Produced by: OKG Research Author: Wang Lele, Bi Lianghuan, Jiang Zhaosheng

In the past year, the "deglobalization" disputes in the physical world have continued. In the digital world, a new model of globalization is gradually emerging.

In 2024, countries and regions with more than half of the world's population held general elections. The Russian-Ukrainian war entered its third year, and the war between Kazakhstan and Israel continued to spread. In his new book Nexus, Israeli historian Harari attributed the mystery of human civilization to the ability to tell stories. Globalization, as the dominant narrative, has experienced its peak from the late 20th century to the early 21st century. However, the narrative of promoting win-win globalization led by developed countries was opposed by themselves: the dividends brought by globalization have not been universal, and the widening income gap and asset price bubbles have been highlighted in the context of slowing economic growth, further polarizing the rich and the poor.

At the same time, a quietly rising wave of digitalization is showing a completely different direction. According to statistics from the OKLink Research Institute, as of now, crypto assets have been legalized in more than half of the countries and regions (119 countries and 4 British territories). Since El Salvador became the first country in the world to use Bitcoin as legal tender in 2021, many third world countries such as Cuba and the Central African Republic have followed suit. In early 2024, the United States approved 11 Bitcoin spot ETFs, and Bitcoin entered the mainstream financial market. In addition, Trump made ten major commitments to crypto assets in the year of the election, including the establishment of a national strategic reserve of Bitcoin, which set off a new round of sovereign countries' adoption of crypto assets and further promoted the trend of crypto asset globalization.

Developed countries' "self-opposition"

Globalization was once regarded by developed countries as a tool to shape the global economic order. However, they, who were the first to advocate globalization, have now become the first voices to question this system. The cross-border flow of capital and industry has promoted the improvement of global production efficiency, helped developed countries complete the transformation from manufacturing to high value-added technology and financial services, and promoted consumption upgrades with lower-cost goods.

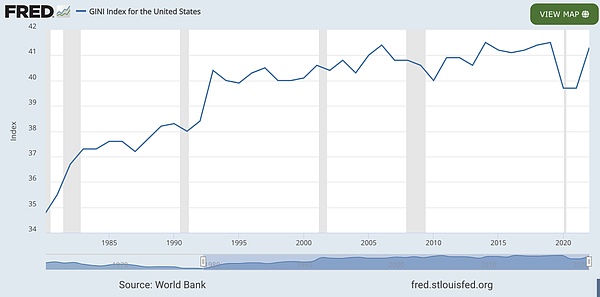

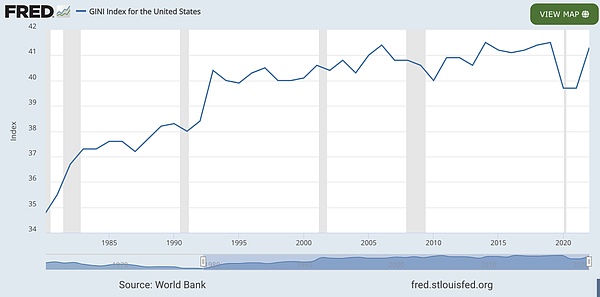

However, this process has also buried profound structural contradictions, causing the original beneficiaries to begin to reflect on the price paid for globalization. The most notable of these is the uneven distribution of wealth. Taking the United States as an example, its Gini coefficient rose from 34.7% in 1980 to 41.3% in 2019, and income inequality increased by 19%. Although it fell back in 2020, it then rebounded to a high level. The income distribution problem remains severe, sounding the alarm for the globalization model.

Figure Gini coefficient of the United States (1980-2022)

In addition, the production dominance of developed countries has declined: the global GDP share of the BRICS countries has jumped from 7.7% in 2000 to 37.4% in 2023, the US share has dropped from 30.5% in 2000 to 24.2% in 2023, and the EU share has dropped from 26.6% to 17.5%. Looking at manufacturing alone, the share of developed countries in global manufacturing has dropped from more than 70% in 2000 to about 45% in 2023, while the share of manufacturing value added in East Asia and the Pacific has climbed from 31.9% in 2007 to 46.5% in 2021. This imbalance has exacerbated the inequality of global competition and distribution, and has become a microcosm of the deep-seated contradictions of the globalization model.

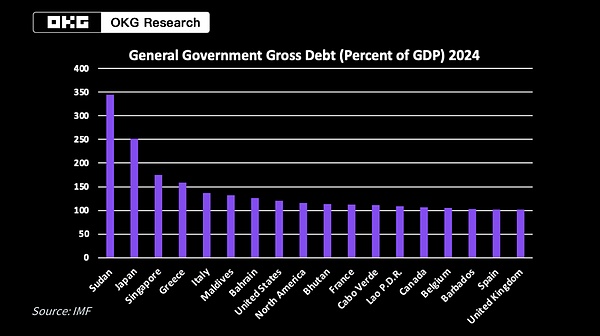

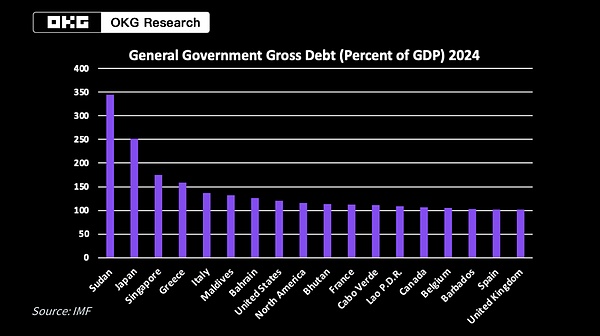

At the same time, the public debt problem in developed countries is also becoming increasingly intensified, and the high public debt has further exacerbated the hidden worries of globalization. The US government debt as a percentage of GDP has risen from 58% in 2000 to 98% in 2023, and Japan has long maintained above 200%, approaching 260% in 2023. With the surge in fiscal deficits and interest payments, debt pressure has weakened policy flexibility. These economic structural problems highlight that the imbalance in the distribution of benefits and risk transfer brought about by globalization is forcing developed countries to re-examine the globalization system they dominate and its sustainability.

Figure 2024 Global Government Public Debt/GDP

At present, as the deep-seated contradictions of globalization become more and more apparent, the uneven flow of capital and wealth distribution have led to a deepening of social rifts. Historically, war has often been an extreme means of resolving economic contradictions and political disputes, especially when the international system is unbalanced or the economic structure encounters a major crisis. The Marshall Plan after World War I promoted the reconstruction of Europe and became the starting point of post-war economic globalization; during the Cold War after World War II, the arms race and technological innovation between the East and the West accelerated the revolutionary transformation of science and technology and industry. Although war has brought great destruction, it has also often given rise to a new order and the reconstruction of the global system.

Today,we stand in the wave of digital transformation and see that technological innovation has gradually replaced the previous armed confrontation and become one of the new driving forces for economic and social development.In this new context, the way of globalization is also undergoing profound changes: it is no longer a simple expansion, but a process of continuous self-correction and evolution. Innovation is opening up an unprecedented "new world" for the global economy.

The "new world" of globalization

At the end of the 15th century, Columbus intended to find gold and spices in the Asian continent, but unexpectedly discovered a new continent full of opportunities in the Americas.

16 years ago, Bitcoin was born. This is defined in the white paper as "a peer-to-peer electronic cash system" to solve systemic problems such as the vulnerability of relying on traditional financial credit intermediaries. However, this initial idea that seemed to "subvert tradition" has long since changed. Bitcoin is no longer just "electronic cash", but is regarded as "digital gold", and even rises to the discussion of national strategic reserves. The crypto market represented by Bitcoin is gradually penetrating the global financial landscape: From a niche testing ground for geek punks, it has gradually evolved into the "New World of America" in the financial world.

This "new world" is different from traditional globalization. It not only breaks through the limitations of geographical boundaries, but also breaks through the inherent model dominated by a power center. It does not rely on a single economy or political power, but establishes a new trust system through global consensus mechanisms and technical means, which is the foundation of new globalization.

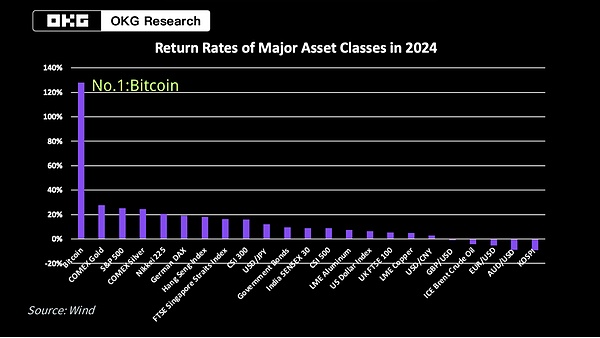

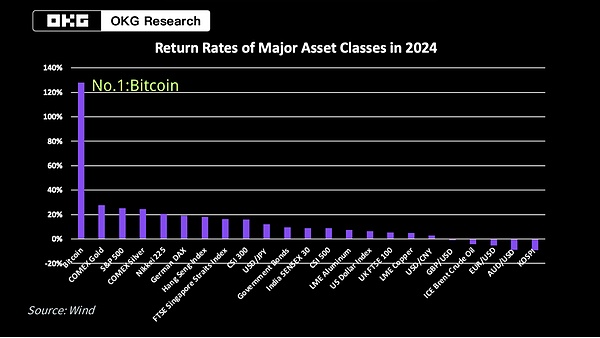

Against the backdrop of the intensifying trend of "deglobalization" in the real economy and escalating geopolitical tensions, the global economy is under pressure, and the crypto market is gradually becoming a new "decompression valve". Taking Bitcoin as an example, in the performance ranking of major asset classes in 2024, Bitcoin ranks first with an annual return of 128%. From the perspective of market value, as of November 12, 2024, the asset market value of Bitcoin has surpassed silver and ranked as the eighth largest asset in the world. This not only highlights the new status of crypto assets in the traditional financial system, but also reflects its hedging and value-added potential in a complex economic environment.

Figure 2024 Asset Class Yield Ranking

This is not only the result of capital chasing, but also the embodiment of the formation of a new global market driven by the borderless nature of crypto assets. Against the backdrop of geopolitical conflicts and restricted capital flows, cryptocurrencies have demonstrated their unique economic function of "depoliticization". Traditional economic systems are often deeply affected by geopolitics. For example, the SWIFT system (a global interbank communication protocol) is often used as a game tool between countries during sanctions. After Russia suffered SWIFT sanctions, some economic activities turned to crypto assets. It shows the flexibility and depoliticization of crypto assets in dealing with international conflicts. Russian President Vladimir Putin also signed a law to recognize crypto assets as "property" and set a tax framework for their trading and mining, thereby giving them legal status. For example, in 2022, the Ukrainian government raised more than $150 million in donations through crypto assets, demonstrating its rapid response and cross-border capital flow capabilities in crises.

Looking deeper, crypto assets are promoting a new economic model that does not rely on power centers. This system based on technological trust replaces traditional institutional trust. Unlike the fragility of the traditional financial system - financial crises, bank failures, currency depreciation and other issues often expose the shortcomings of power centers - crypto assets fundamentally reduce these risks through technical means. In this trust world dominated by algorithms, real power no longer comes from a single authority, but from the joint participation and guarantee of countless nodes around the world. Just as the Bitcoin network has about 15,000 nodes that vary with the activity of the network and user participation, this decentralization greatly reduces the risk of "single point failure".

This trust mechanism also provides a new foundation for global collaboration. The 24-hour non-stop trading and borderless nature of crypto assets break through the restrictions of religion, holidays and national borders. Crypto assets are providing the possibility to bridge the cracks and reconstruct order in a world divided by deglobalization.

As the saying goes, all those who want to make the last penny will never get what they want. The "globalization" of the physical world is like yesterday's news. The attempt to squeeze out the last penny of profit will often eventually lead to the imbalance and rupture of the system. Today's crypto market seems to have given a brand new answer.

Anais

Anais