Author: David Liang, coindesk Translation: Shan Oppa, Golden Finance

Expectations that U.S. regulators may approve a spot Bitcoin ETF next year are driving Bitcoin prices higher. According to Path Crypto’s David Liang, we may see a slowdown in Bitcoin prices as we approach the halving in April 2024.

Optimism about the approval of a spot Bitcoin ETF application has triggered a nearly 49% rise in BTC prices since October. For logistical and consistency reasons, the SEC may approve or deny multiple applications at the same time. (Unless otherwise noted, numbers quoted are as of December 18.)

Spot BTC trading is concentrated on a few exchanges: Coinbase, Binance, Bybit and OKX. They account for approximately 65% of spot BTC transactions. Binance accounts for 35.5%, Bybit, OKX and Coinbase account for 11.3%, 9.2% and 8.9% respectively.

The average BTC order size has been declining since the beginning of 2021 and is around $1,652. While smaller order sizes are relevant to retail clients, many, if not most, institutions break trading orders into smaller orders to minimize slippage. It would be unwise to assume that retail customers are primarily responsible for BTC’s recent trading patterns based on order size analysis alone.

Coinbase's trading summary for the third quarter of 2023 shows that three of the past four quarter-on-quarter metrics have seen volume declines. Trading volumes for retail and institutional traders fell at similar rates last year, with retail and institutional clients trading approximately $4.2 billion and $24.7 billion, respectively, in the third quarter.

Bitcoin futures market

Bitcoin futures market

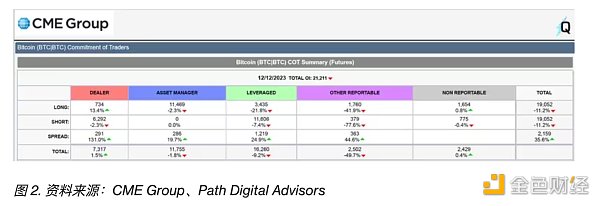

CME Group’s BTC futures open interest reached US$4.55 billion, accounting for approximately 25% of all BTC open interest. The current level of open interest reaches its highest level since the second quarter of 2022.

p>

The majority of CME BTC futures positions are held by asset managers and leveraged funds, with the former exhibiting a bullish bias and the latter exhibiting a bearish bias. This seems intuitive, as asset managers tend to take longer time frames to invest than other buy-side clients. In contrast, hedge funds and commodity trading advisors (CTAs) tend to trade on shorter time frames and perform basis trades and hedging.

Institutional investors have become more active in the cryptocurrency space. CME Group noted that “average large Bitcoin open interest holders, with at least 25 contracts, hit an all-time high during the week of November 7, 2023.”

The funding rate aligns the perpetual futures price with the spot price. When the funding rate is positive, investors holding long contracts pay funding fees to investors holding short contracts, and vice versa. Funding rates are trending upward alongside BTC spot prices, indicating bullish sentiment and bias.

Bitcoin Outlook

Recently, the historical relationship between BTC price and consumer interest has decoupled. If consumer interest is driven entirely by retail customers, then it appears to be one of two things:

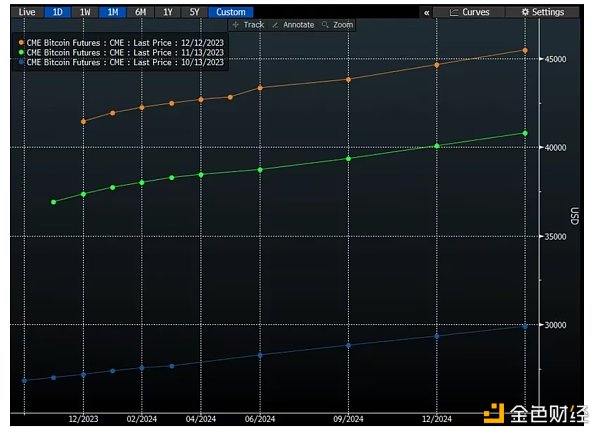

Sentiment among institutional investors appears to be positive. A parallel upward shift in the futures curve for each month of Q4 2023 indicates bullish activity and a long bias among institutional investors.

The ETF approval is already fully priced into Bitcoin prices, so the positive momentum from the announcement may be offset by traders unwinding their positions. This suggests that reversion to the mean may occur in the days following the announcement. Thereafter, the market may recalibrate its focus on the halving in April.

< span style="font-size: 14px;">Figure 3. Source: Bloomberg, Path Digital Advisors LLC

< span style="font-size: 14px;">Figure 3. Source: Bloomberg, Path Digital Advisors LLC

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance