labor activists became routine.5 Apple’s defenders argue that complaints about Foxconn may be less about Apple than about the lives of poor Chinese workers. On the other hand, Apple was not always so obsessed with paying the lowest possible wages. The original Mac was assembled in Fremont, California.

Foxconn and its shareholders found working with Apple lucrative,6 but some less important suppliers complained that the tactics were indifferent at best and predatory at worst. The most notorious of these was GT Advanced Technologies Inc. In 2013, the company signed a deal with Apple to open a plant in Mesa, Arizona, to produce sapphire designed to make iPhone screens more durable. Less than a year later, the company went bankrupt. In a bankruptcy filing, a GT Advanced executive accused Apple of a “classic bait-and-switch strategy” and arbitrary pricing that led the company to take all the risk, and he allegedly told the team to “put on your big boy pants and accept the deal.” The sapphire screens never arrived, and Apple disputed GT Advanced’s characterization and accused the company of mismanagement before walking away. (GT Advanced later settled, without admitting wrongdoing, with the Securities and Exchange Commission’s lawsuit, which accused it of misleading investors. Apple also denied wrongdoing after settling a class-action lawsuit brought by GT investors.)

Over the next decade, a pattern emerged. Apple would sign a long-term agreement with a supplier of a key component while secretly designing an in-house replacement that would ultimately render the supplier uncompetitive.For example, in 2017, the company told Imagination Technologies Ltd., which designed the graphics processor for the iPhone, that it was now developing its own version of the chip, a graphics processing unit (GPU). Imagination claimed the replacement chip infringed its patents and amounted to theft. Apple eventually agreed to a new licensing deal, but by the time that happened, Imagination’s stock price had plummeted and it was sold to a Chinese-backed private equity firm.

Three years later, Apple Inc. announced it was ending its long-standing relationship with Intel Corp. and opting instead to use so-called “Apple chips.” These chips are designed by Apple itself and manufactured by Intel’s rival, TSMC.The decision was understandable, and other large tech companies have made similar moves. Intel had repeatedly delayed the launch of its next-generation chips and lagged behind TSMC. But Apple’s move coincided with a decline from which Intel has yet to fully recover.

This sequence of events has geopolitical implications. Intel is the last U.S. semiconductor company to make its own state-of-the-art chips, rather than outsourcing production to factories in Taiwan or South Korea. So Apple isn’t just imposing its supply chain approach on its partners. In a way, it’s imposing its model on the U.S. semiconductor industry, which is a key component of the country’s economic and national security.

In August 2020, Epic Games Inc., the company behind the hit game Fortnite, introduced a new character to the world: Tart Tycoon.7 He wears a snazzy suit, has a disdainful expression, and a head that resembles that of Granny Smith. The avatar is so obvious a stand-in for Cook that people might not have noticed it were it not for the way Epic chose to introduce him: a shot-for-shot parody of Apple’s famous Super Bowl ad.

In a spoof video posted by Epic on social media, Tart Tycoon appears on a telescreen that resembles Ridley Scott’s imagination. “For years, they gave us their songs, their labor, and their dreams,” he roared. “In exchange, we took our tribute, our profits, and our control.” Instead of a hammer, the Fortnite character smashed the screen with a pickaxe in the shape of a rainbow-colored unicorn. “Epic breaks the App Store monopoly,” the text reads, inviting gamers to “join the fight to stop 2020 from being 1984.”

Like many of Apple’s critics, Epic CEO Tim Sweeney grew up an Apple fan and was one of Jobs’s champions of the original iMac in 1998. But in recent years, Sweeney has been pushing Cook and other executives to allow software companies to open their own app stores on the iPhone, which would allow Epic to circumvent Apple’s content restrictions and high fees.

The suggestion would be contrary to the official App Store terms, but not entirely impossible. Apple has reached a secret agreement with Amazon.com Inc. to halve its sales commission to 15% in exchange for launching Prime Video on Apple TV. Apple has also privately warned Netflix Inc. that it would cancel a similar arrangement unless the streaming giant stopped testing removing in-app subscription purchases to avoid Apple’s fees entirely. 8 Apple also violated its own rules by allowing Tencent Holdings Ltd. and its 900 million-user messaging app WeChat to create internal “mini-apps” that can order food or hail taxis. 9 Apple has said it will not favor any developer over others and that the rules related to premium video streaming and mini-apps will eventually be enforced uniformly. In late 2020, Apple announced it would allow any developer with less than $1 million in revenue to pay a 15% commission, rather than the standard 30%.

Epic doesn’t have the clout of WeChat, but Tencent is an investor in Epic and Fortnite is a blockbuster. So before he went public with his concerns, Sweeney tried to negotiate. In June, he sent an email to Cook and several deputies asking Apple to allow competing app stores from Epic and other developers to open up software distribution like it did on PCs. After Apple objected, he sent another email at 2:08 a.m. on August 13, announcing that Epic would "no longer abide by Apple's payment processing restrictions" and would instead roll out its own commerce system in Fortnite. In other words, Sweeney unilaterally decided to stop paying Apple's tax. Apple responded by removing Fortnite from its App Store. A few hours later, Epic released "1980-Fortnite." It also filed a 65-page lawsuit.

A federal judge ultimately ruled that Epic had violated its contract with Apple and that the App Store itself was legal, but Apple had to make one important adjustment. Epic and other developers on the web should be allowed to link to their own payment systems, thereby sidestepping some of Apple's fees. But when Apple later added that feature, it also introduced new rules and fees that made the outside purchasing option meaningless. Any developer who adopted the new system had to agree to share its website transaction records with Apple, submit to audits and pay a 27% commission on any payments that occurred outside of the iPhone. The number seemed significant. Credit card processing fees are typically around 3%, meaning Apple was effectively replacing a 30% tax with one that added up to the same number but with much more paperwork. Epic protested loudly, arguing in a legal filing that "Apple's so-called compliance" was a "scam." The companies are back in court.

Still, Epic's lawsuit marks a turning point for the partnerships that Apple has with software makers and its entire ecosystem that it relies on. A handful of companies, such as Spotify Technology SA, were so incensed by the inherent advantages of Apple's rival services that they became outspoken critics of what they alleged were anticompetitive practices. Meanwhile, in many other corners of the Apple empire, powerful partners began to grumble behind the scenes. Apple says the vast majority of its partners thrive on working with the company, whose high standards are aimed at delivering the best products for customers.

One disgruntled partner is Goldman Sachs Group Inc., which teamed up with Apple two years ago to launch Apple Card, a titanium credit card that promised to upend consumer finance. According to a former senior manager at the investment firm, the Goldman team found Apple's counterparts extremely arrogant in bargaining on everything from legal compliance to marketing. When the card was launched, it featured a slogan saying it was "created by Apple, not a bank," which upset Goldman executives. "The reaction was, 'What do you mean you made this thing yourself? Because you don't know how to lend or comply with regulations,'" the manager recalled. "It felt like we were just a supplier, and Goldman wasn't used to being treated like one." A Goldman spokesman declined to comment.

A similar situation played out in Detroit. Apple CarPlay, software used to display iPhone apps on a car's screen, was originally conceived as a convenience for drivers. Eventually, however, some automakers began to worry about Apple trying to irreversibly integrate itself into all of their cars. In 2022, Apple announced that CarPlay would expand to speedometers, climate controls, fuel gauges, and other areas. People familiar with GM's thinking say Apple rarely listens to product feedback and instead views GM's cars as distribution centers for its software. Alan Wexler, GM's senior vice president of strategy and innovation, told Bloomberg Businessweek earlier this year that the next generation of CarPlay could turn its cars into "iPhones that you drive." Apple says CarPlay is optional and automakers can integrate it for free.

At this point, Apple's cultural influence has extended far beyond tech and into Hollywood. The premium streaming service Apple TV+ has produced a true phenomenon, the misfits sitcom Ted Lasso. Elsewhere in the department, however, artists began making complaints that sounded eerily like any iPhone developer, about a company willing to overspend dramatically or shut down projects for reasons that seemed arbitrary, unclear, or downright bizarre. A producer on one of the company’s shows said the whole effort felt hollow and self-serving, like “an in-house branding exercise by the richest company in the world that only makes sense in a zero-interest rate environment.”

Apple canceled a sitcom co-created by Oscar-winning screenwriter Cord Jefferson10 because Cook apparently harbored a grudge against the defunct blog Gawker, Jefferson’s former employer and the inspiration for the show. The company severed ties with comedian Jon Stewart over creative differences over how they covered topics involving Apple’s business. This spring, Stewart returned to The Daily Show to interview Federal Trade Commission Chairwoman Lina Khan, who has been leading the Biden administration’s antitrust crackdown.

In previous segments, Stewart has delivered a monologue gently mocking tech executives for making outlandish claims about artificial intelligence. He told Khan that Apple bosses had been actively trying to add AI features to its devices, but they had rebuffed the idea. “Why are they so afraid to discuss these topics in the public sphere?” Stewart asked. Khan thinks Apple’s market dominance is the problem. “It just goes to show one of the dangers of having so much power and decision-making concentrated in a few companies,” she said.

Stewart pointed out that he had also tried to interview Khan when he was still at Apple, but the idea was shot down. “Apple asked us not to do that,” he said. The comedian then deadpanned, “This has nothing to do with your job.”

Eleven days before Khan appeared on The Daily Show, his colleagues at the Justice Department filed a lawsuit seeking to significantly limit Apple’s power. Prosecutors have been investigating Apple since 2019, interviewing the company’s partners (including executives from General Motors and Goldman Sachs) and collecting reams of internal documents, according to people involved in the case. They have also attended every day of Epic’s trial, listening to potential evidence for their own investigation and gaining insight into possible legal strategies.

Part of what weakened Epic’s lawsuit, according to federal prosecutors, was that Google’s app store has similar platform fees and rules, but more people use it. That is, it’s not even clear whether Apple has a monopoly on the app store market. (Epic also sued Google, and a jury ruled in favor of Epic in December 2023. Google is appealing the verdict.)

In building its case against Apple, the Justice Department has broadened its focus to focus on how Apple controls its ecosystem, enabling it to dominate what the indictment describes as the “high-performance smartphone market,” with the government alleging a share of more than 70% of U.S. revenue. As Apple countered in its response, there is no generally accepted “market for high-performance smartphones.” 11

Moreover, the lock-in effect that the DOJ case targeted is precisely what Apple consumers love most about its products—they feel secure and are simple to use. But the DOJ’s ultimate argument is that Apple’s integrated hardware, software, and App Store stifle competition and make it nearly impossible for consumers to leave for a competitor’s product. It’s hard enough to simply move your life from an iPhone to an Android device while keeping your personal data and purchased content. That’s even harder if you’re also paying for other expensive Apple devices and subscriptions.

The Justice Department’s lawsuit, filed in March, also targets Apple’s role in hindering competitors from creating that situation. For example, Apple has limited the ability of third-party smartwatches to maintain a constant connection to the iPhone in certain situations, making them run slightly slower than the Apple Watch. In mobile messaging, non-Apple text messages appear in green bubbles, while those sent through its own hardware appear blue, creating a social stigma for non-iPhone users. (One meme on TikTok begins: “He got a 10, but he’s on an Android phone. What’s his new score?”12) The lawsuit will take years to fight, but the Justice Department’s successful case against Google shows how high the stakes are. The government is considering asking a judge to break up the search giant and could do the same with Apple if it wins.

Even if the case is dismissed, the lawsuit could still indicate that Apple’s leadership is waning. After all, anticompetitive behavior is sometimes a symptom of a company running out of ideas. “This is no longer the Apple that once pushed the boundaries of technology and design,” Spotify CEO Daniel Ek wrote earlier this year.

The accusation is not new. For nearly the entirety of Cook’s tenure as CEO, critics have argued that Apple would never release a product that could rival the iPhone. There are counterarguments: Both the Apple Watch and AirPods have sold enough units to define new categories. The company’s laptops and tablets are consistently ranked as best products. But its portfolio is also successful in large part because many of them are essentially extensions of the iPhone, the default option if you already live your digital life in Apple’s garden. Their success perhaps proves the Justice Department’s point, not disprove it.

Earlier this year, Apple abandoned an electric car project after spending $10 billion over a decade. Its Vision Pro headphones haven’t been a hit with developers, perhaps because the company has strained relations with partners or with consumers, who have mostly ignored them because of their $3,500 price tag. For now, the headphones serve two purposes: as a very expensive personal theater and a good metaphor for incorporating Apple’s meticulous control into every moment of the wearer. In that sense, it’s the reverse of the “1984” ad. Instead of giving people the power to smash telescreens, Apple is trying to wrap them in them.

Does it matter? In the short term, no. Despite regulatory pressure and public criticism, Apple's stock price has not been affected. On July 16, the stock price soared to an all-time high. Apple recently announced that it would launch new artificial intelligence tools and an enhanced virtual assistant for the iPhone. The bot will be better than the old Siri, but gentler than ChatGPT. If the new Siri can't answer a question, it will simply provide a link to OpenAI's service. It's a safe, incremental fix, "one more thing" in the most mundane sense.

But in the long run, it's hard not to see a company losing some of the moral authority it worked so hard to cultivate when it created the Mac. If Apple had treated its early partners the same way it treats its current ones, it might not exist. The first killer app ever, VisiCalc, a spreadsheet program for the Apple II, transformed the pre-Mac company from a hobbyist pastime into a PC pioneer. Co-founder Bob Frankston said that if Jobs had tried to impose today's rules on the VisiCalc team, his "technical response" would have been "a middle finger." Alan Kay, another legendary computer scientist, complains that the post-iMac company has strayed from Jobs’s original ideals. “He chose ‘convenience for the mass consumer’ over his early ‘wheel of thought’ goal,” Kay says. “The iPhone and iPad look a lot like some of my early ideas, but they’re used in almost the opposite way.”

Apple itself is aware of this shift in perception, though it seems unsure how to respond. This spring, the company aired but quickly pulled the plug on the ad, “Crush,” which seemed to perfectly capture critics’ sense that Apple’s power has become destructive. “Crush” opens with a giant hydraulic press pressing down on a real-life pyramid of creative tools. Beneath the press are an upright piano, a guitar, and a trumpet; an easel with bottles of paint; a clay sculpture; a chess set; a record player; camera lenses; and a stack of notebooks. As Sonny & Cher's "All I Ever Need Is You" plays in the background, the hydraulic press descends inexorably and irresistibly, squeezing everything inside into a colorful powder. Then the press lifts up to reveal Apple's new iPad. It's thinner than its predecessor.

The BTC halving will, to some extent, promote the development of the BTC chain ecosystem and may become a “catalyst” for accelerating ecological innovation.

JinseFinance

JinseFinanceAdam Back opposes Defiance 2X Short MSTR ETF, citing its potential negative impact due to high Bitcoin correlation. Back warns against risks in volatile trading environment and expresses doubts about effectiveness.

Xu Lin

Xu LinPorto Alegre in Brazil makes legislative history with the unanimous approval of an AI-drafted law, heralding a new era in lawmaking and technology integration.

YouQuan

YouQuanThe U.S. government's increased actions against the crypto industry recently.

Bitcoinist

BitcoinistAccording to a recent report, Kraken's new CEO, Dave Ripley, announced that he does not intend to register Kraken with SEC.

Bitcoinist

Bitcoinist"Don't fight the Fed" is an investing mantra. It suggests that you should align your choices with actions taken by the U.S. Federal Reserve and the Federal Open Market Committee (FOMC) on interest rates, economic growth and price stability.

Cointelegraph

CointelegraphIs Michael Saylor’s side of the story the reality of the situation? Or is he on a damage control tour? ...

Bitcoinist

BitcoinistPoor earnings coupled with overvalued fundamental metrics pose long-term bearish risks for MSTR.

Cointelegraph

CointelegraphAs MicroStrategy stock slumps, Michael Saylor remains confident Bitcoin holdings will cover a potential margin-call on BTC-backed loans.

Cointelegraph

CointelegraphLeading US auction house Phillips will auction off a piece from the Baqueirat collection in May. Accepted payment methods include Bitcoin and Ethereum.

Cointelegraph

Cointelegraph