Author: Nancy Lubale, CoinTelegraph; Compiled by: Baishui, Golden Finance

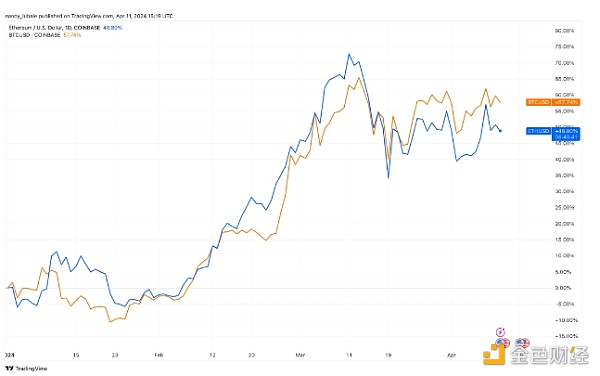

ETH has been rising since the beginning of the new year, but began to gradually fall back in mid-March. Since January, altcoins have lagged behind BTC. Year-to-date, Bitcoin's respective USD trading pairs have risen by about 48%, while BTC has risen by 57%.

Performance of Bitcoin and Ethereum from the beginning of the year to date. Source: TradingView

There are several main reasons why ETH has underperformed BTC over the past few days, including reduced network activity and declining sentiment around the Ethereum ETF spot approval in May.

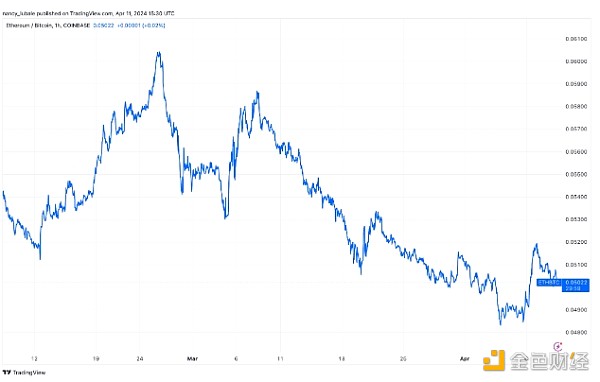

ETH Trending Lower Against BTC Over the Past 30 Days

Ethereum has fallen 13.5% over the past 30 days, underperforming Bitcoin and other Layer 1 tokens. BTC’s price has only fallen 4% over the past 30 days, while other Layer 1 tokens such as BNB Chain and Solana have risen 15.5% and 16% respectively over the same time frame.

The ETH/BTC ratio began to decline on March 8 and reached a year-to-date low of $0.047 on April 7.

Bitcoin and Ethereum's performance so far this year. Source: TradingView

There are many reasons why Ethereum has underperformed Bitcoin over the past month, including BTC prices hitting all-time highs, spot BTC ETF investments exceeding $10 billion, and Bitcoin Ordinals trading volume surging to nearly $3 billion. The upcoming Bitcoin supply halving, which historically precedes a bull run in the cryptocurrency market, is also bullish for Bitcoin prices.

Declining on-chain activity leads to Ethereum’s underperformance

Investigating Ethereum’s network activity, including its scaling solutions, can also provide insight into why Ethereum continues to underperform Bitcoin. Decentralized applications (DApps) are the core of Layer 1 blockchains, and the decline in users and numbers indicates a reduction in demand for ETH.

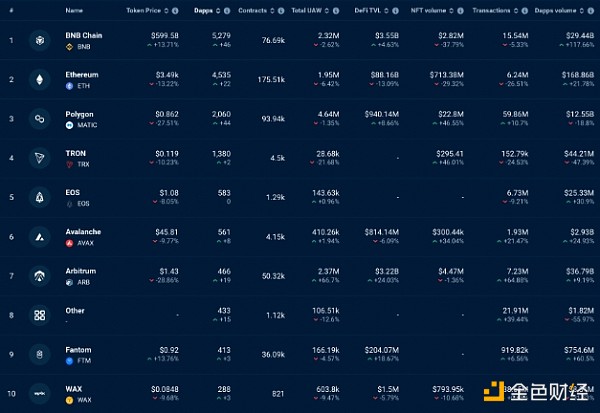

Data from Web3 data aggregator DappRadar shows that the number of active addresses for the top Ethereum decentralized applications (DApps) has decreased by an average of 6.42% over the past 30 days.

Blockchain ranking by 30-day DApp transaction volume. Source: DappRadar

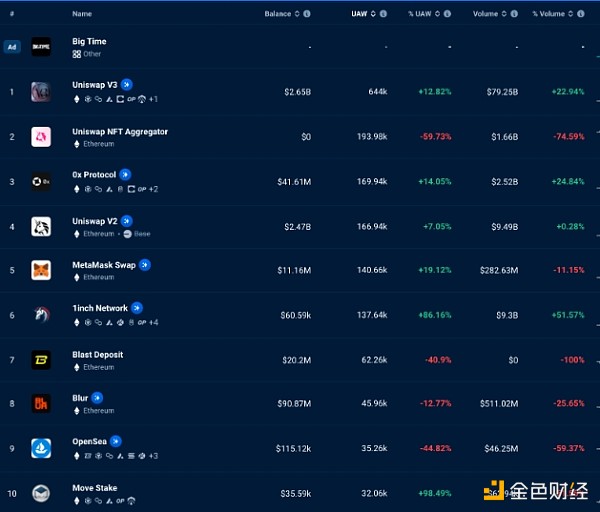

In the past 30 days, Ethereum DApp transaction volume has dropped by 26.51% due to the decrease of Uniswap, MetaMask Swap, Blur and OpenSea.

Performance of top Ethereum DApps. Source: DappRadar

Other data from Coinglass shows that Ethereum network activity (specific metrics) has declined over the past 30 days. Ethereum's daily active addresses fell from 622,963 on March 20 to 499,448 on April 10.

Number of active addresses on Ethereum. Source: Glassnode

While Ethereum remains the leader in the DeFi space, Solana has recently captured market share in the space in terms of on-chain activity driven by Memecoin mania and stablecoin transfers.

Ethereum Spot ETF May Not Be Available in May

In addition to weak on-chain metrics, the decreasing likelihood of an Ethereum exchange-traded fund (ETF) being approved in May has also added to ETH’s bearish momentum and lack of strength relative to Bitcoin.

VanEck CEO Jan van Eck is the latest to express doubts about the U.S. SEC approving a spot Ether ETF in May.

In an interview with CNBC on April 9, van Eck said he believes the multi-billion dollar investment firm’s Ethereum ETF application “will probably be rejected.” VanEck and Cathie Wood’s ARK Invest are among the first wealth management firms to apply for an Ethereum ETF in the U.S. The two firms are awaiting the SEC’s final decision on their applications, which is scheduled for May 23 and May 24, respectively.

Van Eck explained the regulatory process, stressing that the SEC typically provides comments on ETF applications and is constantly in contact with applicants. In the case of Ethereum, however, there has been a notable silence.

“The way the legal process works is that regulators give you comments on your application, and that happened for weeks before the Bitcoin ETF was launched, but now in the case of Ethereum, the odds are going down.”

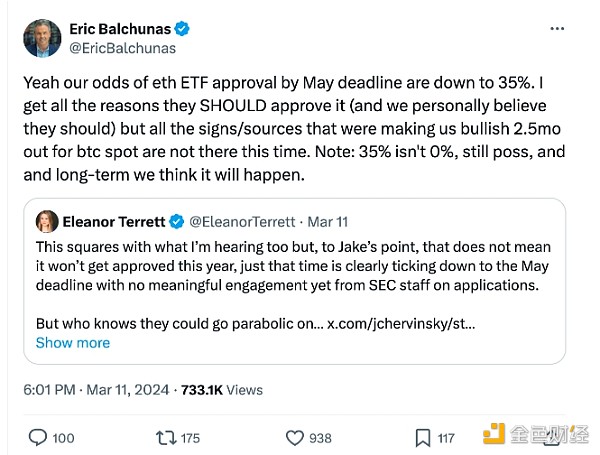

Bloomberg ETF analyst Eric Blachunas, who previously gave an Ethereum ETF a 70% chance of approval in May, has also been pessimistic, recently lowering that probability to 35%, saying the SEC’s lack of communication with issuers could be a bad sign for an Ethereum ETF.

Source: Eric Blachunas

Analyst James Seyffart also expressed concern about the SEC's inaction, questioning the lack of communication in anticipation of the filing.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance 链向资讯

链向资讯