从以太坊交易生命周期观察订单流创新

JinseFinance

JinseFinance

Compiled by: Liu Jiaolian

Although this year is 2024, BTC ETFs have landed in the US stock market and our Hong Kong stock market, there are still some people who are late to the party and have insufficient cognitive level, and they talk about the fallacy that Bitcoin is a Ponzi scheme. Therefore, Jiaolian compiled the long article "Why Bitcoin is not a Ponzi scheme: point by point analysis" written by American investor Lyn Alden on January 11, 2021 as follows, which complements the above article on June 8, 2021 of Jiaolian, and hopes to help readers who are new to this industry.

Article | Lyn Alden. Why Bitcoin is Not a Ponzi Scheme: Point by Point. 2021.1.11

One of the concerns I have seen about Bitcoin is that it is a Ponzi scheme. The argument goes that because the Bitcoin network continues to rely on new buyers, eventually, as new buyers run out, the price of Bitcoin will collapse.

Therefore, this article takes a hard look at this concern by comparing Bitcoin to systems with Ponzi-like characteristics to see if this argument has merit.

In short, Bitcoin does not meet the definition of a Ponzi scheme, either narrowly or broadly.

To begin the discussion of whether Bitcoin is a Ponzi scheme, we need a definition.

Here is the definition of a Ponzi scheme by the U.S. Securities and Exchange Commission (SEC)[1]:

“A Ponzi scheme is an investment scam in which new investors’ funds are used to pay existing investors. Ponzi scheme organizers typically promise to invest your money in return for high returns with little risk. But in many Ponzi schemes, the scammers do not invest the money. Instead, they use the money to pay earlier investors and may keep some for themselves.

With little legitimate income, Ponzi schemes require a constant flow of new funds to survive. These schemes collapse when it becomes difficult to recruit new investors or when a large number of existing investors cash out.

The Ponzi scheme is named after Charles Ponzi, who in the 1920s They further list "red flags" to watch out for: "Many Ponzi schemes share common characteristics. Watch for these warning signs: High returns with little or no risk. Every investment carries some degree of risk, and investments with higher returns are generally riskier. Be extremely skeptical of any "guaranteed" investment opportunity. Returns that are too consistent. Investments tend to rise and fall over time. Be skeptical of investments that regularly generate positive returns regardless of overall market conditions. left;">Unregistered investments. Ponzi schemes often involve investments that are not registered with the SEC or state regulators. Registration is important because it gives investors access to a company's management, products, services, and financial information.

Unlicensed sellers. Federal and state securities laws require investment professionals and firms to be licensed or registered. Most Ponzi schemes involve unlicensed individuals or unregistered firms.

Secretive, complex strategies. Avoid investing if you don't understand it or don't have access to complete information about it.

Paperwork problems. Errors in account statements may be a sign that funds were not invested as promised.

Difficulty withdrawing funds. If you don’t receive a payment or have difficulty withdrawing it, be suspicious. Ponzi scheme promoters sometimes try to prevent participants from cashing out by offering higher returns to keep participants in place. ”

I think this is a good set of information. Let’s see how many properties (if any) Bitcoin has. ---

[1] https://www.investor.gov/protect-your-investments/fraud/types-fraud/ponzi-scheme

Bitcoin’s Launch

Before comparing Bitcoin to the above list point by point, let’s first review how Bitcoin was launched.

In August 2008, a person who called himself Satoshi Nakamoto created Bitcoin.org.

Two months later, in October 2008, Nakamoto released the Bitcoin white paper. This document explains how the Bitcoin technology works, including a solution to the double-spending problem. As you can see from the link, the white paper is written in the format and style of an academic research paper, as it proposes a major technical breakthrough that provides a solution to a well-known computer science problem related to digital scarcity. There are no promises of getting rich or rewards in the text.

Three months later, in January 2009, Nakamoto released the original Bitcoin software. In the blockchain's custom genesis block, he included a timestamped headline from a Times of London article about bank bailouts, probably to prove that there was no pre-mining and to set the tone for the project.

From there, he worked six days to mine Block 1, which contained the first 50 spendable Bitcoins, and released the Bitcoin source code that day, January 9. On January 10, Hal Finney publicly tweeted that he was also running the Bitcoin software, and from the beginning, Satoshi had been testing the system by sending Bitcoins to Hal.

