Author: 1kx, Translation: Golden Finance xiaozou

Meme coin is the intersection of digital currency and Internet culture, attracting participants at all stages of the crypto cycle. Once again, they captured the zeitgeist with their relatability, virality, and attractive profit return potential.

In this article, we will introduce the following content:

Memecoin The Origin of Proof-of-Work Meme Blockchain

How Memecoin achieves cyclical evolution: ICOs, tokens, Summer of DeFi, Solana

How NFT affects the meme currency landscape

Recent developments and new trends

Potential Risks and Opportunities

1, What is Meme?

Meme is a culture carrying ideas and symbols that spreads among people. Like genes, memes vary in their ability to spread, with those that resonate most surviving, while those with less impact are quickly forgotten.

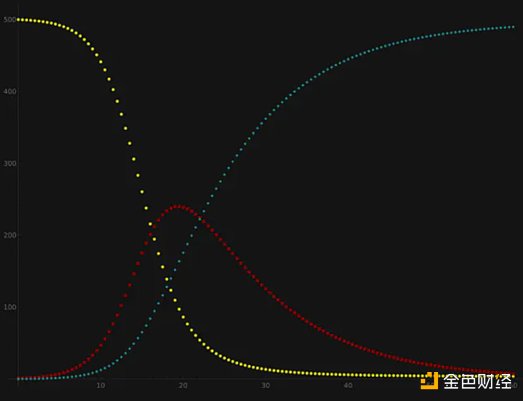

The Internet gave rise to the concept of "Internet memes," which allowed memes and cultural ideas to spread more quickly, often in the form of images, videos, GIFs, and jokes. One study likened the spread of Internet memes to a disease: "Memes spread in a viral pattern, "infecting" an individual, a pattern reminiscent of the SIR model of disease transmission.

A "memecoin" is a cryptocurrency whose value Derived entirely from the memes associated with them, essentially bringing economic value to the concept of memes.

With the emergence of meme coins, cultural ideas and symbols and their dissemination can be traded and Speculative. Their value is based on memes' relevance and ability to garner attention, creating a new market in which cultural resonance is quantifiable and economically valuable.< /p>

2, MemeA Brief History of Coins

Let’s take a brief look at each crypto cycle and the modules created during these cycles. Yincoin:

< p>

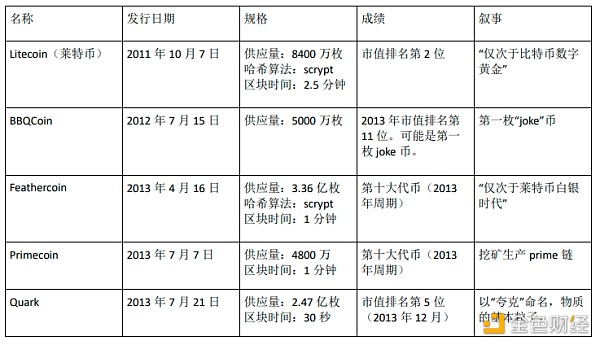

3, Proof-of-Work Memecoins

Proof-of-Work Memecoins are primarily designed for miners to allocate their resources to mining and selling new coins. Many of these memecoins are was debuted on Bitcointalk’s Alternative Cryptocurrency Forum. While a fair number of memecoins failed to be listed on exchanges, those that were successful were able to be traded on centralized platforms such as Cryptsy and BTC-E, which The platform is now closed. Each memecoin typically has a different name and brand, hashing algorithm, block time, and supply, all of which together make up their overall narrative or "meme."

The first wave of tokens after Bitcoin were “memecoins,” in the sense that they had little value other than providing a new idea. For example:

These coins (except Litecoin) are dead (low trading volume and market cap, no exchange support, vulnerable to 51% attacks). This may be due to several reasons: memes are not durable (lack of longevity culture) and their access issues (each memecoin is an entire blockchain).

Litecoin’s survival is likely due to the sheer appeal of Bitcoin’s memetic value (“digital gold”), which gained modern popularity long before other memecoins. Ongoing support from the exchange.

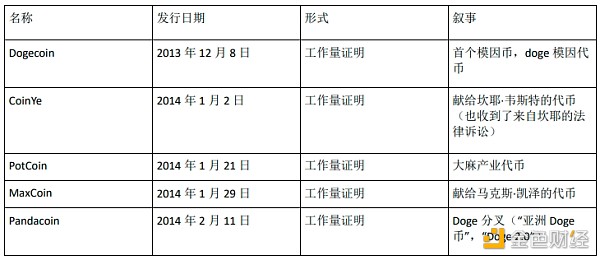

4, Dogecoin (Dogecoin): the first meme coin

The earliest doge meme was in 2013 It started spreading on 4chan and Reddit last summer. Capitalizing on this cultural trend, on December 8, 2013, Jackson Palmer and Billy Markus launched Dogecoin on Bitcointalk. It is the first cryptocurrency based on an internet meme.

Dogecoin’s success has led to a new “category” of tokens that are rebellious, humorous, and ironic, utilizing celebrities (Kanye West, Max Kaiser) and animals (Pandacoin), or trying to attract the attention of a specific community. These are all proof-of-work tokens launched on Bitcointalk’s “Alternative Cryptocurrency” subforum. The "specs" became less important and more important the "meme". For example:

< strong style="font-size: 24px;">5, ICO< /strong>Prosperity and the rise of Ethereum

The rise of Ethereum has brought a wave of innovation and achieved new Use cases, better user experience, attract new users.

Some specific improvements include:

Token issuance Easier (ERC20 standard)

Bring a new user base (non-miners)

Token creators can earn more Much money (unlike non-premined PoW tokens, ERC20s are sold via ICO)

Introducing interoperability/one ecosystem/one wallet (via ERC20)

p>

The ICO era has brought a wave of more "serious" projects: theDAO, Filecoin, Tezos, EOS, Cardano, Tron and Bancor, which try to have some kind of value beyond memes utility or goal.

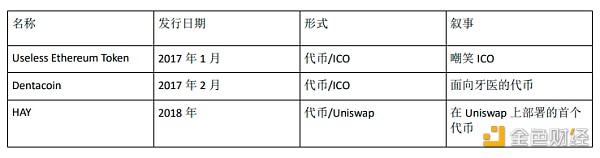

There are also a handful of meme coins that aren't particularly eye-catching, but still attract some attention.

One example is the Useless Ethereum Token released in June 2017, which mocked the idea of an ICO and raised 310 ETH.

While Dentacoin was originally a “dentist cryptocurrency,” it was viewed as a meme coin and reached a peak market capitalization of $2 billion in January 2018.

HAYCOIN was the first ERC20 deployed to Uni v1 and a memecoin created in this era (2018). Hayden Adams, the founder of Uniswap, created the token as a test for the Uniswap protocol. It didn’t have much usage and transaction volume at the time, but it revived in 2023 due to its historical significance.

6 , meme collections, and earlyNFT

Besides cryptocurrencies, one part of the Pepe the Frog meme is “Rare Pepes,” that is, not publicly releasable Memes, if posted publicly, will carry the "RARE PEPE DO NOT SAVE" watermark.

Between 2016 and 2018, a group of counterparty developers (a smart contract protocol developed on top of the Bitcoin network) and Pepe meme supporters created the Rare Pepe wallet Pepe Cash and curated the "Rare Pepe meme” in order to trade on counterparty agreements.

Rare Pepe is generally considered the second batch of NFT collections and will continue to maintain its value, with some Rare Pepe selling for more than $500,000.

With the release of CryptoPunks, MoonCats, and CryptoKitties, NFTs are beginning to enter the Ethereum zeitgeist: non-fungible tokens that can point to pictures and other media. Posted as a joke on Reddit in 2017, EtherRocks is a collection of 100 colored stones. The series was hardly popular at the time (only 30 were minted), but later recovered strongly, triggering frantic buying, reaching a floor price of 305 ETH in August 2021 (worth $1 million at the time).

Another collectible meme coin is Unisocks (SOCKS) released by Hayden Adams on May 9, 2019. 500 physical socks were created and they can be redeemed using 1 SOCK (one ERC20). At the time of writing, at $53,000 each, they may be the most expensive socks in the world.

7 , DeFi Summer

In June 2020, Compound Finance pioneered a new token distribution method: "liquidity mining" or "yield mining" mine". Users will lock their assets to provide liquidity and be rewarded with tokens.

This new primitive started the "DeFi Summer" and reached its climax with the "food coin" income mining farm. The income farm provided 10,000% APY (denominated in meme coins) in exchange for It is your tokens that are locked in the Yam or Pickle contract.

8, meme stocks and dogs Dogecoin

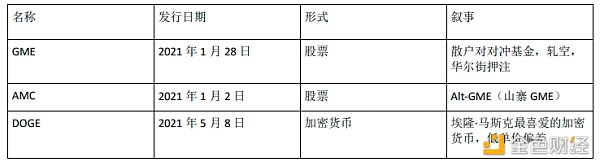

Suppressed incentives, interest rate cuts, cheap money and the COVID-19 lockdown make the entire year 2021 full of high risks.

In early 2021, retail traders gathered on Reddit and began to spread the "Gamestock" meme and post pictures/videos, driving the stock's price to rise rapidly. Thanks to Robinhood’s superior user experience (mobile app, free), many ordinary users can participate.

The "GME" mania has led many people to start speculating on other assets, especially those that can be purchased on Robinhood. DOGE was listed on Robinhood in 2018 and was priced at 0.008 cents at the end of January, which was a very attractive "price" for retail investors. In early February 2021, Elon Musk began posting a large number of tweets spreading the "Doge" meme. DOGE coin peaked in May 2021 with a market capitalization of $90 billion.

DOGE’s popularity The extent has resulted in a number of crypto-native memecoins, including Shiba Inu, Floki, and Safemoon, all of which have reached fairly high valuations within a few months.

< strong style="font-size: 24px;">9, NFT< /strong>Prosperity:"Meme coins with picturesmeme coins"

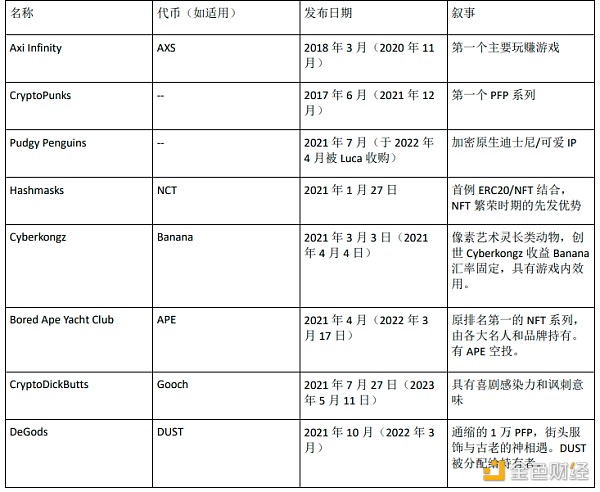

With the standardization of ERC721 and the emergence of universal marketplaces like OpenSea, NFTs create a new cryptoasset "class": a unique visual representation of an overarching "culture" or "meme" .

Some of the most well-known NFTs include: CryptoPunks, Bored Apes, Squiggles, and Pudgy Penguins. NFTs are shown off as avatars on platforms like Twitter and Discord, and people use them virally as their status symbols. These PFPs signify prestige and "membership of a certain cultural club." Many collectibles make their holders wealthy, but holders cannot sell their NFTs “without leaving the community.” In order to reward loyal holders, some NFT projects have released "meme coins" (ERC20) in their communities, treating them as a form of liquidity, "utility" and cultural "currency".

Some examples of NFT projects (and their meme coins) in this era are as follows:

10 , recent (2023year to date)

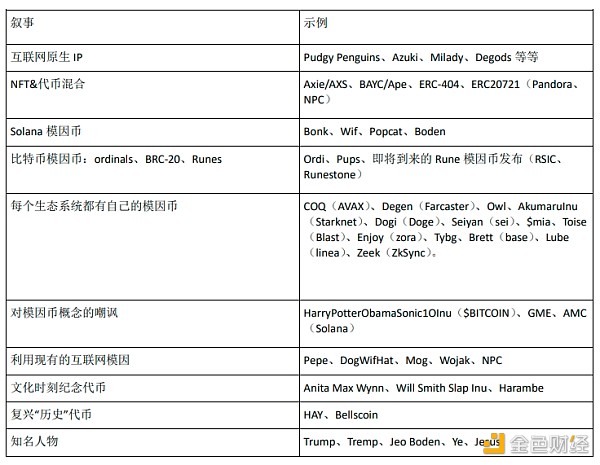

As cryptocurrencies recover from the bear market, new memes, cultures, ideas, and ecosystems continue to emerge. Memecoins have been one of the few categories that continues to gain traction (volume, market cap appreciation, social interest) and have recently seen a surge in interest.

Some recent accounts are as follows:

11, common patterns

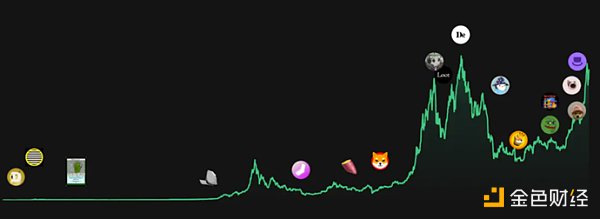

Every cycle has some form of memecoin: memecoins manifest themselves in different ways depending on the underlying technology (PoW coins, ERC20, and NFT), which are new technologies or forms One of the earliest "applications".

Although memecoins appear in a variety of different types of media, they all accumulate value in the same way: they all require attention, narrative, and publicity to survive and spread. Although there is no lack of attention and excitement about new media in the beginning, long-term value can only be retained through sustained attention. Just NFT is not enough, just Ordinal is not enough. Attention is highly cyclical, and after the initial media hype cycle, more factors are needed to drive basic attention.

First there were memes, then there were memecoins: For the most successful memecoins, like doge, pepe, and dogwifhat, the internet memes came first, and the memecoins came first. It’s about leveraging existing awareness and communication.

Cryptocurrency memes are just getting started: crypto natives are already starting to create memes that successfully expand beyond web3. A prime example of this trend is the emergence of crypto intellectual property, especially NFT projects like Pudgy Penguins.

Low Price Becomes a Meme: From the very early days of altcoins, users have loved speculating on tokens at lower “prices” (because of high supply). There is a psychological incentive that if a humble token reaches $1, it may turn the holder into a millionaire overnight. The price itself is a meme.

Strong Community+Marketing: Meme coins require a strong community, founders or “spokesmen” to create content, promote the brand and spread the “meme”.

Organic Release to Dedicated Teams: The first wave of meme coins were released organically, often fairly, with no internal staff or team allocations. There are many benefits to publishing organically, but there are also risks, like rugs being pulled or funds being stolen. An emerging solution is that meme coins have dedicated teams incentivized to direct attention around them, such as the PFP project.

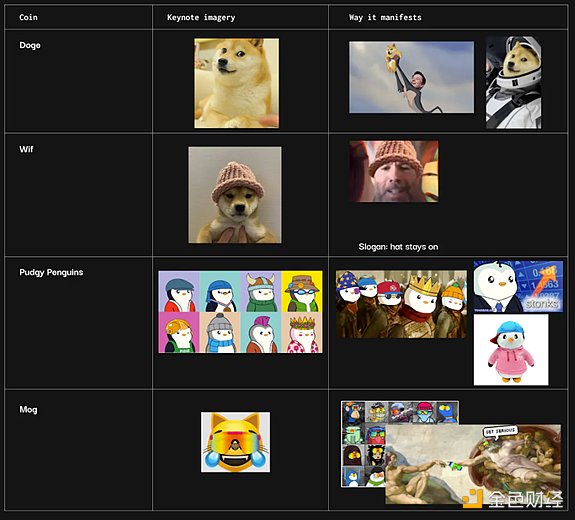

Attention-grabbing images, derivative images and slogans spread memes: Images are the main way memes spread on social networks. Often, there is a theme at the beginning and then manifests itself in many different ways.

12 , Opportunity

The total market value of meme coins exceeds 60 billion US dollars, and the daily trading volume exceeds 13 billion US dollars, which has huge financial value.

Since the only function of a meme is to spread into other people's minds, catching the next "meme" early on can be a lucrative opportunity. Creators and investors “work for” the meme by expanding its reach and are rewarded in the process for becoming early backers.

Whether it’s a lottery ticket to get rich, following an influencer’s choice, or speculating on social trends and ideas, memecoins have been exploding since the inception of cryptocurrencies. growth.

13, Risks

Despite the opportunities, memecoins are not without risks. Many memecoins tend to appeal to users who are trying to make quick money effortlessly, viewing it as a lottery or a form of gambling.

Another common trend is “rug pulling” and “pump-and-dump” operations, which are played out almost daily on decentralized networks via memecoins. According to a recent report from blockchain analytics company CipherTrace, rug-pulling accounted for 99% of all crypto fraud in 2023, with total losses of $2.1 billion. It is important to check some key characteristics of memecoins, such as the status of LP tokens (are they burned or held centrally?), team allocation, transfer taxes, and whether the contract is abandoned.

In addition, there is a lack of clarity regarding the regulation of meme coins. The most noteworthy regulation regarding memecoins is that in June 2021, Thailand’s Securities and Exchange Commission banned tokens that “have no clear purpose or substance” and whose prices are influenced by social media trends and celebrities.

Another major problem is that a meme may not "survive" purely due to a lack of interest, attention, and ideological approval, rather than due to any malicious behavior. These investment losses can create a hostile or indifferent community of holders.

WenJun

WenJun

WenJun

WenJun dailyhodl

dailyhodl CryptoSlate

CryptoSlate Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph 链向资讯

链向资讯 Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph