Author: 0xXiao Wang, 0xSpring Bridge, 0xCloud Crane Source: X, @0xInv1ctus

First put the conclusion first: BITTENSER is essentially an AI memecoin. In this round of AI+crypto hype, it has become the king of AI coin market value due to its certain technical disguise. The narrative is grand and easy to spread (AI+crypto, decentralized AI), the project logic is pretentious but naive in nature, and a shell application is made to let the public see the effect, but there is no actual application value.

The entire BITTENSER project is full of waste of resources, logical loopholes, false data, and has very serious selling risks and selling pressure.

In order to avoid readers from spending too much time reading boring, long, and stinky codes and technical documents, the editor will first explain why we accuse the BITTENSER project of being full of waste of resources, logical loopholes, false data, and having very serious selling risks and selling pressure; and then use the project roadmap as a supplement. At the end, we will attach two research cases of BITTENSER subnets for readers.

In addition: When you read this article, the hedge fund to which StinkyInsect Labs belongs has already opened a short position on TAO at an average price of around 402. Let's wait and see!

StinkyInsect Labs is a non-independent subsidiary of C Labs and AllinClub. We independently operate a hedge fund with an annualized return of more than 300% and regularly publish short-selling reports. This article is our first officially released short-selling report.

Waste of resources:

Bittensor's so-called innovative solutions and its Yuma Consensus, which is constantly touted on social media, make the entire project look advanced technology, but in fact these theories and white papers are nonsense piled up with some terms and formulas.

According to it, Bittensor aims to democratize the process of building artificial intelligence-driven use cases by creating an open P2P market where people can share and use machine learning models.

Bittensor's vision is grand and abstract, but the available system it actually provides is naive, worthless, and even wasteful of resources. It can neither promote the development of AI technology at any level nor bring about the democratization of AI use.

The 32 subnets are essentially 32 competition platforms similar to Kaggle, except that the rewards are $TAO tokens. Taking the subnet 1 maintained by Opentensor as an example, what is this so-called subnet that allows better models to stand out doing? Simply put, the verifiers in the network continuously generate topics through APIs such as Wikipedia API, StackOverflow, mathgenerator, etc., and then input the topics into GPT to generate prompts, and distribute the prompts to nearly 1,000 miners in the subnet. After receiving the prompts, the miners call GPT or other LLMs to generate answers and return them to the verifiers. After getting the answers, the verifiers compare the text similarity with the pre-generated reference answers (also generated by GPT), and score the miners. The higher the similarity between the miner's answer and the reference answer, the more $TAO rewards they get.

What is the point of such a subnet? It is nothing but a waste of the computing power of OpenAI or other LLM providers, as well as the fees paid for the API. The questions are randomly called, such as a middle school math problem generated from the mathgenerator website, and the LLM is called to organize the language; the miner's answer is generated by an external LLM, and the verifier's reference answer is also generated by calling LLM, and the scoring is just a comparison of text similarity. The only value of such a system is to waste resources and entertain oneself.

Not only subnet 1, but other subnets also have serious meaninglessness problems.

Logical loopholes

According to Bittensor, the key to the competitive market it created is to ensure the fairness and objectivity of the evaluation results. To this end, Bittensor proposed the Yuma consensus mechanism, which aims to calculate the final evaluation results based on the diverse evaluations provided by many verifiers. Similar to the Byzantine Fault Tolerant consensus mechanism, as long as the majority of validators in the network are honest, the correct decision will be made in the end. Assuming that honest validators can provide objective evaluations, the evaluation results after consensus will also be fair and objective.

What role does Yuma Consensus play in the system? The answer is that it only determines how the $TAO generated by each block is distributed among the subnets. How the rewards of miners and validators in each subnet are distributed is arbitrarily determined by the subnet owner. In theory, the subnet owner can manipulate the rewards given to any subnet participant.

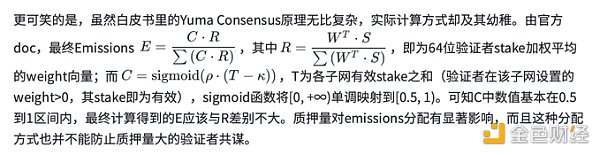

What's even more ridiculous is that although the Yuma Consensus principle in the white paper is extremely complex, the actual calculation method is extremely naive.

The innovative subnet competition mechanism claimed by Bittensor not only fails to create value, but is also full of loopholes. The official does not seem to shy away from this point. Subnet owners can submit request forms to the Opentensor Foundation every week to adjust the weight scores given to each subnet. But if the score can be manipulated through such requests, then what is the meaning of the score itself and what kind of consensus does it reflect?

For a technical interpretation of the Bittensor white paper and its claimed principles, please refer to this article: Deep Dive on Bittensor (TAO) | goodalexander. The Whitepaper section of the article points out the contradictions and illogicalities of the Bittensor white paper.

The claimed actual application cases are just empty shells:

Bittensor and its supporters continue to claim on Twitter that they have actual application cases, such as the two subnets currently ranked in the top three of Emissions, taoshi and Cortext.

Actual investigation found that Taoshi's current applications include Dale and Timeless. Dale claims to be a trading bot that can trade according to the trading signal of Taoshi subnet, but it is still under development; Timeless operates a TG group of several hundred people, which mainly discusses trading and claims that the community has made money from the trading signal of Taoshi subnet. These two shell applications cannot prove that Taoshi has any actual value.

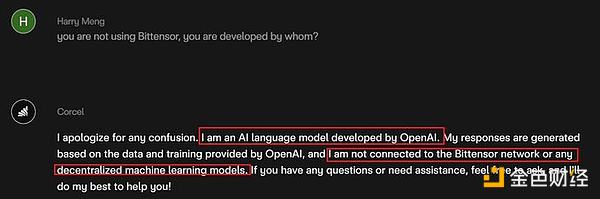

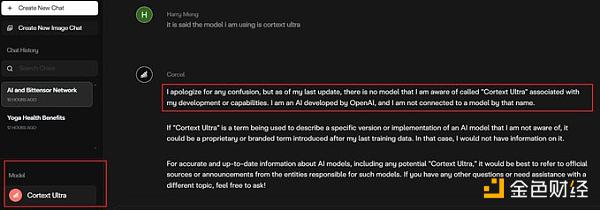

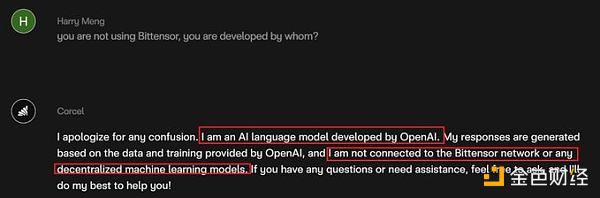

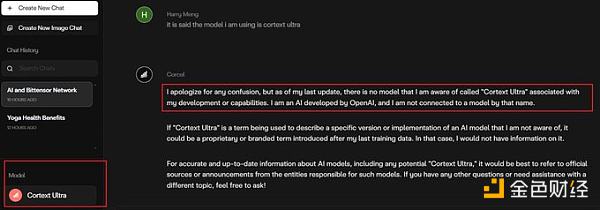

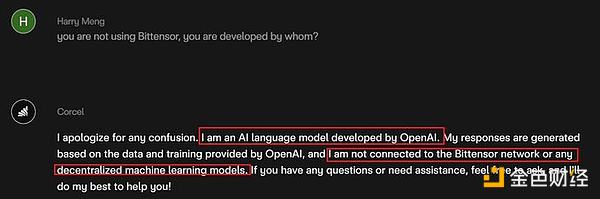

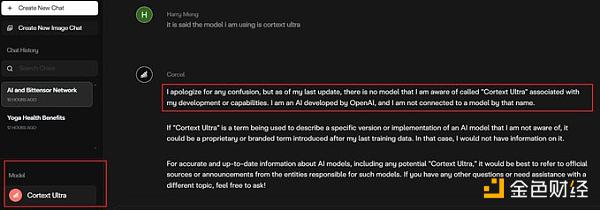

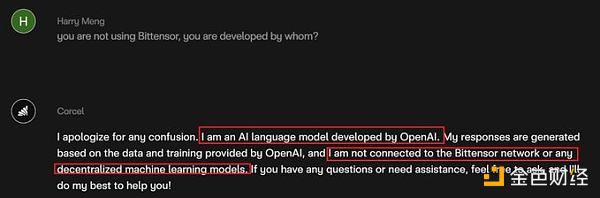

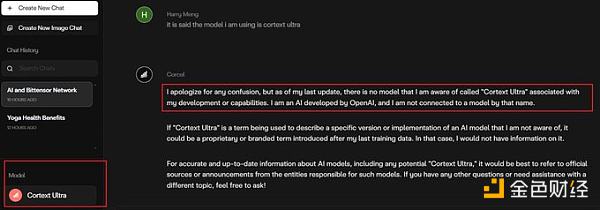

On the other side is Corcel, which is widely cited as a Bittensor application case. Corcel claims to call Cortext's API, and after users ask questions, the answers they get are generated by miners. In the actual test of text prompting, when asking who the developer of the model is, the answer obtained is "I am an AIlanguage model developed by OpenAI...I am not connected to the Bittensor network or any decentralized machine learning models". It can be seen that it is purely a shell application that directly calls the OpenAI API and has nothing to do with the answer of the miners in the subnet.

Blockchain maintenance and data authenticity are in doubt:

Currently, the weight scoring in the subnet, as well as the generation, distribution, and pledge of tokens are all recorded on the Subtensor chain. However, the consensus mechanism and node maintenance incentive mechanism of the Subtensor chain are unknown. The only on-chain data source is the taostats.io website, which claims to be maintained by @mogmachine and has nothing to do with the Opentensor Foundation. Therefore, we have reason to doubt the authenticity of the data.

The tokens are highly controlled by a small internal group, the source is unknown, and there is a risk of selling at any time:

Bittensor claims that the tokens are fair launch, but in fact, $TAO tokens have been produced since 2021. There is no document or information to explain the distribution rules and final destination of the tokens produced from January 3, 2021 to October 2, 2023 when the subnet is launched.

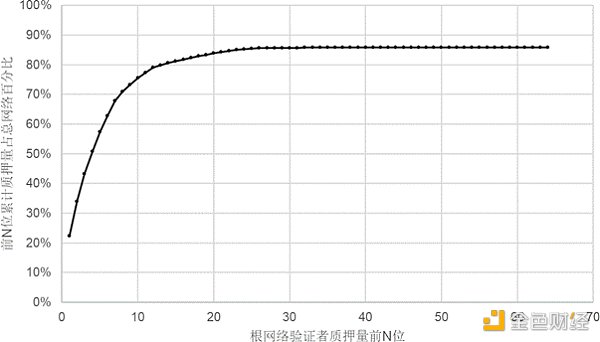

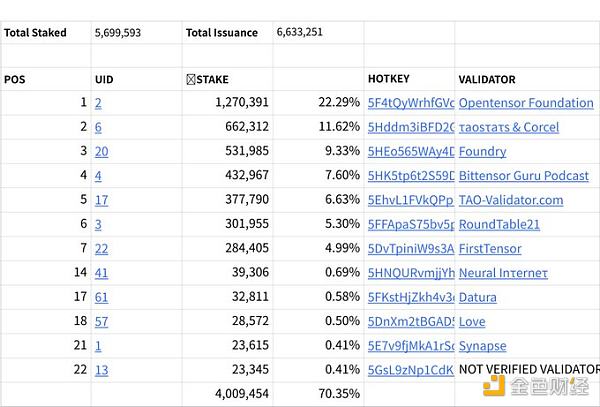

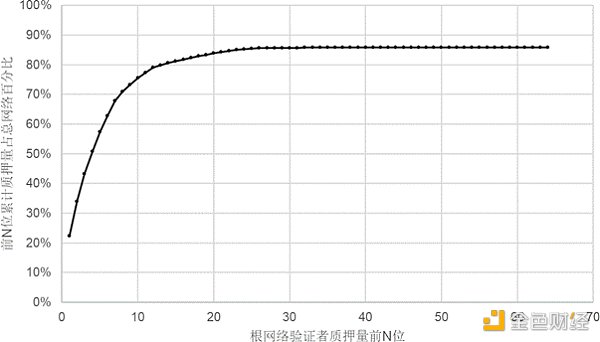

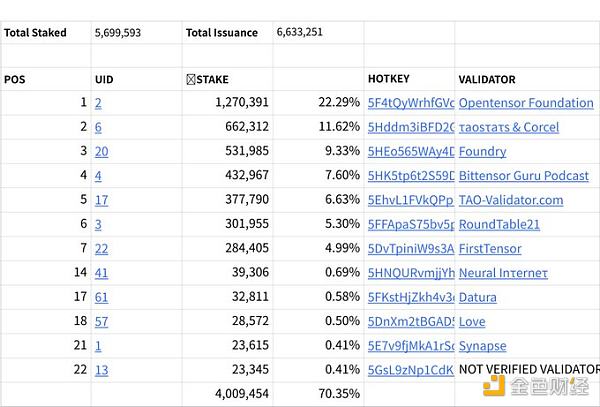

From the current results, the top 12 root network validators account for 79% of the entire network. Among the 12 members of the Senate, except for the 12th who is unnamed and the 3rd Foundry who is a well-known mining farm, the other 10 validators Opentensor Foundation, τaosτaτs &Corcel, Bittensor Guru Podcast, TAO-Validator.com, RoundTable21, FirstTensor, Neural Inτerneτ, Datura, Love, Synapse, the business and voice on Twitter are all around bittensor, or simply only the staking business. There is reason to believe that these validators who control $20B+ worth of $TAO maintain close relations and form internal small groups.

Currently, the vast majority of circulating tokens are entrusted to small groups for staking, making them the decisive validators in the network. Although each validator has thousands of addresses entrusted, it seems that thousands of $TAO token holders voluntarily delegate their tokens for voting, but there is reason to suspect that most of these anonymous addresses are controlled by small teams themselves. More importantly, there is no lock-up period for bittensor's pledge, and the pledge can be canceled at any time, which means that the pledged tokens, which currently account for 85% of the total circulation, can be sold at any time.

Summary: BITTENSER is the first big-character poster after the establishment of this organization. It richly and profoundly presents how a WEB3AI project is "successful". Controlling chips, skinning AI, false information and the enclosure of small circles have created the miracle of tens of billions of FDV and billions of MC under the promotion of VC and hot money, and successfully launched BN. It is hard not to speculate that the main purpose of launching BN is to ship.

In essence, a Polkadot subnet-mainnet model L1+miner split is not as relevant to the AI concept that everyone is chasing after as WORLDCOIN. At least WORLDCOIN has Ultraman's investment, while TAO only has Ultraman's openai API.

In this regard, this agency gives the BITTENSER project a strong bearish rating, and expects its price to drop to $100-150/piece in a short period of time (6 months).

When the time comes, the world will work together, and when the luck is gone, the hero will not be free. I hope that VCs who invest in garbage projects like TAO will think carefully about their role in the market. For a VC with sufficient background and due diligence, code review and ecological data re-verification capabilities, they should not invest in such a skinned API project.

Or, this is just one of the evils done by VCs.

Appendix:

Two subnet case studies

Taoshi (subnet 8)

Taoshi should have been called time series prediction in history, and it has no practical application value. It was rebranded as a trading platform in March, and applications such as Tradewithdale and Timeless were launched.

Subnet 8 TAOSHI operates a proprietary trading network (Proprietary Trading Network). PTN receives signals from quantitative and deep learning machine learning trading systems to provide the world's most complete trading signals across various asset classes. With this system, only the world's best traders and deep learning/quantitative based trading systems can compete.

• Miner registration, mining and scoring:

◦ The registration fee for miners is 5TAO.

◦ Miners need to submit LONG/SHORT/FLAT trading signals and leverage multiples in real time during the opening time. Optional trading pairs include foreign exchange (such as EUR/CHF, EUR/USD, GBP/USD), cryptocurrencies (such as BTC/USD, ETH/USD), indices (such as SPX, DJI), etc.

◦ Miners can only have one trading pair position at any time. ◦ Miners must close at least 10 positions in the past 30 days to participate in the scoring.

◦ Miner scoring criteria: based on the combined omega ratio and total return. For details, please refer to https://github.com/taoshidev/proprietary-trading-network/tree/main/vali_objects/scoring. • Elimination criteria for miners: ◦ 1. Reaching the maximum retracement limit for the day. At the close of any trading day, if the miner's maximum retracement for the day reaches 5% (compared to the daily high), the miner will be eliminated. ◦ 2. Reaching the maximum retracement limit for the entire period. If at any point in time, the miner reaches a 10% retracement (compared to the all time high), the miner will be eliminated. ◦ 3. Plagiarism. If the system detects that the transactions submitted by the miner plagiarize other miners, the miner will be eliminated.

◦ There is a 9-day protection period after the miner registers. The registration fee will not be refunded after the miner is eliminated.

• Validator tasks:

◦ The validator needs to maintain the portfolio, position, and net worth of each miner, and eliminate the miner when the miner reaches the maximum drawdown limit.

The setting of the competition itself is ridiculous. It is not a strategy, but a trading competition. Effective strategies need to be backtested. In addition, there is no need to introduce the concept of miners, validators, or any blockchain technology.

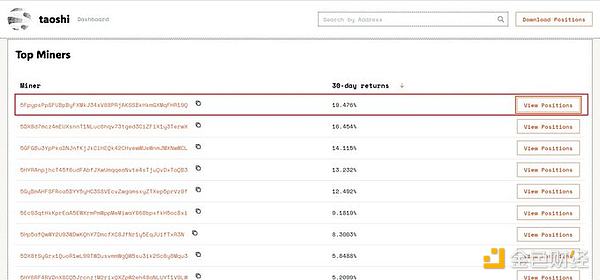

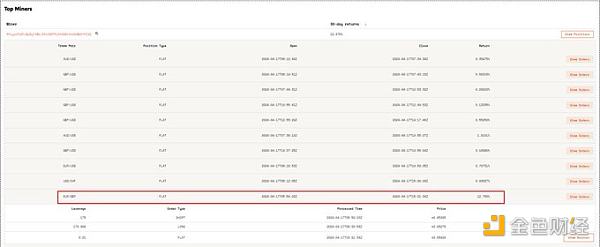

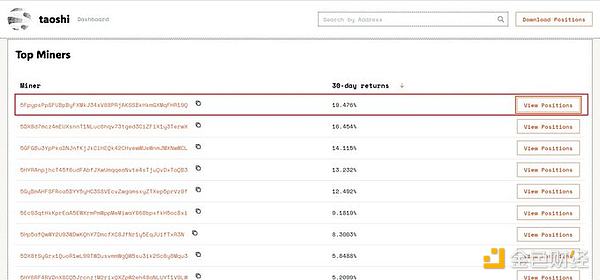

Taoshi dashboard can view the miner address with the highest yield, as well as all past transactions. https://dashboard.taoshi.io/

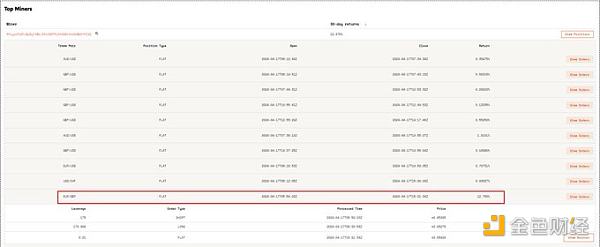

At the time of writing (UTC 2024-04-21 08:56), the address with the highest 30-day return has a 30-day return rate of 19.476%. Most of it is contributed by one transaction. This address shorted with 175x leverage at 2024-04-17 05:59:20 when the EUR/GBP price was $0.85345, and closed the position 98 seconds later at 2024-04-17 06:00:58 when the price was $0.85276 (0.01x leverage was left and closed at 15:01:34). It can be calculated that the profit of this transaction is 14.1%, and 12.75% after considering the transaction fee.

Actual application:

Dale: https://twitter.com/tradewithdale. A trading bot that claims to be able to trade based on the trading signal of the Taoshi subnet. Twitter said it is under development.

Timeless: https://twitter.com/Timeless_io. Operates a TG group of several hundred people, which mainly discusses transactions. Claims that the community has made money from the trading signal of the Taoshi subnet.

Cortext (subnet 18)

The official github repo readme does not talk about any mining, verification and incentive mechanisms in the subnet. The following is obtained from source code analysis.

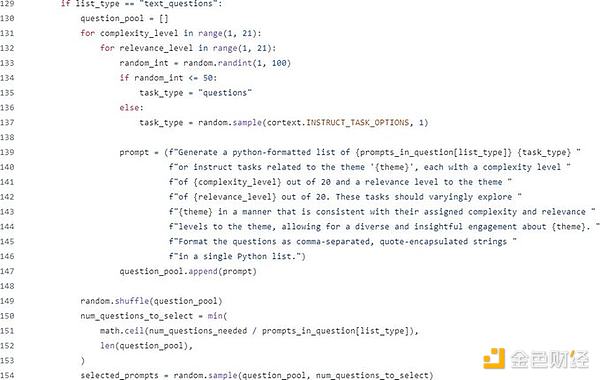

• Verifier question generation:

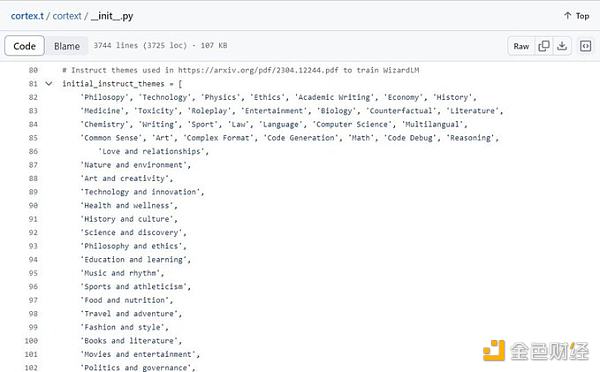

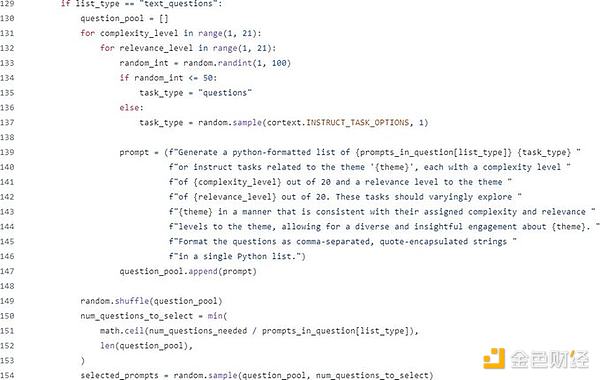

◦ There are 1000+ given topics for text and images. The verifier randomly selects a topic and applies it to the question template, calling openai GPT4-turbo to generate prompts for miners. https://github.com/corcel-api/cortex.t/blob/main/validators/text_validator.py

◦ Question template in github.com/corcel-api/cortex.t/blob/main/cortext/utils.py

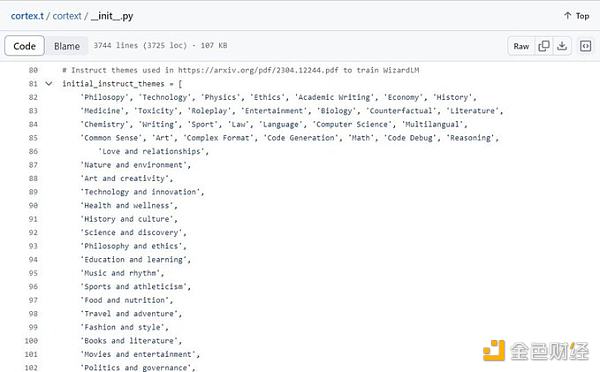

◦ Given a topic in https://github.com/corcel-api/cortex.t/blob/main/cortext/__init__.py

• Validator reference answer generation

◦ Text prompting calls GPT4 to generate reference answers; image generation calls DALL-E model to generate images

• Miner answer generation

◦ After receiving the prompt, the miner can choose anthropic.claude-v2:1 Anthropic, gemini-pro, claude-3-opus and other models to answer the questions. https://github.com/corcel-api/cortex.t/blob/main/miner/miner.py

• Miner answer scoring

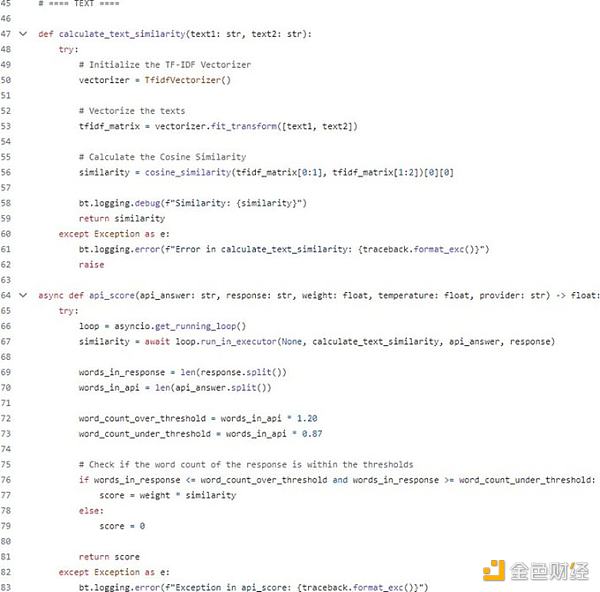

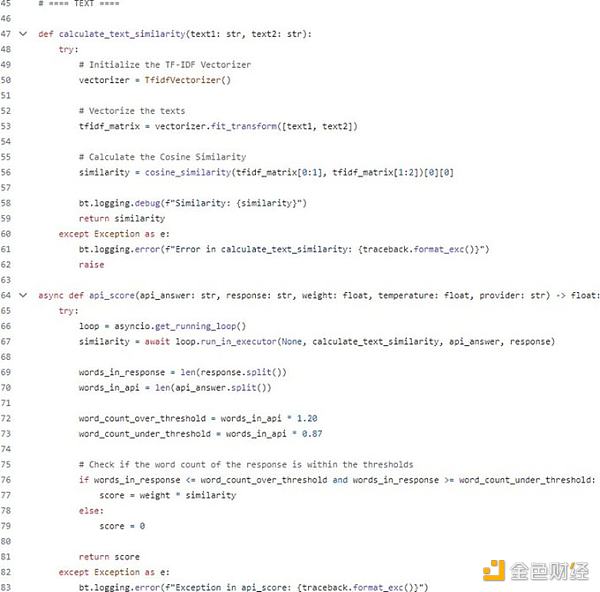

◦ Compare the similarity between the response and the reference answer.

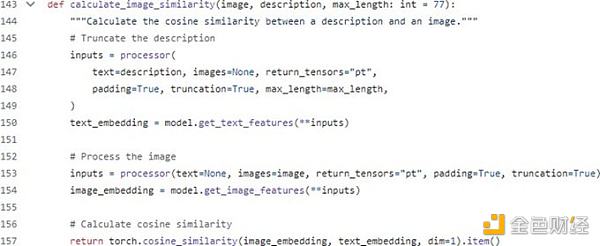

◦ For text prompting, the similarity comparison algorithm is TF-IDF, and cosine_similarity is calculated after vectorization. At the same time, there is a penalty if the response is too long or too short compared to the reference answer;

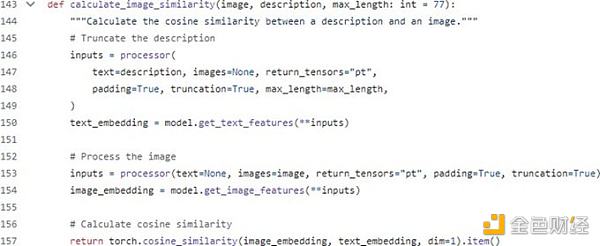

◦ For image generation, the similarity comparison algorithm is the perceptual image hash algorithm, which maps the image into a hash string. The similarity between two images can be compared by judging the number of inconsistent positions between the two hash strings, which is still converted into cosine_similarity function calculation. https://github.com/corcel-api/cortex.t/blob/main/cortext/reward.py

Actual application:

• Corcel. Can complete Text Prompting, Image Generation tasks. Claims to call Cortext’s API, and after users ask questions, the answers they get are generated by miners. https://corcel.io/

• In the actual test of text prompting, when asking the model developer, the answer was “I am an AI language model developed by OpenAI...I am not connected to the Bittensor network or any decentralized machine learning models”

Development history:

The source of this part mainly comes from: https://taostats.io/tokenomics/; https://messari.io/project/bittensor/profile

Mid-May 2021: The Opentensor Foundation suspends Kusanagi to deal with some early consensus issues.

November 2, 2021: “Kusanagi” forks into “Nakamoto”. The 546,113 TAO previously generated by Kusanagi were migrated to Nakamoto.

January 10, 2023: Finney testnet released, testing delegated staking and subnet functionality.

January 13, 2023: Successfully won a Polkadot parallel chain slot in the auction. However, due to concerns about the speed of Polkadot development, it was subsequently decided to use its own independent L1 blockchain built on Substrate instead of relying on Polkadot. https://www.theblockbeats.info/en/flash/123619

March 20, 2023: Finney mainnet released. March 28, 2023: Opentensor Foundation released Chattensor, an LLM built on Bittensor.

July 24, 2023: Opentensor Foundation releases Bittensor Language Model (BTLM). As a "3 billion parameter language model", BTLM is designed to be compatible with mobile devices and requires much less memory than popular 7 billion and 10 billion parameter models such as OpenAI's GPT-3 and Meta's LLaMA. https://opentensor.medium.com/introducing-bittensor-language-model-a-state-of-the-art-3b-parameter-model-for-mobile-and-edge- 2fe916fb81b0

October 2, 2023: Revelotion upgrade, subnets officially launched, allowing users to create subnets to create incentives for specific types of machine learning tasks, such as generating images, composing music, or crawling Internet content.

December 14, 2024: Messari researcher Sami Kassab released a Bittensor research report https://twitter.com/Old_Samster/status/1734977722424938993, and has been bullish on $TAO since then.

January 10, 2024: Opentensor Foundation proposes BIT001 proposal (First Bitttensor Improvement Template), proposing a dynamic TAO token incentive mechanism.

JinseFinance

JinseFinance