Author: Paul Veradittakit, Partner at Pantera Capital; Translation: Jinse Finance xiaozou

As the first and largest crypto asset by market capitalization, Bitcoin remains one of the most influential assets in the entire liquid token market. However, despite its widespread use and acceptance as a decentralized global store of value, many still criticize Bitcoin’s scalability, programmability, and ability to attract developers, especially after the Ethereum and smart contract platform boom.

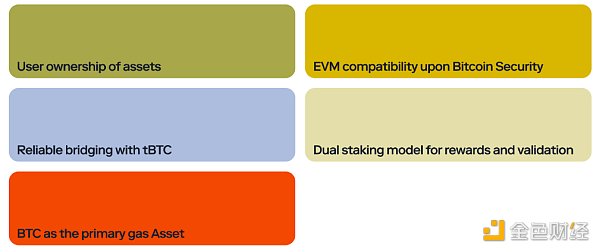

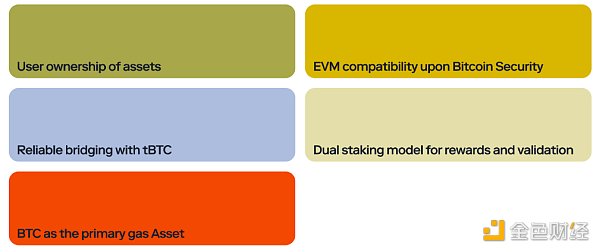

Mezo is an EVM-compatible Bitcoin economic layer that aims to overcome the above obstacles. This article will explore the current state of Bitcoin, the innovative work being done by Mezo, and its potential future impact on the cryptocurrency ecosystem.

1. Current Landscape

Bitcoin’s dominance in the cryptocurrency market is undeniable. Today, there are more than 100 million Bitcoin holders worldwide, and Bitcoin’s market value is about three times that of the second largest crypto asset, ETH. Despite this, Bitcoin can be said to be rigid in terms of innovation and simplicity. Unlike Ethereum and other scalable smart contract platforms, Bitcoin’s core design has always limited its scalability and programmability.

Industry leaders such as Thesis, the venture capital firm that incubated Mezo, are now seeking new ways to enhance Bitcoin’s capabilities through L2 solutions. These advances are essential to enabling more complex functions on the Bitcoin network, such as smart contracts and decentralized applications (dApps).

2. Progress and Milestones

To date, Mezo has made impressive progress in the journey of the Bitcoin revolution. The project integrates all of Thesis' consumer-facing Bitcoin products into a highly cohesive ecosystem on the Mezo platform. Together, these projects create a more usable Bitcoin economy, all powered by Mezo.

Mezo is made possible by some key upgrades to the Bitcoin mainnet that facilitate Bitcoin development. The most important developments in recent years are:

Taproot Upgrade (November 2021): Enhances the data storage capacity of Bitcoin blocks.

Ordinal Inscriptions (January 2023): Enables a metadata layer to make each sat non-fungible.

BRC-20 Tokens (March 2023): Introduces a standardized protocol for deployment, minting, and transfer functions through JSON code.

These milestones highlight the growing potential of the Bitcoin network as a hub for decentralized financial applications (DeFi) and non-fungible tokens (NFTs).

3. Attractiveness

In recent months, Mezo has demonstrated early market dominance in the Bitcoin L2 ecosystem. Currently, the team ranks among the top Bitcoin L2 in terms of total locked value (TVL). As the Mezo team begins to launch its public testnet and attract more and more developers to develop applications on Mezo, we expect this growth to continue.

4. Impact now and in the future

The progress of Bitcoin's base layer is of great significance. Mezo opens up new opportunities for financial innovation by extending Bitcoin’s programmability, especially in regions with high Bitcoin adoption rates such as Latin America, Africa, and Asia. The introduction of the Bitcoin DeFi ecosystem can expand rapidly. We believe this could promote BTC DeFi market capitalization to approximately $50 billion to $400 billion, depending on adoption.

In addition, macro trends of technological improvement and institutional adoption provide strong impetus. Bitcoin ETF applications from large companies prove that L2 solutions have been accepted, institutional interest is increasing, and Bitcoin has a bright future beyond current limitations.

5. Key players and their contributions

The core of Mezo’s groundbreaking vision involves several key figures who bring rich experience and expertise. Leading the charge is Mezo’s CEO Matt Luongo, who previously co-founded Thesis and served as CTO of Scholrly. Carolyn Reckhow is Mezo’s COO, with extensive experience in the global operations departments of Consensys and Casa, responsible for ensuring the smooth execution of operational strategies. Antonio Salazar Cardozo, CTO of Mezo, leverages his deep technical expertise from his time as Technical Director at Keep Network to drive technical innovation. These leaders, supported by a team of senior professionals, are working together to build scalable and innovative Bitcoin L2 solutions.

Pantera led Mezo's $21 million financing, with participation from several other top investment firms.

6. Conclusion

In summary, Mezo represents a major advancement for the Bitcoin ecosystem, solving long-standing scalability and programmability issues. By building an EVM-compatible Bitcoin layer, Mezo will unlock new potential for Bitcoin in DeFi and beyond. With a strong team, recent technology upgrades, and growing institutional interest, Mezo has become an important force in shaping the future of Bitcoin scaling and Bitcoin adoption.

JinseFinance

JinseFinance