Opinion: Should Ethereum abandon the “ultra-robust currency” narrative?

It’s critical that Ethereum abandons its ultra-sound money narrative — I’m not sure if that’s a good thing or a bad thing.

JinseFinance

JinseFinance

Source: AiYing Compliance

Initially, stablecoins were mainly used for collateral and settlement between cryptocurrency traders, but as technology and markets mature, their application scenarios have expanded rapidly, especially in emerging markets with weak financial infrastructure. Recent research from institutions such as Visa and Castle Island Ventures shows that stablecoins have gone beyond their speculative uses and have gradually become an important part of the global financial system, especially in emerging economies such as Brazil, Nigeria, Turkey, Indonesia and India.

Users in these markets have found that stablecoins can not only serve as investment tools, but also provide them with more efficient channels for remittances, payments and savings, especially when local currencies are unstable and banking services are not popular. Stablecoins are subverting traditional financial models and becoming an effective means to deal with currency depreciation and inflation in these markets, and also providing a new direction for thinking about global financial services.

Related articles:

【Ten Thousand Words Long Research Report】Stablecoin Track: Model, Operating Principle, Trend and Thinking of Hong Kong Stablecoin;

Aiying will use this stablecoin report from Visa to organize the rise of stablecoins in emerging markets, actual application scenarios and its far-reaching impact on the global financial industry.

In recent years, the growth rate of stablecoins has been remarkable. Especially in the context of uncertainty in the global financial environment, stablecoins have become an effective tool for many countries and regions to cope with economic challenges. In the first half of 2024, the global stablecoin settlement amount reached a staggering $2.6 trillion, and the figure is expected to rise to $5.28 trillion for the whole year. This phenomenon shows that the use of stablecoins has surpassed the cyclical fluctuations of the cryptocurrency market and has gradually become a key tool in the global financial system.

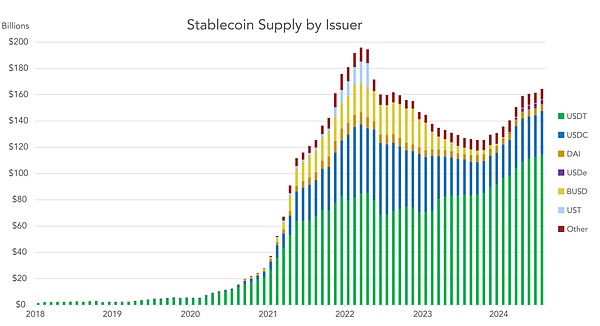

Since 2020, the global supply of stablecoins has continued to rise, especially dollar-pegged stablecoins such as USDT (Tether) and USDC. As of 2024, the total circulating supply of stablecoins has exceeded $160 billion, while in 2020, this figure was only a few billion dollars. This substantial growth not only reflects the strong market demand for stablecoins, but also highlights their huge potential in solving cross-border payments, savings protection, and currency conversion.

(Stablecoin supply divided by issuer)

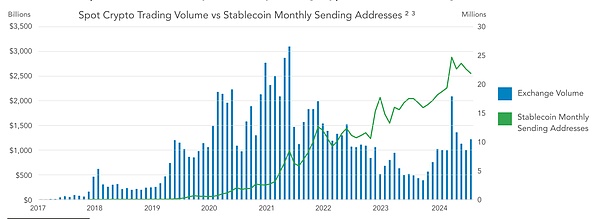

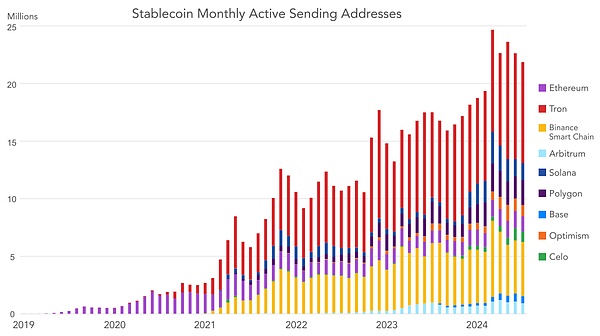

Along with the increase in supply, the user activity of stablecoins has also increased significantly. The report shows that in 2024, there will be more than 20 million active addresses trading stablecoins on the blockchain every month. In line with this, the number of transactions has also maintained a steady increase, showing that users' daily reliance on stablecoins is increasing. Whether used for personal savings or for payments and remittances, stablecoins are increasingly integrated into global economic activities.

It is worth noting that although the cryptocurrency market experienced greater volatility and a downward cycle from 2022 to 2023, the trading volume and usage frequency of stablecoins were not significantly affected. This shows that stablecoins are no longer just a tool in the cryptocurrency market, and their application scenarios are rapidly expanding to the real economy. Especially in emerging markets, the stability and global accessibility of stablecoins make them an important means to combat currency depreciation and financial instability.

(Comparison of cryptocurrency spot trading volume and the number of monthly active sending addresses of stablecoins)

This rapid growth trend shows that stablecoins are no longer just a hedging tool for cryptocurrency investors, but have become an important supplementary force to cope with the limitations of the traditional financial system worldwide, especially in emerging markets. As more and more countries and regions explore the inclusion of stablecoins into the financial system, industry practitioners are facing huge development opportunities.

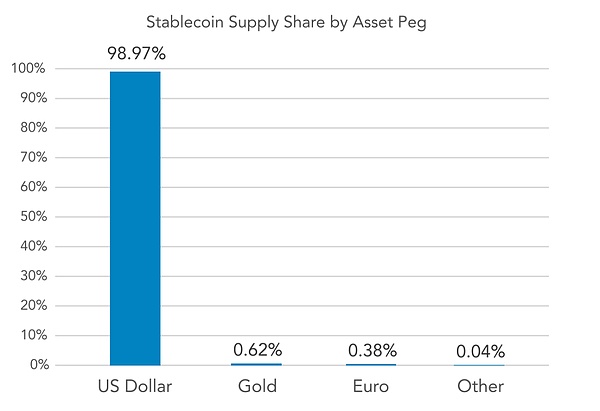

According to the report data, 98.97% of the stablecoin supply is pegged to the US dollar, while only 0.62% is pegged to gold, 0.38% is pegged to the euro, and other types of pegged assets account for only 0.04%. This shows that although there are other stablecoins pegged to the euro, gold, and even the renminbi on the market, users and businesses prefer to use stablecoins pegged to the US dollar for transactions and savings.

(Asset-pegged ratio of stablecoin supply)

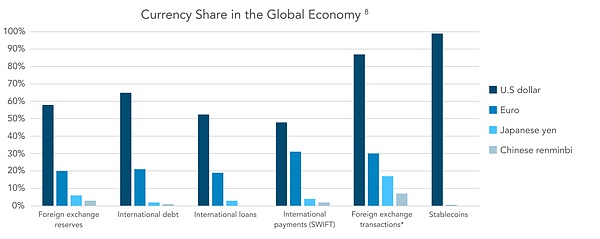

The share of different currencies in the global economy, including the share of the US dollar, euro, yen and renminbi in various financial sectors. Specifically, the chart compares the global market share of these currencies in the following areas: Foreign Exchange Reserves, International Debt, International Loans, International Payments, Foreign Exchange Transactions, and Stablecoins. The chart shows that the US dollar dominates these areas, especially in Foreign Exchange Reserves, International Payments, Foreign Exchange Transactions, and Stablecoins, where its market share is close to or exceeds 60%.

(Shares of different currencies in the global economy)

Although some stablecoins are pegged to the euro, gold, etc., their market share is extremely small. This is because the frequency and convenience of these currencies in international trade, savings and payments are far less extensive than the US dollar. The international influence and liquidity of the US dollar make it the dominant force in the stablecoin market.

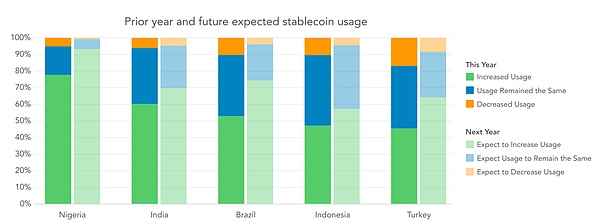

(Changing trends in the use of stablecoins in five countries)

The report analyzes how 2,541 cryptocurrency users use stablecoins in their daily lives through in-depth surveys of five emerging markets (Brazil, Nigeria, Turkey, Indonesia and India). Users in these markets are gradually viewing stablecoins as financial tools to address economic challenges in their respective countries, including currency depreciation, high inflation, and difficulties in cross-border payments. The following is Aiying's detailed analysis of the use of stablecoins in these five countries:

Nigeria has performed most prominently in the use of stablecoins and is one of the countries with the most extensive use of stablecoins among the five emerging markets. As the Naira continues to depreciate, many Nigerian users use stablecoins, especially stablecoins pegged to the US dollar (such as USDT), as a hedging tool to protect their wealth from the depreciation of the local currency.

Purpose: The report shows that Nigerian users mainly use stablecoins to save US dollars and regard them as a savings tool outside the local banking system. In addition, stablecoins are also widely used for remittances and payment of goods and services, helping users bypass the banking system and complete daily payments and transactions. This makes stablecoins an important part of Nigerians' daily lives, especially in the context of currency turmoil and severe inflation.

Actual scenarios: For example, Nigerian users often use stablecoins to send remittances to relatives working abroad or purchase goods on international e-commerce platforms to avoid high foreign exchange fees and the inconvenience of the banking system.

Turkey is also an important market for the use of stablecoins, especially in the context of the country facing high inflation, and users are increasingly using stablecoins to earn income. Due to the continued depreciation of the local currency (Turkish lira), users hope to earn income on the **decentralized finance (DeFi)** platform through stablecoins to fight against the shrinking wealth caused by inflation.

Preferred public chain: The report pointed out that when using stablecoins, Turkish users usually prefer to choose mainstream blockchain platforms such as Ethereum and Binance Smart Chain for transactions. These platforms not only provide high liquidity, but also support a variety of decentralized financial applications, enabling users to obtain higher returns by holding stablecoins.

Actual scenario: Many Turkish users use stablecoins to participate in financial activities such as decentralized lending and liquidity mining to earn additional income, thereby making up for the economic losses caused by currency depreciation.

In Indonesia, the main uses of stablecoins are concentrated on currency conversion and arbitrage transactions. The report points out that the efficiency of currency exchange and international payments by Indonesian users through stablecoins is much higher than that of the traditional banking system, which is one of the main reasons for the rapid popularity of stablecoins in the country.

Purpose: Stablecoins are widely used in commercial payments and cross-border transactions, especially when foreign exchange conversion is required or large international transactions are carried out. The fast settlement and low transaction fees of stablecoins enable enterprises and individual users to bypass the complex processes of traditional banks, saving time and costs.

Actual scenarios: Small and medium-sized enterprises in Indonesia use stablecoins for cross-border trade settlement, greatly reducing the cumbersome procedures of traditional banks. In addition, some individual users use stablecoins to conduct arbitrage operations between different trading platforms to obtain profits from exchange rate fluctuations.

The number of cryptocurrency and stablecoin users in India is growing rapidly, and stablecoins are gradually becoming an important financial tool in India, especially for savings and US dollar transactions. Since India's local currency (rupee) is relatively unstable, some users choose to convert their funds into stablecoins pegged to the US dollar to preserve value.

Purpose: Indian users use stablecoins for savings to avoid depreciation of the local currency. In addition, many users also use stablecoins for daily payments and commercial purposes, through which goods and services are traded, and even used as a salary payment tool.

Actual scenarios: For example, some companies have begun to pay overseas partners through stablecoins to reduce the delays and high fees of cross-border transfers of traditional banks.

In Brazil, stablecoins are mainly used for remittances and commodity payments. Stablecoins provide a more convenient and lower-cost solution when processing cross-border remittances, which has led to an increasing use of them in Brazil. In particular, companies and individuals who rely on cross-border trade have found that using stablecoins for settlement can not only avoid the complex banking system, but also save a lot of transaction costs.

Purpose: When Brazilian users remit money through stablecoins, they can avoid the high fees of traditional banks and enjoy faster arrival time. Therefore, stablecoins have gradually become the first choice for remittance tools. In addition, some Brazilian companies have begun to use stablecoins for cross-border trade settlements, especially when large amounts of funds are needed, the use of stablecoins is more flexible than traditional financial instruments.

Actual scenarios: For example, freelancers in Brazil receive payments from global customers through stablecoins, which greatly improves settlement efficiency while reducing currency exchange losses.

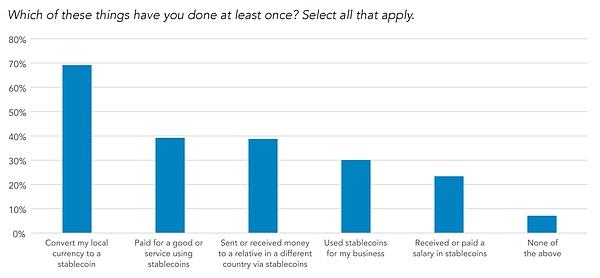

Stablecoins were initially used mainly as value storage and hedging tools in cryptocurrency transactions, but with the increasing instability of the global economy, especially in some emerging markets, the use of stablecoins has gradually expanded to a wider range of actual application scenarios. The report data shows that users not only use stablecoins for savings, but also use them for various activities such as salary distribution, commodity payment, exchange rate conversion, and income collection. This transformation shows the upgrade process of stablecoins from a purely speculative tool to an everyday financial tool.

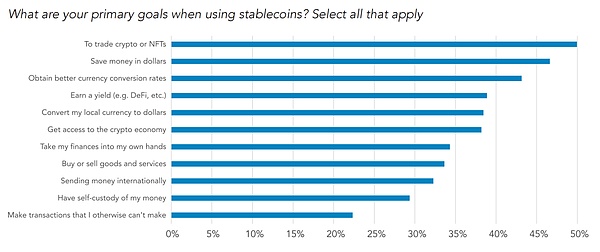

(Questionnaire: The main purpose of users using stablecoins)

Aiying found that what was surprising about this questionnaire was that nearly half of the users used stablecoins mainly for cryptocurrency or NFT transactions, which shows that MeMe has played a great role in promoting and popularizing Web3 education.

(Main usage scenarios in stablecoin applications)

Paying for goods or services with stablecoins and International remittances through stablecoins (about 45%): These two applications are also very common, indicating that stablecoins are widely used for daily consumption and cross-border remittances, especially in scenarios where faster and cheaper payment methods are needed.

Used for business transactions and salary payments: More than 30% of users have used stablecoins to process business transactions or salary payments, indicating that stablecoins are also being incorporated into financial management by companies and enterprises, especially in multinational companies and remote work scenarios.

In summary, it is mainly driven by the following factors:

An important use of stablecoins is to provide users with an alternative to US dollar savings, especially in countries where the local currency is experiencing depreciation pressure or inflation, stablecoins have become a safe haven. The report pointed out that about 47% of users choose to use stablecoins for US dollar savings to avoid wealth shrinkage due to local currency depreciation.

User motivation: In high-inflation countries such as Nigeria and Turkey, users choose to deposit funds in stablecoins pegged to the US dollar to ensure that their wealth is not affected by the depreciation of their local currencies. Stablecoins provide a way to bypass the traditional banking system, allowing users to quickly store and use US dollars around the world.

Actual application scenarios: For example, users in Nigeria convert funds into USDT for storage instead of depositing them into their local bank accounts to avoid wealth loss caused by the depreciation of the Naira.

With the popularity of decentralized finance (DeFi) platforms, more and more users are earning income by depositing stablecoins into DeFi protocols, similar to regular deposits or investments in traditional finance. The report shows that 39% of users said they earn income through stablecoins, and this phenomenon is particularly prominent in emerging markets.

DeFi and income: DeFi platforms allow users to participate in liquidity mining or lending protocols by staking stablecoins, and then obtain interest or token rewards. Compared with the low interest rates of the traditional banking system, DeFi protocols often offer higher annualized yields.

Actual application scenarios: Users in Turkey earn higher returns than traditional financial institutions by depositing USDT or USDC in DeFi protocols such as Aave or Compound, which is also a strategy to cope with the depreciation of the local currency.

Stablecoins also provide users with more efficient exchange rate conversion services than the traditional banking system, especially in the field of cross-border payments or remittances. Traditional banks' foreign exchange conversion fees are high and the process is cumbersome, while using stablecoins for currency conversion is not only cheap but also can be settled quickly.

User behavior: The report pointed out that 43% of users use stablecoins for currency conversion, especially when cross-border payments or international trade are required, the borderless nature of stablecoins makes it an ideal tool.

Actual application scenarios: Small and medium-sized enterprises in Indonesia use USDT or USDC for international payments, bypassing the foreign exchange conversion process and high fees of traditional banks, thereby completing transactions at a more favorable exchange rate. In addition, individual users also tend to use stablecoins for exchange when traveling overseas or making cross-border consumption, enjoying the convenience of instant settlement.

With the rapid expansion of the use of stablecoins around the world, especially in emerging markets, it has had a significant impact on traditional financial infrastructure. Stablecoins have not only changed the landscape of cross-border payments, but also greatly improved financial inclusion, allowing more users to participate in the global economy. This change has brought new challenges and opportunities to the role and efficiency of the global financial system.

Traditional cross-border payment systems are often cumbersome and time-consuming due to the existence of intermediaries, and are accompanied by high transaction fees. This particularly affects individuals and businesses that rely on international trade and remittances, especially in developing countries, where such transactions can take days to complete and cost up to several percentage points of the transaction amount.

Advantages of stablecoins: The decentralized nature of stablecoins eliminates many intermediaries, making cross-border payments more transparent, efficient and low-cost. Through blockchain technology, stablecoins can complete the transfer of funds around the world in minutes, and the fees are only a fraction of traditional bank transfers. This is particularly important in emerging markets, where users in many countries rely on remittances or international payments to make a living or conduct business.

Actual application scenarios: For example, individuals and businesses in Nigeria use stablecoins (such as USDT or USDC) to send money to relatives or business partners abroad, which not only saves the cumbersome process of the banking system, but also avoids high foreign exchange conversion and transfer fees. Similarly, small and medium-sized enterprises in Indonesia use stablecoins for cross-border trade payments, which improves transaction efficiency and increases profit margins by reducing intermediary fees.

Eliminate the middleman: The application of stablecoins eliminates intermediaries in traditional finance such as banks and payment processing institutions, which greatly shortens the settlement time and enables funds to be cleared within a few minutes. And through the transparency of blockchain, all transactions can be tracked and verified in the public ledger, which enhances trust and transparency.

Financial inclusion has always been a challenge for the global financial system, especially in emerging markets, where many people do not have access to traditional banking services. These people may not be able to open a bank account or obtain loan and savings services due to lack of sufficient identification, credit history or living in remote areas.

Stablecoins lower the entry barrier: The application of stablecoins does not rely on traditional banking infrastructure. As long as users have an Internet connection and a crypto wallet, they can participate in global financial activities. It provides a way for people who are excluded from the banking system to store, transfer and pay in a decentralized way, enabling them to participate in the global economy.

Help from decentralized finance (DeFi): Stablecoins combined with decentralized finance (DeFi) further enhance financial inclusion. Users can obtain loans by staking stablecoins or get returns on savings through DeFi protocols without the high deposits or credit assessments required by traditional banks.

Actual application scenarios: For example, users in Turkey and Nigeria bypass the restrictions of local banks through stablecoins and use stablecoins for savings and payments. At the same time, many immigrants working abroad use stablecoins to remit money to their families, and these funds can be quickly received by their families and used for daily consumption without going through expensive and inefficient remittance services. Many small businesses in India and Brazil also use stablecoins to pay international suppliers, avoiding the delays and fees of the traditional financial system.

The traditional financial system often requires users to provide a lot of identity proof and credit history, which makes it impossible for a large number of low-income, unbanked or credit-poor individuals to participate in financial activities, especially in rural areas or areas with slow economic development. Stablecoins eliminate these barriers through blockchain technology and digital wallets, allowing financial services to reach previously excluded user groups.

The key to solving the problem: Stablecoins do not require complicated account opening procedures. Users only need to download a digital wallet to use stablecoins for financial activities such as storage, payment, and cross-border transfers. Most of these wallet applications can be used on smartphones, which is particularly important for emerging markets where the penetration rate of mobile phones is higher than the ownership rate of bank accounts.

Actual application scenarios: In remote areas of Indonesia and India, many users have obtained financial services through stablecoins, which was unimaginable before. Through mobile applications and stablecoins, they can deposit their savings in more stable digital dollars, avoiding losses caused by currency depreciation, while also participating in international trade and payments, thus breaking the long-term financial exclusion phenomenon.

