Author: David; Source: TechFlow Research

On the eve of the results of the Bitcoin Spot ETF, the crypto market experienced a flash this week. Broken pin.

After the panic, Ethereum ecological tokens such as LDO and ARB rebounded quickly, and some Ethereum L2 with smaller market capitalization such as Metis even hit higher points However, it illustrates from another perspective the current optimism of market funds towards the Ethereum ecosystem.

But L2 has collectively promoted, and most of the projects in liquidity staking only have Beta returns. What other narratives can be laid out around the Ethereum ecosystem?

Don’t forget another big but not yet fully realized catalyst - Restaking and EigenLayer.

Re-Staking derived from liquidity staking has gradually evolved into liquidity staking in the eternal pursuit of efficiency and returns by capital. The matryoshka version of token (LST) - Liquidity Recollateralized Token (LRT).

Outside of CEX, some tokens related to the LRT concept have experienced good gains recently.

Sounds familiar, but don’t fully understand the logic?

In this issue, we will help you quickly understand the logic of re-staking and LRT, and dig deeper into projects with low market value or that have not yet released Tokens.

Review re-staking and liquidity nesting dolls

Re-staking Staking is not a new concept.

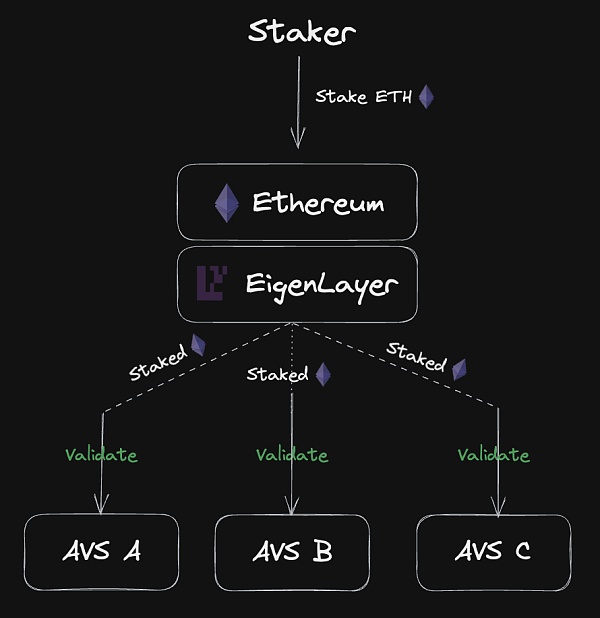

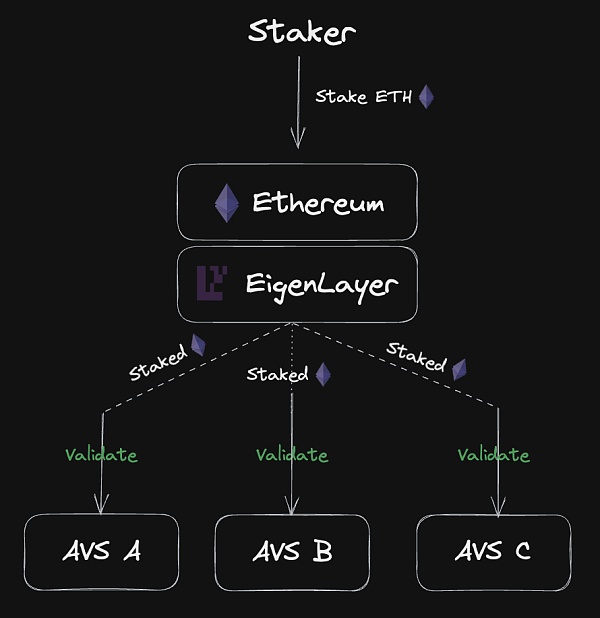

As early as June last year, EigenLayer introduced the concept of "re-pledge" on Ethereum. It allows users to re-stake already staked Ethereum or Liquidity Staked Tokens (LST) to provide additional security for various decentralized services on Ethereum and earn additional rewards for themselves.

I will not repeat the technical principles of EigenLayer here, and assume that all readers have a certain understanding of it.

On the contrary, if you are not entangled in the internal technical details of EigenLayer, it will be easier to understand the logic of liquidity staking and re-staking:

To put it bluntly:

For Ethereum, staking maintains security, and staking maintains more Safe;

As for investment, pledging to find returns, Re-stake to find more yields.

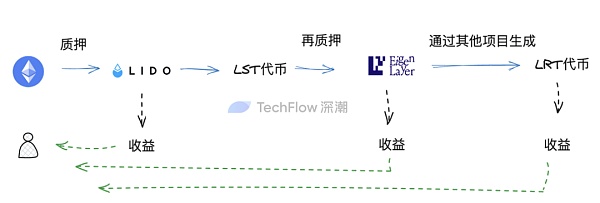

So just from an investment perspective, how is the current method of finding income implemented? The following picture is a minimalist version of understanding:

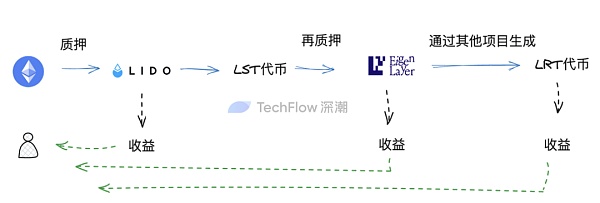

1. I have ETH and pledge the ETH to an LSD service provider, such as Lido;

2. I get LST (liquidity staked token), such as stETH;

3. I re-stake stETH into EigenLayer;

4. I can get benefits from steps 1 and 3.

Obviously, before the emergence of EigenLayer, the LST in my hand could only obtain one kind of income; after having EigenLayer, I obtained an additional layer of income. Not a loss in theory.

But in the mature re-pledge process above, there is a key problem: Liquidity is trapped.

Your LST is re-pledged into EigenLayer, and you lose the opportunity to invest LST elsewhere to generate income.

EigenLayer, as a re-pledge layer, will return you income due to your pledged investment, but it will not give you the same liquidity as when you hold the currency.

In the crypto market, an environment that emphasizes capital efficiency, liquidity never sleeps. The speculative orientation does not actually accept that the liquidity of the token is completely locked in one place and cannot be expanded.

Therefore, the current logic of finding income through "pledge - then pledge" is not perfect.

In order to allow tokens to obtain more liquidity and opportunities, LRT (Liquidity Re-pledge Token) came into being. In fact, the principle of LRT is very easy to understand. To use a very popular analogy, it is:

Mortgage Certificate.

If I have ETH, I can exchange it for LST (stETH) through liquidity staking. At this time, this stETH is actually a mortgage certificate, used to prove "I did pledge ETH", but the original asset in my hand is only ETH itself.

Similarly, if I have LST, I can exchange it for a new mortgage certificate through re-pledge, which can be used to prove "I did re-pledge" stETH", but the original asset in my hand is still ETH itself.

Essentially, this new mortgage certificate is LRT, that is, Liquidity Re-pledge Token. You can use this new certificate to do more financial operations, such as mortgages and loans, to solve the liquidity lock situation during re-pledge.

If you still can't understand the principle, you might as well imagine a matryoshka doll with three layers of dolls.

ETH can be used to withdraw LST, and LST can be used to withdraw LRT. When you have three layers of matryoshka dolls in your hand, you can use these three dolls to do different things (pledge, re-pledge, other methods of earning interest). For each layer of matryoshka dolls, you have one more layer to use for flow. Opportunities for sexual gain.

So, when Ethereum regains attention, how to solve the capital efficiency problem in EigenLayer re-staking may evolve a new narrative of LRT.

What related projects deserve attention?

Projects related to LRT in the current market that try to solve the problem of capital efficiency have begun to be noticed, and some of them have achieved very good results. price performance.

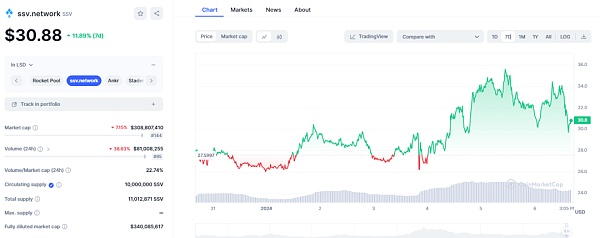

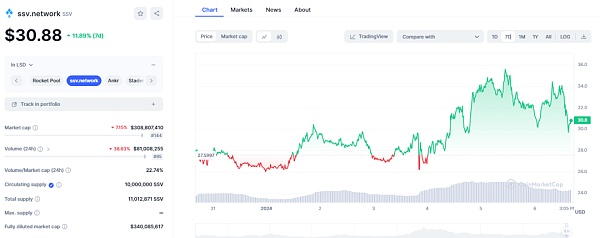

But from an investment research perspective, we are not inclined to introduce projects that have been fully price discovered, such as SSV. Therefore, the projects I will try to find next are more inclined to the following two categories:

< p style="text-align: left;">

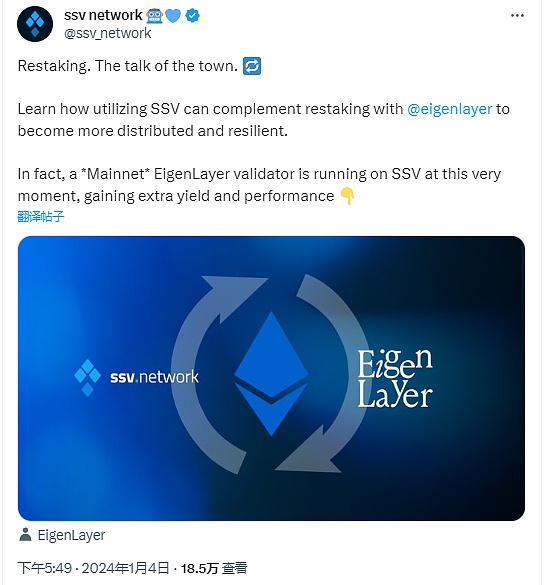

Low market cap projects with tokensSSV Network($ SSV): Seamless re-employment of liquidity staking projects

Previous liquidity staking projects can be re-staking if they can do staking business Business can be regarded as a kind of seamless re-employment for professional counterparts.

This logic is very obvious in SSV.

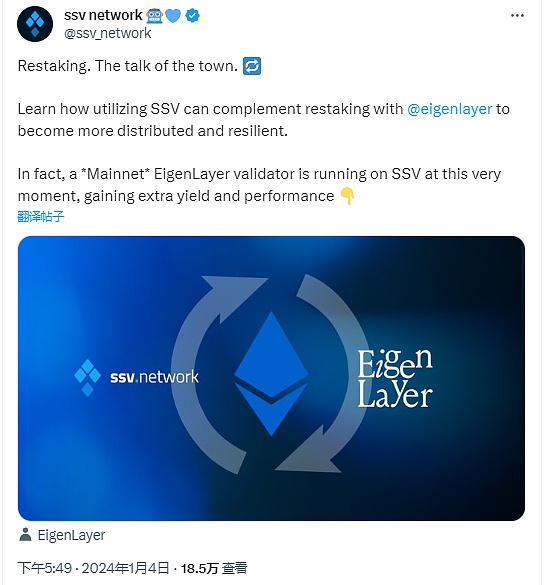

On January 4, SSV announced on Twitter that it had begun to enter the re-staking business, allowing the responsibilities of EigenLayer's validators to be distributed to SSV, using the distributed and non-custodial features of SSV to enhance the performance and performance of its validators. safety. This process not only increases the elasticity and distribution of validator operations, but also improves fault tolerance and performance, ultimately bringing more revenue and higher security to users.

At the same time, users can also obtain additional rewards on top of the pledged ETH assets.

It is worth mentioning that SSV’s re-pledge nodes are very distributed and can currently be combined with four nodes, ANKR/Forbole/Dragon Stake/Shard Labs, to provide re-pledge services.

However, the SSV token’s gains in the past week have not been significant. Considering that it is already well-known in the liquidity staking circuit, and its re-pledge business is a professional counterpart, its market value of about 300 million is not particularly high, and we can still look forward to its performance under the re-pledge narrative in the future.

Restake Finance ($RSTK): The first modular liquidity re-pledge protocol on EigenLayer

As you can see from the name of the project, Restake Finance focuses on making EigenLayer Pledge-related businesses.

Based on understanding the above LRT operating logic, the business of Restake Finance becomes very easy to understand:

Users deposit the LST generated by liquidity staking into Restake Finance;

The project helps users deposit LST into EigenLayer, and allows users to generate reaped ETH (rstETH) as a re-pledge certificate;

Users take rstETH and go to various DeFi to earn income, and they will also get EigenLayer reward points (considering that EigenLayer also No coins were issued)

Image source: Twitter user @jinglingcookies

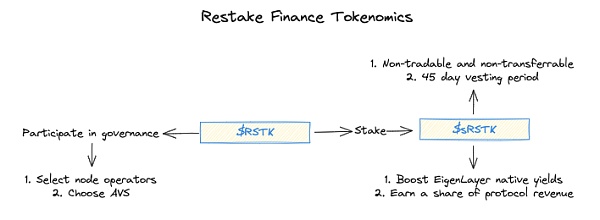

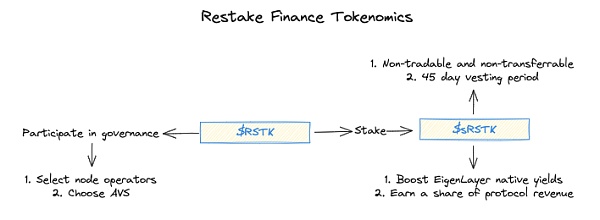

At the same time, the project's own native token is called RSTK, which is built on Ethereum. In summary, it has the functions of governance, staking and increasing income:

Governance:

Increase income:

< ul class=" list-paddingleft-2">

$RSTK can be staked to increase the income from EigenLayer's native output. 5% of the EigenLayer restaking rewards accumulated on the Restake Finance platform will be distributed to stakers, while earning a share of the revenue of the Restake protocol itself.

Staking $RSTK will receive $sRSTK. These tokens are used to track the user's governance rights. and revenue sharing rights, which cannot be traded or transferred. If users want to redeem their $RSTK, there is a 45-day unlock period.

As a successful proxy for EigenLayer: $RSTK is designed to be a successful proxy for EigenLayer. As more AVS join, wider adoption of EigenLayer, along with higher yields and more protocol revenue, will increase the value of $RSTK.

Image source: Twitter user @jinglingcookies

Overall, there is not much newness in the design of the token function, and it is more of a classic focus on staking to obtain additional income.

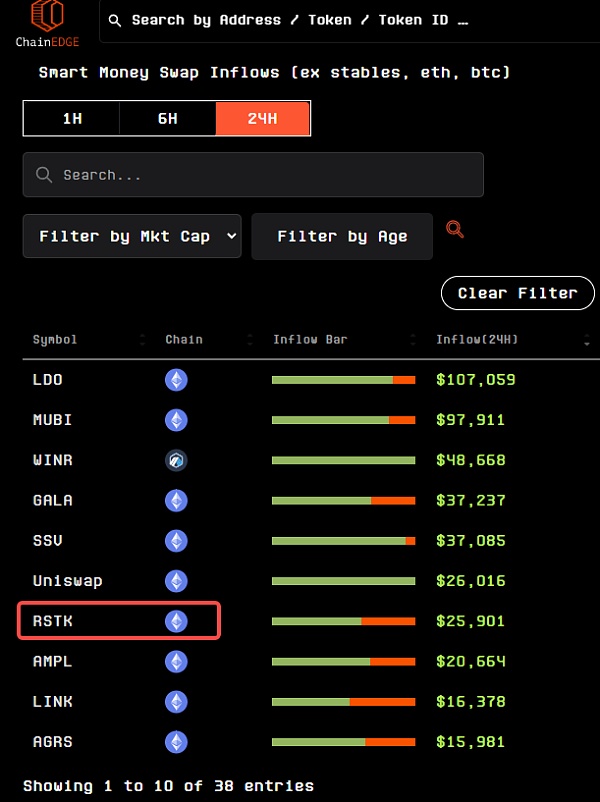

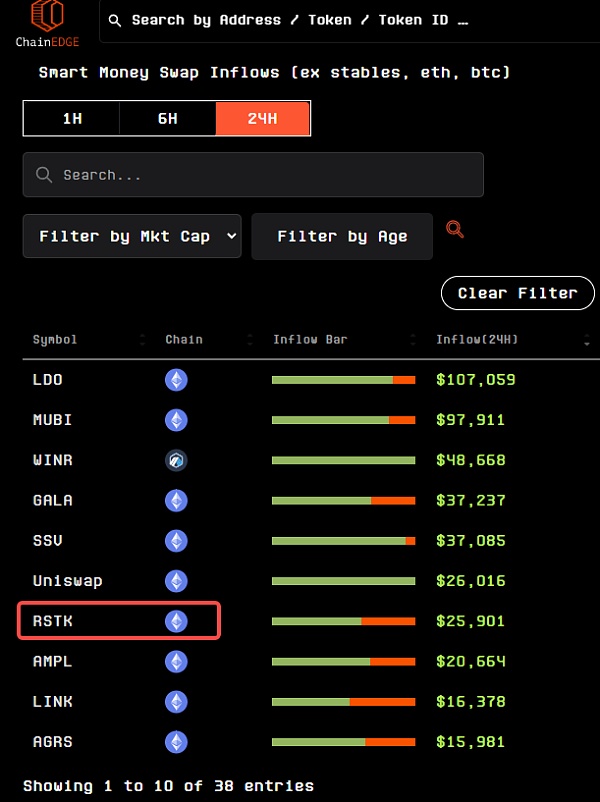

But in terms of token performance, RSTK has recently ushered in a highlight moment.

Since the opening of trading on December 20, RSTK has increased nearly 20 times as of press time; but its market value is only US$38 million, and according to the author's observation, smart money has purchased varying amounts of RSTK every day in the past week.

So is RSTK underrated?

Considering that SSV Network has also begun to engage in re-pledge related business, its current market value is US$330 million. If the re-pledge business becomes a mainstream choice for "seamless re-employment" of mature liquidity staking projects, then this probably means that RSTK still has about 10 times the market value of mature projects; and if compared directly with LDO, the space Larger, but considering LDO's leading position and focusing on the main business of LSD, it has great advantages, so this comparison is not practical.

Therefore, the author believes that in the long term, there are not many new projects with tokens that can be bet on in the current LRT narrative, and the LSD project will seamlessly re-employ. Counting at most Beta benefits, projects like RSTK that have been re-staking from the beginning are more worthy of attention.

However, in the short term, due to the uncertainty of Bitcoin ETFs, the possibility of extreme market changes increases. From an investment research perspective, it is difficult to wait until the stone falls to find stability. The entry point would be a better choice.

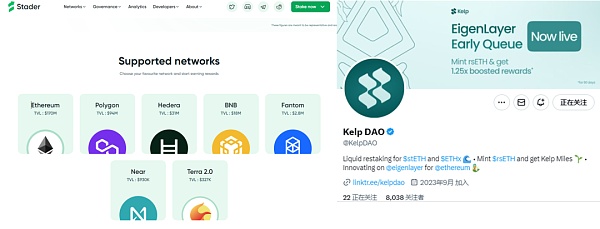

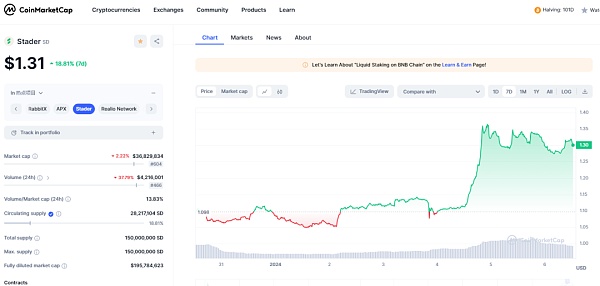

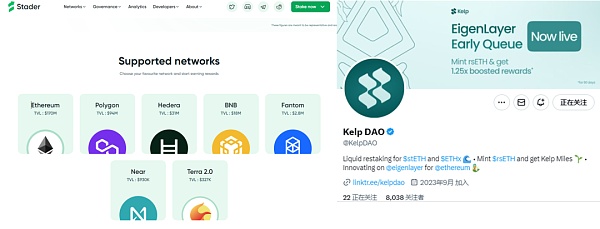

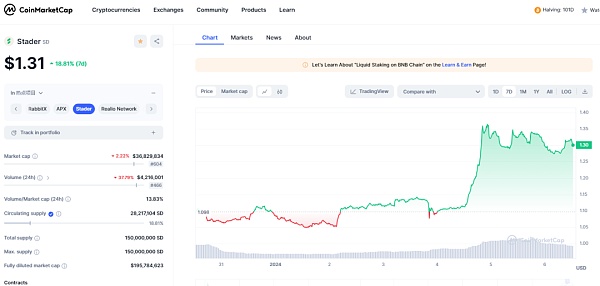

Stader Labs X KelpDAO ($SD): Support new organizations for re-staking

Stader Labs is not an old face. It emerged as early as last year in the liquidity staking narrative brought about by Shanghai’s upgrade. However, the characteristic of Stader is that it supports multi-chain staking. From its official website, you can see that it is not only Ethereum, but also supports a variety of L1 and L2 staking.

And this all-rounder can start the LRT re-pledge business very smoothly.

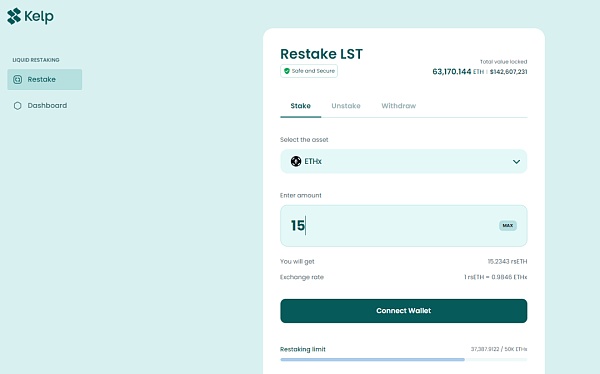

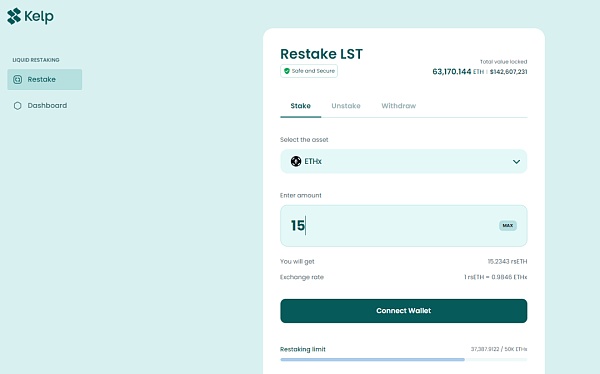

Stader also supports an organization called Kelp DAO, which focuses on liquidity re-pledge. The business model is also similar to Restake Finance:

Deposit stETH and other LST into the Kelp protocol, which can be exchanged for rsETH tokens, and then use rsETH to do more acquisitions Proceeds operations. At the same time, due to the linkage with EigenLayer, it means that users can not only obtain EigenLayer points by staking again, but also can withdraw liquidity and use LRT to earn interest, while enjoying the interest-earning income of LST.

In terms of tokens, since Kelp DAO currently has no tokens, the token SD of Stader Labs, which is associated with a public name, can become a target of attention.

SD has experienced an increase of about 20% in the past week, and its market value is close to that of RSTK, both in the range of about 35 million.

But unlike RSTK, SD is an old currency that is newly speculated. It will usher in new performance after obtaining the re-staking narrative; at the same time, considering that Kelp DAO is the only Direct business, but no token issuance. In the future, we may also look forward to the linkage effect between SD tokens and Kelp token issuance, such as airdrops.

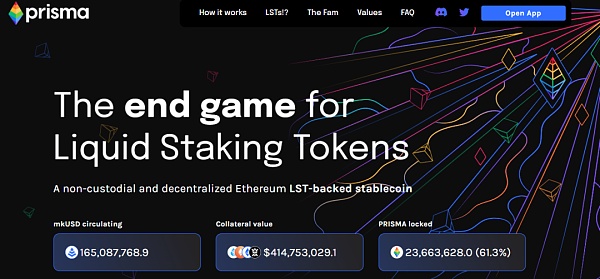

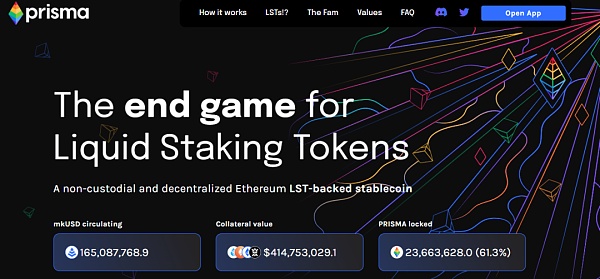

Prisma ($PRISMA): Not entirely related to LRT, another alternative to LSDFi

The above two have codes The currency projects are all articles that directly focus on liberating liquidity of EigenLayer, but in fact there is more than one way to liberate token liquidity.

There is still another idea in the market, which is not directly linked to EigenLayer but uses its own resources to release liquidity and generate income. The representative project is Prisma.

Strictly speaking, this project is not LRT, but more like LSDFi.

Prisma entered the public eye half a year ago. What attracted attention at that time was that its investment and endorsement lineup was too luxurious:

The project has been jointly endorsed by the founders of Curve Finance, Convex Finance, Swell Network and CoingeckoFinance, as well as Frax Finance, Conic Finance, Tetranode, OK Venture, Llama Airforce, GBV, Agnostic Fund , Ankr Founders, MCEG, Eric Chen and other well-known first-line project parties participated in the investment.

Although the financing amount has not been announced, it can be said that the top DeFi projects have been basically listed on the Internet.

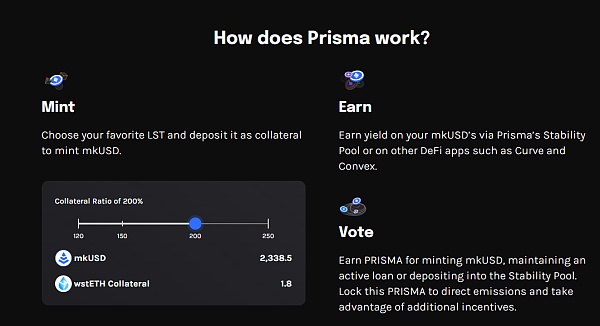

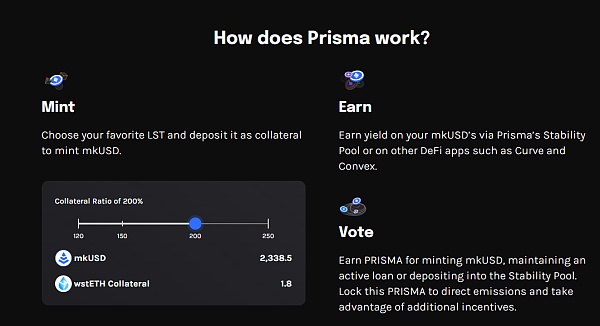

The way Prisma releases LST liquidity is:

Deposit LST into Prisma Protocol

Mint stablecoin named mkUSD

Use mkUSD to perform pledge mining, lending and other activities in different DeFi protocols to generate income and release the liquidity of LST

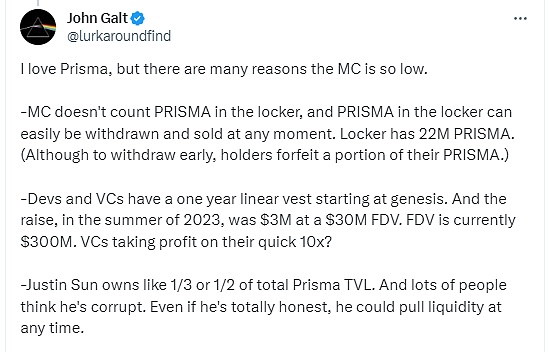

In terms of tokens, PRISMA has experienced ups and downs in the past month, with more than 1 times the amplitude between high and low points. The price is very unstable, but it has also experienced good gains in the past week.

In contrast, the market value of the token is only about 17 million, which is extremely susceptible to the impact of news, leading to rapid rise or fall.

Considering the luxurious endorsement lineup, why is the market value of the current project so low? The narrative of LSDFi has a certain appeal, but this does not completely mean that the project is underestimated. Instead, the following points need to be considered:

PRISMA's circulating market value does not take the locked tokens into account, and there are approximately 22 million PRISMA in the project that have not been calculated;

Locked tokens can be withdrawn and sold to the market at any time, which may also have an impact on prices;

According to Twitter user @lurkaroundfind, Sun Ge owns 1/3 to 1/2 of the total PRISMA TVL, which is also an unstable factor.

But unstable + small market capitalization means certain operating opportunities.

Overall, the market value of PRISMA is very small, but it endorses luxury and follows the LSDFi narrative. There will be no particularly large migration costs in subsequent transfers to LRT, and it is not ruled out that it can use the narrative The possibility of causing trouble.

It is recommended that a reasonable operation should be to configure a small position to gain profits in the band pump & dump.

Picca Network ($PICA): Liquidity Re-staking on the Road to Solana

If you feel that the liquidity surrounding Ethereum The projects in the re-hypothecation narrative are too crowded, and a feasible plan B is to find targets of the same narrative in the popular Solana ecosystem.

The target that meets this search criteria is currently Picasso Network.

The project itself aims to support multiple L1s, mainly promoting cross-ecosystem blockchain communication (IBC) between ecosystems such as Polkadot, Kusama and Cosmos, and Expand to other networks such as Ethereum and Solana.

However, the project is currently targeting the gap in the liquidity re-pledge track in the Solana ecosystem, trying to enable the Solana ecosystem to achieve re-pledge through IBC capabilities.

In terms of specific implementation, Picasso is launching a Restaking Vault plan. Excluding the technical details, you can roughly understand Picasso as an EigenLayer on Solana. The implementation method is roughly as follows:

Provides a validator for Solana through Picasso's Solana<>IBC connection;

Users can stake Solana liquidity to mSOL/jSOL/Orca LP on projects (such as Marinade/Jito/Orca/Blaze) /bSOL and other LST tokens are re-pledged into the validator;

While protecting network security , to earn re-pledge income.

A potential opportunity is that Solana’s liquidity staking rate is not as good as ETH, and data shows that there is still about 8 About % of SOL is not pledged, which is good for liquidity staking but also good for liquidity re-pledge.

Given that Solana’s liquidity staking project has experienced widespread gains before, if Ethereum’s re-staking narrative rears its ugly head, market funds may also overflow to the On the same narrative as Solana.

In terms of tokens, Picasso has experienced a nearly doubled increase in the past week, and its market value has reached about 100 million US dollars. Compared with the aforementioned several For liquidity re-pledge projects on Ethereum, the market value is relatively high; however, considering its IBC characteristics, its main business is not limited to liquidity re-pledge, so its market value cannot be completely compared with similar projects on Ethereum.

Considering that the Solana ecosystem has not performed as well as Ethereum-related projects in the past week, Picasso can be used as an alternative in the investment portfolio and cooperate with observing the flow of funds to Solana before making operations.

Potential projects without tokens

In addition to the above projects In addition, there are some projects on the LRT track that currently do not have tokens, but they are also making frequent moves to re-pledge.

Due to space reasons, only a brief list and description are provided here. Interested readers can check the project social media and official website for more information.

Puffer Finance: Lowering the validator threshold through native re-staking

EigenLayer has a 32 ETH threshold requirement for general Ethereum re-pledge nodes, and AVS can only be run if this requirement is met.

Puffer's re-pledge function is to lower this threshold to below 2 ETH in an attempt to attract small nodes.

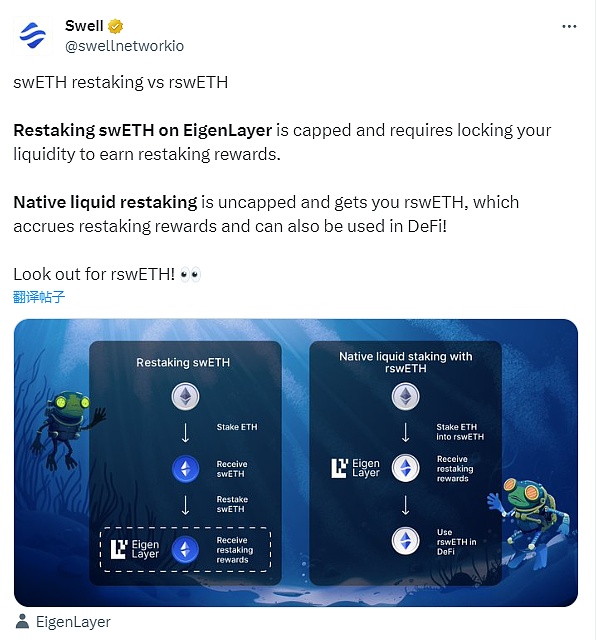

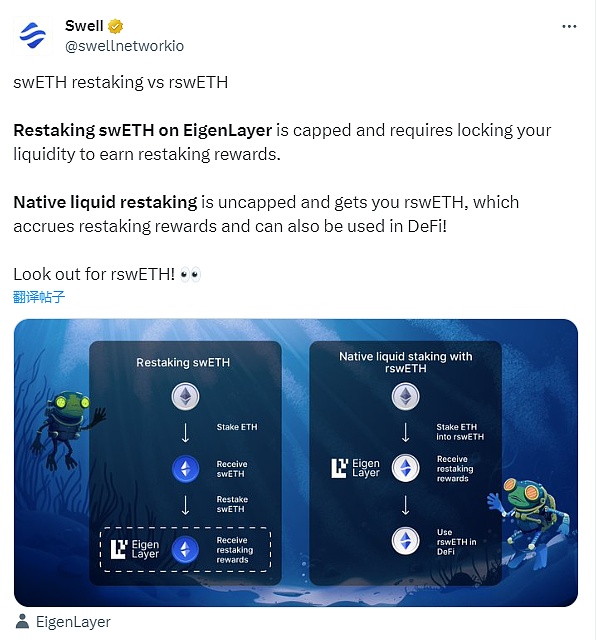

Swell: Liquidity staking and re-staking, earning points for airdrops

Swell used to do liquidity staking on Ethereum. The re-staking function was recently announced, allowing ETH to be deposited and swapped out for rswETH.

Considering that Swell has not issued coins yet, LSD could be exchanged for points before. Now participating in re-staking can also increase the chance of points.

ether.fi: Provide a seamless re-staking experience

This project is functionally similar to Swell and Puffer, and the current total pledged TVL has reached about 120 million US dollars.

In addition to the above, there are still some items not listed due to space limitations. But if LRT is hot enough, I believe that these unissued currency projects will actively market to attract users to re-stake, and it will only be a matter of time before everyone discovers it.

Summary

Finally, in the process of researching the project The author is also thinking, is the re-pledge of liquidity considered a progress?

From the perspective of Ethereum, it does further ensure the security of different projects through EigenLayer.

Butfrom a practical benefit point of view, it is more like a speculative leverage created for liquidity. Leverage means that there is still only one copy of the original asset, but through the mapping of tokens and the locking of equity, the original ETH can be used to continuously increase the leverage doll, and multiple derivatives certificates can appear.

At best, these derivatives certificates have greatly revitalized liquidity in the tailwind situation and are more conducive to market speculation;

< p style="text-align: left;">

But at worst, the various protocols that issue derivatives are connected to each other because of liquidity. Holding A can lend B, and lending B can revitalize C. Once there is a problem with the A protocol itself (hacker attack or self-inflicted evil) and the scale is large, the risks will be chained.

When the wind is blowing, the matryoshka is on the lever, but when the wind is blowing, the birds and beasts are scattered.

Ethereum has opened up an open space, and EigenLayer is like building a runway on the open space; for those who are eager for returns and have the courage to take risks, liquidity , there’s nothing better than giving them a reason to run on the track.

Liquidity never sleeps, and pleasing liquidity is the eternal narrative theme of the encryption market.

JinseFinance

JinseFinance