By Subrat Patnaik, Carmen Reinicke, Bloomberg

Nvidia Corp. was already the world’s most valuable semiconductor company. Now it’s the first computer chip company ever to hit $3 trillion.

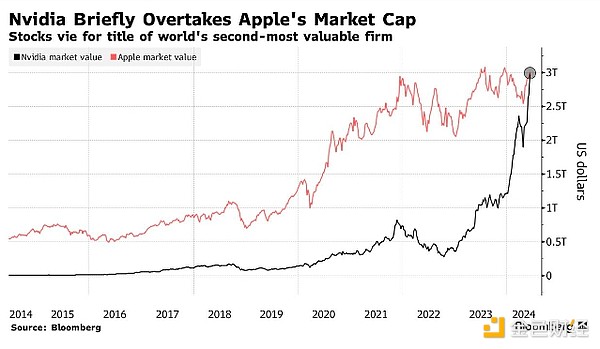

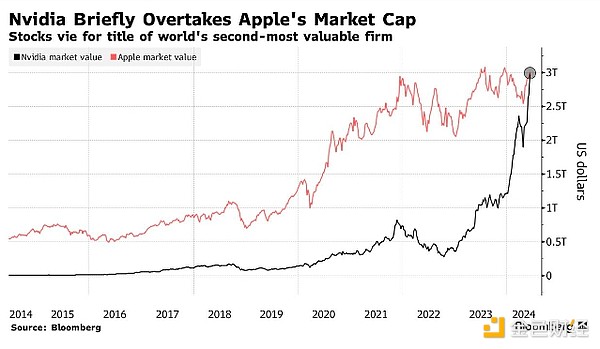

Shares of the Santa Clara, California-based company have risen about 147% this year, adding about $1.8 trillion to its market value as demand for chips used to power artificial intelligence tasks surges. Shares rose 5.2% to close at a record $1,224.40 on Wednesday, taking its market value past $3 trillion and passing Apple Inc. in the process.

Nvidia’s market value last surpassed Apple’s in 2002, five years before the first iPhone was released. At the time, both companies were worth less than $10 billion.

Nvidia isn’t showing any signs of slowing down or letting rivals catch up; CEO Jensen Huang has said the company plans to upgrade its so-called AI accelerators every year. Wednesday’s stock rally boosted his fortune by more than $5 billion to $107.4 billion, according to the Bloomberg Billionaires Index. Huang told attendees at a keynote at National Taiwan University that the rise of generative AI is a new industrial revolution, and Nvidia is expected to play a big role as the technology moves to personal computers. “We think this sea change is just beginning,” said Angelo Zino, senior equity analyst at CFRA Research. Zino said after the CEO’s keynote that he likes the “increased visibility” and sees “strong momentum on the GPU/CPU/networking front driving the stock up to consensus expectations.” The company has arguably been the biggest beneficiary of heavy investments in artificial intelligence, helping it enter the race for the title of the world’s most valuable company. The chipmaker's market value still lags behind Microsoft, but with its shares soaring, Wall Street believes it's only a matter of time before Nvidia surpasses Microsoft.

Apple has struggled this year, with the tech giant's shares pressured by concerns about cooling iPhone demand in China and fines from the European Union. The stock only recently turned positive on the 2024 outlook as investor sentiment toward the iPhone maker is slowly improving.

Wilfred

Wilfred