Author: DeFi Cheetah, Crypto KOL; Translation: Golden Finance xiaozou

In 1 month, CRV soared from $0.2 to $1.1, what happened?

In short, Curve Finance is becoming a gateway for institutions to enter DeFi, and crvUSD is expected to grow exponentially due to huge institutional capital inflows.

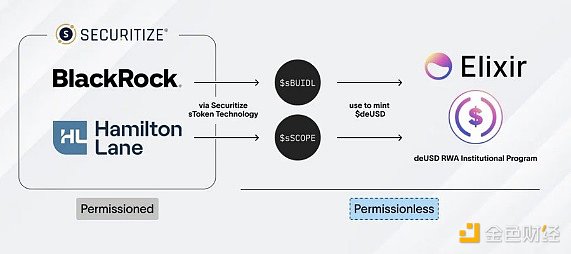

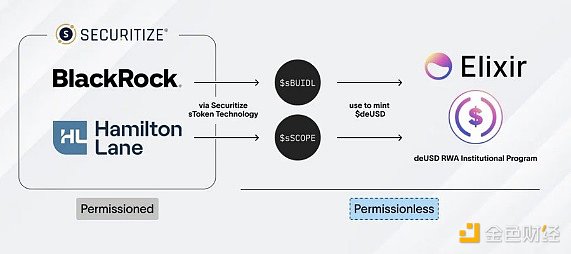

BlackRock's tokenized money market fund BUIDL (tokenized U.S. Treasury bonds) is a problem: due to regulatory requirements, BUIDL holders can initially only transfer tokens to other pre-approved investors; this means that they are completely separated from the DeFi field.

Elixir has emerged, and BUIDL holders can use sBUIDL to mint deUSD, that is, pledge BUIDL. More importantly, just like USDe, Elixir chose Curve Finance as the main liquidity center for deUSD.

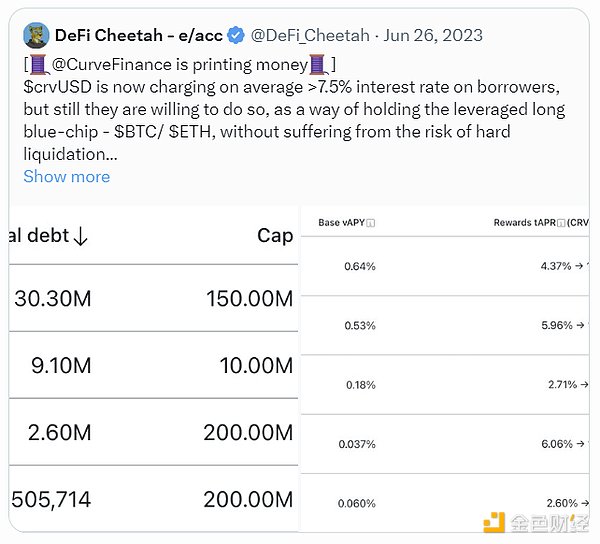

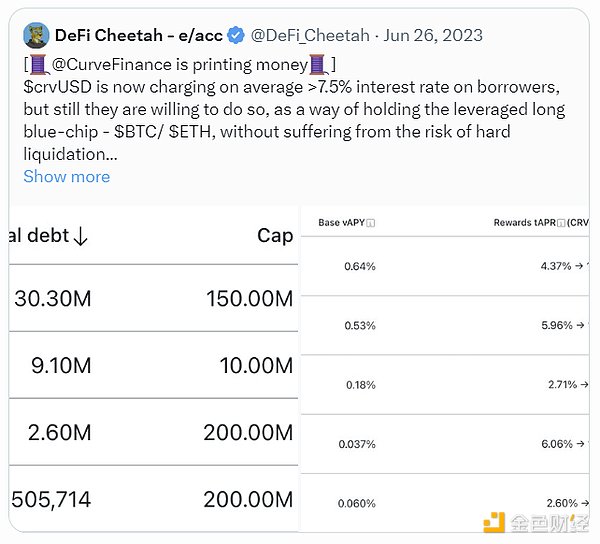

But why are these capital inflows related to the crvUSD business? Because a large part of this money may buy and pledge crvUSD to obtain a yield of about 15%, which comes from the interest income of crvUSD. Then another flywheel is started...

Some background supplements to help understand: These interest incomes come from leverage demand in the bull market, and users on DeFi Saver borrow crvUSD using BTC or ETH or other collateral. Once BUIDL holders and other tokenized US Treasury holders mint deUSD or other stablecoins supported on Curve Finance, they can very easily buy crvUSD and stake it, earning a yield of about 15% without any lock-up period!

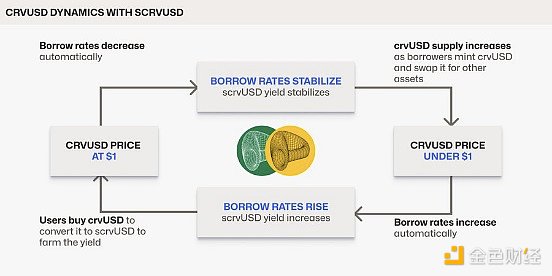

You might be thinking: if more people come to share the yield, won’t the yield drop significantly? Here’s the magic: as more and more people buy and stake crvUSD, both the interest income and TVL will grow exponentially! This is due to the flywheel effect of crvUSD.

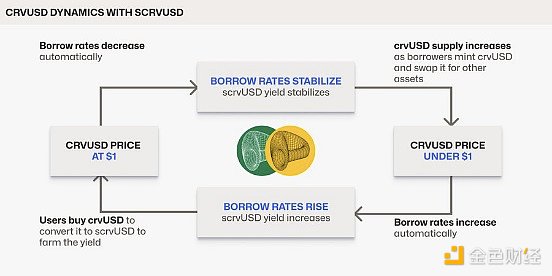

As more and more people buy and stake crvUSD, the price of crvUSD is above $1, and the price movement causes PegKeeper to print more crvUSD. As PegKeeper debt accumulates more and more, the interest rate will fall. In a bull market, the demand for borrowing is huge, which drives crvUSD below $1 again. This pushes up the yield on crvUSD, and more people will buy crvUSD to earn yield, which drives down the interest rate again to encourage more borrowing.

This flywheel contributes to the exponential growth of crvUSD. For more details on what affects the crvUSD interest rate, please read my tweet:

In fact, the current bottleneck of crvUSD is not borrowing demand, but buying pressure or use cases that can help digest the selling pressure brought by the mortgage lending cycle/leverage. If crvUSD is always below $1, the interest rate is still too high and no one will join.

But BlackRock's BUIDL and Elixir illuminate the final take-off path of the crvUSD flywheel: institutions enjoy the benefits brought by interest income, and the income needs of institutions give crvUSD room to expand. It's a perfect win-win!

Bernice

Bernice