Author: Mehdi Brahimi, Miguel Kudry, Head of Institutional Business at L1, CoinDesk; Translated by Tao Zhu, Golden Finance

With the advent of tokenization, financial markets are undergoing a transformation. This movement is not just a speculative trend among tech enthusiasts, but a fundamental shift in the way assets are managed and traded around the world.

The tokenization of real-world assets (RWA) is not only an emerging trend, but also an emerging trend. It is laying the foundation for a new era of asset management.

The distinction between crypto-native tokens and tokenized RWAs is crucial. Crypto-native tokens, such as Bitcoin and Ethereum, are purely digital and can be used as speculative investments, stores of value, or as utilities within their own ecosystems. Tokenized RWAs, on the other hand, connect the digital and traditional financial worlds, effectively bringing liquidity and decentralization to increase accessibility to previously "illiquid" assets.

On March 20, BlackRock launched its first tokenized fund, BUIDL (Private Short-Term Treasury Bond Fund), marking a major milestone in tokenization. Not only did BUIDL attract nearly $300 million in assets in its first month, but BlackRock, the largest asset manager, also said that tokenization will become the "next generation of the market." Tokenized government treasuries are already a $1.2 billion track, including products such as Franklin Templeton's BENJI, BlackRock's BUIDL, and Ondo Finance's USDY, which has achieved a rapid 10x growth since January last year.

Currently, on-chain RWAs represent a $7.5 billion market. While this may seem insignificant relative to the tens of trillions of dollars worth of assets under traditional management, the rate of growth and the expanding range of tokenized assets (including treasuries, commodities, private equity, real estate, private credit, etc.) indicate a turning point. A 2022 Boston Consulting Group report estimated that the tokenized asset market could grow to $16 trillion by 2030, which would greatly facilitate the development of entirely new financial ecosystems in lending, liquidity pools, futures and derivatives, and other markets by DeFi protocols that cater to these assets. Trillions of dollars of new wealth are being created on-chain. This is a new group of investors who want to access and interact with financial products and services through their wallets. These crypto-native investors benefit from an ecosystem that operates 24x7, with lower barriers to entry than traditional finance, walled gardens, and operating hours, and sometimes even ahead of traditional markets.

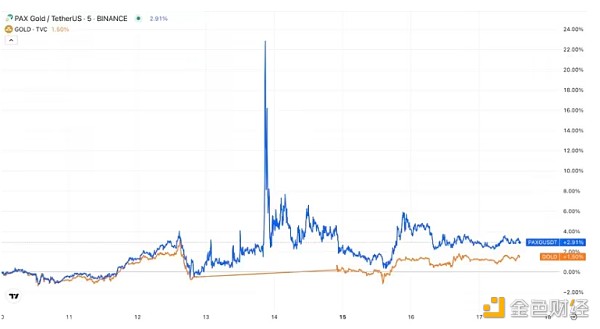

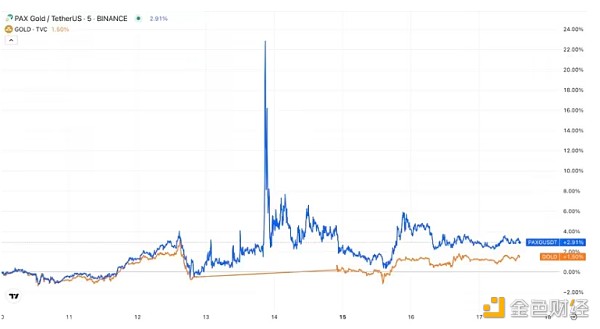

X user @kaledora analyzed a recent example on April 13, 2024, where PAXG (a tokenized gold) was trading at a 20% premium to its April 12 closing price as geopolitical tensions between Iran and Israel increased, with volume peaking at the close of Sunday, April 14. This coincided with the gold market opening at 5pm ET, demonstrating that the fundamental principles of asset security that are critical to traditional markets also apply to digital assets.

L1 Institutional Business Director Mehdi Brahimi said that the integration of real-world assets and wallet infrastructure on the chain will replace intermediaries and become the standard for the modern asset management life cycle.

The concept of "Bring Your Own Wallet" (BYOW) encapsulates the autonomy and power transfer that blockchain brings to individual investors. BYOW eliminates the reliance on asset custody intermediaries, enabling investors to manage and access their assets without the constraints and delayed settlement of traditional intermediaries.

As more assets come on-chain, asset managers may adopt strategies that allow them to tap into new sources of liquidity and arbitrage between on-chain and off-chain markets. This evolution brings familiar territory on-chain, providing asset managers with the traditional frameworks they are accustomed to, allowing them to apply basic portfolio construction principles and manage investment strategies in a digital asset environment, thereby providing allocation opportunities for crypto-native investors.

Looking forward, the tokenization of asset classes and the integration of crypto-native investment principles may become the standard for the modern asset management lifecycle. This transformation is not only inevitable, it is inevitable. It is clearly underway. The asset managers and allocators who embrace this change will build a new generation of firms that align with a new generation of investors. A generation that brings its own wallet.

JinseFinance

JinseFinance