The innovative application of Liquid Re-Staking Token and the development of the recently launched Blast, a public chain that supports Layer 2 automatic staking function, are leading the way A new wave in DeFi staking. This Bing Ventures article will focus on the background behind this development, what this development means for the DeFi staking field, and the main current trends and prospects in this field.

Liquidity re-pledge protocol: the latest innovation in the LSD field

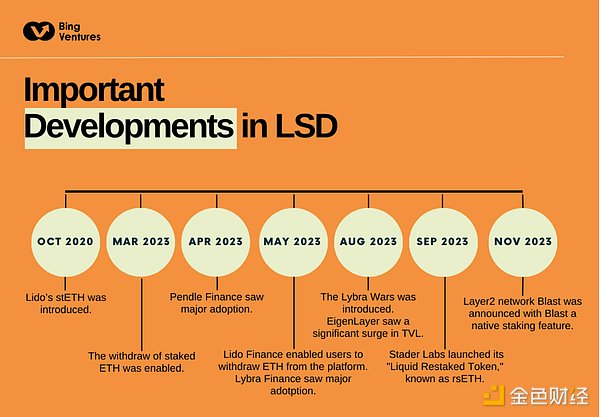

In the Ethereum ecosystem, especially after the Shanghai upgrade, the development of the field of Liquid Staking Derivatives has shown full innovation and adaptability. Started with Lido, a player that plays a key role in the Ethereum staking mechanism. By providing a staking solution for Ethereum, Lido solves the significant problem of liquidity lock-in. Their approach allows users to stake Ethereum while maintaining some liquidity, which is a significant leap from the traditional, rigid staking paradigm.

Subsequently, the addition of Pendle Finance brought a new transformation, making the Users can conduct income transactions through interest-rate-based protocols, adding new gameplay to the LSD field and opening up new ways for income optimization and risk management.

However, the market’s desire for higher yields and more efficient use of pledged assets has not been fully satisfied. . This has led to the development of more complex mechanisms such as the restaking protocol Eigenlayer. Eigenlayer allows stakers to re-stake their Ethereum, enhancing the security and reliability of other protocols. This not only increases stakers’ potential earnings, but also contributes to the resilience and security of the entire Ethereum network.

But a challenge soon arose when tokens locked on Eigenlayer were lost Liquidity, becomes inactive, and thus diversity in the DeFi space becomes limited. This has led to the innovation of Liquidity Rehyping Tokens (LRT), a solution that unlocks the liquidity of these rehypothecated assets while allowing stakers to further increase their returns by participating in DeFi. Users can deposit LRT into the liquidity re-pledge protocol to obtain income.

As a result, the LSD field has evolved from its starting point of single-level pledges to a much more complex and multifaceted ecosystem. Recent developments such as the launch of Blast exemplify this trend. Blast is an EVM-compatible Ethereum second-layer network that provides native ETH and stablecoin staking benefits on its chain, which further democratizes the acquisition of staking rewards and makes the process more user-friendly and diverse. This evolution of the LSD narrative highlights a dynamic and adaptable Ethereum ecosystem that is constantly innovating to meet user demands for greater liquidity and yields, while navigating the complexities and risks inherent in the world of decentralized finance. navigation.

DeFi’s next narrative: LRT

< /p>

< /p>

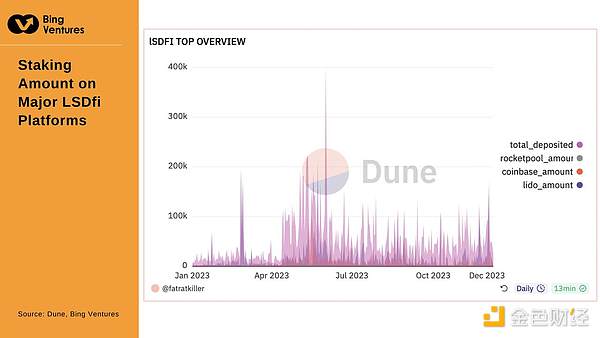

Source: Dune, Bing Ventures

In the field of DeFi, the emergence of Liquidity Re-pledge Tokens (LRT) is a profound innovation to the traditional pledge model. LRT not only breaks the limitations of single pledge in concept, but also promotes the popularization of multi-protocol pledge enhancement in practice. Through the EigenLayer platform, users can cross the boundaries of a single protocol and stake their ETH resources in multiple Active Verification Services (AVS). This not only significantly improves the security of the network, but also injects more complexity into the DeFi ecosystem. Security levels.

LRT has many advantages: significant improvement in capital efficiency, improvement in network security Enhancements, and huge savings in resource allocation for developers. However, at the same time, we should also be alert to the attendant risks: including potential fine risks, protocol centralization issues, and revenue dilution caused by fierce market competition.

In terms of the market prospects of LRT, we see the huge temptation of its high-yield potential. LRT provides ETH stakers with additional revenue channels, which include not only basic staking revenue, but also Eigenlayer rewards and potential token issuance. In addition, through incentives such as airdrops, LRT is expected to attract a wider range of user participation, thus driving the overall growth of DeFi leverage. This trend is expected to replicate or even surpass the success of the 2020 DeFi Summer.

The future trend is eye-catching. Driven by LRT, it is expected that a competitive situation similar to "Curve War" will emerge in the DeFi field, and token economics may evolve into a more complex veTokenomics model. At the same time, the introduction of the emerging AVS, through token rewards or its influence on the LRT protocol’s token issuance decisions, can become a key driver to attract ETH re-staking.

In summary, LRT can unlock liquidity, increase returns, and optimize governance and risk management. , has demonstrated its unique value. In this way, LRT is not only a staking tool, but also a key factor driving DeFi innovation and growth. Its development and application will bring far-reaching changes to the DeFi ecosystem and open up new possibilities for users, developers and the entire blockchain world.

Risks and challenges associated with it

Stader Labs, as a dark horse in the industry, recently launched the liquid re-pledge token rsETH, which has attracted widespread attention on the Ethereum mainnet. Through rsETH, users can re-pledge existing liquid pledge tokens (such as Coinbase's cbETH, Lido's stETH, and Rocket Pool's rETH) on multiple different networks, and mint new liquid token representatives on this basis. Its share in the re-pledge agreement greatly enhances the flexibility and liquidity of pledged assets. With the support of EigenLayer, rsETH has achieved large-scale re-staking of ETH by simplifying the process for users to enter the re-staking ecosystem, further strengthening the decentralized nature of the Ethereum network.

However, this innovative financial instrument also brings many risks. Vitalik Buterin, the founder of Ethereum and the co-founder of EigenLayer, have pointed out that re-pledging may lead to complex scenarios, which may pose a threat to the security of the main network. In addition, as more and more AVS and LRT emerge, excessive distraction of industry funds and attention may lead to market instability and weakening of governance structures.

As an emerging force in the Web3 ecosystem, the Blast Layer2 public chain uses its original automatic compound interest function , breathing new life into Layer 2 solutions. The innovation of Blast is to provide basic income for deposits on the Layer 2 network, provide stable staking returns through cooperation with protocols such as Lido, and at the same time invest stablecoin assets in protocols such as MakerDAO to achieve additional income. Although Blast’s operating model brings convenience and benefits to users, its TVL composition and strategy also reveal potential centralization risks and market sensitivity issues.

The future challenge for Blast is how its strategy affects the actual utilization of assets and dynamics within the ecosystem Capital conversion. Blast’s TVL strategy needs to change from static capital preservation to dynamic capital appreciation to ensure network vitality and Dapp’s liquidity. Only in this way can it truly achieve its goal of promoting the growth of the blockchain network, rather than just serving as a storage medium for capital.

Overall, the emergence of Stader Labs’ rsETH and Blast Layer2 public chains marks the development of the DeFi field Innovation and progress in the pledge model. But while pursuing maximization of returns, we must also remain alert to the potential risks in these emerging models to ensure the security and healthy development of the Ethereum network. The future DeFi ecosystem will need to find a more robust and sustainable balance between innovation and risk management.

Imagination on new ways to play Ethereum staking

We believe that dynamic staking strategies like LRT are having a profound impact on the Ethereum staking market. First, the automation and efficiency of the strategy lower the investment threshold and attract more individual investors. Secondly, as more funds flow in, market liquidity increases significantly, which helps stabilize the entire DeFi ecosystem. In addition, dynamic staking strategies drive innovation and development in the market by providing diversified and customized investment options. However, the implementation of this strategy also faces technical challenges, especially building efficient and accurate algorithm models, as well as ensuring system security and resisting cyber attacks.

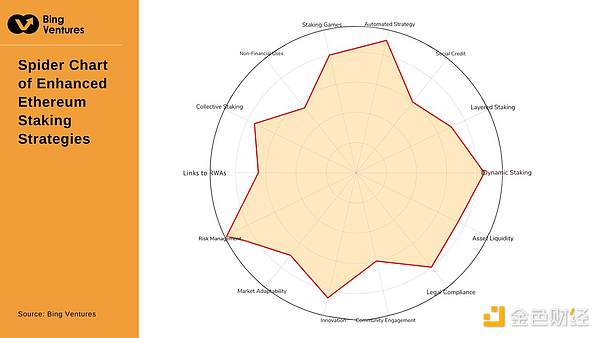

Source: Bing Ventures

At the same time, some new Ethereum staking paradigms other than LRT are also being explored and deserve attention.

Layered Staking System, as a new model, is emerging as the market matures and the diversified needs of investors. The system distributes pledged assets across different risk tiers, each with different return potential and risk allocation. The low-risk tier provides relatively stable returns and is suitable for risk-averse investors, while the high-risk tier is suitable for investors with higher risk tolerance. The system's flexibility allows investors to allocate assets based on their own risk appetite and market forecasts. Implementing a tiered pledge system requires complex smart contracts and sophisticated risk management strategies to ensure the liquidity and security of assets at each level. The emergence of the tiered staking system provides investors with more choices and flexibility, pushing the Ethereum staking market toward a more mature and diversified direction.

In addition, the automated staking strategy based on smart contracts automatically executes pledges, releases pledges or re-stakes through smart contracts. Allocating pledged assets improves the efficiency and effectiveness of asset management. The risk management capabilities of automated staking strategies are enhanced by specific risk parameters set by smart contracts that automatically adjust staking positions once market conditions trigger these parameters. Despite challenges such as ensuring the security and reliability of smart contracts, it is expected that as technology develops, the security of smart contracts will be enhanced, promoting the application of automated staking strategies in a wider range of fields.

The collective pledge and shared revenue model enables multiple investors to jointly pledge their assets and Proportionally share the revenue generated. This model automatically distributes income through smart contracts, providing small investors with the opportunity to cooperate and add value. Smart contracts play a central role in the collective staking model, automatically executing income distribution and ensuring that each participant receives fair income. Collective staking provides small investors with the opportunity to reduce risks and costs, increasing the inclusivity of the DeFi ecosystem.

Finally, linking pledged assets to physical assets (RWA) is an innovative development in the DeFi field . Under this model, physical assets such as real estate, artwork, etc. can be used as the underlying assets of the pledged assets, which are represented on the blockchain through tokenization and used for pledge. This provides liquidity to assets that are typically illiquid, providing owners of physical assets with a new source of funding. Despite challenges, such as ensuring accurate valuation and tokenization of physical assets, and dealing with regulatory and compliance issues related to physical assets, the future model of tying pledged assets to RWA is expected to be more widely used in the future, providing traditional assets with It provides holders with new funding channels, provides cryptocurrency investors with new investment opportunities, and deepens the integration of the cryptocurrency market with traditional financial markets.

In short, the DeFi staking field will usher in more innovation and development in the future, which is very worthy of investors and DeFi players pay attention.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance XingChi

XingChi JinseFinance

JinseFinance JinseFinance

JinseFinance Nell

Nell Beincrypto

Beincrypto Ledgerinsights

Ledgerinsights Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph