Author: Frost, Lucy; Source: Blockbeats

On April 9, Bitcoin's second-layer network Mezo completed a $21 million Series A financing, led by Pantera Capital, with participation from Multicoin, Hack VC, Draper Associates, etc.

The rapid development of "Inscription" has promoted the prosperity of the BTC ecosystem, but it has also intensified the competition for BTC network resources. Excessive gas is constantly increasing the entry threshold for BTC ecosystem players. The demand for L2 is urgent, and the flourishing L2 projects are attracting the attention of the community and investors.

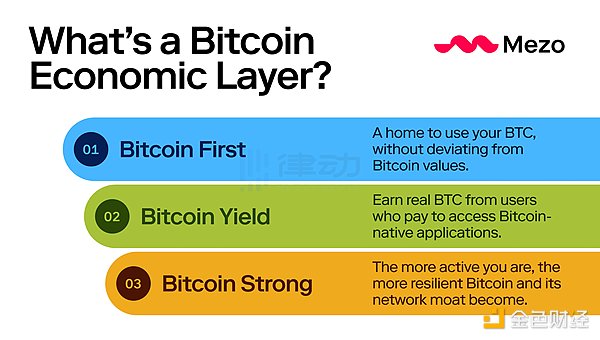

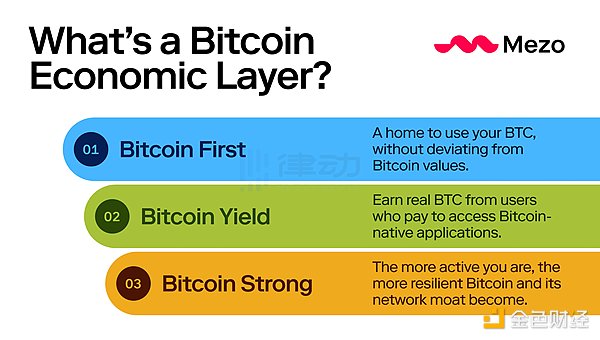

Many BTC L2s prioritize the needs of Bitcoin miners over the needs of users, while Mezo prioritizes the economic needs of users and Bitcoin holders, and thus proposes the concept of the Bitcoin economic layer. To achieve this vision, Mezo focuses on HODLers who have been active in the BTC ecosystem for a long time.

The project team once said, "We want to ensure that people who own Bitcoin can actually run this chain." To this end, Mezo provides benefits to users who protect the security of the Bitcoin network to ensure that they will continue to hold Bitcoin, so that both holders and on-chain traders have certain benefits. The team hopes that anyone who has really touched Bitcoin should be able to make money with Bitcoin, rather than just a useless decoration on a shelf.

What is the Bitcoin economic layer?

From the projects currently running on the second layer of Bitcoin, we can roughly see that the well-known second-layer Bitcoin projects were established relatively early and have been exploring related technologies for a long time. Some of their developers are builders of the original Bitcoin ecosystem, some are builders of the second layer of Ethereum, and some are builders of connection technology.

With the maturity of the basic Bitcoin protocol, the underlying layers of basic technologies such as Segregated Witness, Taproot, Schnorr Signature, MAST Merkel Abstract Syntax Tree, and Tapscript have gradually formed. However, new projects entering the second-layer construction of Bitcoin generally do not have too many accumulated advantages. Emerging teams need to find their own latecomer advantages, such as studying the latest technologies, solving those lightweight and most attractive needs first, and attracting a certain number of applications to enter.

Related reading: "An article sorting out the basic knowledge system of Bitcoin second-layer (Layer2) construction"

Since most BTC L2 will use BTC as gas as an important part of the Layer2 narrative. From a strategic perspective, this increases miners' income and stimulates the interest of community developers. But whether this can stimulate overall growth remains to be seen.

Therefore, the Bitcoin L2 that Mezo wants to build is not only a technical connection, but more of an economic connection, that is, to build the economic layer of Bitcoin.

According to Mezo, the Bitcoin economic layer focuses on user interests, by focusing on increasing users' wealth, community and productive uses, while expanding Bitcoin's core functions and changing the way users interact with Bitcoin, aiming to combine the core technology and functions of Layer2 with the economic needs of Bitcoin holders.

How does Mezo implement the Bitcoin economic layer?

Mezo aims to deepen the functionality of Bitcoin infrastructure by facilitating cheaper and faster transactions without deviating from the underlying principles of the network. To achieve this vision, Mezo focuses on long-term active holders of the BTC ecosystem, setting up three mechanisms: HODL Proof, HODL Score, and deposit custody.

Based on tBTC

Mezo uses tBTC as its foundation, which is a Bitcoin bridge created by Threshold Network. Threshold Network is a privacy-focused merged network that combines the functionality of Keep and NuCypher. Keep enables any user who owns BTC (and some ETH) to create tBTC by using a network of signers.

Unlike previous solutions, there is no central custodian of the locked Bitcoin. Signers are randomly selected, and a different group of signers is selected for each minted tBTC. Signers provide collateral (ETH) to ensure that they cannot easily run away with the funds. In addition, deposits are always overcollateralized. That is, for every 1 BTC deposited, the signer must provide 1.5 BTC worth of ETH as collateral.

Another interesting aspect is that the signer creates a unique address using the threshold signature protocol. This means that a single signer cannot take the funds. The cooperation of all assigned signers is required to perform the operation. If all signers want to break the protocol and steal the locked BTC, they need to cooperate to do so. If they deviate from the protocol, anyone can provide evidence that the signer has misbehaved. In return, the plaintiff will receive the signer's collateral as a reward. Since the signer's deposit is overcollateralized, there is more to lose than to gain from stealing BTC.

Related reading: 《一文入门tBTC:德Fi桥之间比特币与ETH》

As an Ethereum token with the same value as BTC, tBTC acts as a bridge between Bitcoin and Ethereum. BTC holders can deposit BTC into a smart contract and receive tBTC.

All BTC in Mezo is held in smart contracts, and the lock-up contract is upgradeable via a multi-signature run by the Mezo development team. Each minted tBTC is backed 1:1 by the Bitcoin cryptocurrency in the reserve and secured by signers, nodes that manage Bitcoin deposits and redemptions.

Incentivizing BTC Holders

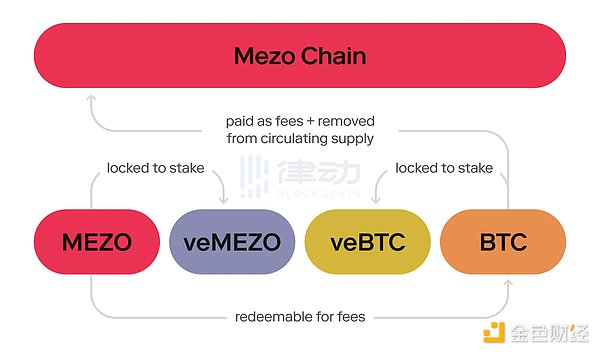

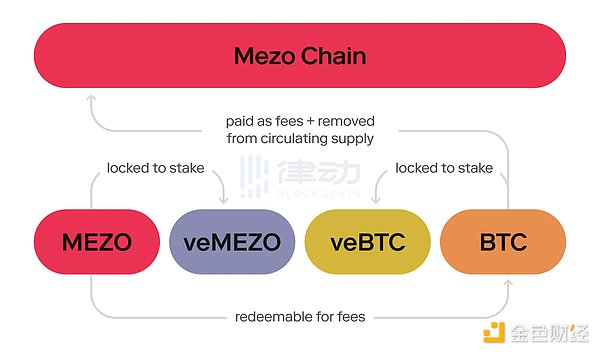

Mezo uses HODL Proof as a consensus mechanism. At the launch of the Mezo mainnet, users can contribute to network security through HODL Proof and earn a yield. A portion of Gas removes Bitcoin from circulation, and as network activity grows, this approach can reduce supply, reward long-term holders, and strengthen Bitcoin's security and economic foundation.

Users can lock BTC on Mezo to establish a HODL Score, which is calculated based on the user's Bitcoin deposits on Mezo and the results of inviting new users to participate in HODL. The longer the deposit is locked, the higher the score. At the same time, in addition to locking BTC, users can also lock MEZO tokens and verify transactions through CometBFT consensus to protect the network.

Currently supports deposits with BTC, tBTC, and wBTC.

In addition, when a user HODLs on Mezo, he will receive 5 one-time use invitations that can be shared with friends, and the user's inviter can also receive 5 one-time use invitations. Users can get HODL Score based on their own deposits, their inviters, and the inviter's inviter's deposits. Users can choose to lock their deposits for 2, 6, or 9 months. It is worth noting that locked deposits cannot be withdrawn before the lock-up period ends, and unlocked deposits can be used.

HODL points are accumulated based on the amount of BTC deposited and the lock-up period, and all versions of BTC deposits can earn the same points. Locking 1 Bitcoin per day can earn 1,000 points, and longer lock-up periods can bring HODL point bonuses. Locking for 2 months can earn 3 times the point bonus; locking for 6 months can earn 10 times the point bonus; locking for 9 months can earn 16 times the point bonus.

How to get HODL points?

The project currently supports Metamask, Taho and Unisat wallets for connection. For native BTC deposits, Mezo currently accepts "traditional" or "native Segwit" wallet address types, that is, addresses starting with "1" or "bc1q". The project is working on adding nested segregated witness support (addresses starting with "3").

First, enter the project website and enter the invitation code. If you don't have an invitation code, you can join the project Discord to get it. After entering the channel, contact the administrator in the waiting room to enter the invitation code channel.

JinseFinance

JinseFinance