Source: Grayscale; Compiled by: Deng Tong, Golden Finance

Summary

The results of the US election pushed Bitcoin to a record high. Although cryptocurrency is a bipartisan issue, Grayscale Research expects that unified Republican control of the White House and Congress should lead to legislation and regulatory oversight that is more conducive to industry innovation. President-elect Trump's nominations for key cabinet positions appear to be consistent with a pro-cryptocurrency policy agenda.

Other major cryptocurrency market developments include the launch of Bitcoin ETP options, MicroStrategy's large purchase of Bitcoin, a surge in trading volume on South Korean cryptocurrency exchanges, innovations in artificial intelligence agents, and market attention to Dogecoin.

2024 is a favorable period for cryptocurrency returns, and Grayscale Research believes that the bull market may continue next year.

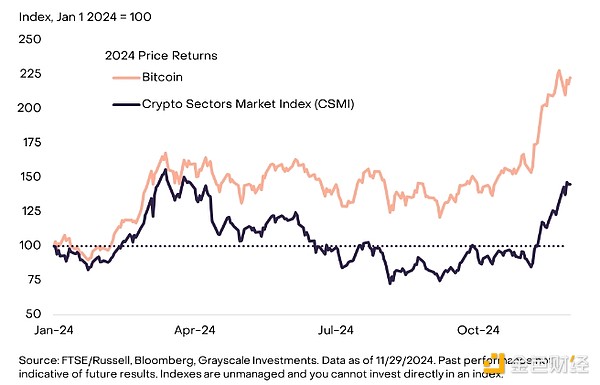

Prior to November, Bitcoin had appreciated 60% through 2024, but last month’s gains brought its year-to-date return to 110%. Unlike previous months, November’s favorable crypto market environment extended far beyond Bitcoin: our Crypto Sector Market Index (CSMI), which measures returns across a broad range of digital assets, gained 59% during the month and now also has positive returns for the year (Table 1).

Chart 1: Bitcoin has appreciated 110% this year

While cryptocurrency is a global phenomenon, Grayscale Research sees the recent U.S. election results as a potential turning point for the digital asset industry. The next president and Congress are likely to adopt comprehensive crypto legislation and help shape institutional oversight by appointing and confirming key regulators. These decisions could impact many aspects of blockchain adoption and development in the U.S., including asset tokenization, the use of stablecoins, and the integration of decentralized finance (DeFi) applications with traditional systems.

At the voter level, polling data suggests that cryptocurrency is a bipartisan issue, with Bitcoin ownership rates slightly higher among Democrats than Republicans. But among current and incoming members of Congress, Republicans have been more vocal in their support of digital asset innovation, and President-elect Trump has publicly supported the industry. As such, we view Republican control of the White House and Congress as a positive outcome for the crypto markets (see our previous election report for more details). The nominations of Scott Bessent as Treasury Secretary and Howard Lutnick as Commerce Secretary are encouraging early signs for the incoming administration, given both candidates’ past rhetoric and expertise in cryptocurrency. [2]

While many assets appreciated following the U.S. election, Bitcoin and the broader cryptocurrency market were among the best performing segments on a risk-adjusted basis (i.e., taking into account the volatility of each asset). Equity markets broadly appreciated, led by financial stocks, likely on expectations of lower tax rates and deregulation of certain industries (Exhibit 2). Meanwhile, the renminbi depreciated, likely on the threat of higher U.S. tariffs[3], while gold prices also fell, likely reflecting reduced tail risk of a contested election outcome.

Exhibit 2: Cryptocurrency markets outperformed traditional assets in November

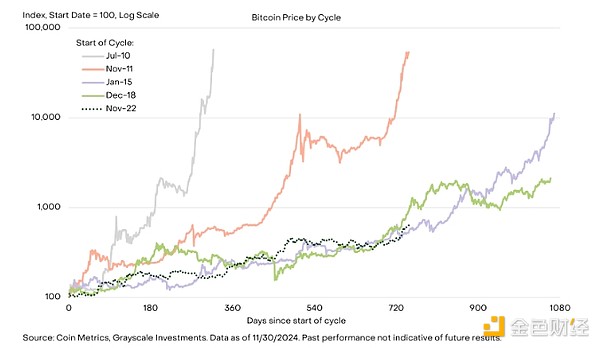

Like many physical commodities, Bitcoin’s price returns are characterized by a high degree of momentum (statistical persistence), which can give the appearance of price “cycles.” While each period has its own specific drivers, past Bitcoin cycles may be partially related to the four-year halving schedule. As Bitcoin matures and is adopted by a wider range of traditional investors, and the supply impact of the four-year halving declines, the cyclical nature of Bitcoin prices may become less frequent. While Bitcoin's price may always show some momentum - as with many physical commodities - changes may not occur every four years.

Nevertheless, past cycles may provide some guidance for Bitcoin's typical statistical behavior. Bitcoin's price reached a cyclical low in November 2022 and has been appreciating for about two years. The past four Bitcoin price cycles averaged 2.2 years, and the last two cycles averaged nearly three years. For the current cycle, the cumulative returns to date look roughly comparable to the previous two bull runs (Exhibit 3). While fundamental variables such as the state of the economy and the strength of the U.S. dollar will ultimately drive Bitcoin's price, history suggests the recent price rally may continue.

Chart 3: Pre-cycle Bitcoin Price Tracking

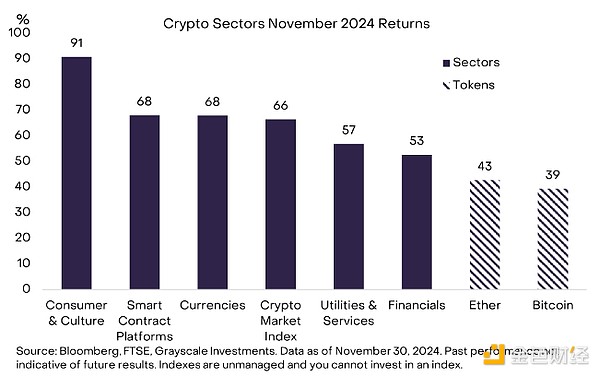

The broader financial market structure around Bitcoin continued to mature in November. US-listed spot Bitcoin exchange-traded products (ETPs) saw another $6.5 billion in net inflows, some of which may have flowed into spot/futures “basis trades”. Bitcoin ETP options also began trading last month. As of November 30, open interest in Bitcoin ETP products with listed options was $7 billion, with approximately 70% of that in call options and 30% in put options. Improvements in the market structure around spot Bitcoin ETPs could ultimately have an impact on proxy investments such as MicroStrategy shares. MicroStrategy is a publicly traded company that is nominally in the software business but primarily operates as a Bitcoin investment vehicle. [4] In November, the company purchased $12 billion in Bitcoin for its balance sheet and announced plans to purchase a total of $42 billion in Bitcoin over the next three years. [5] From a crypto industry perspective, the best performing segments were Consumer and Cultural, largely due to the strong performance of Dogecoin (DOGE), which is up 161% this month (Chart 4). Despite its meme origins, Dogecoin’s blockchain is derived from a fork of Bitcoin[6] and has faster block times than Bitcoin, Bitcoin Cash, and Litecoin, and comparable transactions per second to Bitcoin. [7]

Dogecoin is the largest asset in the consumer and cultural sectors by market capitalization. Blockchain received more attention on November 12 when Trump announced plans to create a Department of Government Efficiency, abbreviated as DOGE, co-led by Musk.[8] The department aims to reduce government waste and promote structural reforms. While there is no direct relationship between the proposed departments, the sharp increase in attention to Musk and the DOGE meme may have stimulated demand for the token and boosted its price.

Chart 4: Consumer and cultural cryptocurrency sectors outperformed on meme coin demand

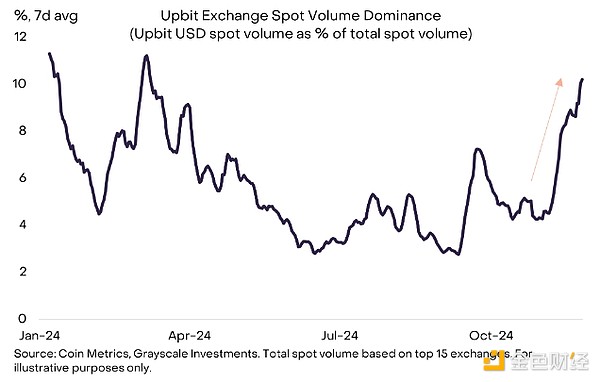

Besides Bitcoin and Dogecoin, the biggest gainers in market cap last month were XRP and Stellar Lumens (XLM), two crypto-related projects that initially focused on cross-border remittances but later expanded to other use cases, such as asset tokenization and supporting central bank digital currencies (CBDCs). Since the end of October, XRP has risen 281% and XLM has risen nearly 470%. The U.S. election results may provide more regulatory clarity for cryptocurrency projects engaged in remittance applications, which may improve the fundamentals of both projects. However, recent returns may also be driven by idiosyncratic flows. In particular, XLM’s sharp appreciation corresponds to a surge in trading volume on the South Korea-centric Upbit exchange, which may indicate large-scale speculative trading in XLM by South Korean investors (Chart 5). Therefore, XLM’s short-term prospects may depend on whether demand from these sources can continue, rather than on the project’s fundamentals.

Chart 5: South Korea-centric Upbit exchange volume surges

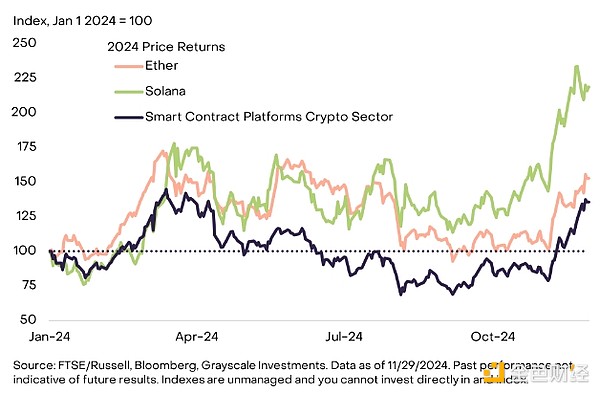

Crypto industry leader Solana continues to outperform the Ethereum network thanks to its smart contract platform, in part due to widespread meme coin trading on Solana.[9] Solana now generates fees comparable to Ethereum Layer 1, but has only about a quarter of its market cap. [10] If Solana can continue to expand adoption beyond meme coins, into categories such as decentralized physical infrastructure (DePin) or stablecoin payments, Grayscale Research believes it could continue to experience higher fee growth and token price performance. Among the larger smart contract platform blockchains[11], the best performers were Cardano (+216%), Polkadot (+127%), and Sui (+77%). [12]

While Ethereum has underperformed Bitcoin and Solana this year, its performance has been roughly in line with the overall smart contract platform cryptocurrency industry (Exhibit 6). Ethereum has certain competitive advantages that could support adoption over the coming year, including a solid lead in asset tokenization efforts and a broad network of application developers. Grayscale Research believes that Ethereum is “playing the long game”: bootstrapping network effects by keeping fees low on Base and other Layer 2s. In the post-election regulatory environment, trends in institutional adoption of digital assets may help determine whether Ethereum’s scaling strategy will support its leading position among smart contract platforms over time.

Chart 6: Ethereum has lagged behind Solana this year

Developers continue to explore innovative applications of blockchain technology, with recent market focus on projects related to decentralized artificial intelligence (deAI). This is a diverse category, but many projects are focused on leveraging economic incentives based on blockchain infrastructure to develop components of AI technology in a decentralized manner, including data collection and storytelling, computation, and model training and inference. In a recent report, Grayscale Research profiled recent experiments with “AI influencers”: autonomous AI agents active on social media that are able to make and receive payments using blockchain wallets. Another innovative market segment is decentralized science (DeSci), where projects leverage blockchain technology to help create a transparent, accessible, and collaborative scientific research environment. In early November, a DeSci event attended by major industry figures drew more attention to applications in this market segment. [13]

Crypto valuations rose sharply in November, with a series of market signals suggesting that speculative traders are currently relatively long in their positions. Without more fundamental news, cryptocurrency markets are likely to remain more range-bound in the short term.

However, Looking ahead to next year, Grayscale Research believes the bull run is likely to continue, especially if the macro backdrop remains favorable (i.e. the economy avoids a recession and the Fed lowers interest rates). Investors around the world are adopting Bitcoin as a unique form of money that offers digital scarcity and censorship resistance. We believe that the demand for these features will continue to grow as long as governments fail to control rising debt burdens and policymakers create friction into the fiat currency system through sanctions and other capital controls. Beyond Bitcoin, market structure is evolving to allow investors to more efficiently access crypto assets, and the incoming Congress is likely to bring greater regulatory clarity in the United States. market, and developers continue to bring exciting new applications to market, such as those related to decentralized artificial intelligence. While 2024 was a very good year for the crypto markets, we see no reason why 2025 cannot be just as good or better.

References

[1] The FTSE/Grayscale Crypto Sectors series of indices are weighted by the square root of the market capitalization of their constituent stocks, thereby reducing the relative weight of Bitcoin and other large-cap tokens.

[2] Source: DL News, AP, WSJ.

[3] Source: Reuters.

[4] Source: Financial [5] Source: Financial Times. [6] Dogecoin is a fork of LuckyCoin, LuckyCoin is a fork of Litecoin, and Litecoin is a fork of Bitcoin. [7] The average block interval over the past year is: Dogecoin (1.1), Bitcoin (9.9), Bitcoin Cash (10.3) and Litecoin (2.5); the average daily transactions per second over the past year are: Dogecoin (6.2), Bitcoin (6.2), Bitcoin Cash (0.8), Litecoin (3.3). Source: Coin Metrics, Grayscale Investments. Data as of November 29, 2024. For illustrative purposes only.

[8] Source: X.com.

[9] Source: Dune Analytics. Note that this does not include Dogecoin, which has its own blockchain. [10] Source: Artemis. Data as of November 30, 2024. [11] Defined here as companies with a market cap of more than $5 billion. [12] Source: Artemis. Data as of November 30, 2024.

[13] Source: Unchained Crypto.

Brian

Brian

Brian

Brian Weiliang

Weiliang Miyuki

Miyuki Alex

Alex Brian

Brian Brian

Brian Weiliang

Weiliang Miyuki

Miyuki Brian

Brian Weiliang

Weiliang