For Bitcoin and the broader cryptocurrency industry, 2024 is destined to be extraordinary.

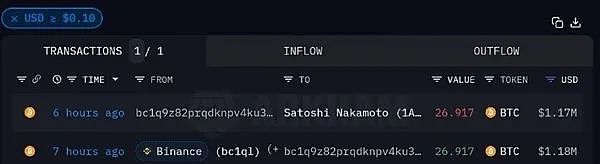

On January 6, a mysterious address starting with "bc1q9z" sent 26.91 BTC to an address labeled Satoshi Nakamoto. Coinbase director Conor said on the social platform that either Satoshi Nakamoto woke up and purchased 27 Bitcoins from Binance and deposited them in the wallet, or someone just destroyed $1 million worth of Bitcoins.

On January 11, the U.S. Securities and Exchange Commission announced the results of its vote to approve the Bitcoin spot ETF listing application. The vote passed 3 to 2, with Chairman Gary Gensler, Commissioner Hester Pierce and Commissioner Mark Uyeda voting in favor. Officially approved the listing of spot Bitcoin ETF.

On January 13, Gary Gensler rarely mentioned "Satoshi Nakamoto" in an interview with CNBC, saying that there is innovation in the field of blockchain ledger systems, but spot There is a certain irony in the launch of the Bitcoin ETF as it goes against Satoshi’s mission to decentralize, he explained: “There is no doubt that there is innovation in this space, and I teach around ledger systems at MIT These innovations are just accounting systems called blockchain technology. There is an irony in this. Satoshi Nakamoto said that this will be a decentralized system and finance, and this (ETF) leads to centralization.” .

This series of operations, coupled with the upcoming halving of Bitcoin block rewards, makes the crypto community question whether it is true that after 21 million BTC are mined, Will "force" Satoshi Nakamoto to show up? Koala Finance will do an in-depth analysis in this article.

After mining 21 million BTC, will Satoshi Nakamoto appear and trigger a new round of "money printing"?

Satoshi Nakamoto, known as the "Father of Bitcoin", released the "Bitcoin White Paper" in 2008, which agreed on the total amount of Bitcoin. There will be only 21 million. Bitcoin was born in 2009, but since then, the traces of Satoshi Nakamoto have become the mystery of the century. No one can accurately prove who Satoshi Nakamoto is.

In fact, the person who first proposed that Satoshi Nakamoto will appear after 21 million Bitcoins hits the maximum supply is also very well-known, that is, the CEO of JPMorgan Chase Jamie Dimon, who believes that Bitcoin may be obsolete once the maximum supply is issued noted: “I think it’s very likely that when we hit 21 million Bitcoins, Satoshi Nakamoto will show up, laugh hysterically, and then Be quiet, and then all Bitcoins will be deleted."

On the other hand, due to increasing mining difficulty, the last Bitcoin will not be around until around 2140 It will be completely mined, which means that even if "Satoshi Nakamoto" is alive, it will be difficult to prove it by 2140. After all, no one can live to be more than 130 years old. According to BTC.com data, Bitcoin mining difficulty has ushered in the latest mining difficulty adjustment at block height 824,544. The current mining difficulty has been raised to 73.2 T, an increase of about 1.65% and continues to hit a record high. The difficulty curve Indicators such as and the logarithm of difficulty have also been climbing, which means that the last Bitcoin will be mined even after 2140, or even further.

Another question is, if there is no guarantee that the issuance of Bitcoin will end once the circulating supply reaches 21 million Bitcoins? No one knows whether Bitcoin will stop at 21 million. Jamie Dimon also admitted that "I have never met a person who told me that they know the facts." Therefore, he put forward this unique theory, that is: once Bitcoin hits the issuance The maximum supply (i.e. 23 million coins) will continue to be issued, just like the "tide of money printing" of the US dollar.

Of course, the market also views Bitcoin from other angles, and believes that 2024 will be the most critical year for Bitcoin. Let us continue to analyze——

Will 2024 be the “Year of Bitcoin”?

With the U.S. Securities and Exchange Commission’s approval of a spot Bitcoin ETF and the next Bitcoin halving event scheduled to take place in April this year, 2024 has already It’s been a transformative year for digital assets, especially Bitcoin.

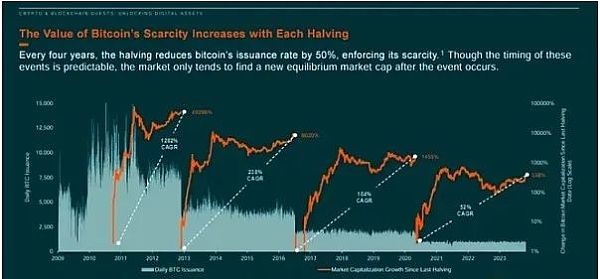

Historically, "halvings" cause Bitcoin prices to rise significantly in the following months and years (as shown in the chart below). While the actual timing of this event is predictable, it will take time for the market to find a new price equilibrium.

Not only that, the Bitcoin RSI is currently below 50, the MACD is negative below its signal line, and the current price is below the 20 and 50-period moving averages, which are $42,701 and $42,932 respectively. Analysts believe that if Bitcoin breaks through the "pivot point" of $43,100, there will be greater room for flexibility.

The last Bitcoin halving occurred on May 11, 2020, when the block reward dropped from 12.5 BTC to 6.25 BTC. Since the event, Bitcoin has grown at a CAGR of 52%, with the fastest growth occurring in the first 9-12 months after the event. The combination of these factors provides a compelling investment case for Bitcoin. , and provides a potential entry point. Using the stock-to-flow model, we can find that the implied value of each Bitcoin in April 2024 is approximately $62,000, which is approximately 34% higher than the current price. (Koala Note: The stock-to-flow model can quantify the value of assets with limited supply. ).

In any case, for Bitcoin, and the entire cryptocurrency market, this year is worth focusing on, let's wait and see.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive  Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph