Cardano's ADA cryptocurrency witnessed a significant drop of nearly 21% over the past month, prompting concerns among investors. Despite the typical strategy of accumulating during market corrections, ADA's recent decline failed to attract interest from large investors known as whales.

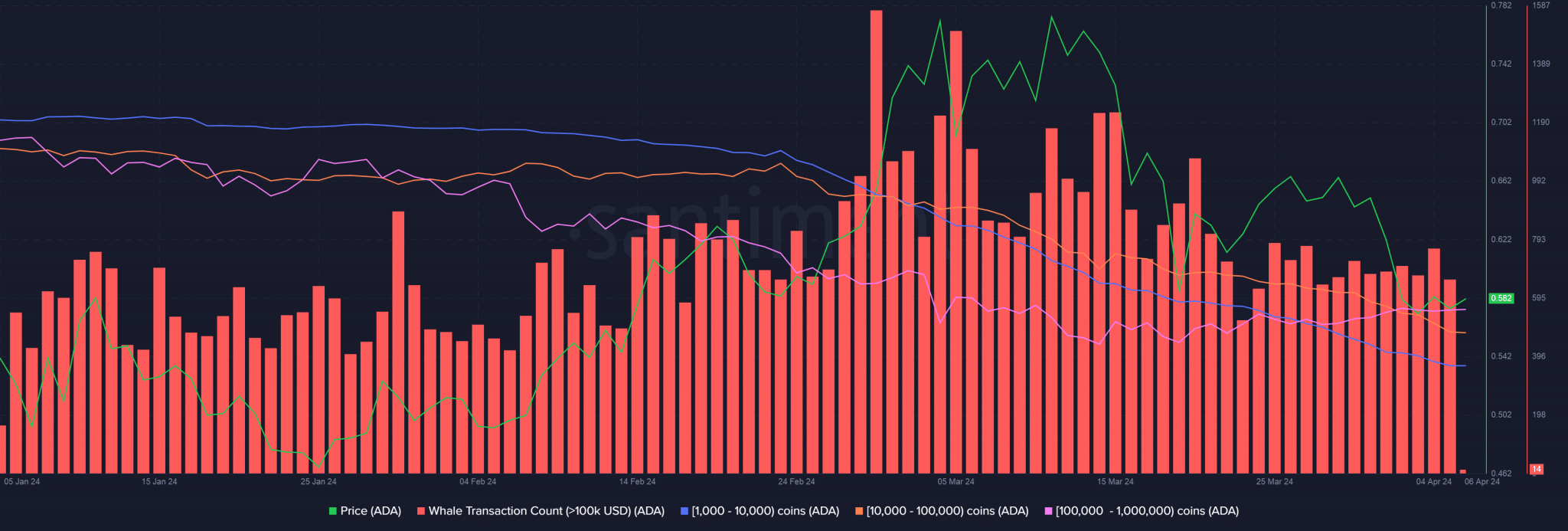

Whale disinterest was evident in a notable decrease in transactions exceeding $1,000 over the last few weeks, as reported by AMBCrypto utilizing Santiment’s data. Additionally, the cohort holding between 1,000 to 1 million ADA coins notably decreased during this period, indicating whale sell-offs.

Ali Martinez, a renowned technical analyst, interpreted these trends as bearish signals, predicting potential price stagnation or further declines.

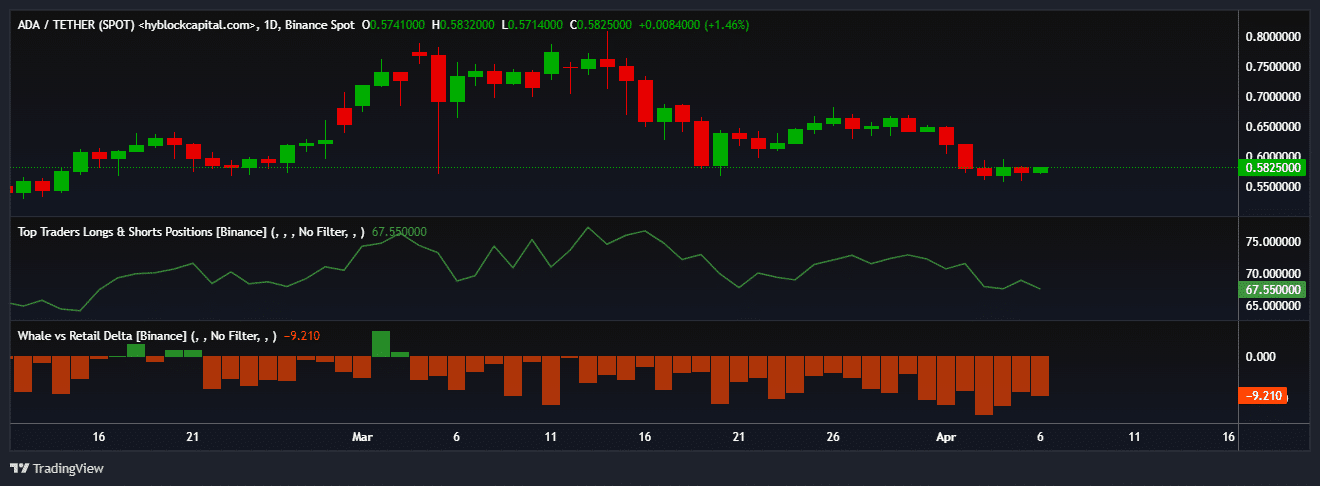

This bearish sentiment extended to ADA's derivatives market, with data from Hyblock Capital indicating a decrease in whale positions on Binance from 76% to 67% since mid-March.

Interestingly, retail investors exhibited higher long exposure compared to whales, suggesting a lack of confidence among whales in ADA's recovery potential, which could influence broader market sentiment.

Further exacerbating ADA's woes, Grayscale, the world's largest digital asset manager, recently removed ADA from its flagship Grayscale Digital Large Cap Fund (GDLC). This removal, from a fund representing a basket of large-cap digital cryptocurrencies, signifies ADA's diminishing prominence in the market.

YouQuan

YouQuan