A few days ago, Michael Saylor, the founder of Microstrategy, tweeted that Microstrategy has taken action again and added another 14,620 BTC at an average price of about $42,110. As of 2023.12.26, MicroStrategy has accumulated a total of 189,150 BTC, with a total cost of approximately 5.9 billion U.S. dollars, and the average cost of adding a position is approximately 31,168 U.S. dollars.

Simple calculation shows that based on the current BTC current price of about 43k, the micro-strategy's position floating profit (43000-31168)/31168 = 38%, the net profit is about more than 2.2 billion US dollars.

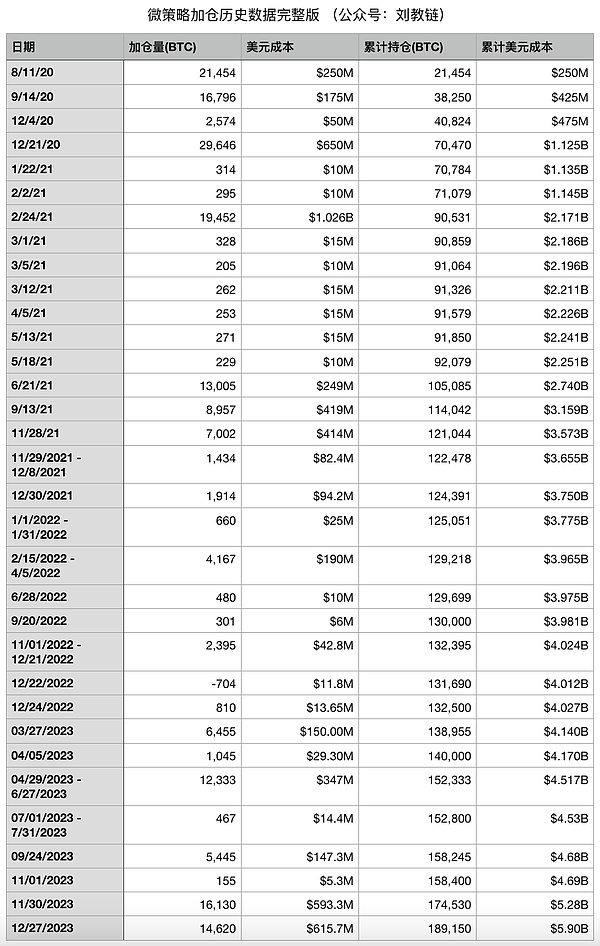

Jiaolian has compiled the historical data of all positions added by micro-strategy from the beginning of August 2020 to the end of December 2023 as follows:

Purchase from the end of 2020 Since a batch of BTC, the micro-strategy has continued to increase positions, passing through bulls and bears. After increasing positions at the high point of the bull market in 2021, it also experienced increasing positions at the low point of the bear market at the end of 2022. It climbed through snowy mountains, walked through grassland, and went through hardships and dangers, and finally completed the initial completion. Positive result.

Looking from a longer perspective, the only effect of the bull market is to increase the cost of adding positions. So for long-term hoarders who continue to increase their positions, which one is a better journey, the generous plateau cattle (2021 type) or the pointed alpine cattle (2017 type)?

What’s interesting is that the micro-strategy, which insists on adding BTC regardless of bulls or bears, is also the only strategy suitable for the vast majority of newbies. Refer to Jiaolian’s 2021.8.21 article “From Investment Novice to Financial Freedom”.

It is particularly noteworthy that there are three basic points of this strategy:1. Only add, not subtract, only buy, not sell. 2. Add positions in batches without stud. 3. Only add BTC, and don’t touch copycats and local dogs.

However, looking deeper, micro-strategy actually does some "more professional" operations that go beyond Xiaobai's.

First, lend the position.

Michael Saylor has said more than once that micro-strategies will always hold their BTC positions and never sell.

However, he also disclosed at the end of 2021 that MicroStrategy would lend his BTC to hedge funds.

In other words, the micro-strategy itself will never sell coins, but the hedge fund that borrows BTC will definitely sell coins, buy and sell them back and forth, and perform arbitrage.

This is similar to the fact that the U.S. Treasury Department/Federal Reserve will not sell the gold it holds, but will lend the gold to investment banks like JP Morgan to go to the gold market." Market making" is similar.

So there is an additional layer of risk here, that is, the hedge fund that borrowed BTC screwed up and lost BTC, and the hedge fund cannot afford the compensation and goes bankrupt. , if the micro-strategy cannot recover the same amount of BTC as the currency standard, it will suffer a net loss of the amount of BTC.

In the long run, hedge funds losing money is an inevitable event. This question was discussed in Jiaolian’s 2021.1.1 article “Why Can’t Your Investment Outperform Bitcoin?” has been discussed in detail in ".

Some friends may put their digital assets on financial management platforms to "deposit and earn interest", which is somewhat similar to what micro-strategy does. The risk point is naturally that the financial management platform loses money or even runs away.

Second, off-site leverage.

MicroStrategy has issued some long-term junk bonds in previous years. Some do not even need to pay interest, and their maturity dates are several years long, with most maturing around 2027-2028. Michael Saylor firmly believes that the price of BTC will become even higher in a few years, which will allow micro strategies to pay off debt and pay maturity returns.

It is said that MicroStrategy currently holds a total of about 2.2 billion U.S. dollars in debt, and the current value of its BTC position is about 8.1 billion U.S. dollars, that is, every 100 USD BTC corresponds to USD 27 debt. This does not take into account MicroStrategy's other business assets. These debts are over-the-counter debts. Unless BTC falls below $11,000 on the maturity date, which is around 2027-2028, its BTC will be enough to cover these debts.

However, if MicroStrategy is forced to sell such a large amount of BTC to repay debt, it may be a heavy blow to the market.

Many pie hoarders with mortgage loans may be in a situation similar to micro-strategy and other over-the-counter leverage. Of course, mortgages require monthly interest payments, and the interest rate is quite high, and it is floating (LPR), which is much worse than the leverage of micro strategies. However, housing loans are almost the best leverage that ordinary workers can use. Regarding the discussion of this issue, Jiaolian once wrote an article "Have saved 500,000, should you repay the loan or hoard coins?" 》(2023.6.3 article).

Third, add financing.

Just some time ago this year, MicroStrategy issued additional shares (MSTR) in the U.S. secondary market, raised funds from the secondary market, and used the funds of U.S. stock investors. Add money to your BTC position. Benefiting from the market trend of BTC this year, it has strongly promoted the rise of MSTR stock, allowing Michael Saylor to use additional stock issuance to raise funds to increase his position.

Some people question if BTC turns downward, or if MSTR is decoupled from the performance of BTC, will micro-strategy be forced to sell BTC to save the market?

However, you must know the difference between stock financing and bond financing. Stocks do not promise to repay, so even if MSTR falls to zero, the micro strategy can be ignored . Of course, it is not clear whether Michael Saylor has done equity pledge financing. If so, then the stock price will fall to a certain extent, which will cause the stock to be liquidated, and the related pledged stocks will be liquidated by the brokerage. However, brokers cannot force MicroStrategy or Michael Saylor to sell BTC to replenish margin.

Grayscale's continued negative premium in 2022 has set a certain example. Even in the worst times, GBTC's negative premium was as high as -50%, but Grayscale remained unchanged. At that time, many people FUD the market and said that Grayscale was about to explode. However, Grayscale is a trust that cannot be breached by any recourse. Friends who don’t understand can review the 2023.1.12 article “Gemini tears up DCG and complains about being deceived in her relationship. Grayscale’s tens of billions of pie positions will not explode?” 》

The Grayscale Trust with 630,000 BTC is more than three times the size of the micro-strategy holdings.

From the perspective of a legal firewall, Grayscale Trust is definitely more ironclad than MicroStrategy.

But in any case, even if some netizens say that after the listing of Bitcoin spot ETF, it took away the users of MSTR and caused users to sell MSTR, it is only However, the decline in MSTR of the US stock market and even decoupling from the correlation with BTC will not necessarily lead to micro-strategies being forced to sell BTC positions. Grayscale does not promise that the performance of GBTC will be consistent with BTC, and MicroStrategy will not promise that the performance of MSTR will always be consistent with BTC.

Here we need to remind some friends who hold MSTR as a Bitcoin ETF in the US stock market to pay attention to the risk of decoupling negative premium.

This kind of gameplay essentially transfers risks to external investors through the rules of the game. For example, Grayscale GBTC has a negative premium, and the risk is blocked by the trust firewall, exploding speculators such as Sanjian Capital who were hyping GBTC premium arbitrage (refer to the stage play "Qian Huahua" written by Jiaolian on January 13, 2023). Then, micro-strategy MSTR may also experience a negative premium, and equity financing itself cuts off the promise of income and isolates the risk in the US stock market, with US stock investors paying for it.

For ordinary people, there may not be such a commitment-free financing channel to obtain funds to add BTC.

Fourth, off-site income.

Don’t forget that micro-strategy itself has business and business income. It has a steady stream of off-site cash flow to support its position-building behavior.

Of course, this is similar to most ordinary cake hoarders. The best strategy is to make money off-site and use the income earned off-site to add BTC.

To sum up, it can be seen that micro-strategy can use some financial resources that are not available to ordinary people, or are better than those that ordinary people can obtain. Tools to help it better hoard BTC, then it is a high probability that micro-strategy can outperform most ordinary pie hoarders. The excess returns people earn come from structural advantages.

After analysis, micro-strategy may lose its BTC position due to its aggressive leverage strategy during extreme black swan risks, causing it to underperform the currency. However, as long as BTC continues to outperform the traditional world, it will probably be difficult for micro-strategies to make a splash.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund JinseFinance

JinseFinance Davin

Davin Bitcoinist

Bitcoinist