Author: George Kaloudis, CoinDesk; Compiler: Baishui, Golden Finance

Some people have proposed legislation to allow the US government to store large amounts of Bitcoin as a strategic reserve, starting with seized Bitcoin that the government already holds.

Many people have questions: Is it legal to keep seized Bitcoin? How does holding Bitcoin reduce the deficit? Why does the US government need to have Bitcoin reserves?

President Donald Trump attended the Bitcoin conference, and if you missed it, you will find that it was a speech that combined a campaign speech and a cryptocurrency speech.

In my opinion (like many others), the main theme of the Bitcoin conference this year was politics. This is a far cry from 2022 when the theme is open source technology.

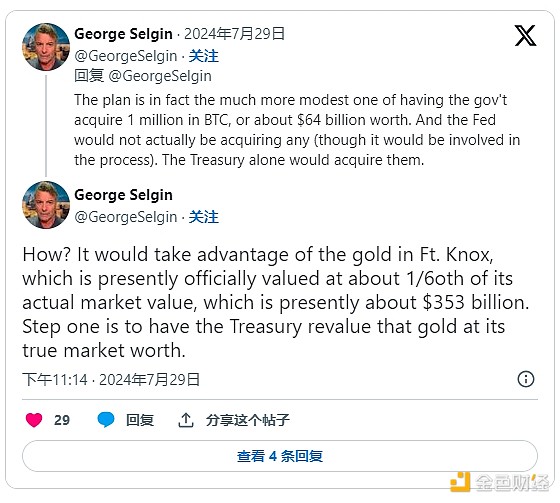

So far, it seems that the main "political" item that everyone is talking about is that the US government may soon begin to build a strategic reserve of Bitcoin. At the conference, Sen. Cynthia Loomis (R-Wyo.) announced that she was drafting a bill that would put on hold the more than 200,000 bitcoins currently held by the U.S. and keep adding to it until the country reaches 1 million bitcoins. As for those billions of dollars worth of bitcoin, the government “would have to hold it for 20 years, during which time the only thing it could be used to pay is the national debt of our nation.” According to Saturday’s speech, Trump is also getting in on the action! “So as a final part of my program today, I am announcing that if I am elected, my administration will adopt the following policies… reserve 100% of all Bitcoin currently held or acquired by the U.S. government… That will actually become the core of the National Strategic Bitcoin Reserve,” he said on stage.

“Most of the Bitcoin currently held by the government was acquired through law enforcement actions. You know. They took it from you. Let’s take that person’s life. Let’s take his family, his house, his Bitcoin. We’ll turn it into Bitcoin. It’s been taken from you because that’s where we’re going now. That’s where this country is going — to a fascist regime. So I will take steps to transform this vast wealth into a permanent national asset for the benefit of all Americans…”

That’s certainly a good thing. We all certainly have questions. Like: “How?” “What?” and “Why?”

Those questions will be clearly answered over time (hopefully). But for now, I have three questions and thoughts.

How, What, and Why

First, I have a question about the Bitcoins held by the US government. They can't just take the seized Bitcoins as they can with civil forfeiture, right? Especially since we know that about 95,000 of them belong to people who were stolen by criminals. Sure, the US government is keeping 200,000 Bitcoins, but is it really the US government's (actually, yes, since Bitcoin is a bearer asset, it's kind of like the US government's Bitcoin, there's a lesson in self-custody here)? Senator Lummis is going to go to the legislature and say, "Hey, remember all that stolen Bitcoin that we stole when we caught the bad guys? Now it's ours. We're going to keep it." I can't imagine that going to go over well. So right from the start, we have a provenance problem.

Secondly, if this bill becomes policy, the U.S. government will be holding Bitcoin, which is definitely... weird. Trump said in his speech, "The federal government owns almost 210,000 Bitcoins, 1% of the total supply, which complicates things a little bit. But our government has a long history of violating the cardinal rule that every Bitcoin holder knows by heart: Never sell your Bitcoin."

Obviously, a sentence in a speech is not the same as written law, so maybe the U.S. government will sell some of its Bitcoin. We'll see. Not to be overly negative, but Lummis' plan suggests that the U.S. government will not be able to sell its Bitcoin reserves for 20 years unless it is used to pay down the national debt. If you think the potential oversupply of sales of returned Mt. Gox coins is bad for the price of Bitcoin, imagine a million government Bitcoins (over $65 billion) that could be sold immediately to cover the national deficit. Or slowly over the course of a year. Bloodbath.

Senator Cynthia Lummis holds a copy of the Bitcoin Reserve Act (Danny Nelson/CoinDesk)

Third, and perhaps the most important point: Why? Why does the United States need a Bitcoin reserve? When I think of "U.S. government reserves," I think of the Strategic Petroleum Reserve (SPR), which is an emergency stockpile of oil maintained by the Department of Energy (DOE) and released to the market when oil becomes expensive or scarce for whatever reason. The DOE maintains the SPR for a good reason: if all the oil in the world disappeared at this moment, the entire world would collapse. Now think about it, if Bitcoin disappeared, would the entire world collapse?

I mean, yes, I'd be out of work and I'd probably lose a lot of money, but what about the entire world? I like Bitcoin, yes, but is it necessary? What's the point?

To be fair, the US government does have a large gold reserve, about 20% of the world’s gold reserves, if presidential candidate Robert F. Kennedy Jr. is to be believed, and in his Bitcoin conference speech the day before President Trump called for a 4 million Bitcoin reserve (four times the Lummis Act!) to match Bitcoin’s huge share of supply with gold. Since Bitcoin is supposed to be digital gold, what’s the difference?

The difference is that gold has been a currency longer than Bitcoin (or even the dollar), and the dollar was backed by gold at one point, so the US government must have gold. And it still holds a lot of it.

Anyway, I hope there will be more clarity, because I haven’t quite bought into this yet, and I look forward to seeing our unanswered questions answered.

In the meantime, I’ll quote the closing words of Trump’s 2024 Bitcoin conference speech: “Have fun and enjoy your Bitcoin and crypto and all the other things you’re playing with.”

We will, President Trump. We will.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance