Author: NihaoVand Source: X, @nihaovand

Binance Research released their annual report for the first half of the year. I always think that the research reports of Binance and Huobi are very meaningful. Unfortunately, Huobi Research has stopped updating. Then I will summarize BN's research report, take you to read and highlight this report. The original text can be followed @BinanceResearch Very high-quality content, but the low interaction volume is not right. Before entering the main text, let me briefly talk about my way of thinking when reading research reports. I never read various data reports to learn, but to "check the answers". What do I know about the content, what is different from what others know, and how to reflect on it?

The main content of the report covers the performance of the crypto market in the first half of 2024 and future expectations.

It mainly consists of several themes and their key points:

1. Market Overview: The growth of the total market value of the crypto market and its driving factors.

In the first half of 2024, the total market value of the crypto market increased significantly, from about US$1.65 trillion at the beginning of the year to about US$2.27 trillion, a growth rate of 37.3%.

This growth was mainly driven by the following factors:

1. Strong buying performance in the first quarter:

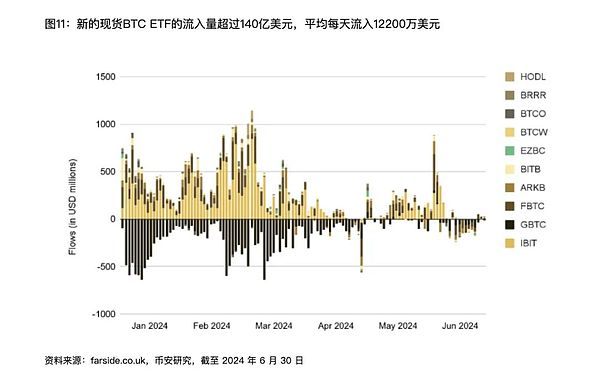

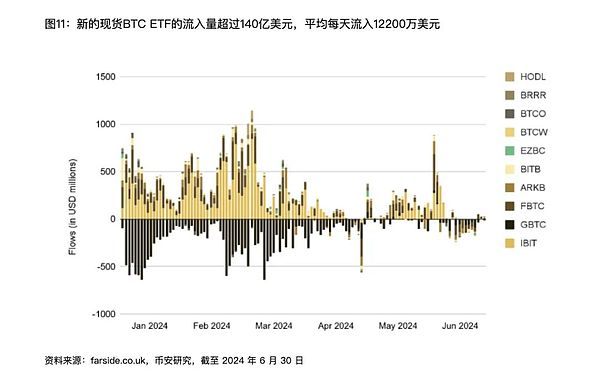

The approval of the Bitcoin spot ETF in the United States, despite the initial flat price reaction, has seen a significant increase in capital inflows in the following months.

(I think that when traditional funds launch Bitcoin financial products to retail investment on a larger scale, they will continue to lead a wave of increases)

Participation of institutional investors: The approval of Bitcoin spot ETFs provides institutional investors with a more direct and safer way to invest in cryptocurrencies, attracting a wide range of institutional investors including hedge funds and pension funds. According to statistics, as of the first half of 2024, these ETFs have attracted more than $14.7 billion in inflows.

2. Narratives drive the growth of on-chain activities and trading volumes.

Bitcoin halving: Supply reduction, which in turn drives up prices

Ordinals and Inscriptions technology on Bitcoin has triggered the activity of the NFT market

Restaking: The concept of restaking on Ethereum has attracted widespread attention and capital inflows from the market

Memecoins and Airdrop Seasons: The craze for Memecoins and airdrop activities of multiple projects have attracted a large number of new users and funds.

3. Other macroeconomic factors:

The interest rate policy of the Federal Reserve, the global economic situation

The change in the market's perception of cryptocurrency as a safe-haven asset has also had a positive impact on the market.

When traditional financial markets perform poorly, investors are more inclined to turn to the crypto market to seek higher returns.

2. Progress of Layer-1 Blockchain

Progress of Ethereum

1. Restaking:

EigenLayer dominates the restaking process. In the first half of 2024, EigenLayer's total locked value (TVL) reached US$14 billion, accounting for more than 85% of the entire market.

EigenLayer allows Ethereum stakers to reuse their staked ETH to protect other applications (called active verification services, AVS) and earn income through this process.

2. EIP-4844 Update:

Ethereum completed the Dencun hard fork in March 2024 and launched EIP-4844

Since the launch of EIP-4844, L2 transaction fees have generally dropped by more than 90%.

3. Development of the DeFi market:

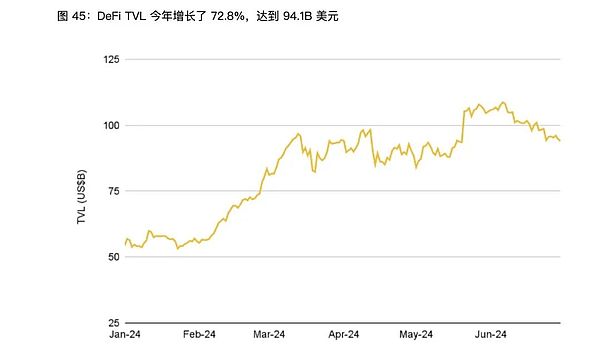

Ethereum continues to dominate the DeFi market, with a TVL of $51.6 billion, far higher than other Layer-1 blockchains.

Major DeFi applications and protocols on Ethereum continue to attract a large number of users and capital, driving the continued growth of the market.

4. Approval of spot ETH ETF:

At the end of May 2024, the U.S. Securities and Exchange Commission (SEC) approved the listing applications of several spot ETH ETFs

Although some people expect that the capital inflow of ETH ETFs may be lower than that of Bitcoin ETFs, this approval is still seen as a major positive for the Ethereum market.

BNB Chain

1.OpBNB:

OpBNB is the BNB Chain OptimisticRollupL2 solution based on OP Stack, supporting up to 5,000 transactions per second (TPS) and with an average gas fee as low as 0.001gwei.

Since its launch in September 2023, OpBNB has seen a total transaction volume of over 1.1 billion, with 3.5 million daily active accounts.

2.BNB Greenfield:

BNB Greenfield is a decentralized data storage infrastructure in the BNB Chain ecosystem that allows users to create, store, and exchange data that they fully own.

Since its launch in Q4 2023, BNB Greenfield has seen a storage volume of 2.15TB, a total transaction volume of 6.8 million, and 35,000 total addresses.

3.Memecoins and Airdrops:

BNB Chain has launched a number of community initiatives with a focus on Memecoins and airdrops, including MemeInnovation Battle and Airdrop Alliance.

The Meme lnnovation Battle program supports Memecoin innovation with $1 million in funding, and the AirdropAlliance program airdrops tokens to users of high-quality projects.

Solana

1.Memecoins:

Solana has performed well in the Memecoins market

Solana has further promoted the activity of the Memecoin market by airdropping BONK Memecoin to Solana SagaMobile users.

2.DePIN (Decentralized Physical Infrastructure Network):

Solana has played an important role in hosting key DePIN projects, including Helium and Hivemapper.

3.Solana Actions and Binks:

Solana Actions is an API that returns transactions on the Solana chain, and Blinks converts any Solana Action into a shareable link, and users can perform on-chain transactions directly in the link.

This innovation allows users to access Solana's dApps from any platform that can share links.

Other Layer-1 Projects

1.Avalanche:

Avalanche released the Teleporter communication protocol to improve interconnection between its subnets, supporting cross-subnet transmission of tokens, NFTs, and messages.

The Avalanche Foundation continues to support the ecosystem, including the $100 million Culture Catalyst Fund and the $50 million Vista Fund.

2.Cosmos:

The Cosmos ecosystem revolves around the Cosmos Hub, connecting multiple application chains (Zones) through the Inter-Chain Communication Protocol (IBC).

There are currently 80 active IBC-enabled Zones with a total market value of over $31 billion.

3.Tron:

Tron has performed well as a stablecoin settlement chain, hosting more than 50% of USDT and is the second largest DeFiTVL network:

Justin Sun announced that Tron is developing a Bitcoin L2 solution.

4.TON:

The TON market has grown significantly over the past year, with total market capitalization growing from approximately $8 billion in January to over $18 billion at the end of June.

TON's integration with Telegram is one of the main drivers of its growth.

5.Fantom:

The Fantom Foundation announced its new L1Sonic, which will have native L2 bridging to Ethereum and will be able to handle 2,000 transactions per second (TPS).

6.Berachain:

Berachain uses a novel liquidity proof consensus mechanism, focusing on building systemic liquidity within the Berachain ecosystem and aligning all stakeholders.

7.Cardano:

Cardano's DeFiTVL reached a new high of more than $500 million in the first half of 2024.

Cardano is preparing for the upcoming Chang hard fork, which is expected to fully decentralize its governance by the end of July.

8.NEAR Protocol:

NEAR Protocol is active in the AlxCrypto subfield and is about to release its data availability solution NEAR DA.

3. Decentralized Finance/DEFI

Overall Performance of the DeFi Market

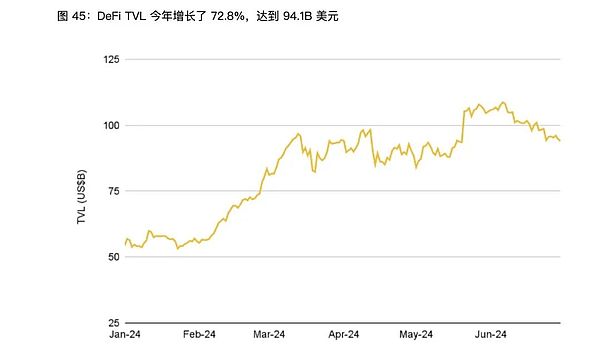

In the first half of 2024, the DeFi market attracted a large amount of capital, pushing the total locked value (TVL) from US$54.4 billion at the beginning of the year to US$94.1 billion, an increase of 72.8%. This growth benefits almost all DeFi projects, from major markets to niche markets.

Development of Sub-tracks

1. Liquid Staking:

Liquid staking means that users can continue to participate in other DeFi activities through the derivatives of staked tokens while staking tokens.

This market grew significantly in the first half of 2024, mainly driven by platforms such as Lido and Rocket Pool.

2. Restaking:

Restaking allows users to further stake on top of already staked tokens to provide security for other applications.

EigenLayer is a major player in this field, with a TVL of $14 billion, accounting for more than 85% of the entire market.

3. Decentralized Lending:

The decentralized lending market continued to grow in the first half of 2024, with major platforms including Aave, Compound, and MakerDAO.

These platforms allow users to lend or borrow crypto assets without intermediaries, providing flexible lending conditions and higher yields.

4. Decentralized Exchange (DEX):

The DEX market continued to expand in the first half of 2024, with platforms such as Uniswap, SushiSwap, and Curve maintaining market dominance.

DEX provides a trustless trading environment where users can exchange tokens directly on the chain, avoiding the potential risks of centralized exchanges.

5. Yield:

Yield products in the DeFi market continue to be favored by investors, including liquidity mining, yield farms, and interest rate agreements.

These products provide a variety of ways for users to earn passive income by providing liquidity or lending.

6. Derivatives:

The DeFi derivatives market continued to grow in the first half of 2024, with major platforms including dYdX, Synthetix, and Perpetual Protocol.

These platforms allow users to trade leverage, futures, and options, increasing the depth and liquidity of the market.

7. Prediction Market:

Prediction markets performed well in the first half of 2024, with major platforms including Augur and Polymarket.

These platforms allow users to bet on future events, thereby using market wisdom to predict outcomes.

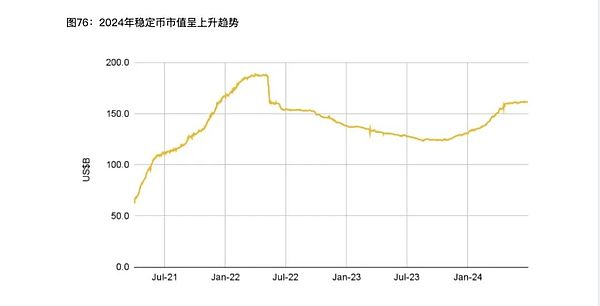

Fourth, Stablecoins

Overview

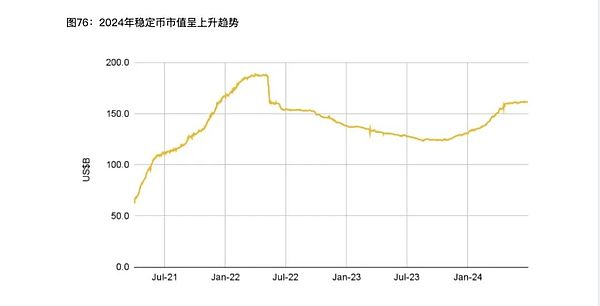

In the first half of 2024, the market value of the stablecoin market reached US$161 billion, close to the peak in April 2022. The stablecoin market has shown significant growth in its recovery process after the TerraUSD (UST) crash.

Major Players

1. Tether's USDT:

USDT continues to dominate the market, occupying the largest market share. Its stability and widespread use make it the most popular stablecoin.

2. Circle's USDC:

USDC performed well in the first half of 2024 and increased its market share. Its transparency and compliance make it the first choice for many institutional investors.

3. Other stablecoins:

MakerDAO's DAI: DAI, as a decentralized stablecoin, continues to be popular with users, and its market share has also increased.

Ethena's USDe: USDe launched by Ethena performed well in the first half of 2024, and its market share increased significantly.

First Digital's FDUSD and Paypal's PYUSD also occupy a certain share in the market.

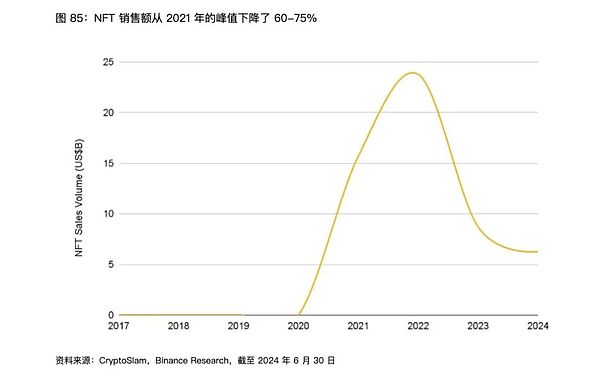

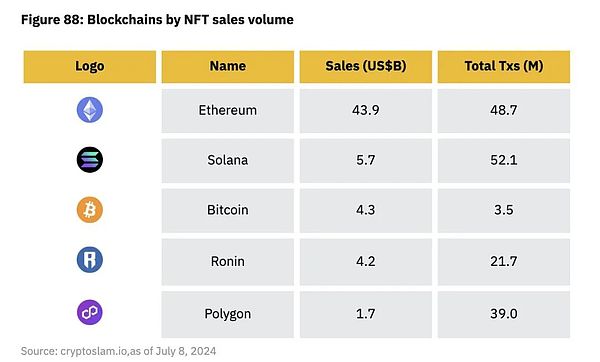

V. NFT and Socialfi

NFT Market Overview

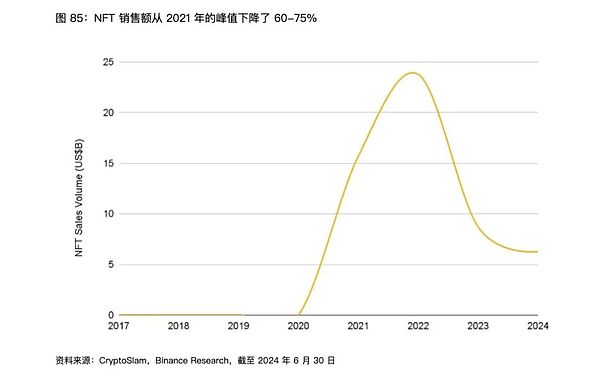

In the first half of 2024, the NFT market experienced some fluctuations, with sales volume declining and the floor price of major projects falling by more than 50%. However, some platforms and projects performed outstandingly.

Major NFT Markets

1.Bur:

Blur continued to maintain its market dominance through the Blast token airdrop, and its innovative trading mechanism attracted a large number of users.

2.Pudgy Penguins:

Pudgy Penguins achieved certain success after launching physical toys, further expanding its brand influence.

3.Bitcoin NFT:

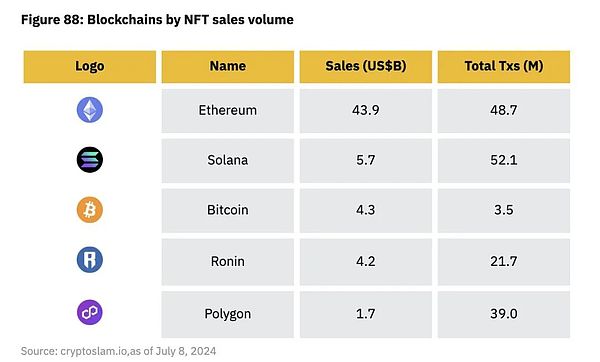

Bitcoin NFT continued to perform strongly in the first half of 2024, attracting a lot of attention.

Socialfi Web3 social development

1.ens Protocol:

Lens Protocol announced the upcoming zk chain LensNetwork, further promoting the development of the social field.

2.Farcaster:

The number of Farcaster users continues to grow, and Frames has been launched to further enhance the user experience.

3.friend.tech:

friend.tech released its token and v2 version, attracting more users and investors.

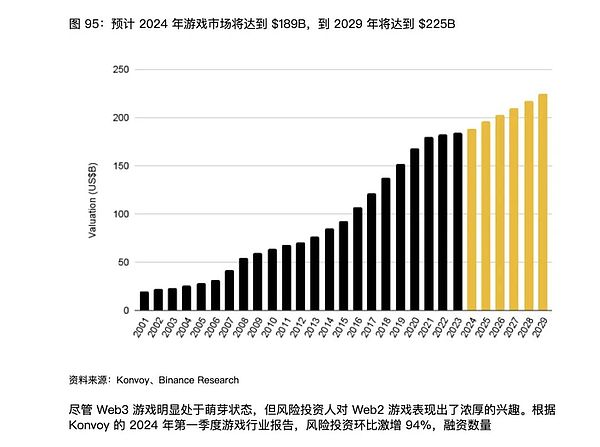

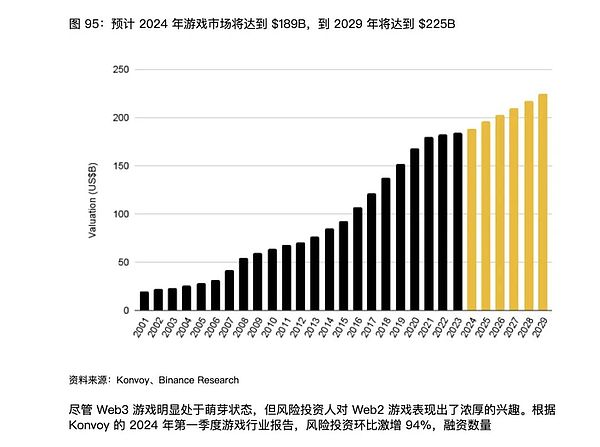

Six, Gaming

Macro perspective

Web3 games performed strongly in the first quarter of 2024, but the market value of game project tokens fell significantly in the second quarter. However, user growth indicators remain healthy.

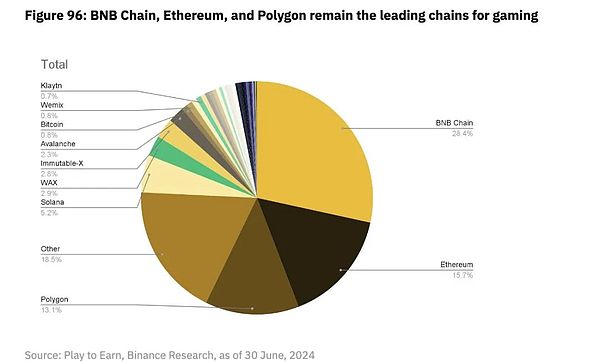

Major game projects and trends

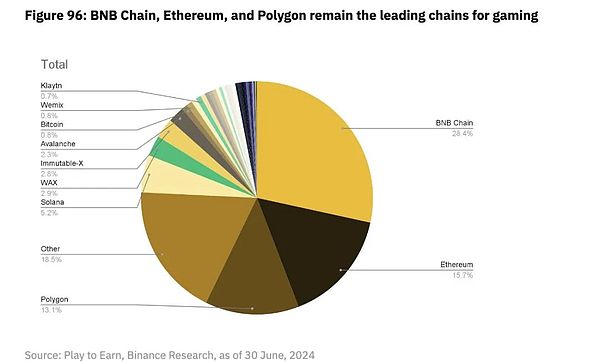

From the chain point of view, BNB, Ethereum and Polygon are still the primary chains adopted by game projects. These three chains together support more than 50% of game projects

Main Trends

1.Tap-to-Earn:

The Tap-to-Earn model became a major trend in the first half of 2024. This model allows players to earn cryptocurrency through simple interactions and clicks, lowering the threshold for game participation and attracting a large number of players.

2.Fully On-Chain Games (FOCG):

The concept of Fully On-Chain Games (FOCG) is gradually emerging. These games run entirely on the blockchain, providing unprecedented transparency and fairness. Players can view and verify all game operations and results on the chain, which enhances the trust of the game.

3. Infrastructure Development:

The infrastructure of Web3 games is also developing. Platforms such as Ronin and XAI provide game developers with a more efficient and secure development environment, promoting the birth of more high-quality Web3 games.

4. In-game Economy:

With the popularity of Web3 games, the in-game economic system has become more complex and diversified. Players can not only earn income through games, but also trade, invest and manage assets in the game, creating a complete virtual economic ecosystem.

Main Game Projects

1.XAI:

XAlGaming Chain:XAl is a blockchain focused on games developed by Offchain Labs. The chain raised more than 13,000 ETH (about $40 million) through its node sale activities and went online in March 2024. The market value of the XAI token is currently $130 million.

Functions and Advantages:The XAI chain provides game developers with an efficient and secure development environment, supports the operation of on-chain games, and solves the latency and scalability problems of traditional blockchains in the gaming field.

2.Pixels:

Pixels attracted a large number of players through its unique game mechanics and token economic model, becoming one of the Web3 games with the fastest user growth in the first half of 2024.

3.Hamster kombat:

This game attracted a large number of players through token airdrops and interesting gameplay, and the user base grew rapidly in a short period of time.

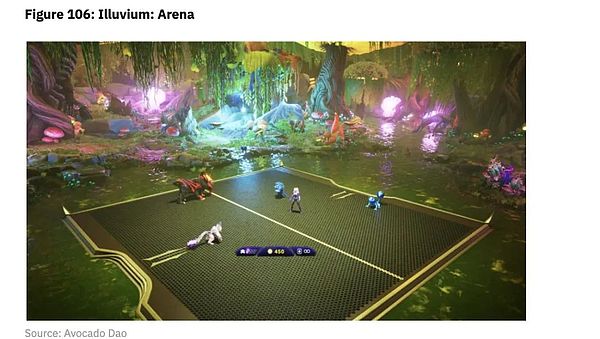

4.Big Time, Nifty lsland and Illuvium:

These MMORPG and Metaverse projects continued to attract a large number of users and investments in the first half of 2024, consolidating their position in the Web3 game market.

“

VII. Other Topics

1. Memecoins

In the first half of 2024, Memecoins performed outstandingly in the crypto market

Solana is particularly prominent in the Memecoins market, and many Memecoin trading activities are concentrated on the Solana chain for reasons including low transaction fees and efficient transaction speed.

2. Major Memecoin projects:

BONK: This is a Memecoin on Solana, which is airdropped to Solana Saga gained attention due to its popularity among mobile phone users.

Pump.fun: A platform for creating and trading Memecoins. Pump.fun ensures that each token is launched fairly, without pre-sales and team allocations, attracting a large number of traders.

Since the launch of the platform, more than 1.1 million new Memecoins have been deployed, generating approximately $42 million in revenue.

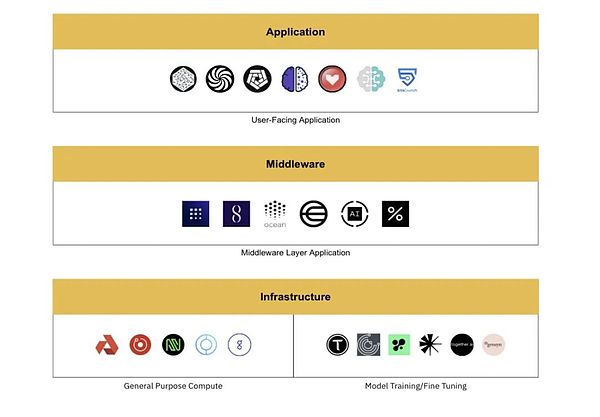

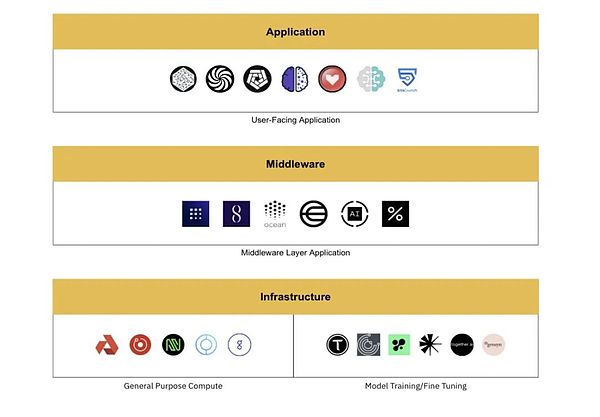

3. Artificial Intelligence (AI)

1. Application of Al in the crypto market:

Trading strategies and market analysis: AI is used to develop advanced trading algorithms and market analysis tools to improve trading efficiency and predict market trends. For example, many trading platforms use AI technology to analyze market data and provide more accurate trading signals.

Risk management: AI technology is used for risk management and compliance monitoring to help exchanges and financial institutions identify potential risks and prevent fraud.

2. The integration of AI and blockchain!

Smart contracts and automation: AI technology is integrated into smart contracts to automatically execute complex agreements and transactions, improving efficiency and security. For example, smart contracts can automatically execute transactions based on preset conditions without human intervention.

Data analysis and prediction: AI is used to analyze blockchain data, identify patterns and trends, and provide deeper market insights and predictions.

4. Main AI projects:

Fetch.ai: This is a blockchain-based AI platform that aims to create a decentralized digital economy that enables intelligent agents to perform tasks and transactions autonomously.

SingularityNET: This is a decentralized AI network that allows anyone to create, share, and monetize AI services.

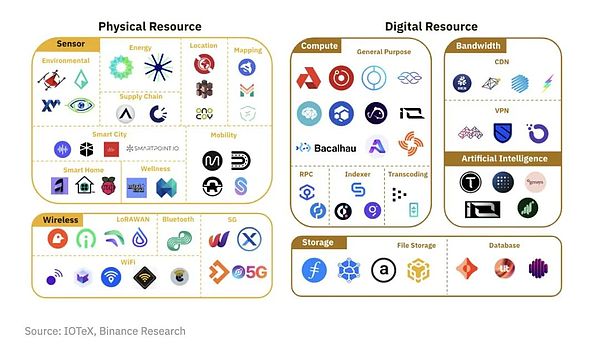

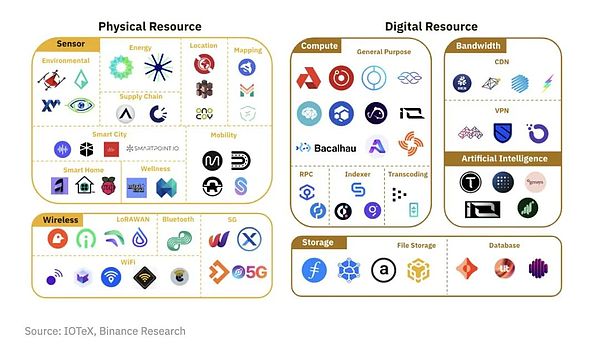

5. Decentralized Physical Infrastructure Network (DePIN)

Main DePIN projects:

Helium: This is a decentralized IoT network that uses blockchain technology and cryptoeconomics to incentivize individuals and businesses to provide network coverage. Helium has covered multiple locations in North America, Europe, and East Asia

Hivemapper: This is a decentralized mapping service that creates global maps through community-contributed data. Hivemapper has mapped more than 20% of the global road network.

Render: This is a decentralized graphics processing network that uses idle GPU resources for efficient graphics rendering.

The rapid development of the DePIN project demonstrates the potential of decentralized infrastructure. With the emergence of more projects and technological advances, DePIN is expected to further expand its scope of application and market influence in the next few years.

Other blockchains such as Polygon and Arbitrum have also begun to get involved in the DePIN field, increasing the competitiveness of the market.

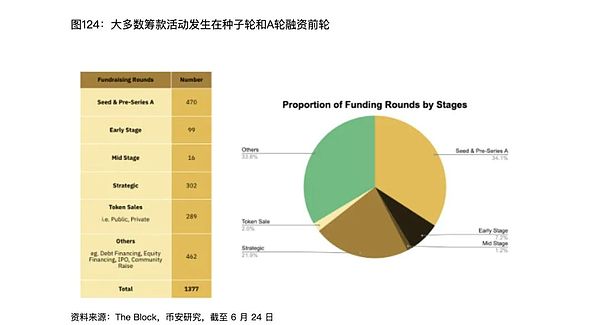

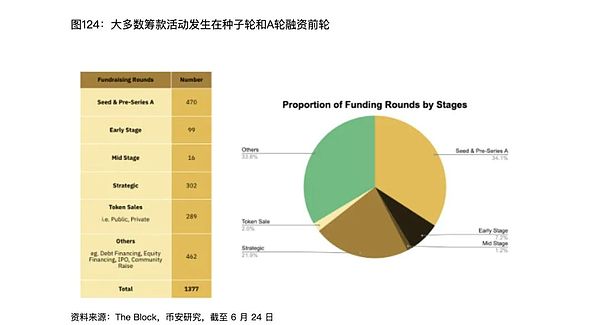

VIII. Fundraising Activity &institutional Adoption

Fundraising Activity

In the first half of 2024, the financing activities in the crypto market increased significantly, and many projects successfully raised a large amount of funds. The following is a detailed analysis of this field:

1. Total financing amount:

In the first half of 2024, the total financing amount of crypto projects reached billions of US dollars, showing the strong market demand for new technologies and innovative projects.

The financing activities covered various types of projects, including decentralized finance (DeFi), non-fungible tokens (NFTs), Layer-1 and Layer-2 blockchains, Web3 infrastructure, etc.

2. Major financing rounds and projects:

Arbitrum: As a leading Layer-2 solution, Arbitrum successfully raised a large amount of funds in the first half of 2024 to expand its ecosystem and enhance its technical capabilities.

Web3 infrastructure projects: Many infrastructure projects, such as decentralized storage, cross-chain bridging, and blockchain interoperability platforms, have also received significant financing support.

3. Investor types:

Traditional venture capital firms (such as a16z, Sequoia Capital) and crypto-focused venture capital firms (such as Pantera Capital, Paradigm) are active in investment activities in the crypto market.

Institutional investors and family offices have also begun to participate more in financing activities in the crypto market, showing confidence in the long-term growth potential of this field.

Institutional adoption

In the first half of 2024, institutional investors' interest in the crypto market continued to grow, especially after the approval of the Bitcoin spot ETF, which attracted a large amount of institutional capital inflows. The following is a detailed analysis of this field:

1. The impact of Bitcoin spot ETFs:

As of the end of June 2024, spot ETFs have attracted a total inflow of more than $14.7 billion, and the total amount of Bitcoin held has reached 865,000 BTC (about $52 billion).

2. Participation of institutional investors:

Major financial institutions such as BlackRock, Grayscale, and Fidelity dominate the Bitcoin spot ETF market, accounting for more than 80% of the market share.

Other countries and regions have also begun to approve Bitcoin and Ethereum spot ETFs, such as Hong Kong and Europe, which has further promoted the interest of global institutional investors in crypto assets.

3. Expansion to other crypto assets:

Institutional investors' interest is not limited to Bitcoin, and is expected to expand to Ethereum and other major crypto assets in the future. The approval of Ethereum spot ETFs also gained significant attention in the first half of 2024.

Infrastructure Construction

1. Blockchain Interoperability:

Cross-chain bridging and interoperability protocols (such as Polkadot, Cosmos) have made significant progress in the first half of 2024, facilitating the flow of assets and data between different blockchains.

These solutions enable users to seamlessly trade and operate across multiple blockchains, improving the connectivity and usability of the entire ecosystem.

2. Decentralized storage and computing:

Decentralized storage projects (such as Filecoin, Arweave) and decentralized computing platforms (such as Golem, iExec) performed strongly in the first half of 2024, attracting a large number of users and developers.

These projects provide reliable and secure storage and computing resources, supporting the development of a wider range of decentralized applications.

3. Layer-2 solutions:

Layer-2 solutions (such as Arbitrum, Optimism, zkSync) continued to expand their market in the first half of 2024, providing a more efficient and low-cost trading environment.

Advances in Layer-2 technology have helped alleviate the congestion problems of major blockchains (such as Ethereum) and improved user experience.

Expanding access to cryptocurrency trading

Through ETFs and other financial products, more investors are able to easily enter the crypto market, increasing the breadth and depth of the market. The following is a detailed analysis of this area:

1. ETF and ETP products:

The launch of Bitcoin and Ethereum spot ETFs has made it easy for investors in traditional financial markets to invest in crypto assets without having to directly purchase and manage cryptocurrencies.

The European crypto ETP (Exchange Traded Product) market is also growing rapidly, with total assets under management (AUM) growing from $5.3 billion to more than $12 billion in the first half of 2024.

2. Participation of financial institutions:

Major banks and asset management companies (such as Morgan Stanley and Fidelity Investments) have begun to provide cryptocurrency investment products and services, increasing investors' access to the crypto market.

The participation of these financial institutions has increased the trust and stability of the market and attracted more conservative investors.

Real-World Assets (RWAs)

1. Tokenization of RWAs:

The tokenization of real-world assets (such as real estate, art, and commodities) allows these assets to be traded and managed on the blockchain, improving liquidity and transparency.

Through blockchain technology, investors can purchase and hold partial asset tokens, diversify investment risks, and enjoy the potential for asset appreciation.

2.Main projects and platforms:

RealT: This is a platform focused on real estate tokenization, allowing users to purchase and trade tokens of real estate assets.

Securitize: This is a platform that provides tokenization solutions for real-world assets, supporting the tokenization of multiple asset classes.

The tokenization of RWAs is expected to grow rapidly in the next few years, attracting more traditional investors and institutions to participate.

This trend will further promote the application of blockchain technology in the fields of finance and asset management, and enhance the overall efficiency and transparency of the market.

JinseFinance

JinseFinance