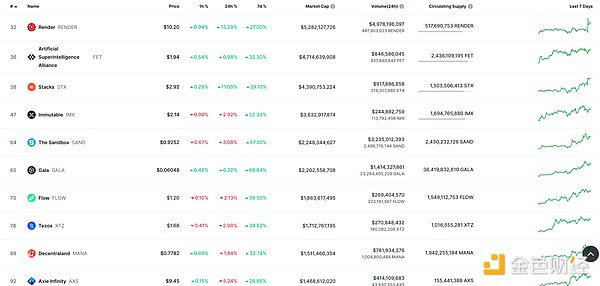

DeFi data

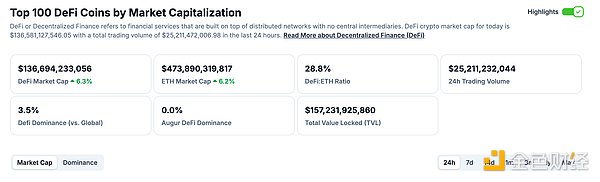

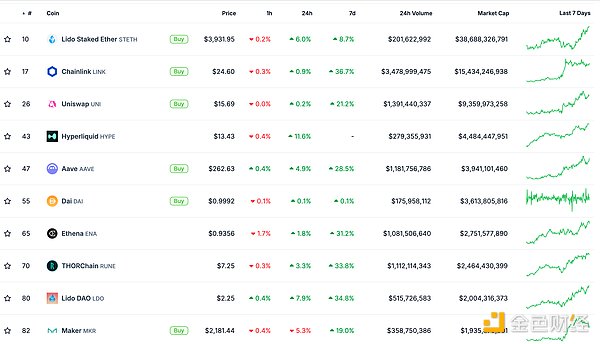

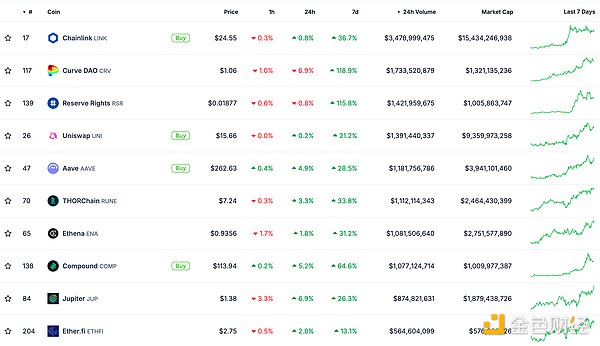

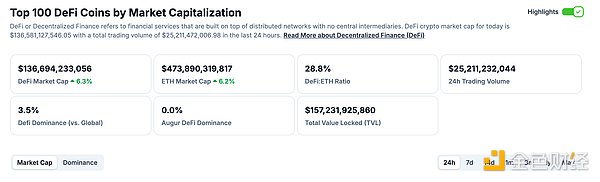

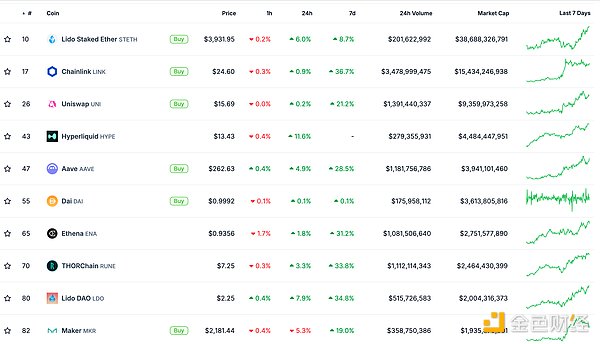

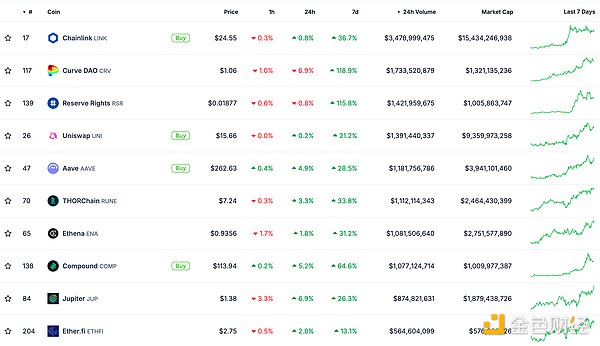

1. Total market value of DeFi tokens: 136.694 billion US dollars

DeFi total market value data source: coingecko

2. The transaction volume of decentralized exchanges in the past 24 hours was 25.211 billion US dollars

Top ten rankings of DeFi projects with locked assets and locked-in volume Data source: defillama

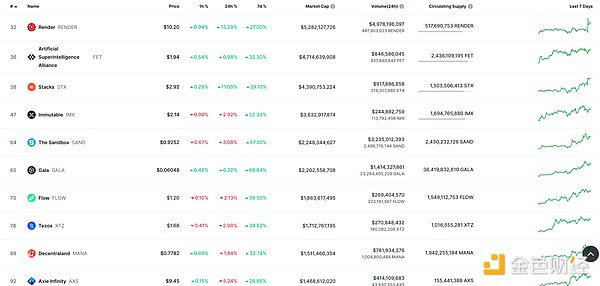

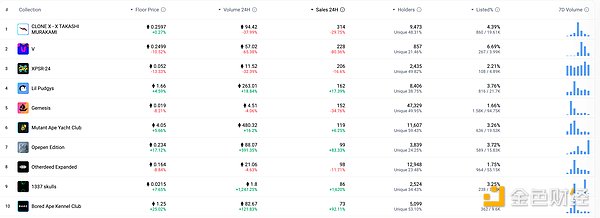

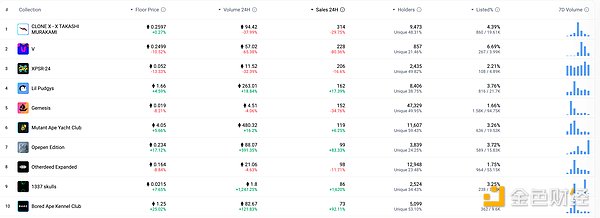

NFT data

1. Total market value of NFT: US$52.421 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2. 24-hour NFT trading volume: 19.651 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

3. Top NFTs in 24 hours

Top 10 NFTs with the highest sales in 24 hours Data source: NFTGO

Headlines

BTC breaks through $100,000, setting a new record

DeFi hot spots

1.Mint Blockchain launches NIPs Platform developer platform

On December 5, Mint Blockchain recently released the NIPs Platform developer platform on its official website, supporting dozens of types of NFT asset protocol standards including ERC721, ERC1155, ERC404, ERC7765, etc., as well as multiple NFT infrastructure tools, including NFT deployment tools, NFT casting tools, NFT Launchpad, NFT Marketplace, NFT data index, etc. Web3 developers and users can deploy NFT asset contracts and issue new assets based on the low threshold of NIPs Platform.

2. Botanix Labs launches final testnet for its Bitcoin L2

Golden Finance reported that Botanix Labs, an L2 platform built for Bitcoin native DeFi, announced the launch of the Aragog testnet, marking the launch of the latest testnet version of its Spiderchain Bitcoin L2. Aragog replaces the v0 testnet launched in November 2023 and includes "pre-mainnet deployment" of multiple Bitcoin native applications.

The Botanix team said in a press release that the Aragog testnet brings the blockchain solution closer to its mainnet, which is scheduled to be launched in 2025.

3. Ethereum L2 TVL breaks through 55 billion US dollars, setting a new record, with a 7-day increase of 8.64%

Golden Finance reported that according to L2BEAT data, Ethereum L2 TVL broke through 55 billion US dollars, and now reported 56.06 billion US dollars, setting a new record, with a 7-day increase of 8.64%. Among them, the top five TVLs are:

1. Arbitrum One TVL is 20.81 billion US dollars;

2. Base TVL is 12.81 billion US dollars;

3. OP Mainnet TVL is 8.71 billion US dollars;

4. Blast TVL is 1.61 billion US dollars;

5. ZKsync Era TVL is 1.33 billion US dollars.

4. Austin Federa, head of strategy at the Solana Foundation, leaves the Solana Foundation and starts a new protocol

Golden Finance reported that Austin Federa, head of strategy at the Solana Foundation, has left the project and co-founded a new protocol and network for managing high-performance, permissionless networks.

According to Federa, his new project DoubleZero is not a layer 1 or layer 2 protocol, but something completely different, a blockchain-optimized N1, a new global base layer network that hopes to increase bandwidth and reduce latency.

5.a16z's 2025 crypto trends: decentralized chatbots, on-chain government bonds

According to Golden Finance, a16z listed the key areas of the cryptocurrency industry in the coming year, emphasizing that tokenized use cases and the integration of artificial intelligence and blockchain technology are potential growth drivers.

According to a16z's report, applications based on artificial intelligence and running on the chain are expected to bring at least three emerging trends throughout the industry: wallets driven by artificial intelligence agents, decentralized autonomous chatbots, and identity solutions. The company believes that decentralized chatbots can be used for social media content and asset management through a trusted execution environment: "By running a group of permissionless nodes and coordinated by a consensus protocol, chatbots can even become the first truly autonomous billion-dollar entity."

Another trend expected to emerge in 2025 is related to stablecoins. In the past few months, the industry has established a market suitable for global remittances, and several companies and protocols have launched new stablecoins pegged to the US dollar. a16z predicts that stablecoins will gradually replace everyday credit card transactions starting next year.

In addition, as the infrastructure matures, more "unconventional assets" are expected to be on-chain by 2025, enabling cross-sector tokenization. The report predicts that previously overlooked assets such as biometric data will generate new sources of revenue.

"Individuals can tokenize their biometric data; the information can then be rented out to companies through smart contracts," the report states, adding that the collection of medical data through decentralized scientific protocols has become possible, enabling users to profit from previously untapped resources.

On-chain trading of government bonds is another prospect for 2025 and beyond. The market for tokens backed by government securities began to flourish in 2024, supported by institutional adoption of digital assets. Looking ahead, a16z expects governments themselves to explore the benefits of issuing debt on-chain.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment philosophy and be sure to increase risk awareness.

JinseFinance

JinseFinance