Hayscale has been an important representative of buying institutions in the crypto world since its birth. It is also one of the largest crypto "big name whales" and has been trustworthy for many years. The fund approach provides investors with compliant cryptocurrency investment channels.

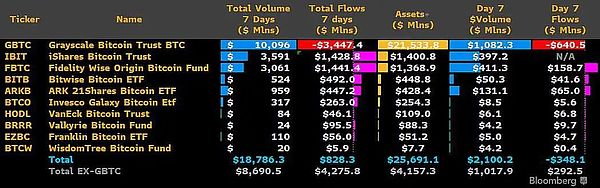

On January 11, after the Grayscale GBTC Trust successfully converted into a spot Bitcoin ETF, it began to cause continuous selling pressure on BTC - as of the time of publication, GBTC has experienced a cumulative outflow of US$3.45 billion, and except for GBTC, the other 10 ETFs are all experiencing net inflows.

This also means thatGrayscale GBTC is the core factor causing the current overall capital outflow of Bitcoin ETF, becoming the largest sell-off in the short term .

Grayscale: (once) the largest encrypted "big whale"

Since 2019, Grayscale has been an important whale in the encryption world - as a digital currency group DCG (Digital Currency Group) A specially established subsidiary in 2013. Before the spot Bitcoin ETF was listed for trading, Grayscale had been providing investors with compliant investment channels in the form of trust funds, and more than 90% of the funds came from institutional investors and retirement funds. .

When GBTC was converted to ETF on January 11 this year, the management scale of Grayscale GBTC (AUM) up to 25 billion US dollars, it is the largest cryptocurrency custody whale.

Currently, Grayscale’s current single trust fund also includes ETH, BCH, LTC, XLM, ETC, ZEC, ZEN, SOL, BAT, etc. It can also be seen from this that Grayscale, as an "institutional friend", has quite stable investment preferences and is basically mainstream assets and established currencies.

Andthese trusts themselves are "naked multi-trusts", just like specialized The "Pixiu" that feeds on cryptocurrencies - can only get in but not get out in the short term.

The investors who choose to deposit BTC and ETH for arbitrage purposes not only cause The scale of the trust corresponding to Grayscale continues to grow, which is also absolutely positive for the spot market - it strongly absorbs the corresponding currency from the supply side and buffers the selling pressure.

So although the grayscale GBTC has become a much-criticized bear market trigger, it could have Once regarded as the main engine of the bull market (2020):

Before 2020, Bitcoin Bitcoin ETFs have always been the main channel for incremental over-the-counter funds that the market has longed for. Everyone expects Bitcoin ETFs to bring huge amounts of incremental funds, open up the path for traditional mainstream investors to invest in cryptocurrencies, and open up the way for traditional mainstream investors to invest in cryptocurrencies. Try to push Bitcoin and others to be accepted on a large scale by Wall Street as much as possible, so that crypto asset allocation can gain wider recognition.

Since the entry of institutions represented by Grayscale in 2020, alsoUndertaken everyone’s expectations for Bitcoin ETF, and even played the role of a bull market engine for a time.

Especially in the context of the delay in the application for Bitcoin ETF being approved, Grayscale has established itself as almost the only compliant entry channel, which can be said to make a fortune silently:

In fact, it serves as an intermediate channel for qualified investors and institutions to intervene in the Crypto market, achieving a weak connection between investors and ETH spot, and opening up a channel for direct entry of incremental OTC funds.

Negative premiums gradually smoothed out

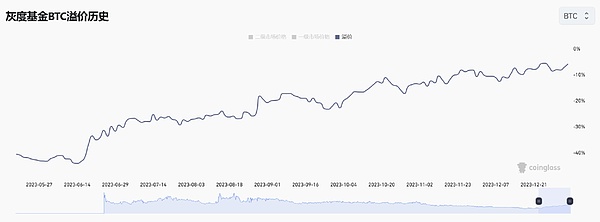

In factas early as June 2023, after the news about BlackRock’s spot Bitcoin ETF, GBTC’s The negative premium begins to gradually narrow.

Take the Coinglass data on July 1, 2023 as an example, grayscale GBTC, ETHE, etc. The negative premium of trust products is almost at a record low - the negative premium of GBTC trust reaches 30%, the negative premium of ETHE is also as high as 30%, and the negative premium of ETC trust reaches an outrageous level of more than 50%.

In the ETF expectation game in the past half year, the negative premium of GBTC has been narrowing. It has risen from 30% to close to 0 today. Most of the funds that were purchased in advance have reached the time to exit at a profit (such as Sister Mu).

From the perspective of negative premium, these investors who have participated in the private placement of GBTC and ETHE trusts in the primary market in the form of cash or BTC or ETH The damage is significant because the Grayscale Cryptocurrency Trust cannot directly redeem its underlying assets - there is no clear exit mechanism, no redemption or reduction of holdings.

Then after these investors have passed 6 or 12 months (the unlocking period of GBTC and ETHE ), the unlocked BTCG and ETHE shares are sold in the US stock secondary market. According to the current negative premium, it can only be a loss.

From this perspective, some people also bought GBTC in large quantities in the secondary market because of the negative premium. ——BlockFi once provided approximately US$1 billion in loans to Three Arrows Capital, with the collateral being two-thirds of Bitcoin and one-third of GBTC.

As a big buyer of GBTC, Three Arrows Capital is most likely betting on the future of GBTC After changing to ETF or opening exchange, the negative premium is evened out, and you can get the profit difference during the period.

So long before this round of ETF application boom,Grayscale had already On the surface, it actively promoted GBTC, ETHE and other trust products to become ETFs, so as to open up the channels for funds and exchanges, equalize the negative premium, and explain to investors. Unfortunately, Three Arrows Capital did not wait for this day.

When will the impact of grayscale end?

Honey then, arsenic today, grayscale on January 11 After the GBTC trust successfully converted into a spot ETF, it began to cause continuous selling pressure on BTC:

As of the time of publication, GBTC once again had outflows of more than $640 million in a single day, the largest single-day outflow to date. After being transferred to ETFs, a cumulative outflow of $3.45 billion had been made. Except for GBTC, the remaining 10 ETFs were all in net inflows.

Especially the first 7 trading days of all spot Bitcoin ETFs as of January 23 The total trading volume is about 19 billion US dollars, and GBTC accounts for more than half. This also means thatthe current incremental funds brought by ETFs are still in the stage of hedging the continued capital outflow of GBTC.

Of course, the sell-off of FTX, which is in the process of bankruptcy, also accounts for a large part - the 22 million GBTC shares sold by FTX in liquidation are worth nearly 10 One hundred million U.S. dollars.

In general, although Grayscale and GBTC were one of the biggest engines in the last bull market, First, for many years, investors have been provided with compliant cryptocurrency investment channels in the form of trust funds. However, after the adoption of ETF, there are traces of GBTC’s capital outflows and selling pressure:

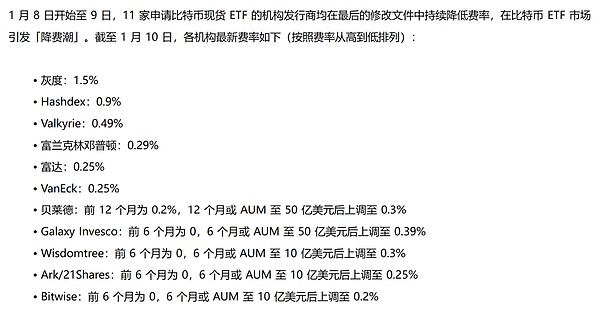

GBTC's 1.5% management fee is much higher than other companies' fee range of 0.2%-0.9%.

To some extent, this will be a clear-cut game in the coming period: GBTC still holds more than 500,000 BTC (approximately 20 billion US dollars), institutions and funds waiting to enter the market will definitely wait for the right time to collect chips to encroach on their share.

This also means that for some time in the future, GBTC’s selling pressure may still overwhelm subjective capital inflows will.

Looking back now, Grayscale has been used to drive off-site growth in 2020. The "bull market engine" of large amounts of capital is not only no longer effective in today's environment, but has even become a potential risk point that may trigger an industry tsunami at any time.

The positive factors when there is a tailwind will be amplified, and only persistence when the tide goes out is even more valuable. For an industry that is still developing at a rapid pace, getting rid of the obsession with whale layout and disenchanting institutions may be one of the greatest experiences we can gain in this special cycle.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Espresso

Espresso