In recent years, Web3 has taken the world by storm with non-fungible tokens (NFTs) taking centre stage since the emergence of the metaverse. It is unsurprising that not only were the words Crypto and Metaverse named words of the year by Collins Dictionary but the abbreviation, NFT was also named the Word of the Year in 2021 by the company.

The dictionary defines “NFT” as a digital certificate of ownership of a unique asset, such as an artwork or a collectable. In essence, this means that a work of art or collectable is one of a kind and can neither be replaced nor replicated. It also can’t be broken down into smaller parts the way cryptocurrencies like Bitcoin can be. Whilst there is no denying that plenty of Web3 advocates and NFT enthusiasts come into the space for the art, culture and hype, not many understand nor recognise the power that comes with NFTs. More than just a declaration of support for a project via a profile picture, NFTs are providing real-world utility to people in life-changing ways.

Leverage NFT DeFi powers

Royalties

The first superpower on the list is royalty payments. With ownership, comes royalties. The original artist or creator of an NFT has the power to set conditions that establish royalty fees when an NFT is sold on the secondary market.

In simpler terms, a creator can build a passive income stream from the sale of their NFT even after selling it. These royalty payments are perpetual, meaning they will continue for an indefinite period of time, benefitting the creator significantly in the long run if the NFT continues to sell or get rented out. Furthermore, the percentage of royalties can be set by the creator at his own discretion.

Through the power of blockchain technology, smart contracts will govern the entirety of the royalty process, reducing the responsibilities of a creator.

Staking

Similarly to cryptocurrencies, staking NFTs is a viable option to generate passive income whilst retaining complete ownership over them. This means you can choose to pledge your NFTs to a blockchain, essentially locking them away — which will prevent you from being able to sell them at any point — with the incentive to earn rewards by doing so.

It’s best to take note that only some platforms may allow you to stake a variety of NFTs. Some platforms may require you to purchase native NFTs if you would like to earn rewards.

Furthermore, the tokens earned can be reinvested into staking or even yield farming.

Lending & Renting

With the advancement of Web3, NFT renting and lending have become not only highly profitable for NFT holders but also extremely useful for those without NFTs:

Lending

NFT lending aims to solve the illiquidity crisis of NFTs by generating a marketplace where NFT owners can mortgage their NFTs in exchange for cryptocurrencies or fiat.

Renting

In a similar sense, NFT rentals are designed for users without NFTs that are looking for a quick and cheaper way to enjoy specific utilities such as members-only events that come with an NFT without the need to pay hundreds or thousands of dollars to own them and holding them forever afterwards.

For example, the Bored Ape Yacht Club collection offers exclusive access to the Yacht Club, a members-only merchandise store and Discord server as well as access to more NFTs and airdrops. In essence, it offers owners an ongoing subscription to new utilities and assets.

Undoubtedly, NFT rentals are on the rise…but there aren’t many places to choose from! Nevertheless, there are a couple of protocols pioneering the space and reNFT is leading the race.

reNFT

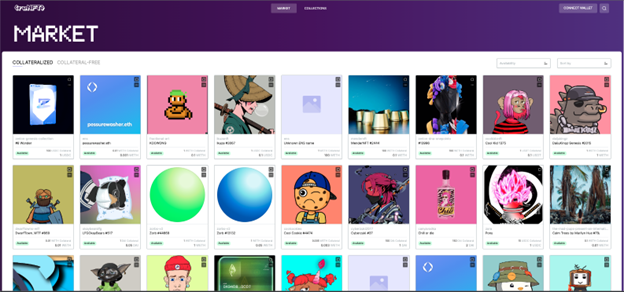

reNFT is a protocol and platform that is set to revolutionise the rental market by enabling companies to rapidly integrate NFT rental functionality into their respective projects. The first NFT rental marketplace on Ethereum, reNFT facilitates trustless renting of NFTs with or without collateral across multiple chains which will soon include compatibility to Polygon, Solana, Avalanche, and more.

(NFT rental marketplace by reNFT)

In simpler terms, if you are an NFT collector with stale assets in your wallet, reNFT enables you to put your NFTs to work by renting them out for a set price, duration and collateral amount. Likewise, as a renter, you can use an NFT that you otherwise wouldn’t purchase or may not be on sale for a set price and a fixed period of time.

$RENT, the protocol’s native token is set to launch later this year. $RENT will be dispersed in a number of ways to lenders, renters and other participants in the ecosystem. reNFT is in the process of becoming a DAO in the coming year; $RENT will allow DAO members to vote on proposals such as the amount of $RENT issued for activities carried out throughout the platform, changing protocol parameters, marketing materials and more.

Furthermore, reNFT fixes the broken Guild scholarship model with its very own Revenue Share Automation that not only simplifies but revolutionises it. Through reNFT’s scholarship automation product, NFT owners will be able to lend NFTs to others with a pre-defined revenue share split for that specific asset. reNFT will automatically distribute earnings of any in-game earned tokens according to the pre-defined percentages.

In essence, this means that the renter does not need to pay to rent an NFT, but can simply use it, as the revenue from playing the game will be automatically shared with the lender; without the involvement of any third party.

Final Thoughts

According to Google Trends, global interest for NFTs rose by 426% in August 2021 with most people showing interest in buying NFTs – there is no doubt that this trend has risen in the past months and will only continue to rise exponentially in the coming years. Thus, instead of holding on tightly to our seats in this bear market, let us put our NFTs to good use and utilise them in ways made possible by projects such as reNFT. NFTs are not only here to stay, they are here to revolutionise the future of Web3. one token at a time.

To learn more about reNFT, visit their website here: https://www.renft.io/

Miyuki

Miyuki

Miyuki

Miyuki Weiliang

Weiliang Brian

Brian Alex

Alex Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Alex

Alex