Technical interpretation: How does Merlin Chain work?

This article will focus on the Merlin Chain technical solution and interpret its publicly available documents and protocol design ideas.

JinseFinance

JinseFinance

Author: Crypto Dog Source: X, @JiamigouCn

MerlinChain has been running for 2 months, and the token $MERL was opened for trading on OK on April 19. Let's see if the token is worth holding for a long time and review the history of Merlin's development.

This article is not a technical analysis article, but an analysis of the advantages and disadvantages of the product from the perspective of the product market to see what information we can get from it.

1.Is Merlin very popular?

After the mainnet of MerlinChain was launched in February, the TVL rushed to nearly 4 billion US dollars in one month, and now it is still maintained at around 3 billion US dollars, which has completed the bottoming demand of the entire project.

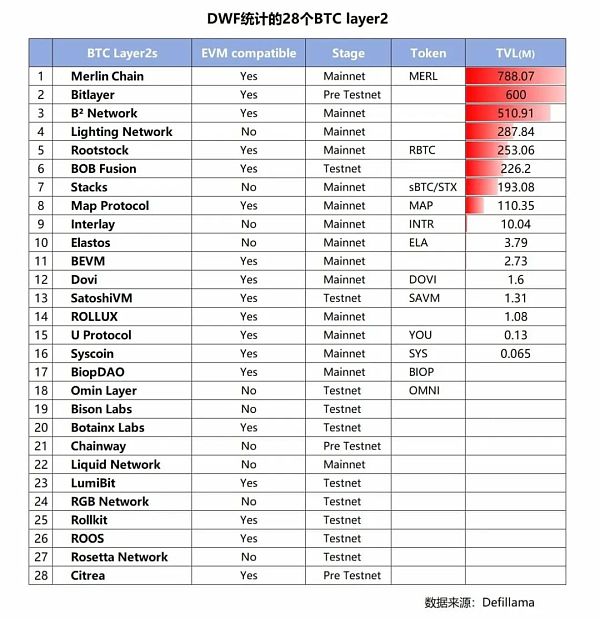

From the 28 BTCLayer2s counted by DWF, MerlinChain has become the absolute leading project of BTC Layer2.

From the data, MerlinChain has reached the level that a public chain should have.

From the perspective of community building, the popularity is also sufficient. Before writing this article, I had a high fever for two weeks. During these two weeks, I read hundreds of articles and papers related to MerlinChain. As a KOL, I intuitively feel that these papers are not like those written by the official, but more of them are spontaneously built and promoted by the community.

For example, this great man organized all the articles of MerlinChain into a Notion for everyone to consult:

https://merlinchain.notion.site/Merlin-Chain-Wiki-8c634e006879462f85bec77f19cb98eb

On Twitter, I saw many opinion leaders with less than 10,000 followers. They wrote a lot of summary tweets in the early stage of the project. I excerpted a little bit of them:

We often say that Rome was not built in a day, and MerinChain was not there at the beginning. Let's see how MerlinChain was launched.

2.Merlin Prequel

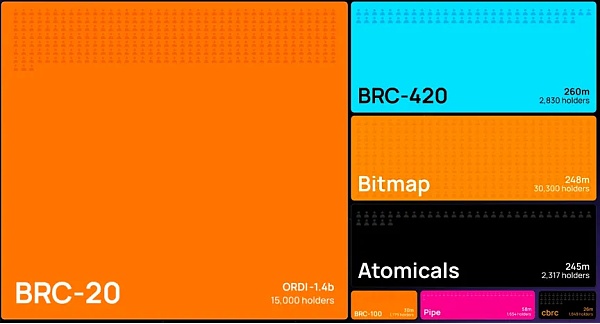

Before the birth of Merin Chain, 600+ inscription assets and 1000+ Bitcoin ecosystem developers were launched; Bitmap.Tech has attracted more than 90% of the traffic of Bitmap, a native asset of Bitcoin, and has 33,500+ independent addresses, making it the largest Ordinals asset community.

Many people say that Merlin is a bottom-up project, that is, first do the ecology, then the technology, and finally do L2. Unlike other projects, it is not like designing a public chain framework first, and then slowly filling in the technology and narrative. This causes a phenomenon that users do not know when the currency will be issued, nor do they know what to do, and they will only run around in various tasks of the project party.

Before Merlin Chain came out, the project party Bitmap.tech had done many projects, such as: the earliest Recursiverse, Bitmap.Game, BRC-420, which can be said to be successful one by one. Not only did it airdrop various big profits for free, but it also created opportunities for ten times, a hundred times, or even a thousand times. At present, the entire ecosystem is being continuously promoted in a chess game.

So the investment institution ABCDE mentioned in the article "Why We Lead the Investment in Bitmap.tech": Bitmap.tech has established the largest layer asset community in the Bitcoin ecosystem, with 33,000 Bitmap holders, and the market value of Bitmap.tech's blue box has exceeded 200 million US dollars, second only to CryptoPunks and BAYC. These assets can have rich asset reserves and user base on the first day of Merlin Chain's launch, and have advantages that other Bitcoin Layer2 cannot match.

In addition to ABCDE, the Merlin project also received investment from 24 institutions including OKXVentures, Foresight Ventures, and Arkstream Capital.

Why is the market value of BRC-420 Blue Box so high, and why has it won so many users' support and brought so many institutions to participate?

Let's take a look at what kind of connecting role BRC,420, the most important technology of Merlin Chain, plays in the ecosystem. After figuring this out, we can understand the next technical analysis of Merlin Chain.

3. Exploration of Bitcoin L2

(I) Possibility of Bitcoin Ecosystem Realization

As early as the early days of BTC, the exploration of BTC's scalability has always existed, especially in the field of asset issuance.

With the popularity of Bitcoin, network congestion and confirmation time have become more and more serious. In 2015, Gavin Andresen and Mike Hearn of the Bitcoin Foundation announced that they would implement the BIP-101 proposal in the new version of BitcoinXT, hoping to increase the block limit to 8MB. However, Greg Maxel, Luke Jr, Pieter Wuille and other BitcoinCore members opposed it, believing that this approach would raise the threshold for running full nodes and bring uncontrollable impacts.

This concern is not without basis. The community believes that 8MB will not be the final solution. Once a large block is chosen, it is likely that continuous expansion will be required in the end. The technical risk stacking and unpredictable risks caused by unlimited expansion do exist.

(II) Failed Bitcoin Forks

The debate over [What is the Bitcoin vision?] led to the split of the Bitcoin community, and finally in 2017 the community began to go their separate ways, forking out BCH (later the BCH community continued to split, and BSV was forked out on BCH).

In addition to BCH (and later BSV), many other BTC forks appeared during this period. According to BitMEXResearch, at least 50 new forked coins appeared within a year after the BCH fork. Many people turned over a new leaf in these forks, and even more people lost everything in this split.

The debate in the community over [What is the Bitcoin vision?] led to the split of the Bitcoin community, and eventually the community began to go their separate ways in 2017, forking out BCH (later the BCH community continued to split, and BSV was forked out on BCH).

In addition to BCH (and the later BSV), many other BTC forks also appeared during this period. According to BitMEXResearch, at least 50 new forked coins appeared within a year after the BCH fork. Many people turned over in these forks, and even more people lost their fortunes in this split.

From the market of various tokens forked from Bitcoin, it can be seen that capacity expansion is obviously not feasible on the Bitcoin blockchain.

After the fork, the BTC chain gradually introduced a series of new technical solutions to improve scalability while maintaining the existing block size, the most important of which are SegWit (Segregated Witness) and Taproot.

(III) Ordinals

As an alternative to directly increasing the block size, Segregated Witness was introduced at the same time as the BCH fork.

SegWit divides transactions into two parts, the first part contains the sending and receiving addresses, and the second part stores the transaction signature or witness data, removing the main block but retaining the verification function. The removal of witness data allows more transactions to be accommodated under the same block size, which improves throughput in another way.

SegWit was introduced as a soft fork, and its adoption rate continued to increase, exceeding 60% in 2020 and reaching 95% in December 2023.

In November 2021, another important upgrade, Taproot, also took effect as a soft fork. Structurally, this upgrade is a combination of BIP340, BIP341, and BIP342. Among them, BIP340 introduced Schnorr signatures that can verify multiple transactions at the same time, replacing the elliptic curve digital signature algorithm (ECDSA), once again expanding the network capacity and speeding up the processing of batch transactions, making it possible to deploy complex smart contracts; BIP341 implements the Merkelized Abstract Syntax Tree (MAST) to optimize the storage of transaction data on the blockchain; BIP342 (or Tapscript) uses Bitcoin's script coding language to adapt Schnorr signatures and Taproot implementations.

SegWit did not initially limit the length of the verification information, which led to subsequent projects being able to circumvent the 4MB block size limit by verifying the information, and also laid the groundwork for the subsequent rise of Ordinals.

There was controversy in the community regarding this approach, with some opponents believing that SegWit’s failure to set a length limit was a mistake, and therefore using verification information to transmit data was an unfair “attack.”

(IV) Early Exploration of Bitcoin Layer2

With the various attempts at the Bitcoin block size dispute, no consensus has been reached on forks and expansions, so these paths are definitely not feasible.

The community began to look for new solutions, that is, to build a "block bridge". Later, various L2s on Ethereum broke out. The Bitcoin community called the method of "packaging and accounting outside the main chain, and finally combining the packaged data and returning to the main chain for confirmation" "L2".

The most mainstream routes in the early Bitcoin L2 solutions were the Lightning Network and Sidechains.

1. Sidechains

The sidechain solution was proposed in a "Technical Paper on Bitcoin Sidechain Solutions" published by Blockstream in 2014. It was not until January 2018 that RSK finally launched a fully functional mainnet. In September of the same year, Blockstream launched the LiquidNetwork sidechain.

The idea of the sidechain is to obtain or send bitcoins from the Bitcoin network, but the transaction behavior is independent of the BTC network. In addition to RSK and Liquid Network, Stacks, RootsStocks, Drivechain, etc. are also sidechain solutions. In addition, developers have also explored and practiced in the direction of state channels and Roll-up.

This is the technical direction of many Bitcoin L2s at present. It can be said that most Bitcoin L2s in the early stage are Bitcoin sidechains.

2. Lightning Network

The Lightning Network was first proposed by Joseph Poon and ThaddeusDryja in 2015. The core idea is to lock a part of Bitcoin in a multi-signature address to establish a separate governance collaboration protocol. Transactions in the Lightning Network are carried out off-chain, and the final result is confirmed by the BTC network. In March 2018, Lightning Labs announced that the Lightning Network was officially launched on the Bitcoin mainnet, with representative applications such as Strike, Taro, and Lightspark.

Fourth, BRC-420, a bridge between the past and the future

Merlin Chain founder Jeff once revealed in an interview that the team did not think of doing Layer2 at the beginning. It was in the process of continuously building products and interacting with developers and users in the community that they found that the interactions that can be done on L1 are too limited, and many ideas cannot be realized. The BitmapTech team happens to have the strongest native foundation among all Bitcoin Layer2s: BRC-420 defines the metaverse standard and copyright standard for Bitcoin assets.

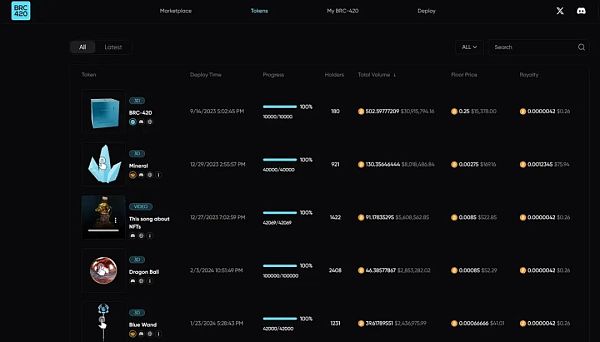

BRC-420 was issued on September 19, 2023, when the inscription was the hottest. At that time, the price was 0.15 U per unit. It rose to $1,000 on November 15, and the price of the blue box reached $40,000 on February 3, becoming the third largest 10k series NFT on the market, second only to BAYC and Punks.

From the price point of view, BRC-420 is not a very cheap product. In the early stage, many people did not understand it and thought it was a cheap product. Later, after understanding it, they felt that it had great technical prospects and could do many things. So let's take a look at the technical direction of BRC-420.

(I) Ordinal Protocol

Before Ordinal, most people believed that BTC could only exist in the blockchain world as a financial attribute, because all previous attempts by developers ended in failure, so many people believed that it was futile to build any ecosystem on BTC, that is, only the Lightning Network and sidechain technology could make a small difference, which was incomparable to the ETH ecosystem and other smart contract platforms such as L1.

After the Ordinal protocol came out, it took a few months to completely popularize the concept of inscription, allowing people to see that it is possible to develop an ecosystem on BTC and surpass all smart contract platforms. From the fact that all smart contract platforms have inscriptions, it can be seen that where the community is, there is consensus.

What is the Ordinal protocol?

To put it in one sentence, Ordinal is an inscription tool that uses BTC as a network disk, but it is inscribed on the blockchain for everyone to see.

Just like you write "XX was here" on a brick, whoever goes to that scenic spot in the future can see this sentence.

The essence of Ordinal is actually very simple. It is more like an NFT protocol. However, unlike ETH or other public chains, where NFT metadata (MetaData) is mostly stored in IPFS or centralized servers, Ordinal's metadata is embedded in the transaction's witness field (Witness Data), as if it were "engraved!" on a specific Satoshi. This is also the origin of the word inscription.

This is also the narrative and gameplay from the beginning of Ordinal - BTC cannot be tampered with, and has the "network disk nature" of permanent storage. Metadata can support text, pictures, videos and other loose properties, except for the 4MB size limit (this limit will no longer exist when we talk about recursive inscriptions later, and this is exactly the problem that Bitmap.Tech solves).

(II) BRC-20, ARC-20, Rune, BRC100SRC-20

The market has new ways to play, and naturally it will not only satisfy NFT. Developers have found various methods on Ordinal and finally released a BRC-20.

1. BRC-201

The concept of BRC-20 is to use the feature of Oridinal that has no restrictions on file formats, design the concept of deploying JSON File on Oridinal, combine Deploy, Mint, Transfer three simple "operation codes", and use Indexer to realize the casting and transfer functions similar to ERC-20.

The role of Indexer is a relatively centralized one for the time being, providing the basic settings for all BRC20 searches on the Bitcoin chain, and indexing the number of BRC20 coins held by each person according to the deployment, mint, and transfer conditions.

After BRC-20, many new ways of playing have emerged on the Ordinal protocol, such as ARC-20, Rune, BRC100, etc. They are all solving the shortcomings of BRC-20, and all of them are writing TokenID, output, quantity and other Token information in the UTXO script, and handing over the transfer to the BTC1 layer to handle security issues.

2. SRC20

SRC20 originated from the BTC Stamps protocol and is in competition with the Ordinal protocol; Ordinal stores data in the isolated witness field, while BTCStamps stores data in the transaction output of BTC.

There is a picture on the Internet that can intuitively describe this passage:

Since SRC-20 does not have the possibility of being isolated witness, it is favored and sought after by more developers in the West. It feels like a weapon to counter the Eastern BRC20 system, but its casting cost is higher.

(III) BRC-420

BRC-420 is the "BTC Metaverse Protocol" launched by the Bitmap.Tech team. Different from the previous asset issuance protocols, BRC420 is more application-oriented and more complex.

Bitmap.Tech founder Jeff once said: The team does and only does what we do and only does what has not appeared in other ecosystems. At first, we did a lot of things based on recursion, such as recursive graffiti and recursive on-chain forums; later we made Bitmap, a completely decentralized data package; and then launched BRC-420.

According to the relevant papers of ABCDE, BRC420 brings three very interesting things:

1. Recursive inscription-type assets. BRC420 defines a more complex asset format in a recursive way. By recursively combining multiple inscriptions into a complex inscription, anyone can create their own metaverse inscriptions, including but not limited to game images, game DLC, HTMI scripts, music, videos, etc. ... and finally realize "on-chain inscription modularization".

2. Royalties on the chain. Because there is a recursive modular asset mutual call, so as small as a character image or pet, as large as the entire game script, virtual machine and even AI large model can be combined into an on-chain asset. At this time, a reasonable, automatically executed royalty system can well encourage the developer ecosystem and allow more valuable modules to exist on the chain. For example, if a popular full-chain game has a certain popular battle system, card drawing system, blind box system, etc., it can be used as a separate module inscription culture, and the original author can also obtain tax benefits when it is called by other games.

3. Bitmap. Bitmap is a very "cool" and hardcore thing. It can be understood as Sandbox land based on BTC, but it is much more native than Sandbox. Because each .bitmap inscription maps every block on Bitcoin, the number increases synchronously with the blocks. There are more than 810,000 Bitmaps now, and 50,000 more are added each year. Holder independent addresses are more than 20,000, second only to Ordi and Sats.

BRC420 certainly does not own Bitmap, but it is the biggest booster behind Bitmap, and it also monopolizes more than 95% of the traffic of Bitmap browsers. More than 100 teams have issued assets on BRC420. It can be said that BRC420 is an application protocol deeply bound to Bitmap.

Such a remarkable achievement is inseparable from the decision of Jeff, the founder of Bitmap.Tech. Jeff believes that any new ecology needs to have its own narrative. Doing Ethereum's things again in the Bitcoin ecosystem, or vice versa, seems to be uninnovative. Just like after the blue box became popular, a 420 protocol appeared on each chain, with boxes of various colors. We must do something that has never appeared before and create a new narrative to develop the Bitcoin ecosystem. For example, many contents of Ethereum are not on the chain, so we have to combine the contents on the chain.

Here, I need to make a summary of BRC-420:

Summary

After the Ordinal protocol came out, its metadata supported text, pictures, videos, JSON File and other properties, making it possible to develop an ecosystem in Bitcoin. However, Ordinal did not solve the 4MB size limit of Bitcoin blocks. The subsequent BRC-20, ARC-20, Rune, BRC100, and SRC-20 are also solving deployment problems, which will bring great disturbances to the development of BitcoinL2;

BRC-420 was originally launched by Bitmap.Tech as the "BTC Metaverse Protocol". Due to its characteristics of "recursive inscription assets" and "picture-to-coin conversion", multiple inscription assets can be recursively combined into a complex inscription. Therefore, BRC420 can carry far more than BRC20 Various asset types, from a character image or pet to the entire game script, virtual machine or even AI model, can be combined into Bitcoin chain assets for developers to purchase or pay royalties. Due to the recursive characteristics of BRC-420, more than 1,000 project parties have issued their own BRC-420 projects on it, which has made BRC-420 a project platform and played a connecting role in the subsequent smooth launch of Merlin Chain's main network.

V. Smooth launch of Merlin Chain

(I) The disruptive nature of BRC-420

As mentioned earlier, BRC-420 solves many problems that Ordinal has not solved. BRC-420 can combine all content on the blockchain through recursive inscriptions. This is a technological breakthrough. Anyone can deploy content on BRC-420, including but not limited to game images, game DLC, HTMI scripts, music, videos, etc.

In the past, many Ethereum contents were not on the chain. All Bitcoin contents, whether game content, application scripts, or social assets, all of these contents must be on the chain and open source on the inscription.

BRC-420 uses the composability of on-chain content to open-source and modularize content on-chain, and finally realizes assetization, paving the technical road for Bitcoin Layer2.

(II) From the perspective of product line, the launch of Merin Chain is bottom-up

Before Bitmap.Tech was ready to do Bitcoin Layer2, the project team had already created Layer1 ecosystems such as Recursiverse, Bitmap.Game, and BRC-420, and it can be said that one by one, it has won over more than 90% of the traffic of Bitmap, the native asset of Bitcoin, and has 33,500+ independent addresses, making it the largest Ordinals asset community.

It can be said that Bitmap.Tech's new narrative from assets to projects has laid a solid foundation in the basic plate of the Bitcoin system.

During this process, the community has mastered a considerable amount of assets. The community hopes that the project can develop positively, so they all build on this asset. Unlike traditional blockchain projects, the project party first has an idea, and then they allocate tokens and make products to attract more users.

Bitmap.Tech founder Jeff once said in an interview: After the Ordinal protocol came out, although the market was hot for a long time, there was a problem with the assets on Btcoin Layer1. All users were buying new assets. If the previous asset did not rise, everyone would run to the next asset to buy new assets. Everyone was always busy, but no one made money.

Most of the assets that rose quickly and had a high market value were three months ago. It is now difficult to produce new assets. One is because the narrative is not fresh, the second is because the application scenarios are too limited, and the third is because financial liquidity and leverage are too weak. Therefore, in order to make this ecosystem more prosperous, it is currently necessary to use the virtual machine environment to realize these functions.

So after Bitmap.Tech matured in all aspects, it launched MerlinChain, absorbing the community and the previous ecology together to do bigger things.

(III) From a macro perspective, Bitcoin Layer2 is a trillion-dollar track

The capital volume of Bitcoin has reached a trillion-dollar scale, and the Bitcoin Layer2 market has not yet been activated.

For comparison, when the market value of Ethereum was 200 billion or 300 billion, the total value of ERC-20 tokens was also 200 billion or 300 billion US dollars. BTC is a trillion-dollar market, but the total market value of BRC tokens is less than 10 billion US dollars. There is still 99 times of space between more than 10 billion US dollars and 1 trillion US dollars. Although this 99 times will not be filled in a short period of time, this is a potential market that no one can ignore.

Most Bitcoin Layer2 projects are just starting, and there is no real leader yet. From the TVL point of view, Merlin Chain is likely to become the leader of Bitcoin Layer2. If Bitcoin Layer2 is activated by one or two leading projects, the market potential can be much greater than the money that can be leveraged by more than ten or twenty Ethereum L2s.

As Jeff, the founder of Bitmap.Tech, said: Bitcoin L2 may play two roles. One is to make the past financial services that have not been well utilized better, and the second is how to make these native innovations on Bitcoin better.

According to statistics, there are now more than 30 BitcoinL2s, which are divided into several major categories such as sidechain Rollup and data availability.

For Merlin, what is the difference between it and other BitcoinL2, please see the next issue of "Merlin Technical Analysis"

Data storage:

https://link.medium.com/cMmwrFRTIb

References:

"ABCDE: The past, present and future of Bitcoin ecology":https://www.theblockbeats.info/news/4937

"Dialogue with Merlin Chain founder Jeff: Why are retail investors uncomfortable? Because they feel they have been cut by institutions":https://www.chaincatcher.com/article/2115067

"Interview with the founder of Merlin Chain: Behind the surge of "Blue Box" and the future of Bitcoin": https://www.techflowpost.com/article/detail 16182.html

"Interpretation of the BTCL2 project Merlin Chain of the Blue Box team": https://www.odaily.news/post/5192755

"How does Merin Chain unite various groups? It contains the code for growth": https://www.theblockbeats.info/news/51989

This article will focus on the Merlin Chain technical solution and interpret its publicly available documents and protocol design ideas.

JinseFinance

JinseFinanceMerlin Chain (MERL) enhances Bitcoin with scalability and interoperability but faces controversy. Criticisms on Twitter include locked-up coins, poor customer service, and speculation of a hack.

Huang Bo

Huang BoPEPE, WIF, MEW, BOME... New wealth codes always seem to emerge in the meme coin sector, but is this really good for the cryptocurrency world?

JinseFinance

JinseFinanceMerlin Chain is a new player in the Bitcoin Layer 2 ecosystem that leverages a decentralized oracle network, an on-chain BTC fraud prevention module, and zero-knowledge (ZK) convolutions to improve Bitcoin’s scalability and efficiency.

JinseFinance

JinseFinanceFocus on the Merlin Chain technical solution and interpret its publicly available documents and protocol design ideas.

JinseFinance

JinseFinancePenta Lab Research Report - Merlin Chain - TVL’s Steady Growth Leads Bitcoin’s Second-Layer Ecosystem

JinseFinance

JinseFinanceMerlin Chain is a ZK Rollup Bitcoin second-layer network launched by the development team of the well-known BRC-420 blue box and Bitmap that supports multiple types of native Bitcoin assets and is compatible with EVM.

JinseFinance

JinseFinanceMerlin Chain, understand MerlinChain in one article Golden Finance, early Merlin Chain is worth participating in

JinseFinance

JinseFinanceCrypto staking rewards Thanks to its high yields, crypto staking, a way to earn passive income, has quickly become popular ...

Bitcoinist

BitcoinistPARODY COIN (PARO) Parody Coin (PARO) is a deflationary utility token in its presale stage, it has joined a host ...

Bitcoinist

Bitcoinist