In 2024, as 10 new spot ETFs begin trading in the US market, Bitcoin's trend will fluctuate like a roller coaster at the beginning of the new year. But although this incident brought market chaos, it was of great historical significance. During this period, Bitcoin prices hit new multi-year highs and year-to-date lows. But there is no doubt that Bitcoin welcomes the power of traditional finance into its world.

Abstract

The U.S. Securities and Exchange Commission has approved the listing of ten new Bitcoin spot ETF products, capping off a historically confusing week for Bitcoin investors.

Bitcoin prices hit multi-year highs before falling to year-to-date lows, with the market selling off 18% over the weekend. This was driven by derivatives leverage and spot profit-taking.

Many indicators have reached levels seen when they encountered major resistance in past cycles, with long-term investors selling about 75,000 Bitcoins Profit taking.

In just two weeks, 2024 has proven to be a true rollercoaster for Bitcoin investors. trip. The U.S. Securities and Exchange Commission has approved 10 Bitcoin spot ETF products for trading in the U.S. market, which can be said to be one of the most significant financial product listing events in history.

In many ways, Bitcoin has succeeded in drawing the traditional financial community and U.S. regulators into a notoriously chaotic and volatile world. On January 9, after the SEC’s social media account was hacked, the news about the ETF’s approval appeared to be a mistake-the hacker posted a false approval notice. The news sent the BTC price soaring to $47,200, but as authorities refuted the rumor, the price quickly fell back to $44,500.

The second oolong occurred on January 10, when the real SEC approval document leaked from the SEC official website before the U.S. market closed. But in the end, all 10 ETF products were approved and began trading on January 11.

As a result, the price of Bitcoin hit a multi-year high, reaching a level of just under $48,800. But then it fell 18% over the weekend, falling to $40,000 when traditional markets were closed, a new low so far this year. Even so, Bitcoin is once again welcoming Wall Street into its world.

Bitcoin Spot ETF Launched

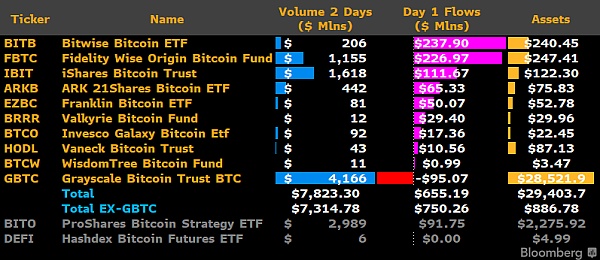

In the first two days of trading, the total trading volume of spot ETFs reached 7.823 billion U.S. dollars, with inflows AUM exceeds US$1.4 billion. This exceeds the $579 million in outflows from the GBTC ETF product currently trading, as investors reallocated their investments after years of investing. The reason is that the latter performed poorly during its period as a closed-end fund (the highest ETF fee was 1.5%, lower than 2.0%).

Despite these outflows, GBTC remains the behemoth among ETFs on the floor, with trading volume of $4.166 billion over two trading days, accounting for approximately 57% of total transaction volume. It is still likely that funds will continue to flow and be shuffled within GBTC in the coming weeks.

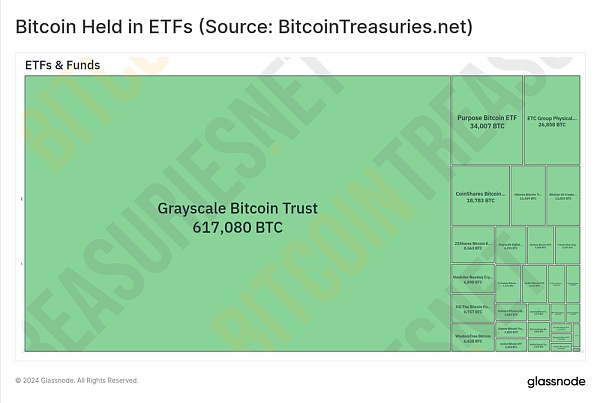

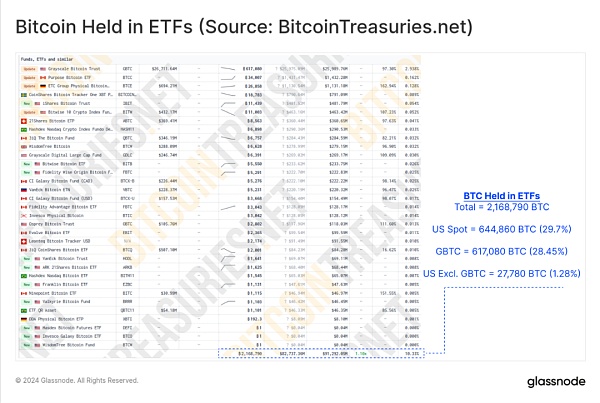

The absolute size of GBTC relative to other ETF products can be seen in the chart below. Despite GBTC outflows, their massive holdings of 617,080 BTC still dwarf their competitors, and the associated liquidity conditions remain attractive to any traders and investors sensitive to market liquidity and depth.

Just two trading days later, U.S. spot ETF products currently hold a total of 644,860 BTC (approximately $27.2 billion), accounting for 29.7% of global ETF holdings.

Overall, the trading volume and AUM have made it one of the largest and most important ETF issuance events in history, which in many respects Marks the end of the initial stage of Bitcoin’s maturity and growth.

News hype event?

Whether it’s a halving, an ETF launch, or the arrival of another Thursday, Bitcoin investors love to debate how these events end in “market "Pricing" method. Despite significant fluctuations along the way, Bitcoin prices have remained essentially flat year to date, indicating that this particular event was priced to perfection.

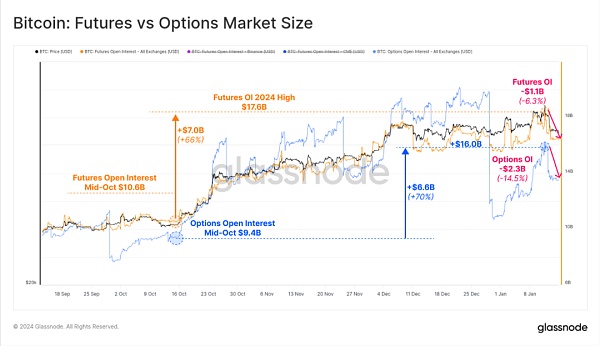

Of course, there are key drivers behind the medium-term volatility, with open interest (OI) rising significantly in both futures and options markets since mid-October :

BTC futures OI (yellow) increased by $7 billion (+66%), $1.1 billion was wiped out of the market this week.

BTC options OI (blue) increased by US$6.6 billion (+70%) this week due to contract expiration. The position was cashed in for US$2.3 billion.

We still need to note that open interest in both markets remains near multi-year highs, indicating rising leverage, and is becoming a more dominant force in the market.

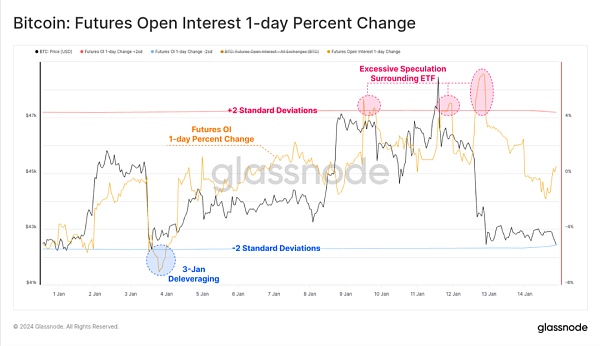

The chart below shows the oscillator for the percentage change in futures open interest. This tool can be used to spot periods of rapid change in overall market leverage.

We can see that a major deleveraging event occurred on January 3, with nearly 1.5 billion in a single day USD OI was closed. Conversely, OI increased significantly between January 9 and 11, with prices approaching $49,000 as ETF speculation peaked.

Over the weekend, OI prices fell to $40,000 due to selloffs as new owners of ETF shares entered Bitcoin's 24/7 trading environment.

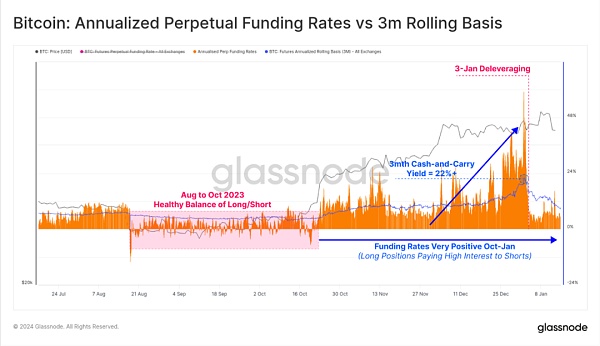

Perpetual funding rates have also maintained a strong positive bias, which currently indicates that leveraged traders are net long and are sometimes paying over 50% annualized returns on the short side. We can also see a clear phase shift in mid-October, which indicates that financing rates changed from a structure that oscillated around the mid-point to a sustained positive value.

Fund interest rates have cooled somewhat this week, but overall remain positive.

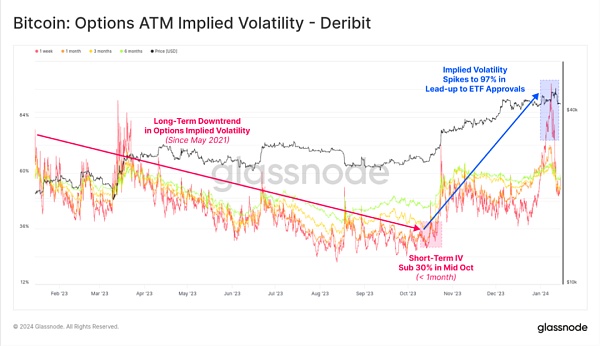

Options Implied Volatility has also reversed course since mid-October, with the metric beginning to surge amid this week's chaos. Since May 2021, this indicator has been declining for years as investor interest waned during the bear market. It is also worth noting that options market infrastructure, liquidity and depth have clearly matured in 2023, with open interest now on par with the futures market.

This downward trend in option implied volatility (IV) appears to be reversing in the short term, compared with a decline of about 30% in October. It has more than tripled since the low, reaching over 97% this week. As spot ETF products open new doors for institutional and retail capital, it is likely that Bitcoin’s volatility will begin to evolve as well.

Long-Term Holders vs. New Traders

How long-dormant Bitcoin holders react during major market events Very common. This includes periods when markets break out of new all-time highs, around cycle tops and bottoms, and periods of significant shifts in market structure (such as Mt Gox, halvings, and now the launch of spot ETFs, etc.).

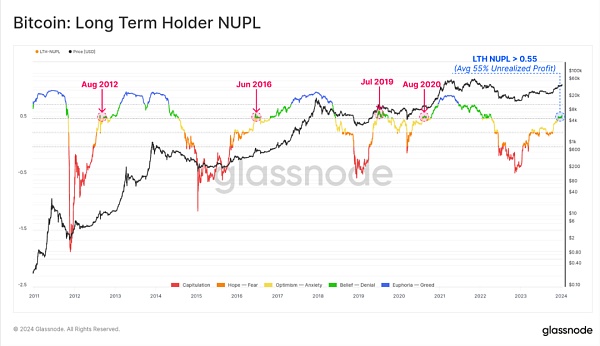

The degree of unrealized gains and losses held by these long-term investors can be measured by the LTH-NUPL indicator. The indicator reached 0.55 this week, a meaningfully positive number that means the average unrealized profit for long-term investors is 55%. This is also the level at which Bitcoin bulls have encountered meaningful resistance in previous cycles.

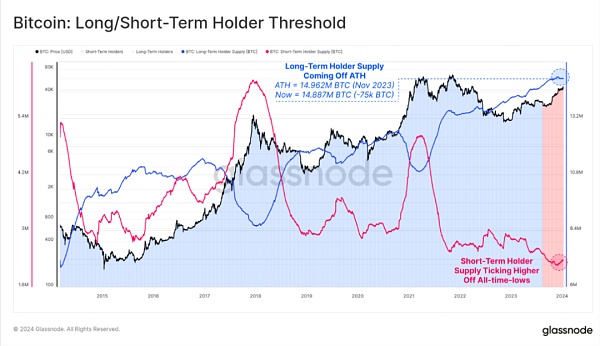

Currently, supply from long-term investors is also slightly below its all-time high, having declined by approximately 75,000 BTC since November as more dormant Bitcoin is used to take profits.

While 75,000 BTC is a meaningful number, it should also be viewed in the context of the total supply to long-term investors accounting for 76.3% of the circulating supply . As these spendings occur, the corresponding indicator, short-term investor supply, is only beginning to recover from its historical lows.

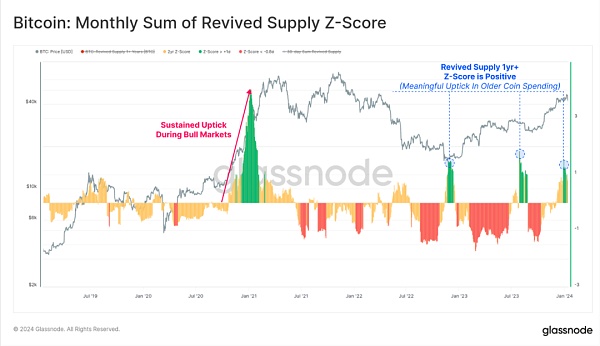

Having said that, these spending amounts from old traders are statistically significant, and this also leads to a standard deviation increase of 1 in the restored supply (using Bitcoin that has been dormant for more than 1 year).

As shown in the chart below, although such events occur relatively rarely, their occurrence usually coincides with situations where a market in an uptrend encounters meaningful resistance. consistent.

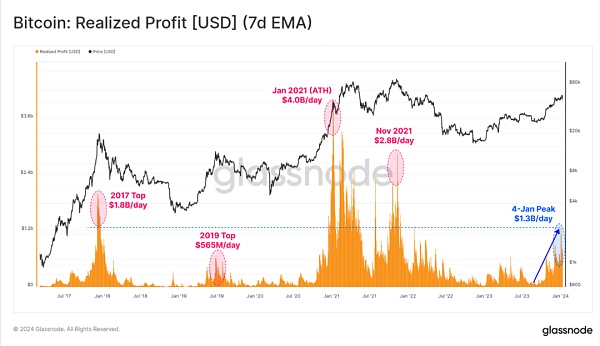

As these long-dormant “old Bitcoins” return to the liquid market, they contribute to the largest profit-taking event since the all-time highs of November 2021. During this cycle, the peak realized profits occurred on January 4, allowing it to lock in more than $1.3 billion in profits per day as these Bitcoins changed hands at a higher underlying cost.

Profit-taking is normal in rising market trends, and the real question is whether emerging demand is enough to absorb all of this profit-taking.

Summary

The events of last week were historic, both literally and figuratively. These new spot Bitcoin ETFs set new records in size, and a decade of industry efforts is finally coming to fruition. This means that after more than a decade of hard work and facing significant political, regulatory and financial resistance, the Bitcoin spot ETF has finally achieved the goal that the industry has been striving for.

Somewhat poetically, since Hal Finney first tweeted "Running bitcoin" on January 11, 2009, this set of spot bitcoin It has been 15 years since the cryptocurrency ETF started trading. The first Bitcoin transaction between him and Satoshi Nakamoto occurred the next day, January 12, 2009.

Multiple indicators in the on-chain and derivatives space suggest that a significant portion of Bitcoin investors are indeed treating this as selling news. The key question going forward is whether demand inflows from ETFs, expectations for the April halving, and holdover investors will be enough to break through this resistance.

ETF listing may have been priced in by the market, but how long will it last?

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Bernice

Bernice JinseFinance

JinseFinance Bernice

Bernice JinseFinance

JinseFinance Kikyo

Kikyo Huang Bo

Huang Bo Clement

Clement Ftftx

Ftftx