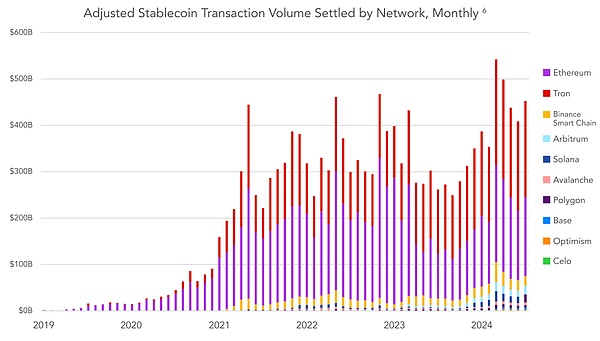

The rapid popularization and widespread use of stablecoins in financial activities such as cross-border payments, savings, and remittances are inseparable from the powerful blockchain technology support behind them. Different blockchain platforms provide different speeds, costs, and security, which directly affects the user experience and the use scenarios of stablecoins. The following are several major blockchain platforms pointed out in the report and the digital wallet choices commonly used by users.

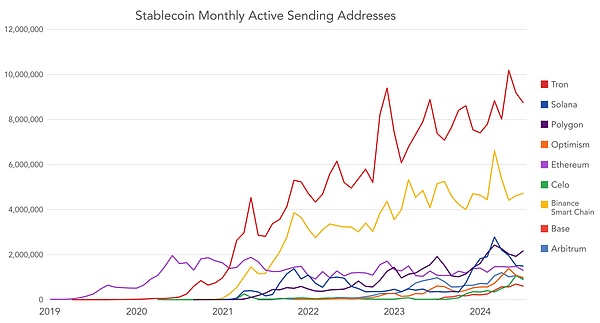

The issuance and trading of stablecoins are inseparable from the support of blockchain platforms. According to the report, Ethereum, Binance Smart Chain (BSC), Solana, and Tron are the most popular mainstream platforms for users to trade stablecoins. Each of these platforms has its own characteristics, and users choose them based on their specific needs, such as transaction speed, fees, platform security, etc.

Transaction volume of stablecoins on each chain (calculated on a monthly basis)

(Monthly active sending addresses of stablecoins on different chains)

(Change trend of the number of monthly active sending addresses of stablecoins on each chain)

Ethereum:

Reasons for popularity: Ethereum is one of the earliest and most influential smart contract platforms, supporting the issuance of multiple stablecoins, such as USDT, USDC, and DAI. Although Ethereum's transaction fees (gas fees) are relatively high, its strong security and ecosystem have attracted a large number of users, especially in high-value transactions and applications on decentralized finance (DeFi) platforms.

Application scenarios: Users tend to choose this platform when trading stablecoins on Ethereum, especially when depositing and withdrawing income on DeFi protocols or participating in liquidity mining, because it provides a wealth of financial applications.

Binance Smart Chain (BSC):

Reasons for popularity: BSC is known for its low cost and high speed, especially when the transaction volume is large, attracting a large number of users who need to complete stablecoin transfers quickly. Compared with Ethereum, BSC has very low transaction fees, so it has an advantage in processing small payments and frequent transactions.

Application scenarios: Many small and medium-sized enterprises and individual users prefer to use BSC for stablecoin transactions, especially in cross-border payments or commodity purchases, its fast settlement and low fees are very attractive to cost-sensitive users.

Solana:

Reasons for popularity: Solana has gradually become another popular choice in stablecoin transactions with its ultra-high transaction speed and extremely low transaction costs. Its ability to process thousands of transactions per second makes it an ideal platform for high-frequency trading and large-scale payment scenarios.

Application scenarios: Solana is widely used in scenarios that require efficient payment and instant settlement, especially for cross-border e-commerce and large payment network users, which can greatly improve transaction efficiency.

Tron:

Reasons for popularity: Tron is known for its extremely low transaction fees and is the preferred platform for small payments and high-frequency trading users. The report pointed out that Tron has become an important choice for stablecoin users in many emerging markets because its transaction costs are almost zero and it can quickly process a large number of small transfers.

Application scenarios: Tron's low fee structure is very suitable for daily remittances, payments, and frequent small transactions. Especially in developing countries such as Nigeria and Indonesia, users are more willing to use Tron for cross-border transfers and commodity payments of stablecoins.

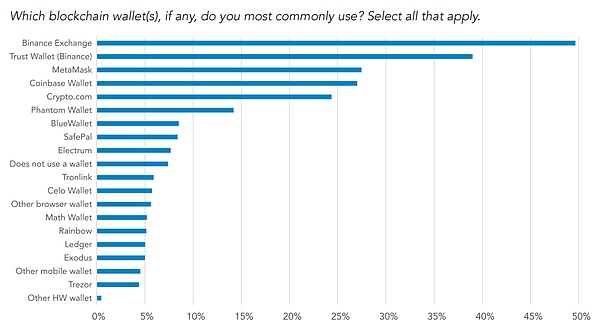

In addition to blockchain platforms, digital wallets play a vital role in the storage and use of stablecoins. The report shows that users usually use exchange wallets and non-custodial wallets (self-custodial wallets) to manage their stablecoin assets.

(The most commonly used blockchain wallet by users)

Exchange Wallet:

Binance Wallet: As one of the world's largest cryptocurrency trading platforms, Binance provides users with convenient and secure exchange wallet services. Users can easily manage and transfer their stablecoin assets on the Binance platform and trade and exchange various cryptocurrencies.

Trust Wallet: Trust Wallet is a mobile wallet associated with Binance that supports a wide range of cryptocurrencies and stablecoins. It is known for its ease of use and support for a variety of blockchain assets, especially in emerging markets where it has a large user base. Users can use Trust Wallet to make payments, store, and transfer money on their mobile phones, which is convenient and fast.

Non-custodial wallets (self-custodial wallets):

MetaMask: MetaMask is one of the most commonly used non-custodial wallets, through which users can directly manage their private keys and have full control over their assets. MetaMask supports stablecoin transactions on Ethereum and other EVM-compatible chains, especially in the DeFi field, where users participate in decentralized financial activities such as lending and liquidity mining through MetaMask.

Advantages: Compared with exchange wallets, non-custodial wallets provide higher security and privacy. Users directly control their private keys and funds without having to rely on centralized exchanges, which is very important for many users who value asset security.

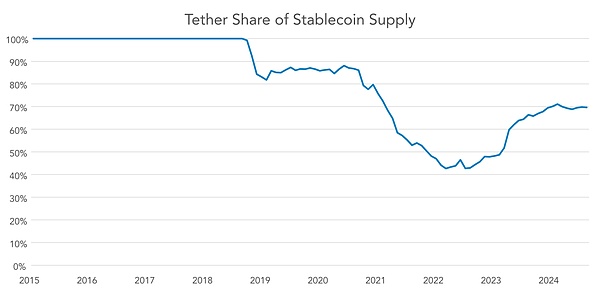

As the application of stablecoins continues to expand around the world, users' trust in them has gradually increased, especially in combating currency fluctuations and facilitating cross-border payments. Stablecoins play a key role in practical needs. The report particularly emphasizes Tether's (USDT) dominance in the stablecoin market. Despite the existence of other competitors, Tether is still the preferred stablecoin for users due to its extensive liquidity, long-term trust of users and huge market share.

(Changes in Tether (USDT)'s market share in the stablecoin supply)

As the earliest issued stablecoin, Tether (USDT) not only has a long market history, but its market share has also remained strong, becoming the world's most traded stablecoin. According to the report data, Tether accounts for most of the total stablecoin supply, especially in emerging markets and global cryptocurrency exchanges, where Tether is widely used for transactions, savings and payments.

Liquidity advantage: Tether's biggest advantage lies in its strong liquidity. Since Tether is pegged to the US dollar at a 1:1 ratio, users can easily exchange Tether for US dollars or other crypto assets. This convenient liquidity makes Tether the preferred tool for cryptocurrency traders and cross-border payment users. Whether it is high-frequency trading or large-value transfers, Tether can ensure fast and stable settlement.

User Trust: Users trust Tether mainly based on its long-term stable market performance. Although there have been doubts about the transparency of Tether's reserves in the past, it has been widely recognized by users as the world's most liquid stablecoin. In the global market, Tether's trading pairs cover most mainstream cryptocurrencies, allowing users to conveniently use Tether as an intermediary tool when trading.

Widely used network: Tether not only exists on multiple blockchains such as Ethereum, Binance Smart Chain, and Tron, but is also supported by the vast majority of cryptocurrency exchanges and decentralized financial platforms around the world. Whether users are trading on centralized exchanges or participating in liquidity mining through DeFi protocols, Tether is almost everywhere. The report specifically points out that Tether's wide network of use has kept its trust among users high.

Users' trust in stablecoins also relies on the transparency and compliance of the issuer. In addition to its liquidity and long-term performance, Tether has been able to maintain its dominance in the market because of its continued efforts to improve transparency and work with global regulators to ensure the legality and compliance of its operations.