Interestingly, since Satoshi showed how to do this in the white paper more than two months before he launched the open source Bitcoin software himself, it is technically possible that someone could have used the newfound knowledge to launch a version before him.

This seems unlikely because Satoshi was the first mover and had a deep understanding and awareness of it all, but it is technically possible. Before launching the first version of the project, he leaked key technical breakthroughs. In between the publication of the white paper and the release of the software, he answered various questions. He explained his choice of the white paper to several other cryptographers on the email list and responded to their criticisms, almost like an academic paper defense. If they were not so skeptical, several of these technicians might have "stole" the project from him.

After its launch, a set of equipment widely believed to belong to Satoshi Nakamoto was a major miner of Bitcoin for the first year. Mining is necessary to continuously verify transactions for the network, and Bitcoin was not quoted in US dollars at the time. Over time, he gradually reduced the amount of mining as mining became more decentralized across the network. Nearly 1 million Bitcoins are believed to belong to Satoshi Nakamoto, which he mined in the early days of Bitcoin and never moved from the initial address. He could have cashed out at any time and made billions of dollars in profits, but now, more than a decade after the Bitcoin project was born, he has not done so. We don't know if he is still alive, but most of his coins have not been moved, except for some early coins used to test transactions.

Soon after, he transferred ownership of his website domain to others, and since then, Bitcoin has been self-sustaining in a circularly evolving community with no input from Satoshi Nakamoto.

Bitcoin is open source and distributed around the world. The blockchain is public, transparent, verifiable, auditable, and analyzable. Businesses can analyze the entire blockchain to see which bitcoins move or stay at different addresses. An open source full node can be run on a basic home computer. It can audit the entire money supply of Bitcoin and other indicators.

With these, we can compare Bitcoin with the red flags of Ponzi schemes.

Satoshi never promised any return on investment, let alone a high return on investment or a stable return on investment. In fact, it is well known that Bitcoin was a highly volatile speculation in its first decade after its birth. For the first year and a half, there were no quotes for Bitcoin, and after that, its price fluctuated greatly.

Satoshi's online posts still exist, and he almost never talked about financial gains. He mainly wrote about technical aspects, freedom, problems with the modern banking system, etc. Satoshi wrote mostly like a programmer, occasionally like an economist, and never like a salesman.

We have to search deep to find examples of him discussing the potential value of Bitcoin. When he talks about the potential value or price of Bitcoin, he talks very matter-of-factly about how to classify Bitcoin, whether it is inflationary or deflationary, and acknowledges that the outcome of this project is highly variable.

Looking for what Satoshi said about the value of Bitcoin, I found the following:

"Producing new coins means that the money supply is increasing on schedule, but this does not necessarily lead to inflation. If the money supply increases at the same rate as the number of people using it, the price will remain stable. If the money supply does not increase as fast as the demand for it, there will be deflation, and early holders of the currency will see the value of the currency increase."

---

"It makes sense to buy some just in case. If enough people have the same idea, it will become a self-fulfilling prophecy. If you can pay a few cents to a website as effortlessly as inserting coins in a vending machine, its use will be very widespread."

---

" "In that sense, it's more like a precious metal. Instead of the supply changing to keep the value constant, the supply is predetermined and the value changes accordingly. As the number of users increases, the value of each coin also increases. It has the potential to form a positive feedback loop; as more users, the value also rises, which may attract more users to take advantage of the increasing value. "

---

」

---

「I am sure that in 20 years, there will either be very large trading volume or no trading volume.」

---

「Bitcoin has no dividends or possible future dividends, so it is not like a stock. It is more like a collectible or a commodity.」

—— Satoshi Nakamoto Quotes

Promises of unusually high or sustained returns on investment are common red flags for Ponzi schemes, and Satoshi Nakamoto's original Bitcoin made no such promises.

Over time, Bitcoin investors have often predicted extremely high prices (and so far, these predictions have been correct). Despite this, the project itself did not have these attributes from the beginning.

Most Ponzi schemes rely on confidentiality. If investors knew that the investments they owned were actually Ponzi schemes, they would try to withdraw their funds immediately. The market cannot properly price the investment until the secret is discovered.

For example, investors in Bernie Madoff’s scheme thought they owned various assets. In reality, the funds that flowed out of early investors were simply repaid from the funds that flowed in from new investors, rather than making money from actual investments. The investments listed on their statements were all fake, and it was almost impossible for any of these customers to verify that the investments were fake.

Bitcoin works on the exact opposite principle. Bitcoin is a distributed open source software that requires majority consensus to change, and every line of code is known and cannot be changed by any central authority. A key principle of Bitcoin is verification rather than trust. The software to run a full node can be downloaded and run for free on an average PC, and can audit the entire blockchain and the entire money supply. It does not rely on any website, key data center, or corporate structure.

So there are no "paperwork issues" or "difficulties in withdrawing funds," which are associated with red flags of Ponzi schemes from the SEC. The whole point of Bitcoin is that it does not rely on any third party; it is immutable and self-verifiable. Bitcoin can only be transferred through a private key associated with a specific address, and if you use a private key to transfer Bitcoin, no one can stop you from doing so.

Of course, there are some bad actors in the surrounding ecosystem. People who rely on others to keep their private keys (rather than keeping them themselves) sometimes lose Bitcoin due to improper custody, but this is not due to a malfunction of the core Bitcoin software. Third-party exchanges can be fraudulent or hacked. Phishing schemes or other frauds can trick people into giving away private keys or account information. But these have nothing to do with Bitcoin itself, and when people use Bitcoin, they must make sure they understand how the system works to avoid falling for scams in the ecosystem.

As mentioned earlier, Satoshi mined almost all of his coins when the software was made public, and anyone else could mine them. He did not give himself any unique advantage to acquire coins faster or more efficiently than others, but instead had to expend computing power and electricity to acquire coins, which in the early days was essential to keep the network functioning. As mentioned earlier, the white paper was released before the launch, which would be unusual or risky if the goal was primarily personal monetary gain.

In stark contrast to Bitcoin's unusually public and fair launch, many later cryptocurrencies did not follow the same principles. Specifically, many later coins had a bunch of pre-mines, meaning that the developers gave tokens to themselves and their investors before the project was made public.

Ethereum's developers gave 72 million tokens to themselves and investors before it was open to the public, which is more than half of Ethereum's current token supply. It was a crowd-sourced project.

Ripple Labs pre-mined 100 billion XRP tokens, most of which are owned by Ripple Labs, and gradually began selling the remaining tokens to the public while still holding onto the majority of them, and is currently being charged by the SEC with selling unregistered securities.

In addition to these two tokens, there are countless other smaller tokens that have been pre-mined and sold to the public.

In some cases, a case can be made in favor of pre-mining, although some are very critical of the practice. Just as startups offer equity to their founders and early investors, new protocols can offer tokens to their founders and early investors, and crowdfunding is a widely accepted practice. I will leave that debate to others. Few would dispute that early developers can be paid if their projects are successful, and that funding is helpful for early development. As long as there is full transparency, it is up to the market to decide what price is fair.

However, Bitcoin is far ahead of most other digital assets when it comes to disproving the idea of a Ponzi scheme. Satoshi showed the world how to do it months in advance with a white paper, then released the project as open source on the first day of spendable token generation, with no premine.

The founder gave himself almost no mining advantage over other early adopters, which is undoubtedly the "cleanest" approach. Satoshi had to mine the first coins with his computer like everyone else, and then spent none of them except to send some of his initial batches out for early testing. This approach raises the possibility of becoming a viral phenomenon based on economic or philosophical principles rather than strictly wealth-based.

Unlike many other blockchains over the years, Bitcoin's development has been spontaneous, driven by a rotating group of large stakeholders and voluntary user donations, rather than through a pre-mined or pre-funded pool of funds.

On the other hand, giving most of the initial tokens to yourself and the initial investors, and then letting later investors mine or buy from scratch, opens more avenues for criticism and skepticism and starts to look more like a Ponzi scheme, whether or not it really is.

One of the really interesting things about Bitcoin is that it is a large digital asset that has thrived without centralized leadership. Satoshi Nakamoto created Bitcoin as an anonymous inventor, worked with others, and continued to develop it in public forums for the first two years, then disappeared. Since then, other developers have taken on the mantle of continuing to develop and promote Bitcoin.

Some of the developers are very important, but none of them are indispensable to the continued development or operation of Bitcoin. In fact, even the second round of developers after Satoshi Nakamoto have mostly moved on to other directions. Hal Finney died in 2014. Some other ultra-early Bitcoin users are more interested in Bitcoin Cash or other projects at different stages.

As Bitcoin has continued to evolve, it has taken on a life of its own. The distributed development community and user base (and the market, when it comes to pricing various paths after hard forks) have determined what Bitcoin is and what it is useful for. Over time, the narrative has changed and expanded, with market forces rewarding or punishing in various directions.

For years, the debate has centered on whether Bitcoin should be optimized for value storage or frequent transactions at the base layer, which has led to multiple hard forks that have all devalued Bitcoin compared to it. The market clearly prefers Bitcoin's base layer to optimize its value storage and wide transaction settlement network, optimize its security and decentralization, and allow frequent small transactions to be processed on the second layer.

All other blockchain-based tokens, including hard forks and tokens associated with entirely new blockchain designs, have followed in the footsteps of Bitcoin, the industry's most autonomous project. Most token projects are still led by the founders, often with a large pre-mine, and unclear future prospects if the founders are no longer involved. Some of the shadiest tokens have paid to be listed on exchanges in an attempt to kick-start a network effect. Bitcoin, by contrast, has always had the most natural growth curve.

The only item on the red flag list that might apply to Bitcoin is when it involves unregulated investments. This doesn’t mean something is a Ponzi scheme; it just means there are red flags and investors should proceed with caution. Especially in Bitcoin’s early days, buying some magical internet money is a high-risk investment for most people.

Bitcoin was designed to be permissionless, operate outside the established financial system, and philosophically lean toward libertarian crypto culture and sound money. For most of its life, it had a steeper learning curve than traditional investments because it relied on the intersection of software, economics, and culture.

Some SEC officials have said that Bitcoin and Ethereum are not securities (which, logically, means they haven’t committed securities fraud). However, many other cryptocurrencies or digital assets are classified as securities, and some, like Ripple Labs, have been accused of selling unregistered securities. The IRS treats Bitcoin and many other digital assets as commodities for tax purposes.

So, in the early days, Bitcoin may indeed have been an unregistered investment, but currently, it has a place in tax laws and regulatory frameworks around the world. Regulation will change over time, but this asset has become mainstream. It is so mainstream that Fidelity and other custodians hold it for institutional clients, and J.P. Morgan has set a price target for it.

Many people who have not studied the industry in depth lump all "cryptocurrencies" into one category. However, it is important for potential investors to study the details and find important differences.

Putting "cryptocurrencies" into one category is like putting "stocks" into one category. Bitcoin is clearly different from other currencies in many properties, and the way it was launched and sustained looks more like a movement or a protocol than an investment, but over time it has become one.

From there, one can examine the thousands of other tokens that have emerged since Bitcoin and draw their own conclusions. They range from well-intentioned projects to outright scams. However, it is important to realize that even if real innovation is happening somewhere, it does not mean that the token associated with that project will necessarily have lasting value. If a token solves some new problem, its solution may eventually be repurposed as a layer of a larger protocol with greater network effects. Likewise, any investment in other tokens has an opportunity cost, which is the ability to buy more Bitcoin.

Bitcoin was launched in the fairest way possible.

Satoshi first showed others how to do this in an academic sense with a white paper, then did it himself a few months later, and anyone could start mining with him within the first few days, as some early adopters did. Satoshi then distributed the development of the software to others, and then disappeared, rather than continue to promote it as a charismatic leader, and has never cashed out to date.

From the beginning, Bitcoin has been an open source and fully transparent project with the most organic growth trajectory in the industry. The market has publicly priced it based on existing information.

Because the narrow definition of a Ponzi scheme obviously does not apply to Bitcoin, some people use a broader definition of a Ponzi scheme to assert that Bitcoin is a Ponzi scheme.

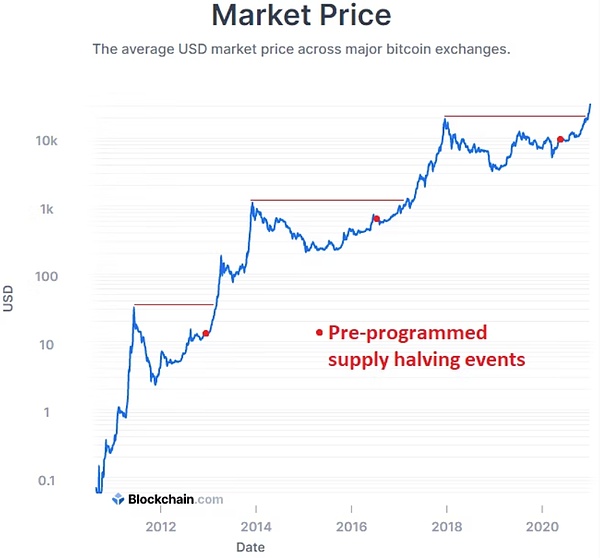

Bitcoin is like a commodity, a scarce digital "item" that does not provide cash flow, but has utility. They are limited to 21 million divisible units, of which over 18.5 million have already been mined on a pre-set schedule. Every four years, the number of new Bitcoins produced per ten-minute block will halve, and the total number of Bitcoins in existence will asymptotically approach 21 million.

Like any commodity, it does not generate cash flows or dividends, and its value is determined solely by someone else’s willingness to pay you or trade with you. Specifically, it is a monetary commodity whose utility lies entirely in storing and transmitting value. This makes gold the closest comparable.

Some people assert that Bitcoin is a Ponzi scheme because it relies on more and more investors entering the space, buying from early investors.

To some extent, this reliance on new investors is correct; Bitcoin’s network effects continue to grow, reaching more people and larger pools of capital, thereby continually increasing its utility and value.

Bitcoin can only be successful in the long term if its market cap reaches and remains at very high levels, in part because its security (hash rate) is tied to its price. If for some reason demand for Bitcoin permanently flattens and declines without reaching sufficiently high levels, Bitcoin will remain a niche asset. Its value, security, and network effects may deteriorate over time. This could set off a vicious cycle that attracts fewer developers to continue building its second layer and surrounding software and hardware ecosystem, potentially leading to quality stagnation, price stagnation, and security stagnation.

However, this does not mean it is a Ponzi scheme, because gold is a 5,000-year-old Ponzi scheme by similar logic. The vast majority of gold's uses are not for industry, but for storing and displaying wealth. It does not generate cash flow and is only worth what someone else pays for it. If people's jewelry tastes change, if people no longer view gold as the best store of value, its network effects may weaken.

It is estimated that the annual production of gold around the world is enough to meet all needs for more than 60 years. If jewelry and value preservation are excluded, this is equivalent to 500 years of industrial supply. Therefore, the balance of supply and demand for gold requires that people continue to see gold as an attractive way to store and display wealth, which is somewhat subjective. Based on industrial demand, gold is in excess supply and the price will be much lower.

However, the reason why gold's monetary network effect has remained strong for so long is that it has a unique set of properties that have made it continue to be considered the best choice for long-term wealth preservation and cross-generational jewelry: it is scarce, beautiful, malleable, fungible, divisible, and virtually chemically indestructible. As fiat currencies come and go around the world, and the amount of money per unit increases rapidly, the supply of gold remains relatively scarce, growing by only about 1.5% per year.

According to industry estimates, the global above-ground gold reserves per capita are about one ounce.

Likewise, Bitcoin relies on network effects, meaning that enough people need to see it as a good asset for it to hold value. But network effects themselves are not a Ponzi scheme. Potential investors can analyze indicators of Bitcoin's network effects and determine for themselves the risk/reward of buying Bitcoin.

According to the broadest definition of a Ponzi scheme, the entire global banking system is a Ponzi scheme.

First, fiat money is in some sense an artificial commodity. The dollar itself is just a piece of paper, or represented on a digital bank ledger. The same is true for the euro, yen, and other currencies. It itself does not generate cash flow, although the institution that holds it for you may be willing to pay you a yield (or in some cases may charge you a negative yield). When we work or sell something to get dollars, we do so only because we believe that its broad network effects (including legal/governmental network effects) will ensure that we can hold these pieces of paper and give them to others in exchange for something valuable.

Second, when we organize these pieces of paper and their digital representations in a fractional reserve banking system, we add another layer of complexity. If about 20% of people try to take their money out of the bank at the same time, the banking system will collapse. Or, more realistically, the bank will deny your withdrawal because they don't have the cash. This happened to some US banks during the pandemic lockdown in early 2020, and it happens frequently around the world. This is one of the SEC's warnings about Ponzi schemes: difficulty receiving payments.

In the famous game of musical chairs, there is a set of chairs, someone plays music, and children (there are one more children than there are chairs) start walking around the chairs in a circle. When the music stops, the children scramble to sit in one of the chairs. A child who is slow to react or has bad luck does not have a seat and therefore has to leave the game.

In the next round, one chair is removed and the music continues for the remaining children. Eventually after multiple rounds, there are two kids and one seat, and then a winner is produced at the end of that round.

The banking system is a perpetual game of musical chairs. There are more kids than chairs, so they can't all get one. This becomes clear if the music stops. However, as long as the music keeps playing (with occasional bailouts by printing money), it keeps going.

Banks collect cash from depositors and use their capital to make loans and buy securities. Only a small portion of depositors' cash is available for withdrawal. Banks' assets include loans owed to them, securities such as Treasury bonds, and cash reserves. Their liabilities include money owed to depositors, as well as any other liabilities they may have, such as bonds issued to creditors.

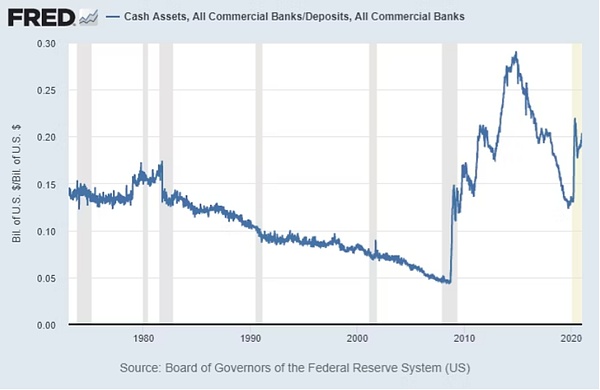

For the US, banks collectively hold about 20% of customer deposits as cash reserves:

As shown, this ratio was below 5% before the global financial crisis (which is why the crisis was so severe and marked a turning point in the long-term debt cycle), but with the implementation of quantitative easing, new regulations and more self-regulation, banks now hold about 20% of deposit balances as reserves.

Similarly, the total amount of physical cash in circulation, which is printed solely by the US Treasury, is only about 13% of total commercial bank deposits, and banks actually hold only a small portion of this as vault cash. Physical cash (by design) is far from enough for a significant number of people to withdraw funds from banks at once.

If enough people do this at the same time, people will experience "difficulty getting their money out."

The way it is currently constructed, the banking system will never end. If enough banks fail, the entire system will grind to a halt.

If a bank goes bankrupt without being bought out, in theory it must sell all of its loans and securities to other banks, convert them all into cash, and then pay out that cash to its depositors. However, if enough banks do this at the same time, the market value of the assets they sold will drop dramatically. The market will become illiquid because there won't be enough buyers.

In practice, if enough banks go bankrupt at the same time, and the market freezes up because the sellers of debt/loans overwhelm the buyers, the Fed will eventually create new dollars to buy assets to re-liquidate the market, which will dramatically increase the amount of dollars in circulation. Otherwise, everything will nominally collapse because there won't be enough units of currency in the system to support the liquidation of the banking system's assets.

Thus, the monetary system is like an ongoing game of musical chairs on a government-issued artificial commodity, where there are far more claims on the money (the children) than there are currently available (the chairs) if everyone is scrambling for it at the same time. The number of children and chairs is constantly increasing, but there are always far more children than chairs. Every time the system partially collapses, a few chairs join the round to keep the system going.

We think this is normal because we think it will never end. Fractional reserve banking has been operating globally for hundreds of years (first with gold backing, then with full fiat currency), though there have been occasional inflationary events along the way to partially reset it.

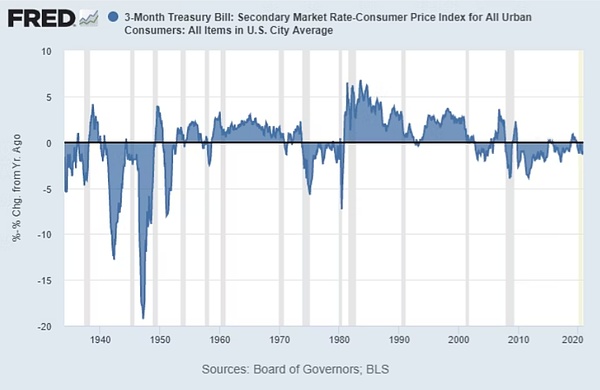

Over the past few decades, each unit of fiat currency has lost about 99% or more of its value. This means that investors either need to earn an interest rate that exceeds the actual inflation rate (which has not happened yet), or they need to buy investments, which inflates the value of stocks and real estate relative to their cash flows and drives up the prices of scarce items like art.

Over the past century, Treasury bonds and bank cash have simply kept pace with inflation, providing no real return. However, this has often been very volatile. In decades such as the 1940s, 1970s, and 2010s, holders of Treasury bonds and bank cash have consistently failed to keep pace with inflation. This chart shows nine decades of Treasury bond rates minus the official inflation rate:

Bitcoin is an emerging deflationary savings and payment technology that is primarily used in an unleveraged manner, meaning most people just buy, hold, and occasionally trade. There are some Bitcoin banks and some people on exchanges that use leverage. Still, the system's overall debt is low relative to market value, and you can self-custody your assets.

Another way to say a Ponzi scheme is that Bitcoin is a Ponzi scheme because it has friction costs. The system requires constant work to keep it going.

But Bitcoin is like any other business system in this respect. A healthy transaction network has friction costs of its own.

For Bitcoin, miners invest in custom hardware, electricity, and personnel to support Bitcoin mining, which means validating transactions and earning Bitcoin and transaction fees.

Miners take on a lot of risk and are rewarded, and they are necessary for the system to work. There are also market makers who provide liquidity between buyers and sellers or convert fiat currencies into Bitcoin, making it easier to buy and sell Bitcoin, and they will inevitably charge transaction fees.

Some institutions offer custody solutions: charging a small fee to hold Bitcoin.

Similarly, gold miners invest vast sums of money in personnel, exploration, equipment, and energy to extract gold from the ground. Companies then purify and mint it into bars and coins, protect and store it for investors, ship it to buyers, verify its purity, make it into jewelry, melt it down to purify and re-mint it, and so on.

Atoms of gold are constantly in circulation in various forms thanks to the efforts of those in the gold industry, from the finest Swiss minters to high-end jewelers to bullion dealers and “we buy gold!” pawn shops. Gold’s energy work favors creation over maintenance, but the industry also has these ongoing frictional costs.

Similarly, the global fiat currency system has frictional costs. Banks and fintechs collect more than $100 billion a year in transaction fees related to payments, acting as custodians and managers of customer assets, and providing liquidity as market makers between buyers and sellers.

For example, I recently analyzed DBS Group Holdings, the largest bank in Singapore. They generate about S$900 million in fees per quarter, which is over S$3 billion per year. In U.S. dollars, that’s over $2.5 billion in fees per year.

This is a bank with a market cap of $50 billion. There are two other banks in Singapore that are of comparable size. JPMorgan, the largest bank in the U.S., is over 7 times as large, and there are several banks in the U.S. that are about the same size. Visa and Mastercard alone have annual revenues of about $40 billion. Globally, banks and fintechs generate a combined fee of over $100 billion per year.

It takes work to verify transactions and store value, so any monetary system has friction costs. Friction costs only become a problem when transaction fees become too high as a percentage of payment value. Compared to existing monetary systems, Bitcoin’s friction costs are quite low, and layer 2 can continue to reduce fees further.

For example, Strike App aims to be the cheapest global payment network running on the Bitcoin/Lightning Network.

This extends to non-monetary goods as well. In addition to gold, wealthy investors store wealth in a variety of items that do not generate cash flow, including fine art, fine wines, classic cars, and ultra-high-end beachfront properties that they cannot rent out. For example, there are certain beaches in Florida or California that have nothing but $30 million homes and are empty at all times. I like going to those beaches because they are usually empty.

These scarce items tend to appreciate in value over time, which is why people hold them. However, they incur friction costs when you buy, sell, and maintain them. As long as those friction costs are lower than the average appreciation rate over time, they are decent investments compared to holding fiat currencies, and not Ponzi schemes.

The broadest definition of a Ponzi scheme is any system that must run continuously to remain functional or has frictional costs.

Bitcoin doesn’t actually fit this broader definition of a Ponzi scheme, any more than the gold market, the global fiat banking system, or less liquid markets like art, fine wine, collector cars, or beachfront property do. In other words, if your definition of something is so broad that it includes all non-cash flow stores of value, then you need a better definition.

All of these scarce items have some utility in addition to their store of value properties. Gold and art let you enjoy and display visual beauty. Wine lets you enjoy and display gustatory beauty. Collectible cars and beachfront homes let you enjoy and display graphical and tactile beauty. Bitcoin enables you to make payments both domestically and internationally without any direct mechanism that is blocked by a third party, thus providing users with unparalleled financial liquidity.

These scarce items maintain or increase in value over time, and investors are willing to pay a small friction cost as a percentage of their investment rather than holding fiat cash whose value depreciates over time.

Yes, Bitcoin needs to continue to operate, and must reach a sizable market cap for the network to be sustainable, but I think this is best viewed as a technological disruption that investors should price based on their perception of its probability of success or failure. This is a network effect that competes with existing network effects, especially in the global banking system. Ironically, the global banking system exhibits more characteristics of a Ponzi scheme than any other system on this list.

Any new technology goes through a period of evaluation and is either rejected or accepted. Markets may be irrational at first, either going up or down, but over time assets are evaluated and measured.

Bitcoin's price rises rapidly with the four-year supply halving cycle as its network effects continue to compound while supply remains limited.

Every investment has risks, and of course, Bitcoin's ultimate fate remains to be seen.

If the market continues to view it as a useful savings and payment settlement technology that is accessible to most people in the world and supported by a decentralized consensus around an immutable public ledger, it can continue to take market share as a wealth storage and settlement network until it reaches a mature, widely adopted, and less volatile market cap.

On the other hand, naysayers often assert that Bitcoin has no intrinsic value and that one day everyone will realize what it is and it will go to zero.

However, rather than using this argument, a more sophisticated bear thesis would be that for some reason Bitcoin will not achieve its goal of taking lasting market share from the global banking system, and cite the reasons why they hold this view.

2020 has been a story about institutional acceptance, with Bitcoin seemingly transcending the line between retail investment and institutional allocation. MicroStrategy and Square became the first public companies on major stock exchanges to allocate some or all of their reserves to Bitcoin instead of cash. MassMutual became the first major insurance company to put some of its assets into Bitcoin. Paul Tudor Jones, Stanley Druckenmiller, Bill Miller, and other well-known investors have all expressed bullishness on Bitcoin. Some institutions, such as Fidelity, have been eyeing institutional custody services for Bitcoin for years, but 2020 has seen more institutions join in, including BlackRock, the world's largest asset manager, showing strong interest.

In terms of practicality, Bitcoin allows for self-custody, money movement, and permissionless settlement. While there are other interesting blockchain projects, no other cryptocurrency offers a similar degree of security against attacks on its ledger (either in terms of hash rate or node distribution), nor does it have a sufficiently broad network effect to be consistently recognized as a store of value by the market with a high probability.

Importantly, Bitcoin's growth has been the most organic in the industry, it took the lead and spread quickly, without centralized leadership and promotion, making it more like a foundational protocol than a financial security or business project.

JinseFinance

JinseFinance JinseFinance

JinseFinanceTaiwanese artist and JPEX former spokesperson Nine Chen is being shifted from witness to defendant.

Olive

OliveChina Daily newspaper is venturing into the metaverse and NFT space with a ¥2.813 million budget for a third-party contractor.

Bitcoinworld

BitcoinworldHong Kong police has issued an advisory to the public regarding a growing threat posed by scammers masquerading as representatives of Binance and disseminating deceptive messages.

Kikyo

KikyoKwon’s attorneys will seek to reduce the 30-day detention extention period ruled by the Montenegrin authorities.

cryptopotato

cryptopotato Cointelegraph

CointelegraphAs Decentralized Autonomous Organizations (DAOs) receive more and more attention, we need to face up to the failures and problems that DAO governance encounters today. Critics of the crypto space will see this as just a giant hype bubble, while for DAO enthusiasts, this is an opportunity to improve DAO organization and build solutions.

Cointelegraph

CointelegraphMany articles from established media seem to fundamentally misunderstand what DAOs are and how they work.

Cointelegraph

CointelegraphWith the dramatic expansion of the creator economy, NFTs and Web3 are becoming tools for artists and musicians to gain more financial stability and control.

Cointelegraph

Cointelegraph