Source: TaxDAO

As institutional investors enter the cryptocurrency market, Tether's dominance over USDT may change. Tether has long dominated the stablecoin space, thanks in large part to USDT's status as the first stablecoin backed by fiat currency.

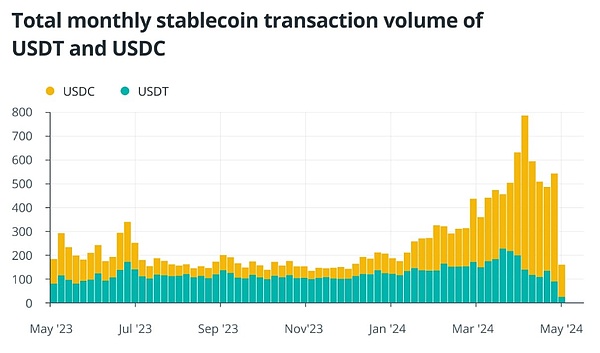

However, in the past few years, new and strong competitors have entered the stablecoin market, creating a strong impact on USDT. Since 2024, the trading volume of Circle's stablecoin USD Coin has been on an upward trend. According to data from payment giant Visa, USDC's monthly trading volume surpassed USDT for the first time in December 2023. In March 2024, USDC trading volume began to rise steadily, maintaining its dominance while USDT trading volume declined. On March 24, 2024, USDC closed the week with nearly five times the volume of USDT. On April 21, 2024, USDT's weekly trading volume continued its downward trend, shrinking to $89 billion, while USDC increased to $455 billion.

Although USDC was launched in 2018, it has occupied 20% of the total stablecoin market.

According to a report released by cryptocurrency exchange OKX in January 2024, the battle for stablecoin leadership is clearly between USDT and USDC, as they together account for 90% of the entire stablecoin market. According to on-chain data, USDC is gaining adoption among cryptocurrency institutions, which could threaten USDT’s hegemony given the important role of institutional investors. The cryptocurrency market has evolved dramatically over the years, from a market rife with scam projects during the initial coin offering (ICO) era to one that is set to attract major institutional investors following the approval of a spot Bitcoin exchange-traded fund earlier this year.

Changpeng Zhao, former CEO of Binance, posted on X on May 2 that the cryptocurrency market has matured and may have entered a "new phase" in which "compliance is extremely important."

This focus on compliance is sparking competition among companies looking to attract a new wave of investors to the cryptocurrency market - that is, compliant stablecoins will stand out.

In this regard, USDT, which has previously been reported to question the authenticity of its reserves, faces challenges. “USDT is an offshore stablecoin that lacks transparency and regulation, while USDC is under close scrutiny from U.S. authorities,” YouHodler’s head of markets Ruslan Lienkha told Cointelegraph. Tether is based in the British Virgin Islands, which is considered a tax haven for offshore banking. In contrast, USDC issuer Circle is subject to U.S. jurisdiction as it is headquartered in Boston, Massachusetts. USDC’s strategy to present itself as a fully regulated, transparent stablecoin could prompt Tether to try to reshape its public image. On April 1, Tether completed an independent audit of the “gold standard” by the American Institute of Certified Public Accountants. The upcoming regulatory frameworks in the United States and Europe may be a factor that attracts compliant users to use USDC instead of USDT. On April 17, the U.S. Congress introduced the Lummis-Gillibrand Payment Stablecoin Act. If it becomes law, it will affect all stablecoins in the U.S. market. If Tether hopes to obtain approval from U.S. authorities, it will need to change its offshore attributes to avoid missing out on one of the world's largest markets.

In the EU market, the upcoming regulatory framework for crypto asset markets will require stablecoin issuers to register as e-money issuers starting June 30.

With the regulations expected to fully take effect later this year, Circle puts EURC, a sister version of USDC pegged to the euro, in a strong position.

On March 21, 2023, Circle applied for a digital asset service provider license from the French regulator. These licenses will grant Circle the status of a registered digital asset service provider, which will "enable Circle to launch its flagship product on the European market" and "begin to become a MiCA-compliant electronic money token under the new regime." Tether has not yet applied to become an electronic money issuer in the EU.

The consolidation of USDC trading volume may be an issue that Tether should not ignore. If it becomes the norm, Tether may lose its crown as the king of stablecoins.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo Sanya

Sanya Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist