4Alpha Research Researchers: Stitich, Cloris

Friends who often attend meetings should be familiar with the term “PayFi”. In fact, this is exactly the topic of Lily Liu’s speech at every meeting. This article will focus on the introduction of the concept of “PayFi” and related projects to help readers keep up with Solana’s latest narrative

Note: Any projects mentioned in this article are for research purposes only and do not represent any recommendations

What is PayFi?

This is what Lily Liu said: “PayFi’s motivation is to realize the original vision of Bitcoin payments. PayFi is not DeFi, but rather creates new financial primitives around the time value of money, etc.”

Vision of PayFi

Lily Liu's initial vision of Bitcoin payment is not a simple "peer-to-peer electronic financial system", but "Program Money, Open Financial System, Digital Property rights, Self Custody and economic sovereignty". PayFi's vision is to "build a system of programmable currency in an open financial system, which can provide users with economic sovereignty and self-custody capabilities."

Programmable currency refers to digital currency that can not only be used for traditional transaction payments, but also automatically perform complex financial operations based on preset rules. In fact, smart contracts and DeFi are an application of programmable currency. However, the reason why PayFi is not DeFi is that DeFi is still based on products around finance and transactions, while PayFi is trying to build products around goods and services. PayFi strictly belongs to the RWA track.

Time value of money

When Lily Liu mentions PayFi, she always mentions 3 examples: "Buy Now Pay Never", "Creator Monetization" and "Account Receivable". Understanding these three examples can further understand PayFi.

1) Buy Now Pay Never

Most people are already very familiar with Buy Now Pay Later (installment payment), while Buy Now Pay Never is almost the opposite of installment payment. Installment payment is a kind of credit loan, which incurs a certain interest cost in exchange for better cash flow. Buy Now Pay Never, on the other hand, deposits money into DeFi products, earns interest through lending, and then uses the interest to make payments, sacrificing cash flow.

For example, if a user buys a $5 coffee, he will deposit $50 into a loan product and lock it. When the interest is enough for $5, he will pay for the coffee and then unlock it and return it to the user's account. All this needs to be executed under automatic rules, which requires the "programmable currency" mentioned earlier.

2) Creator Monetization

This example assumes that many creators will encounter cash flow difficulties. Creation itself requires time and capital investment, but after the creation is completed, it is often not immediately rewarded for various reasons. Therefore, the creator will have a long time to wait for the return from the beginning of the creation to the return. If the creator's cash reserves are insufficient, he may not be able to continue to create during this period, and the time will be wasted.

In Lily Liu's vision, PayFi can help creators solve this problem. For example, if the income of a video is 10,000 US dollars, it takes a month to arrive. The creator can use PayFi to immediately discount this income to 9,000 US dollars, sacrificing a certain amount of income in exchange for better cash flow.

3) Account Receivable

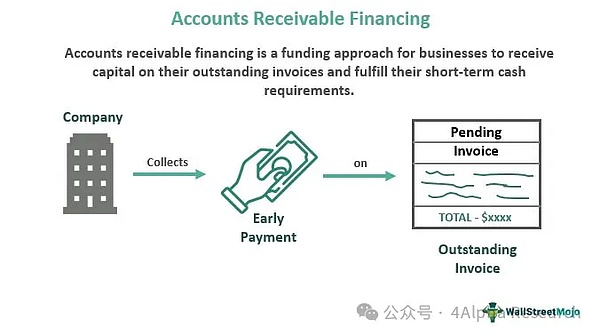

Accounts receivable is a very traditional concept. Simply put, it is the money owed by customers to the company. Due to the existence of accounts receivable, companies sometimes fall into cash flow problems. In order to solve this problem, many accounts receivable financing companies have emerged, using the company's accounts receivable as collateral for loans or directly selling them at a discount, so that the company can get cash immediately, thereby always maintaining a stable cash flow and continuing to grow, without being restricted by the speed of customer payment.

PayFi hopes to further popularize and optimize this scenario. Because although the above services already exist in Web2, the overall capital turnover still relies on the traditional payment system, resulting in slow settlement. Therefore, if the settlement speed can be improved through the blockchain, and the service objects of this supply chain finance can be popularized and the threshold can be lowered, the capital turnover speed of the entire real world can be improved.

The time value of money and the potential of PayFi

In fact, the above three cases all revolve around one point: "time value of money", that is, due to factors such as opportunity cost and interest rate, the current currency is more valuable than the currency of equal value received in the future. What PayFi wants to do is to help users/customers maximize the time value of money. For example, Buy Now Pay Never is paid with the time value of money, while creator monetization and accounts receivable are paid by paying the time value of money to get the money now, which is closer to Buy Now Pay Later.

Overall, PayFi is not a new concept. The problems it solves are all problems that already exist in the traditional financial system and have solutions, but this does not mean that PayFi has no value, because traditional solutions are still not good enough.

Take corporate financing as an example. Accounts receivable is a form of corporate financing. In actual production, from the perspective of financial institutions, in order to meet policy supervision and their own risk control requirements, it is difficult to simplify the evaluation and execution process of mortgages; on this basis, for many small and medium-sized enterprises, it is easy to cause financing difficulties due to the complexity and cumbersomeness of the process, or even be unwilling to finance, and unable to fully utilize the time value of money.

In the cross-border payment scenario, the monetary value of time is more obvious, because cross-border payments rely more on long-standing financial networks such as agent banks and SWIFT, but they cannot transfer funds between different countries in real time, while more and more customer system remittance companies can achieve next-day or same-day settlement for them. In order to meet customer needs and provide a certain degree of real-time performance, these financial institutions must reserve a certain amount of financial capital in various countries in advance (just like Orbiter crosses chains between different bridges), which is a pre-funding account. According to a study by Arf, more than $4 trillion will be locked in pre-funded accounts in 2022, which is a huge waste of the time value of money for financial institutions. Therefore, PayFi still has huge potential value to be discovered, just as the tram is still a car, but it has completed the revolution of the car. Even if PayFi may be old wine in a new bottle, the core element is still to observe whether it can optimize the original system through the means of blockchain, and realize the user experience that cannot be obtained under the old system and technology stack, so as to realize the revolution. What are the projects worth paying attention to in the PayFi field? There are not many projects focusing on the concept of "PayFi" at present. PayFi is still a very early concept. Next, we will focus on introducing several PayFi-related projects to help readers further understand the progress of the PayFi track.

Huma

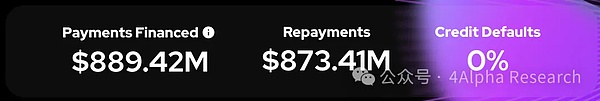

Huma is one of the most popular PayFi concept protocols. As of August 16, 2024, the platform has provided nearly $890 million in payment financing, and the default rate is 0%.

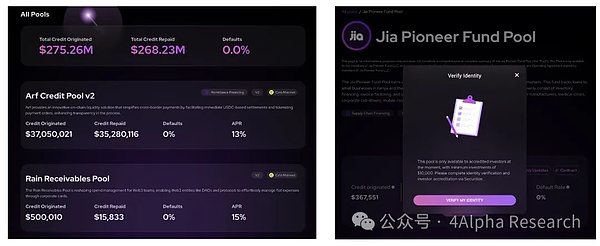

Huma currently has two versions, V1 and V2. V1 is a loan agreement for enterprises and individuals, allowing users to borrow with future income (RWA) as collateral; Huma V2 adds the function of accounts receivable acquisition on the basis of V1.

On Huma, there are currently multiple pools for different purposes and with different partners, but Huma is still a long way from the decentralized, barrier-free, and identity-free financial products expected by the blockchain vision. When the author tried to borrow funds from Huma or provide funds for Huma, he found that he would encounter obstacles such as not being able to find an entrance, requiring KYC, and having certain usage thresholds, which was daunting.

Arf

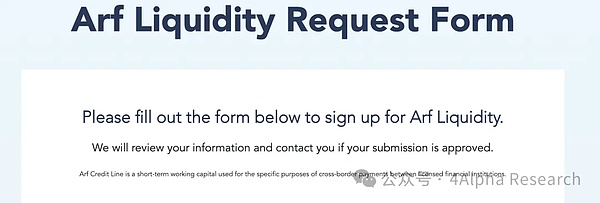

Arf is a cross-border payment network project that provides unsecured, short-term, USDC-based working capital credit lines to licensed financial institutions, allowing these institutions to smoothly make cross-border payments without additional collateral or depositing funds in prepaid accounts.

For example, suppose Arf's European customers want to remit funds to partners in Africa. Customers only need to remit funds to Arf's local bank account, and Arf will convert USDC into local legal currency for the African partner currency and perform same-day settlement for them. After the transaction is completed, Arf's customers can deposit funds into Arf's account through Wire, SWIFT, etc. Arf will immediately convert these deposits into USDC to ensure that the funds are available at any time.

Arf completed a $13 million seed round of financing in 2022. So far, Arf's services are still aimed at enterprises, and you need to fill out an application form to become its customer. In April of this year, Arf announced a merger with Huma, and currently 70% of the nearly 900 million payment financing on the Huma platform comes from Arf. The combination of the two may give full play to Arf's liquidity advantages and Huma's platform advantages.

Credix Finance

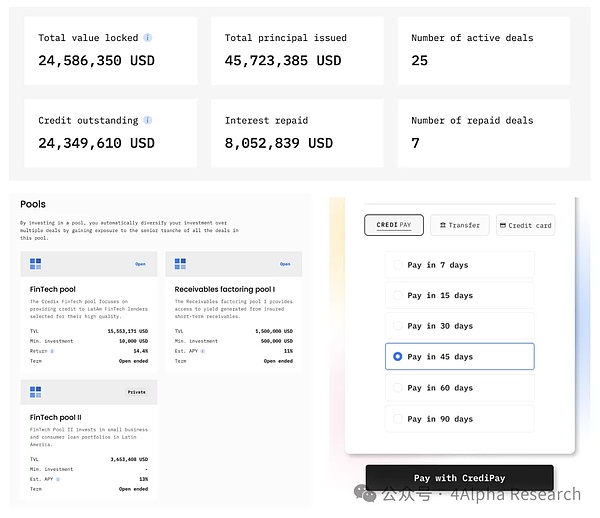

Credix is also a B2B credit agreement in the Solana ecosystem. Its product logic is very similar to Huma. There are investment pools for specific types on the Credix platform. Institutional investors who have passed KYC certification can provide credit by adding liquidity to the pool. Currently, Credix's services are mainly concentrated in Latin America, such as accounts receivable factoring.

Compared with Huma, Credix has higher requirements for investors and supports a narrower range of businesses. Therefore, the amount of loans Credix has lent so far is relatively small compared to Huma and Arf. In addition, Credix has also launched a feature called CrediPay, which is a "Buy Now Pay Later" service for enterprises.

NX Finance

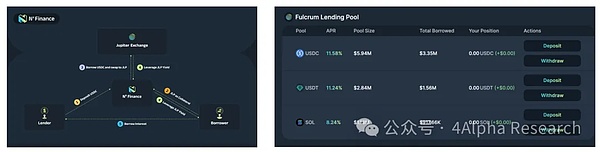

The last thing to introduce is NX Finance. NX is the yield layer protocol on Solana, providing users with leverage or point farming strategies for interest-bearing assets within the Solana ecosystem. The corresponding two types of strategies on NX Finance are called Fulcram strategy and Gold mining strategy. Currently, NX Finance is still in a relatively early stage, and the platform TVL is around 14M.

Fulcrum Strategy: This strategy allows users to leverage high-quality interest-earning assets (currently supports JLP). Lenders obtain interest income paid by borrowers by depositing USDC; borrowers need to use high-quality assets (JLP) supported by the mortgage strategy to borrow. At the same time, NX Finance will use part of the loan to purchase JLP to increase JLP holdings. In other words, borrowers do not get USDC, but the return on JLP after leverage.

Strictly speaking, NX Finance is different from the above projects and is not a PayFi project. It is more like a Crypto Native lending protocol; but from a broader perspective, the lending protocol itself is a full utilization of the time value of currency and is also an indispensable part of achieving Buy Now Pay Never. The ultimate measure of whether a project is PayFi depends on whether the services it provides will eventually involve the real production and consumption needs of customers, rather than a financial lever that simply makes money. To link and integrate these real off-chain needs, the project party needs to do a lot of work, such as applying for licenses.

Summary

Overall, PayFi is still in an extremely early stage, and many projects claiming to be PayFi have not yet been launched. However, at present, PayFi is a subdivision of the RWA track, and is currently mainly iterating around the two needs of accounts receivable factoring and cross-border payments for Web2.

In addition, PayFi is still a certain distance away from the "openness" in its vision, because most of the projects that have launched products still have strict KYC and user geographical restrictions; but even so, we have seen that some PayFi projects, such as Huma, have accumulated a certain amount of data to show the existence of their product demand. As a track far away from on-chain users and exchange users, can PayFi create more innovative products around the time value of money and other attributes of money, and even accommodate more physical asset categories and improve the liquidity of physical assets? These issues are worthy of long-term attention from investors.

Reference

https://x.com/gizmothegizzer/status/1815787976225419745

https://blog.huma.finance/payfi-the-new-frontier-of-rwa

https://medium.com/hashkey-capital-insights/rwa-tokenized-credit-pt-1-market-opportunities-for-on-chain-private-credit-trade-finance-381076772e6d

The content of this article is only for information sharing, and does not promote or endorse any business or investment behavior. Readers are requested to strictly abide by the laws and regulations of their region and not participate in any illegal financial behavior. It does not provide transaction entry, guidance, distribution channel guidance, etc. for the issuance, trading and financing of any virtual currency or digital collections.

4Alpha Research content is prohibited from being reproduced or copied without permission, and violators will be held accountable.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bitcoinist

Bitcoinist Beincrypto

Beincrypto Others

Others Nulltx

Nulltx