Foreword

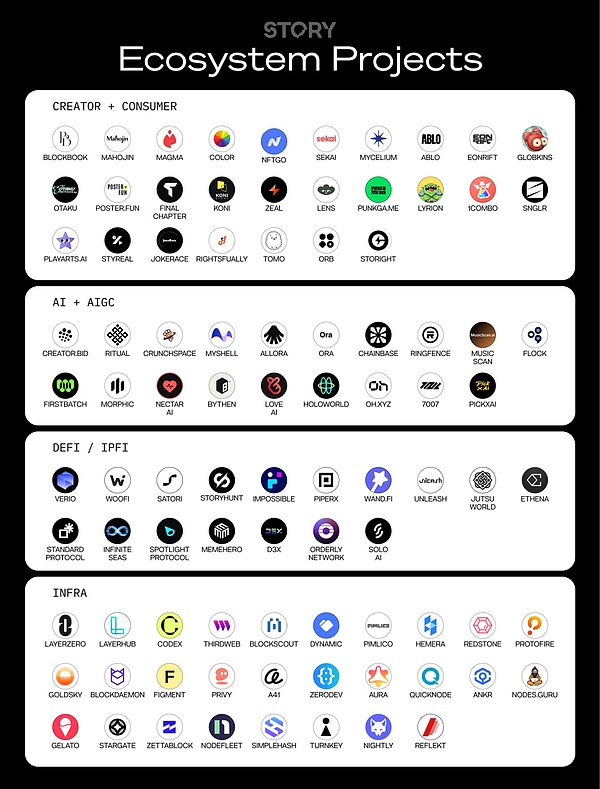

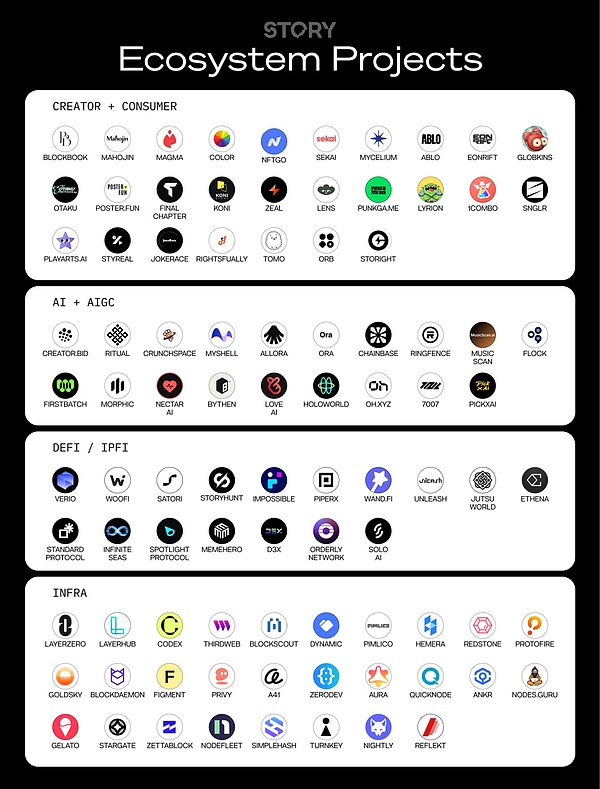

Last week, Story Protocol announced the launch of its final testnet Odyssey. Nearly 100 ecosystem partners are building killer applications on Odyssey. As the last testnet before the official launch, let’s take a closer look at what changes Story Protocol is about to bring to the IP industry with its huge $140 million financing.

1. Current Status of IP Intellectual Property Industry

Since the United States enacted the Digital Millennium Copyright Act in 1998, it has addressed issues such as copyright infringement on the Internet and digital platforms, focusing on preventing the illegal copying and dissemination of copyrighted works. Since then, the global retail sales of the intellectual property industry have expanded to $356 billion in 2024, generating $44 billion in royalties for intellectual property owners.

To better understand the IP landscape, we need to familiarize ourselves with the key players here:

Supply Side:

Demand Side:

Intermediaries:

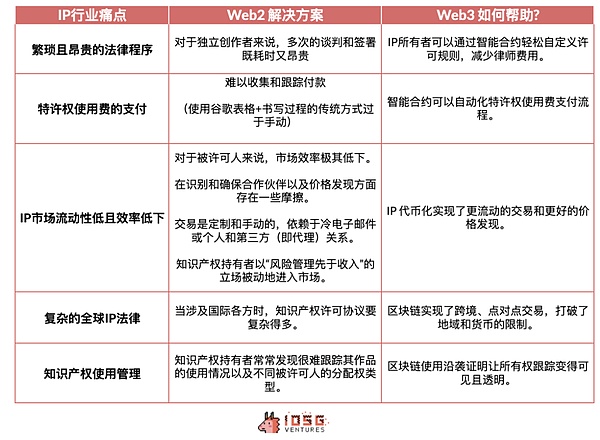

2.Pain points in the intellectual property industry

Despite progress, the current intellectual property industry is far from perfect. Today, nearly 80% of total IP licensing sales are completed through intermediaries: consulting and law firms as mentioned above.

2.1 Friction in IP Licensing

Due to the numerous intermediaries between the supply and demand sides, independent IP creators often lack the time and resources to hire legal and consulting professionals to participate. The manual management task of recording intellectual property contracts using Microsoft and Google tools (sheets, documents, etc.) further delays and complicates the entire licensing process.

This makes secondary independent derivative creators reluctant to pay licensing fees to IP owners through official channels, and more inclined to infringe. Traditionally, for intellectual property licensing transactions between two large companies, an escrow account must be used as an intermediary. The contract must be reviewed and signed by lawyers on both sides before the transaction can proceed. Relying on an escrow account is extremely inefficient, and this process can be completely automated using smart contracts.

2.2 IP Distribution Platforms Hinder Innovation of Intellectual Property

Web 2 distribution platforms often have too much power in IP deal negotiations, especially when it comes to independent IP owners, because these platforms can precisely control the exposure and traffic of each IP.

As Story Protocol founder SY Lee pointed out, content businesses often lack network effects, which forces them to rely on large content production and marketing budgets to survive. This overwhelming negotiating power makes it difficult for smaller IPs to make a profit, often causing them to fail before they even launch. Even large IP studios are hesitant to develop new IPs, choosing instead to focus on expanding existing IPs.

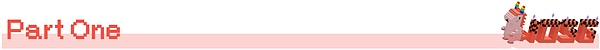

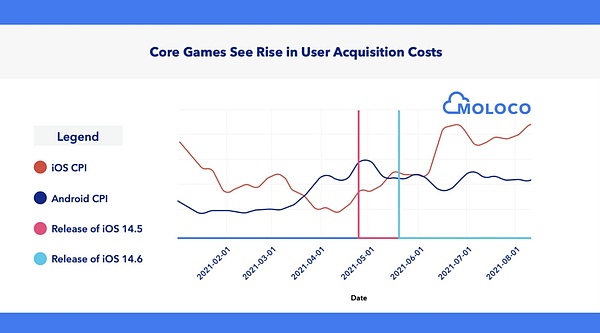

For example, Moloco reported that after Apple banned targeted advertising for mobile consumers, the cost per install soared, causing many mobile apps to fall by the wayside. To combat the pricing power of Web 2 platforms, independent IP owners and creators need an effective way to fight back.

Source: Moloco

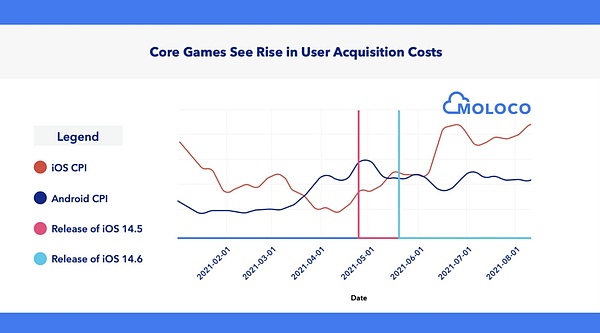

And the most promising solution is to help small independent IP evolve into a network. Transforming intellectual property into a model of fan and creator networks can help break these monopoly structures and bring more value to intellectual property owners.

Source: Story Protocol founder SY Lee

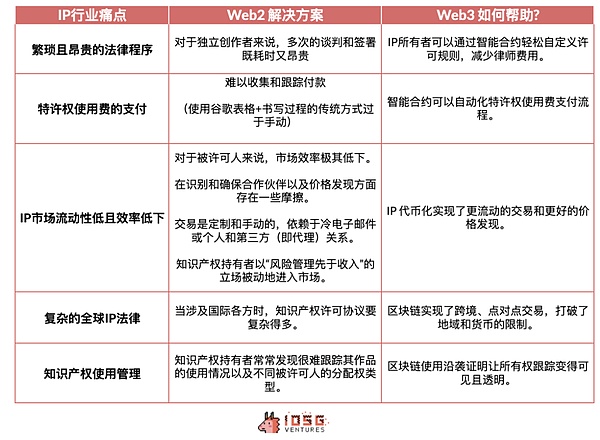

Of course, the problems in the IP industry are far more than this. Here are the challenges encountered by the traditional IP industry and why we believe Web 3 can help solve these problems.

3.Opportunities for Web3

The IP industry faces obvious problems of inefficiency and transparency, and Web 3 provides potential solutions. But haven't NFTs and related protocols already solved these problems?

3.1 Is NFT alone enough?

It is undeniable that the invention of NFTs (i.e. ERC-721 tokens) did introduce a permanent identifier for verifiable ownership of specific metadata such as text, images, and videos, effectively representing IP on-chain!

However, these NFTs are relatively static as their metadata is fixed once minted. To address this limitation, dynamic NFTs (dNFTs) were introduced to provide greater flexibility by encoding predefined conditions in smart contracts to allow automatic metadata updates triggered by on-chain or off-chain events.

Another important issue surrounding NFTs is liquidity and royalties, which is an area that has been widely explored in the financialization of NFTs. Sudoswap solves the liquidity challenge through an AMM model that enables automatic price discovery and adjustment. This solves the liquidity problem in traditional markets such as OpenSea, where sellers often wait for buyers to match prices.

Blur has further improved the NFT trading experience by reducing market fees to 0% and aggregating listings across markets, allowing users to easily compare prices and liquidity across platforms. In addition, Blur has launched Blend, a lending protocol that enables users to borrow and lend without selling their NFTs.

While AMM models and market aggregation have increased liquidity, some NFTs, especially rare or niche ones, may still face liquidity issues in funding pools. To address affordability and liquidity issues, Floor Protocol is attempting to break NFTs into micro-tokens, called μ-Tokens, to make them more accessible. Royalties for NFTs remain a controversial issue, with debates between Blur and OpenSea in the past. Magic Eden has taken a clear stance to charge royalties on all ERC-721C series listed on its platform.

As NFTs continue to develop, the Lego blocks of blockchain innovation in the field of intellectual property seem to be in place, but there is still a key piece missing: the ability to support the programmability of creator derivatives.

3.2 What is the programmability of derivatives?

IP owners need IP creators to create derivatives to maintain the popularity of their IP and extend the life of their IP. The more creators involved, the greater the benefit to the IP in the long run. This creates a dilemma that requires better solutions to effectively manage and enforce licensing agreements.

However, derivative works of IP often involve intricate parent-child relationships that are difficult to handle. It is difficult for current NFT protocols to track the connection between each version created on the chain and effectively implement customized royalty structures or licensing agreements.

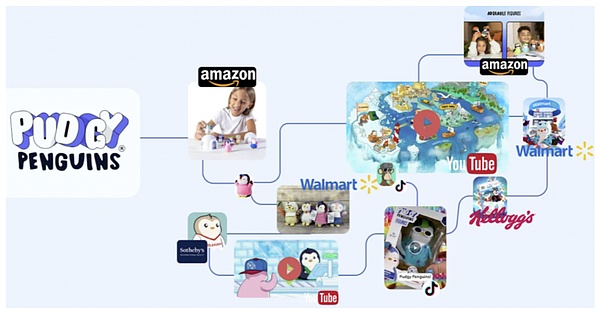

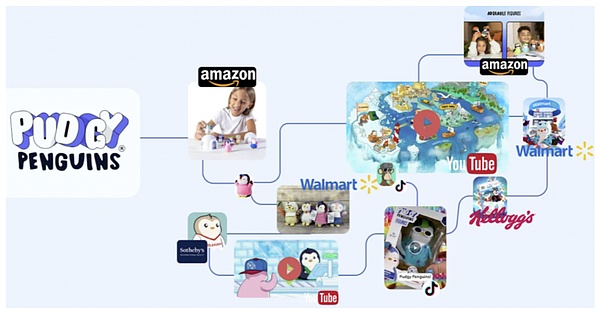

When Pudgy Penguins CEO Luca Netz sold more than 20,000 toys in just two days on the Amazon platform, the cumbersome process of signing partial authorizations with individual NFT holders added additional time and legal costs.

Source: TinTinLand

Derivative programmability essentially refers to supporting IP owners and derivative creators for more efficient IP licensing and version control.

A simple analogy is Git and GitHub. At the core of GitHub is Git, which tracks every modification made to a file. This version control system enables you to track and revert to any point in the version history.

So why is this programmable layer so important for IP creation and attribution?

Intellectual property creation and attribution are key elements in both Web 2 and Web 3 ecosystems. In the context of Web 2, the importance of IP is evident through the rise of AI Generated Content (AIGC) and User Generated Content (UGC). Similarly, in Web 3, the relevance of IP attribution is highlighted by the popularity of memecoins. Examples such as $BRETT, $APU, $PEPE, $PEPE2.0, etc., which originated from the PEPE-themed Boys Club, show the significance of derivative works in this space. These memecoins have shown huge trading volume, but the original creator Matt Furie has difficulty capturing the economic value generated by these derivative assets.

For example, while $PEPE and $PEPE2.0 are viewed as different tokens by the market, $PEPE2.0 is essentially a derivative asset of $PEPE, with only a color change to distinguish the two. This situation highlights the limitations of the current IP management framework in Web 3. Leveraging Story Protocol's IP tracking capabilities, the original holders of $PEPE should capture the value creation of their IP.

Under such a new mechanism, either a portion of the Pepe-themed derivative tokens will be airdropped to the IP owner, or a portion of the transaction fees will be directly given to the IP owner, allowing Matt Furie, the original creator of the Pepe-themed IP, to gain economic benefits.

A more efficient solution is clearly needed to manage the relationship between IP asset derivatives that provides greater programmability, and this is exactly the solution that Story Protocol is actively developing.

4. Story Protocol

The main innovation of Story Protocol is that it can provide IP owners with a comprehensive and open solution to manage their IP assets. This includes functions such as verification, authorization, traceability, and automatic profit distribution and claims, all with enhanced programmability. Story Protocol uses Cosmos-SDK to build an EVM-compatible L1 blockchain, allowing IP owners to easily register their intellectual property as IP assets on L1.

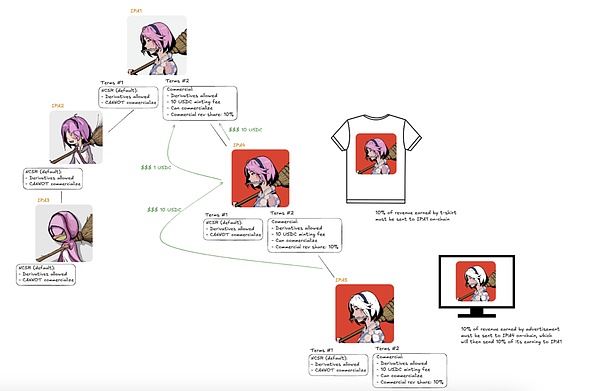

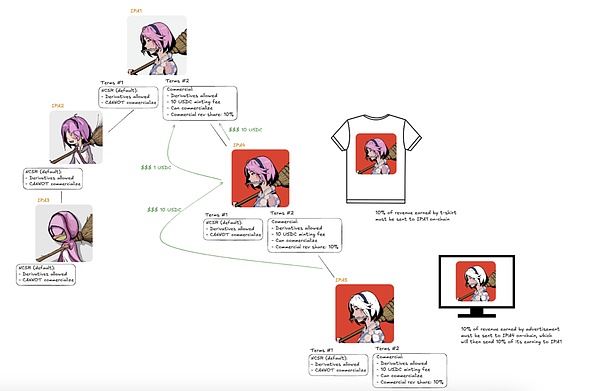

Story Protocol records multi-level parent-child relationships between various IP assets, where each asset can be a Web 3 native NFT or an on-chain proof NFT of a real-world IP, such as Donald Duck. In the case of bringing real-world IP onto the chain, Story Protocol has also developed a code-based contract template called Programmable IP License (PIL). Through PIL, IP owners can map off-chain licensing terms to the blockchain by attaching PIL to their IP assets.

Programmable IP License (PIL) fully embodies the principle of "code is law" in the blockchain field and provides three predefined templates:

Non-Commercial Social Remixing Non-Commercial Use: This template allows users to freely use, share and remix the original IP in a social environment, but explicitly prohibits any commercial use.

Commercial Use Commercial Use Rights But Prohibit Resale and Derivative Development: This template allows users to purchase the right to use the original IP at a preset price, but prohibits reselling the original IP or using it to create and sell commercial derivatives.

Commercial Remix Commercial Use Rights and Allow Resale and Derivative Development: Based on the commercial use template, secondary creation and commercial use of derivatives are allowed.

An IP asset can have multiple different PILs. In addition to the three preset templates, users can also customize their own terms of use. These terms are open and transparent to all participants. Other creators can review these terms and, if they agree, obtain a license with just one click and start creating derivative works immediately.

When derivative works generate income, the smart contract automatically distributes royalties between the original IP creator and the creator of the derivative work according to the preset terms of the original IP. This process is efficient, transparent, and requires no third-party intervention, ensuring that profits are distributed fairly and promptly to all participants. In addition to openness, licensing, and royalty distribution, Story Protocol also includes a dispute module specifically for rights verification. This module allows intellectual property owners to report intellectual property derivative creators in the event of intellectual property infringement. Currently, Story Protocol's legal team serves as an arbitrator, but in the future it may be handed over to a third-party legal team for arbitration.

In the above example, we can see how Azuki IP NFT allows both IP owners and derivative creators to obtain their respective commercialization income through the process of derivative creation and profit distribution.

4.1 From Insufficient Liquidity to Liquidity

Story Protocol, as a new middleman, replaces traditional intermediaries such as legal and consulting services that are costly and cumbersome. This innovation greatly reduces the entry barrier for IP licensing, while ensuring that derivative works and remixes are controllable and traceable, ultimately protecting the originality of IP owners and derivative creators.

However, some people may express concerns about market heterogeneity. The customization of IP is virtually limitless, and when over-customization occurs, it leads to potential liquidity issues in financial markets. How to solve this problem? What automated matching solutions can be implemented to meet the diverse preferences of the demand side?

Solving the market liquidity problem is a key element that differentiates Story Protocol from competitors such as Spaceport.

Through the licensing module and the royalty module, all users of Story Protocol (including IP owners and derivative creators) mainly trade two types of tokens: license tokens and royalty tokens.

License Tokens License Tokens (ERC-721): These tokens grant the right to use intellectual property or create derivatives of intellectual property. They can be minted or purchased on the secondary market by paying a fee. When the license token is destroyed, the holder accepts the licensing terms of the intellectual property, allowing them to start creating derivative works. The system transforms intellectual property derivative rights into tradable assets, providing new income opportunities for original creators.

Royalty Tokens (ERC-20 tokens, 1B supply): These tokens represent a portion of the revenue generated by the IP. Revenue comes from three sources: fees from minting license tokens, IP usage revenue, and revenue splits between the original IP and its derivatives. Royalty tokens allow holders to claim a portion of that revenue, making the future revenue stream of the IP more liquid and accessible to creators and investors.

Licensing tokens transform IP derivative rights into tradable, liquid assets, providing original creators with a diversified revenue stream. At the same time, royalty tokens, as an asset-backed security, can tokenize future cash flows, thereby enhancing liquidity for IP asset owners and investors. This process reflects the benefits of asset securitization, allowing the revenue rights of IP assets to be traded like financial assets. In addition, the purchase or sale of IP royalty tokens reflects investors' optimism or pessimism about the future revenue of the IP.

Story Protocol stands out for its L1 architecture. By registering all IP assets on a single L1, it ensures uniform treatment of these assets and prevents liquidity fragmentation. For example, think of memecoins as a form of intellectual property assets. Although meme coins are typically ERC-20 tokens, if they are converted to ERC-721, they will essentially represent meme NFTs. IP assets deployed on different blockchains, such as $MOODENG, are often treated as different tokens, even if they represent the same underlying asset. This leads to liquidity competition between the same tokens on different chains, which reduces their overall value. Story Protocol's L1 structure solves this problem by consolidating liquidity in one place, preventing the value of assets from being diluted across multiple blockchains. In addition, Story Protocol's royalty payment and licensing module helps control the creation of a large number of copycat derivative memecoins, such as $NEIRO, $Neiro, and $NEIROETH. By introducing royalties, the cost of launching new memecoin derivatives will increase, thereby preventing excessive and unsustainable proliferation of these tokens.

4. IP+Web 3.0 has a promising future

All this sounds very exciting. In fact, we can already clearly imagine how the traditional IP industry will be subverted on a large scale by blockchain.

Especially with the advent of the AIGC era. AIGC represents a revolutionary shift in the way creative works are produced, using advanced artificial intelligence algorithms to automatically generate text, images, audio and video, blurring the line between human creativity and machine-generated output.

However, copyright issues in the field of Gen AI remain unresolved. Traditional intellectual property law allows intellectual property owners to decide how their works are used, including creating new derivative works based on the original work. But there is no clear legal framework for copyright confirmation for content generated by Gen AI.

One situation that remains unresolved is: should these AI-generated works be considered unauthorized derivatives or entirely new intellectual property? This is an issue that urgently needs further clarification and improvement in copyright law.

Today, Gen AI has generated a large amount of content based on existing IP. It is critical for protocols like Story to help establish IP ownership within AIGC and address the traceability, liquidity, and royalty distribution challenges of these AIGC IPs.

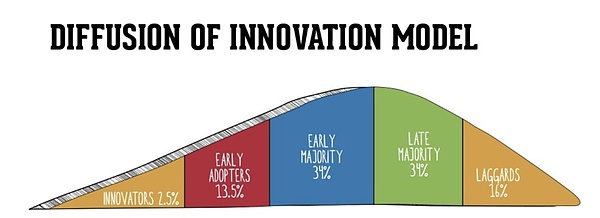

Obviously, we still need to keep our cool. A very obvious fact is that Web 3 is still in its development stage, transitioning from early adopters to early majority as described in the innovation diffusion model.

Source: Everett Rogers's Diffusion of Innovation Theory

However, we believe that this situation will naturally improve over time, and the reasons are clear. According to the recent a16z Cryptocurrency Status Report, there are approximately 617 million cryptocurrency holders, and active addresses and usage have hit record highs. We believe that with the mass adoption of Web3, combined with the progress of Story Protocol itself, the IP era will develop in an ideal direction.

JinseFinance

JinseFinance