Improvement in transparency: Although Tether has been questioned for its reserve issues, in recent years, Tether has increased the transparency of its reserves and regularly issued audit reports to prove to users that its stablecoins are indeed fully backed by US dollar assets. This increase in transparency helps to enhance users' trust, especially under the supervision of regulators, users are more confident that the stablecoins they hold are safe.

Enhanced compliance: As countries around the world gradually strengthen their regulation of cryptocurrencies, stablecoin issuers need to ensure that they comply with the legal requirements of each country. Tether works with regulators in multiple jurisdictions to ensure that it can operate legally and provide reliable services to users. Strengthening compliance not only protects the interests of users, but also further enhances Tether's trust in the global market.

Although stablecoins play an increasingly important role in the global financial system, their widespread use has also attracted the attention of regulators in various countries. In particular, on the issue of cross-border transactions and currency substitution, the potential impact of stablecoins on sovereign currencies has become one of the focuses of regulatory discussions in various countries.

Complexity of cross-border use: The cross-border use of stablecoins has provided unprecedented convenience for global users, but it has also brought considerable challenges to regulators in various countries. Traditional cross-border payments and fund transfers are subject to strict financial controls, and central banks and governments of various countries have clear regulatory provisions on capital flows. However, stablecoins bypass these traditional systems, allowing funds to flow freely across borders, weakening the central bank's ability to control capital flows. This rapid flow of capital may lead to capital flight, monetary policy failure, and potential threats to financial stability.

Risk of substitution for sovereign currencies: The widespread use of stablecoins, especially US dollar stablecoins, has become a de facto "currency substitution" in many economically unstable countries. Due to their distrust of local currencies, users and companies store a large amount of assets in stablecoins, weakening the use and trust of their own currencies. This phenomenon is particularly evident in high-inflation countries. In the long run, it may pose a threat to the status of sovereign currencies and even lead to the destabilization of national monetary systems.

Regulatory uncertainty: As the use of stablecoins becomes increasingly widespread, regulators around the world have begun to take action to try to establish a clear regulatory framework for stablecoins. Although some countries such as the United States and the European Union have begun to discuss and formulate relevant regulatory laws and regulations, a unified regulatory standard has not yet been formed globally. How stablecoin issuers ensure the transparency of reserves, how to deal with the risks of money laundering and terrorist financing, and how to align with the regulatory frameworks of various countries are all key challenges that the stablecoin industry will face in the future.

Actual Cases: For example, the United States' Stablecoin Transparency Act and the European Union's Markets in Crypto-Assets Act (MiCA) have begun to establish transparency requirements and reserve audit systems for stablecoin issuers. At the same time, some emerging market countries are considering restricting the circulation of stablecoins by strengthening the regulation of their own currencies. In the future, the compliance issues of global stablecoins will determine whether they can continue to expand rapidly and their legitimacy in the financial system.

It’s critical that Ethereum abandons its ultra-sound money narrative — I’m not sure if that’s a good thing or a bad thing.

JinseFinance

JinseFinanceKuCoin halts Nigerian naira support amid regulatory pressure. Central Bank blames crypto for naira devaluation. Exchanges follow suit. Pending P2P ban raises concerns. Lack of clarity hampers crypto industry.

Xu Lin

Xu LinBitcoin is an ultra-secure asset. As an ultra-safe asset, Bitcoin’s supply curve is closer to the inelastic level (S0) than every other known commodity and monetary good!

JinseFinance

JinseFinanceSpike in network activity Seses more than 3,000 ETH burned in the past day.

Beincrypto

BeincryptoSound money should reliably store value over time. No currency – not bitcoin, not ether, not the U.S. dollar – seems to be doing that these days.

Coindesk

CoindeskThere are always tons of innovative new ideas in the crypto space. It's a world that's full of innovation, and ...

Bitcoinist

BitcoinistMultiple news outlets have reported that Three Arrows Capital is under intense pressure to meet a Monday deadline and return ...

Bitcoinist

BitcoinistWallet.app is launching the next stage in its EU-based, fully compliant crypto custody wallet, exchange and payment platform that will ...

Bitcoinist

BitcoinistFortress Loans was attacked by oracle machine manipulation, and 1,048.1 ETH and 400,000 DAI (total value of about $2.98 million) were stolen.

Ftftx

FtftxBitcoin’s layer-2 scaling solution, the Lightning Network, has seen payment volume increase by over 400% as real adoption grows.

Cointelegraph

Cointelegraph