Source: Bianniu.com

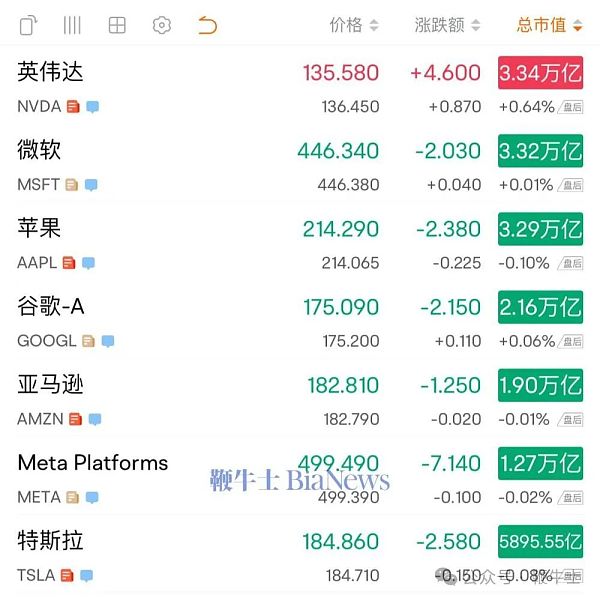

On June 19, according to foreign media reports, Nvidia's (NVDA) market value officially surpassed Microsoft (MSFT) on Tuesday to become the world's most valuable company, just two weeks after it took the second place from Apple (AAPL).

Nvidia's stock price rose about 3.5% today, breaking through $135 per share, giving the chipmaker a market value of more than $3.33 trillion. Microsoft fell 0.4% on Tuesday, with a market value of nearly $3.32 trillion.

In the past 12 months, Nvidia's stock price has risen by more than 215% and more than 3,400% in the past five years. So far this year, Nvidia's stock price has risen by 175%; Microsoft's stock price has risen by nearly 19% in 2024.

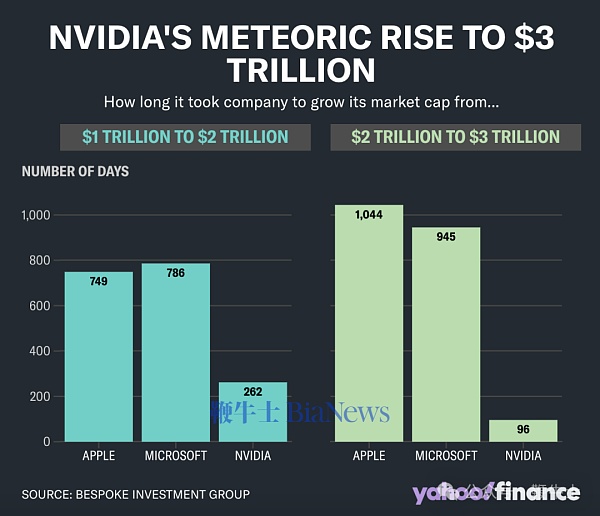

On June 13, 2023, Nvidia’s market cap surpassed $1 trillion for the first time.

On March 1, 2024, the stock surpassed $2 trillion, and then quickly surpassed the $3 trillion mark on June 5.

The company’s rise from $1 trillion to $3 trillion in market value is the fastest on record.

Nvidia’s rise has made it the largest weighted stock in the S&P 500, and the chipmaker has played a key role in the benchmark index’s run to all-time highs in 2024.

As of May, the S&P 500 and Nvidia’s stock price movements were almost perfectly correlated, meaning that if Nvidia’s stock price rises, so does the S&P 500.

As of Monday, Nvidia’s stock price gains alone accounted for a third of the S&P 500’s year-to-date gains, according to Citi’s equity research team.

Nvidia completed its 10-for-1 split on June 10.

The company's rise comes amid an explosion in generative artificial intelligence sparked by OpenAI's launch of its ChatGPT platform in late 2022.

Nvidia's chips, improved graphics cards and CUDA software platform are designed to train and run AI programs, giving it a strategic advantage that experts say will take years for rivals AMD (AMD) and Intel (INTC) to overcome.

Nvidia is the tech industry's go-to supplier of AI chips and integrated software.

Tech giants including Amazon ( AMZN ), Google ( GOOG ), Meta ( META ), Microsoft, Tesla ( TSLA ) and others use its hardware to power everything from cloud-based AI products for customers to their own AI models and services.

During a June 2 keynote at the Computex conference in Taiwan, CEO Jensen Huang announced that the company will release a high-performance version of the Blackwell chip, called Blackwell Ultra, in 2025, followed by a new AI chip platform, Rubin, in 2026. The company will launch an Ultra version of Rubin in 2027.

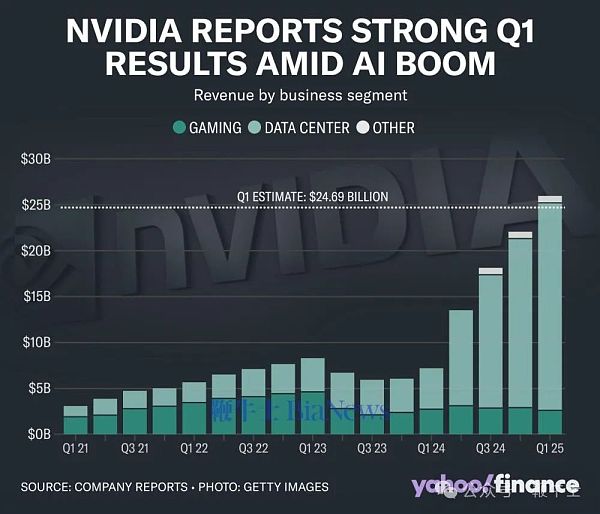

In the first quarter, Nvidia reported adjusted earnings per share of $6.12 and revenue of $26 billion, up 461% and 262%, respectively, from the same period last year.

Nvidia's data center revenue in the most recent quarter increased 427% year-over-year to $22.6 billion, accounting for 86% of the company's total revenue for the quarter.

Nvidia’s most important business was previously its gaming division, which brought in $2.6 billion in revenue.

But AMD and Intel are pushing ahead with their own AI chips, aiming to overtake Nvidia. AMD recently announced that its MI325X and MI350 will be available in 2024 and 2025, respectively, and said its next-generation MI400 AI accelerator platform will be available in 2026.

Meanwhile, Intel said its Gaudi 2 and Gaudi 3 AI accelerators will be priced lower than competing chips. With companies investing billions of dollars in AI chips, any price savings are sure to be welcomed.

Nvidia also faces growing competition from its own customers as Amazon, Google and Microsoft try to wean themselves off their reliance on the company’s chips while saving on capital expenditures.

Founded in 1991, Nvidia spent its first decades primarily as a hardware company, selling chips to gamers that run 3D games. The company has also dabbled in cryptocurrency mining chips and cloud gaming subscriptions.

But over the past two years, Nvidia’s stock has soared as Wall Street has come to recognize that Nvidia’s technology is the engine behind the explosive growth in artificial intelligence that shows no signs of slowing.

The rally has boosted co-founder and CEO Jensen Huang’s net worth to about $117 billion, making him the 11th richest person in the world, according to Forbes.

Microsoft’s stock is up about 20% so far this year. The software giant has also been a major beneficiary of the AI boom, taking a large stake in OpenAI and integrating the startup’s AI models into its most important products, including Office and Windows.

Microsoft is one of the biggest buyers of Nvidia’s graphics processing units (GPUs) for its Azure cloud service. The company just released a new generation of laptops designed to run its artificial intelligence models, called Copilot+.

This is the first time Nvidia has made the list of the most valuable companies in the United States. Apple and Microsoft have been vying for that title for the past few years.

Nvidia’s rise has been so rapid that the company has yet to be included in the Dow Jones Industrial Average, a benchmark of stocks of the 30 most valuable companies in the United States. Last month, Nvidia announced a 10-for-1 stock split alongside its earnings report, which took effect on June 7.

The split gives Nvidia a better chance of being included in the Dow, which is a price-weighted index, meaning companies with higher stock prices, rather than those with higher market capitalization, have more influence on the benchmark.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Chris

Chris JinseFinance

JinseFinance Wilfred

Wilfred JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive