Author: Mia, ChainCatcher

With Aperture Finance intent The total transaction volume of the platform has exceeded 1.3 billion US dollars, the number of users has exceeded 150k, and news about Aperture has been frequently reported recently. Rumors of the project's currency began to leak out, attracting the attention of the crypto community.

AI and "Intent Architecture"

Aperture's vision video posted on Twitter triggered It reflects everyone's imagination of the ultimate form of Aperture products - users only need to tell the chatbot, "Help me try to receive Airdrop tokens," and the system will automatically traverse the airdrop projects on each chain based on the user's wallet address and authorization. And automatically complete the collection. This kind of automation can greatly reduce the time for users to track project updates on Twitter, eliminate the risk of users being deceived by phishing websites, and directly reduce the time of direct interaction with each project application website, etc. According to this development direction, it is estimated that it will be just around the corner to let robots directly help users with airdrops.

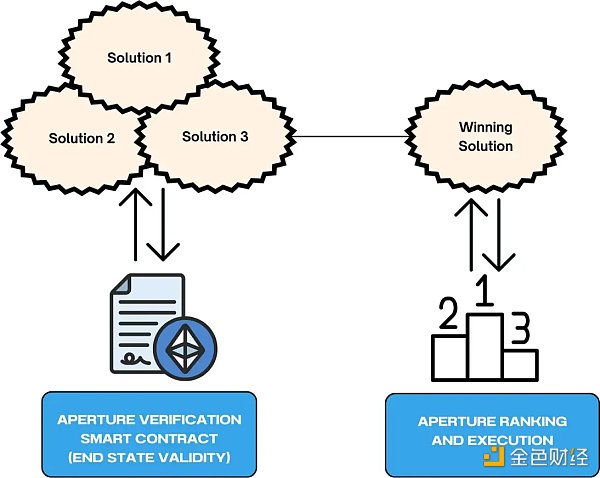

This scene is a typical direct example of the mutual empowerment of artificial intelligence (AI) and intent-based architecture (Intent-based Infra). Through direct text interaction with ChatGPT to express needs, the system automatically extracts, identifies and confirms the user's intention, submits it to the solver network, and the solver network seeks the optimal solution and path, and finally hands it to the optimal solver for execution through the bidding mode.

There are many similar scenarios, including automatically completing trading strategies through solvers, achieving position optimization, periodically capturing data for analysis, etc. . The combination of AI and intent architecture will completely subvert traditional technology architecture and user experience.

Reviewing the background of Aperture

Aperture first emerged from the industry in 2022, and its founders are With a background in Silicon Valley technology companies, there are senior programmers and product managers from Google, Netflix and AWS. His educational background includes Stanford University, Cornell University and the University of California, Berkeley.

2022 will focus on the DeFi cross-chain investment ecosystem, especially the volatility hedging strategy on Terra. A $5.3M seed and strategic round of financing was completed in February 2022, led by ParaFi Capital and Arrington Capital. Other investors include Costanoa Ventures, Divergence Ventures, Rarestone Capital and Krypital Group.

The platform gained $120M in TVL in just 3 weeks. The project provides a synthetic stock token strategy for UST deposits. The stable strategy allows users to earn more UST. However, with the collapse of the Terra algorithm stablecoin, UST has depreciated hugely. During the same period, Mirror Protocol was also attacked by hackers, but Aperture won unanimous praise from investors and users for its proper and thoughtful aftermath. Aperture is also one of the few project developers to stick with the same brand after the end of Terra.

Since late 2022, with the collapse of FTX and many other events, the market has taken a turn for the worse, and many strategic projects have ended operations. Well-known projects include Friction and RoboVault. Aperture took the lead in transforming from strategy to underlying architecture and proposed "Composable Automation", which is a composable automation strategy. Shift from providing investment strategies to providing infrastructure so that users can build their own strategies. This architecture that takes user needs as the starting point and automatically finds the optimal solution based on user intentions is the predecessor of intent architecture. As of the completion of this article, Aperture is the only project on the intended track with actual products and large-scale transaction volume.

The background of the intention track

In June 2023, the investment institution Paradigm issued an article "Intention "Intent-Based Architectures and Their Risks" (Intent-Based Architectures and Their Risks) proposes a development architecture that defines structure rather than process, kicking off the intent architecture. As the concept of intention continues to ferment in the market, Binance Research Institute issued an article "Demystifying the Intent-Centric Thesis" and included Aperture as a member of the intention ecosystem.

On the intent track, the concept of "intent layer" has been discussed more recently. Its core concept is to introduce a user-friendly interface, such as Mobile wallets, as intermediaries that interact with DeFi, lower the threshold for DeFi operations. At this level, "intent" is no longer limited to the user's direct interaction with the DeFi platform, but is an off-chain signed message that represents the state transition and specifically encoded results that the user hopes to achieve. This design pattern improves user experience and execution quality, users only need to approve their desired results, and complex operations are handled by the parser. At the same time, it improves efficiency, and multiple intentions can offset each other or generate economic benefits, improving overall efficiency. Additionally, the flexibility of off-chain computation helps improve efficiency because it is not affected by the limitations of on-chain computation. This intent-based design pattern brings multiple advantages to DeFi, greatly improving user experience and execution quality, and increasing overall efficiency.

The main concept projects of the intention track include Anoma Network, Particle Network, CowSwap and Essential. Aperture's innovation in the "intention layer" is to propose a human natural language interaction method through the ChatGPT channel.

Solver network and sub-products

It is reported that the current self-built intention architecture of Aperture Fiance It has begun to take shape, and developers can interact directly with the platform through APIs. We are still waiting for the specific launch time of the ChatGPT interactive experience.

Aperture Finance's solver categories include:

Liquidity management intent, currently in 9 EVM is compatible with on-chain deployments, including Ethereum mainnet, Arbitrum, Optimism, Polygon, Base, BNB, Avalance, Scroll and Manta. Provide condition-triggered position management based on future market conditions, including automatic management based on currency price, LP component ratio and time. For example, if the ETH price rises to $4,500 and remains at that price for 48 hours, make an adjustment to the LP position of ETH/USDC. The cumulative strategic trading volume reached 1 billion US dollars.

ApertureSwap, which is a decentralized exchange (DEX) deployed by Aperture on the Manta Pacific chain based on UniSwap V3, provides customized intentions for liquidity providers Adjust positions. Among the DEX categories in the Manta ecosystem, TVL is currently second only to QuickSwap, but its transaction volume is the highest in the entire chain.

Temporal Intents, including limit orders with income and segmentation optimization of large trading orders, etc.

Subscription Intents, including periodic trading and position adjustment.

From the information shared by Aperture, the project side will divide the solvers in the network into several levels based on security, solving efficiency and tariffs. Different logics are used to implement competition and result selection. In addition to continuing to expand its solver network, Aperture has also seen partnerships with other large solver development teams, such as Propeller Heads and Enso Finance, to accelerate expansion.

Token model

According to Aperture’s token economics, Aperture's tokens will have three major functions:

The tokens will play a core role in the solver network. As the solver network is liberalized, more third-party solvers will join. At this time, Aperture will require third-party developers to pledge Aperture project tokens to achieve an accountability mechanism, that is, for those who cannot complete the solution or have malicious behavior. Behavioral solver that does slash penalties for staked tokens. For solvers that have consistently performed well, there will be token incentives.

Tokens are used to offset platform handling fees. As an intention platform, Aperture's current total transaction volume has exceeded $1.5B. According to official news, there will be charging plans in the future, so tokens as a fee deduction will be another core use.

For governance. Through staking, users can submit proposals and make decisions on the platform's various rates, partner funds, and the use of DAO funds.

In addition, Aperture recently released the details of the Airdrop event, and we look forward to more detailed information in the future. The intention track is still heating up. Aperture introduced ChatGPT as an interactive method, and AI narrative has added new highlights. The project team may have further currency issuance arrangements and publicity activities for Airdrop in the near future, we will wait and see!

JinseFinance

JinseFinance

JinseFinance

JinseFinance Brian

Brian Cheng Yuan

Cheng Yuan Others

Others Others

Others Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph