BTC has experienced three halvings so far, and will also usher in its fourth halving in 7 days.

In order to meet this critical moment, OKLink Browser, which focuses on building data infrastructure, has already prepared a rich and detailed "halving" topic for Web3 enthusiasts who are concerned about data analysis.

https://www.oklink.com/zh-hans/btc-halving

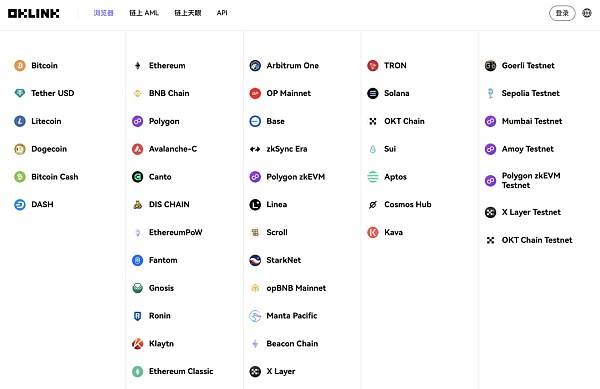

Currently, OKLink has launched 44 mainstream blockchain browsers, parsed more than 200 chains, and fully combined with user needs to launch special pages such as Dencun Cancun Upgrade and Inscription Browser, which greatly saves users' time in searching and collecting data, allowing all users to enjoy the breadth and depth of data while adding more power and obtaining the required data more conveniently and quickly.

Regarding the BTC halving, the media Hive Finance, which is known as the "Blockchain Truth School", raised a question: Is it still effective to use data to "carve a boat to find a sword"? At the same time, it said: The market is changing, and the "rules" seem to be ineffective, but the data on the Bitcoin chain still foreshadows the future, which is not only related to the price, but also where the Bitcoin ecosystem will go after the reward is halved.

Observation 1: "Triple Peaks" Appeared in the Third Halving Cycle

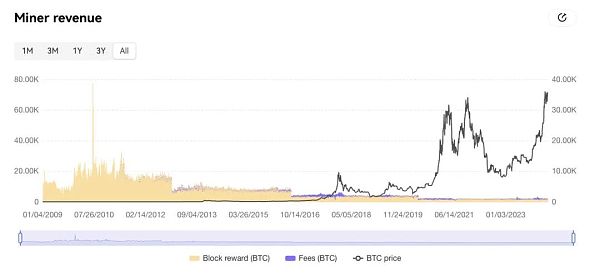

OKLink's "Bitcoin Halving Special Page" The historical price trend data mined shows that from January 2009 to November 2012, the highest price of BTC was only about US$23. During this period, the initial block reward of Bitcoin was 50 BTC.

Bitcoin holders began to explore the "halving" and price rules on November 28, 2012, when the Bitcoin network implemented the rule of halving block rewards for the first time, and the output of each block also dropped to 25 BTC. One year later, on December 1, 2013, the price of BTC reached a new high of $1,127, 47.25 times the previous high.

The recognition that "the halving will set a new high the following year" was deepened the year after the second halving on July 9, 2016.

On May 11, 2020, the third halving ended. When people thought that BTC would reach $67,145 on November 10, 2021, the following year, which was the highest point and a "verification of the law" again, something unexpected happened: on March 14, 2024, BTC hit a new high of $73,737. At this time, the Bitcoin network was still more than a month away from halving.

Observation 2: With fewer incentives, what will support future value?

The huge number of holders and traders is the largest group of Bitcoin ecosystem users. OKLink Bitcoin Browser shows that as of 17:30 on April 12, the number of BTC holding addresses reached 54,047,862, of which the number of active addresses was 726,995, and the 24-hour on-chain transaction volume reached 693.00K BTC.

In addition to holders and traders, miners who maintain the operation of the Bitcoin network are also an important part of the ecological population. If the halving of Bitcoin is good for market traders, it is not so good for miners, because the halving of block production means that they get less rewards from each block.

Under such a reality, miners need to recalculate the input-output ratio of "mining", that is, whether the income from mining BTC can cover or even exceed the input cost (mining machine computing power, electricity, maintenance, etc.).

For Bitcoin miners, income mainly comes from block rewards, followed by transaction fees on the chain. The miner income data on OKLink's "Bitcoin Halving Special Page" clearly shows the miners' income structure.

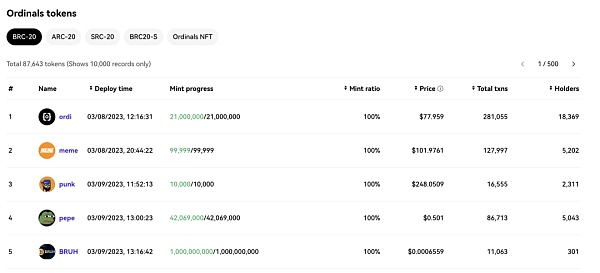

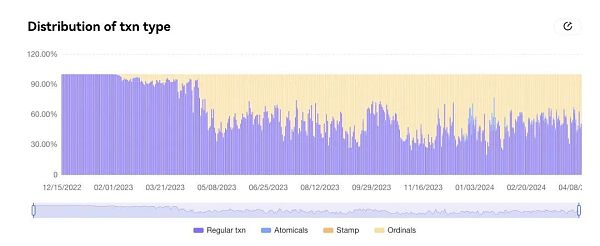

Observation 3: The early rise of the new ecological application "Inscription" This token based on the Ordinals protocol issued on the Bitcoin network - including homogeneous BRC-20 tokens and non-homogeneous Ordinals NFTs, was first created in March 2023 and became popular among the "inscription" user group in May. The inscription protocols on the Bitcoin network have also gradually become richer, and the Atomicals and Stamp protocols have their own supporters in the user group.

OKLink Bitcoin Browser collects all the inscription protocol data on the entire network

OKLink Browser collects all the inscription protocol data on the entire network. The tool shows that as of April 12, there were 87,653 inscription tokens in BRC-20 format on the Bitcoin network, 3,313 Ordinals NFTs; the total number of SRC-20 inscription tokens was second, at 1,013; and 384 ARC-20 inscription tokens.

A large number of inscription tokens were created in the Bitcoin network, which also facilitated large-scale on-chain transactions, and brought miners a fee income that was almost equivalent to mining rewards. With the increase of protocols like Ordinals, users of the Inscription App not only contribute to the transaction fees on the Bitcoin chain, but also enrich the types of Bitcoin transactions.

As the market expands, it is not reliable to follow the history of "Bitcoin halving" to find the exact price, but making good use of Web3 data tools such as OKLink will help value followers discover the progress of Bitcoin adoption. In the data such as the number of currency holding addresses, on-chain transaction volume, number of network nodes, and on-chain transaction types that change over time, the history of Bitcoin is buried, recording the present and the future.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Sanya

Sanya JinseFinance

JinseFinance fx168news

fx168news Nulltx

Nulltx Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Nulltx

Nulltx