Symbiotic, as a rising star in the re-staking sector, has quickly gained market attention with its TVL soaring over $1 billion in one month. Backed by Lido and led by Paradigm and Cyber Fund, Symbiotic is definitely a competitor that EigenLayer cannot underestimate. The following content will explore the similarities and differences between Symbiotic and EigenLayer from three perspectives: the types of assets supported for staking, design concepts, and design methods.

Introduction

Symbiotic and EigenLayer are two platforms that provide shared security through re-staking. Both aim to reduce the origination cost and improve the security of distributed trust networks by allowing "Operators" backed by user pledged funds to take on the work of nodes in distributed trust networks in multiple "Networks". Although both achieve their functions through re-staking, there are obvious differences between the two projects:

Types of Restaking Assets: Symbiotic indicates in its official documentation that they support almost all ERC-20 Tokens, positioning itself as a DeFi service. In contrast, EigenLayer focuses only on ETH-related staking, emphasizing that it is the infrastructure of the blockchain ecosystem.

Design Concept:Symbiotic uses a broader definition of Restaking, aiming to create a flexible and open DeFi market. In contrast, EigenLayer focuses more on leveraging the existing trust in the Ethereum PoS system to maintain a stable and trusted foundation, which is more narrow.

Design Approach: Symbiotic is designed to be more modular and decentralized, supporting a wider range of assets and allowing for deeper customization. EigenLayer is relatively centralized, and its overall design gives priority to the security of the Ethereum PoS system.

Their similarities and differences reflect the design concepts and design methods of Symbiotic and EigenLayer, which will be further explored in the following sections.

Figure 1: Comparison of similarities and differences between Symbiotic and EigenLayer; Source: BlockSec

Functional similarities

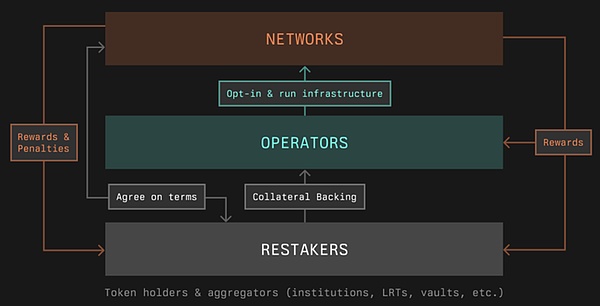

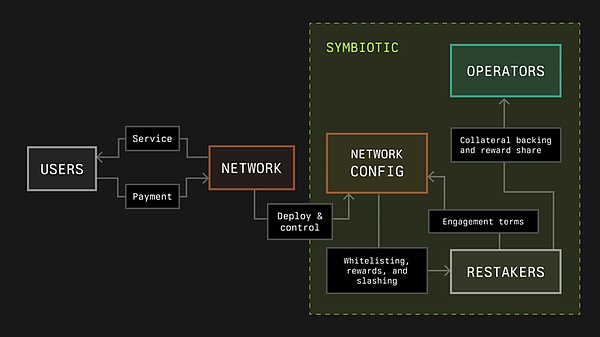

Both Symbiotic and EigenLayer achieve shared pool security through Restaking, which helps reduce the origination cost of distributed trust networks and liberates innovation on blockchains. Their re-staking mechanism allows Operators to back assets from Restakers, use these assets in multiple Networks, perform multiple tasks, and earn multiple rewards while taking multiple risks. Symbiotic's re-staking involves the following process:

Figure 2: Symbiotic's re-staking process; Source: Symbiotic Docs

Restakers: Users (Restakers) re-stake their assets.

Operators: Restaker's assets are delegated to Operators who undertake computations.

Networks: Operators choose to join the selected Networks and accept the terms of cooperation to provide node services for the distributed trust network.

In contrast, the re-staking function provided by EigenLayer is actually very similar. It calls the distributed "network" "Active Verification Service" (AVS). In addition, in the core narrative of EigenLayer, it does not clearly separate the concepts of Operators and Restakers. The difference between the two will be discussed in more detail later.

Differences in Concepts

At an abstract level, EigenLayer and Symbiotic have different attitudes towards the "trust split" problem in the Ethereum PoS field. Based on this difference, they show different approaches to restaking:

EigenLayer:Aims to use Restaking to attract users and build a better blockchain ecosystem based on Ethereum. It emphasizes the restaking of Ethereum PoS trust, only allows ETH-related staking, and protects Ethereum PoS from the problem of trust splitting. EigenLayer positions itself as a basic service to enhance the Ethereum ecosystem.

Symbiotic:Seeks to use the leverage of Restaking to attract as many users as possible, with the goal of creating a flexible and open DeFi market where everyone can make money. It supports reinvestment of various ERC-20 tokens and sees itself as a DeFi service that maximizes opportunities for income and capital efficiency. Symbiotic does not prioritize the problem of trust splitting, and even stands on the opposite side of solving this problem. Their growing TVL (Total Value Locked) may pose a threat to Ethereum PoS.

In addition, Symbiotic separates the role of Staker from Operator, probably because they have Lido as their strong support, which has the best resources of Operators. Therefore, users only need to focus on staking rather than delegation. This separation also encourages users to stake as much as possible.

Design and Service Differences

Symbiotic's design features emphasize an open, modular, and flexible DeFi market with clear role distinctions. The main features include:

Open: Supports multi-asset Restaking, which improves asset utilization by allowing various ERC-20 Tokens to be pledged.

Modular: The system has clear roles, making it more developer-friendly by separating responsibilities between different participants.

Flexible: Allows extensive customization, giving top-level networks full control over their underlying services.

Permissionless: Symbiotic’s core implementation contract is quite lightweight, and the roles involved are permissionless and can be deployed by developers.

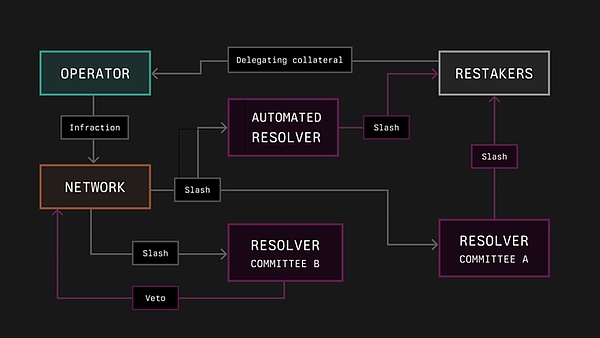

In contrast, EigenLayer retains some centralized elements. A typical example is about reward and punishment supervision. Symbiotic uses the role of Resolver for customized arbitration decisions, which has the potential for decentralization. Compared with EigenLayer’s centralized reward and punishment supervision committee, it provides a more flexible and decentralized solution. Let’s take a deeper look at Symbiotic’s flexible and modular design.

Key Components of Symbiotic

Figure 3: Key Components of Symbiotic; Source: Symbiotic Docs

Symbiotic’s modular design involves 5 main roles: Collateral, Vaults, Operators, Resolvers, and Networks. We will briefly introduce these roles.

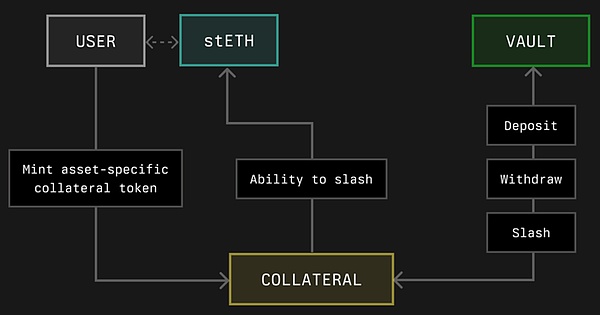

Collateral: Represents the asset to be pledged, which is an abstraction of the pledged asset, supports various types of assets and creates corresponding collateral ERC-20 tokens with extended reward and punishment mechanisms for pledge purposes. The collateral token separates the asset itself from the ability to access, apply rewards or penalties. This separation abstracts assets into collateral tokens, and can even further support various assets outside the Ethereum mainnet.

Figure 4: Collateral; Source: Symbiotic Docs

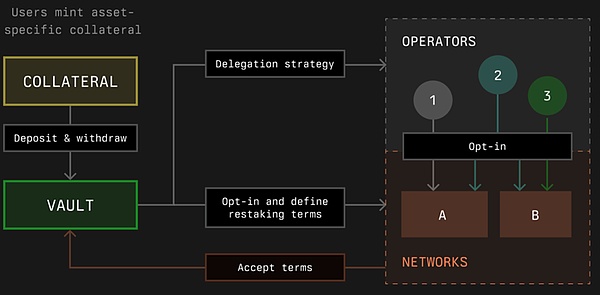

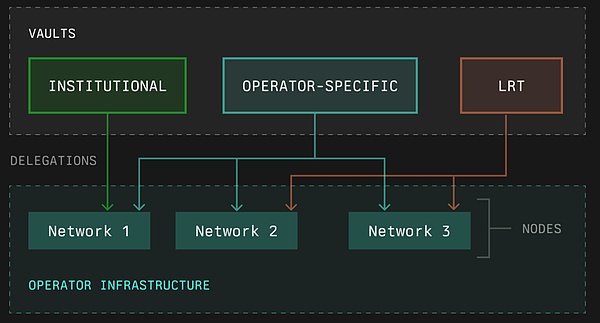

Vaults: Manage deposited collateral tokens. They are responsible for delegating tokens to operators and implementing reward and penalty mechanisms based on predefined protocols. Vaults are usually created by operators based on the terms they accept from the network.

Figure 5: Vaults; Source: Symbiotic Docs

Operators: Nodes that provide computing services. They are backed by assets in various vaults, accept the terms stipulated by the network and choose to join. Operators are crucial in the ecosystem of decentralized networks.

Figure 6: Operators; Source: Symbiotic Docs

Resolvers: Customizable slashing decision arbitrators. They can be centralized addresses, slashing committees, or decentralized entities, providing flexibility in arbitration.

Figure 7: Resolvers; Source: Symbiotic Docs

Networks: Services that require a distributed trust network as the basis. Similar to AVS in EigenLayer.

Figure 8: Networks; Source: Symbiotic Docs

Current Project Status

As of now, Symbiotic has only opened its Restaking function, and entrusting custodial assets to distributed services that require shared security is not yet available. Similarly, EigenLayer has not fully achieved its expectations, and its key features such as slashing and rewards are still waiting to be released. In terms of TVL, as of July 8, 2024, EigenLayer still dominates the market with a TVL of $13.981 billion, while Symbiotic has also reached a TVL of $1.037 billion in one month.

Security Risks

Re-staking based on ERC-20 tokens

The most direct security risk of Symbiotic is the inclusion of almost all ERC-20 tokens in the re-staking field. Re-staking pools generally prefer to use more stable assets, such as native ETH, to minimize risks and bring stable returns. Unlike EigenLayer, which mainly supports native ETH, Symbiotic allows a wider range of ERC-20 tokens to participate in staking. However, the stability of ERC-20 tokens is uneven and varies greatly, which may weaken the security of the staking pool and may lead to financial instability. Allowing almost any ERC-20 token as collateral increases the volatility of the platform, thereby weakening the overall stability of the ecosystem.

To mitigate this security risk, a systematic Token Interdependency Monitoring System monitoring framework should be seriously considered to assess whether a token price collapse will trigger a chain reaction that affects other tokens or the entire pool within the ecosystem. This will help the relevant Collateral managers in Symbiotic to detect problems in a timely manner and make necessary adjustments in a timely manner. Of course, Networks should also think twice when choosing supported re-pledge assets and try to avoid choosing unstable pledge assets.

Trust Split Problem

The trust split problem was raised by the founder of EigenLayer, and we elaborated on this problem in detail in the previous blog. EigenLayer believes that the blockchain ecosystem has invested a lot of effort in launching a distributed trust network. Currently, many of these networks serve as infrastructure for Dapps on the Ethereum mainnet and have attracted a large amount of assets. However, the security of everything on the Ethereum mainnet is guaranteed by the staked assets in Ethereum's PoS staking pool. The infrastructure of these Dapps "diverts" many staked assets to their own staking pools, while still serving the Ethereum mainnet, which seems to form a paradox.

To solve this problem, EigenLayer proposed the Restaking staking set, which aims to redirect PoS staked assets to the distributed trust network infrastructure. This practice of reusing Ethereum PoS staked assets can guide assets in third-party staking pools to flow back to the Ethereum PoS staking pool, effectively alleviating the problem of trust rupture.

In contrast, Symbiotic stands on the opposite side of this problem. By allowing non-ETH re-staking in their own "Collateral", the rapid growth of these assets may pose a threat of trust splitting to the security of Ethereum PoS consensus.

Embracing Leverage

EigenLayer only allows ETH-related assets to be re-pledged, and re-pledge enables a single asset to be pledged in multiple AVS services. This has already introduced some leverage risks to the ecosystem. Symbiotic goes a step further and fully embraces leverage, allowing any ERC-20 token to be re-pledged. As mentioned earlier, ERC-20 tokens are inherently riskier and more volatile. Re-staking ERC-20 tokens multiple times in different networks will further amplify this risk.

Resolver Assignment Risk

Symbiotic's permissionless and modular design brings more openness and freedom to the DeFi market, but also hides greater risks. Each role within the framework can be deployed without permission, which increases the risk of exposure to potential security issues. For example, the role of Resolver, as a significant distinction from EigenLayer, Symbiotic allows the network to designate specific Resolvers to oversee the rewards and penalties of its subordinate operators. This design enhances the decentralization and customizability of the system, but also opens the door to potential malicious Resolvers.

To prevent such malicious Resolvers, security audits can be conducted to ensure the basic reliability of designated Resolvers.

Similar risks to EigenLayer

EigenLayer carries the following risks, which we have elaborated on in previous tweets:

Security risks associated with malicious AVS in a two-way free choice market;

Security risks of excessive utilization of malicious funds due to re-staking;

Security risks of core contracts implemented by the platform itself;

Potential security risks of allowing the platform to exploit and reward and punish Ethereum PoS staking pool assets;

Since Symbiotic has a similar re-staking function, these risks also exist within it.

Conclusion

While similar in functionality, Symbiotic and EigenLayer differ significantly in asset support and system design. Symbiotic supports a wider range of assets and adopts a modular, decentralized design to cater to a more flexible and open DeFi market. In contrast, EigenLayer focuses on leveraging the existing trust in the Ethereum PoS system and maintaining a more centralized but secure platform. These differences highlight the unique value proposition of each platform, meeting the needs of different parts of the decentralized ecosystem.