Author: Marco Manoppo

Source: Pensivepragmatism

In 2021, multiple studies have found that YouTube hosting is the job kids most want to do when they grow up. Long gone are the days when kids would mention typical careers like doctors and astronauts, and younger generations have discovered that creating sensational vlog content on the internet will bring more fame and money.

Jokes aside, we can't deny that Youtube and social media took over the internet and the world about a decade ago, bringing with it a whole new class of "celebrities" who look and feel more like your neighbors. The result of this new type of celebrity, often referred to as an influencer, is a major shift in how we think about branding, status, and culture.

So, how does this tie into NFTs?

The NFT market has experienced its first bull market cycle in 2021, and many retail investors, including those who do not understand finance, have participated. At the same time, celebrities and influencers are flocking to NFTs due to their seemingly "easy to understand" value proposition and the fact that they are easy to make money. As a result, for the first time, we’re seeing cryptocurrencies successfully infiltrate mainstream culture through NFTs — with artists, musicians, and influencers all participating in some type of NFT project.

Perhaps unsurprisingly, after the hype died down and prices stopped rising, there was only growing negativity and skepticism towards NFTs. Many thought, in retrospect, that the $100,000 price tag for jpeg images was a sign of the bubble, without a single actual use case. This negative sentiment has become so bad that there are even more and more Internet celebrities from the perspective of opposing NFT to get more views and exposure.

In this article, I will explain why not all NFTs are useless, and the most strategic and practical use cases for NFTs are in the field of luxury goods, tapping into the human nature of wanting uniqueness and status. In our view, at least in the short term until the regulatory environment matures.

Main points of this article:

The most practical use case for NFTs is tapping into the human nature to seek uniqueness and status.

NFT brands need to be honest and acknowledge that the primary value-add of NFTs is about branding, just like luxury.

Most NFT brands focus too much on the digital experience, which would be the biggest strategic mistake.

Creating an experience that combines reality and digital space through NFT will unlock real value.

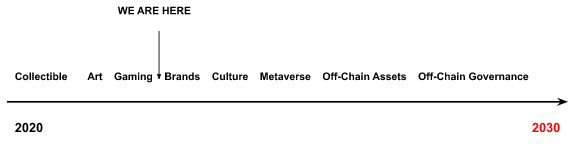

NFT use cases in other industries will not grow until the regulatory environment matures.

In 2022, fame trumps fortune

There is an old saying: "The true happiness in life is being rich and unknown".

While I believe this statement is still true, the rise of influencer culture over the past decade has changed the dynamic between fame and fortune. Gone are the days when celebrities relied on agencies and managers. Celebrities now have direct control over their distribution channels with the help of social media platforms.

As a result, more big names have ventured into business over the past decade. Such as Jay-Z's Marcy Venture Partners, Ashton Kutcher's Sound Ventures. Hollywood stars like Dwayne Johnson and Ryan Reynolds have their own distribution channels and interact directly with their fans, who are also the ultimate consumers of the products they sell. In other words, even your favorite celebrity has become an Internet celebrity.

In short, celebrities with followings have discovered that using their influence to market and sell products is the real reward of fame. This is why Gen Z is more eager than previous generations to become an influencer, because they know that it is getting easier to turn fame into wealth.

So, what does this have to do with NFTs?

The Rise of NFTs

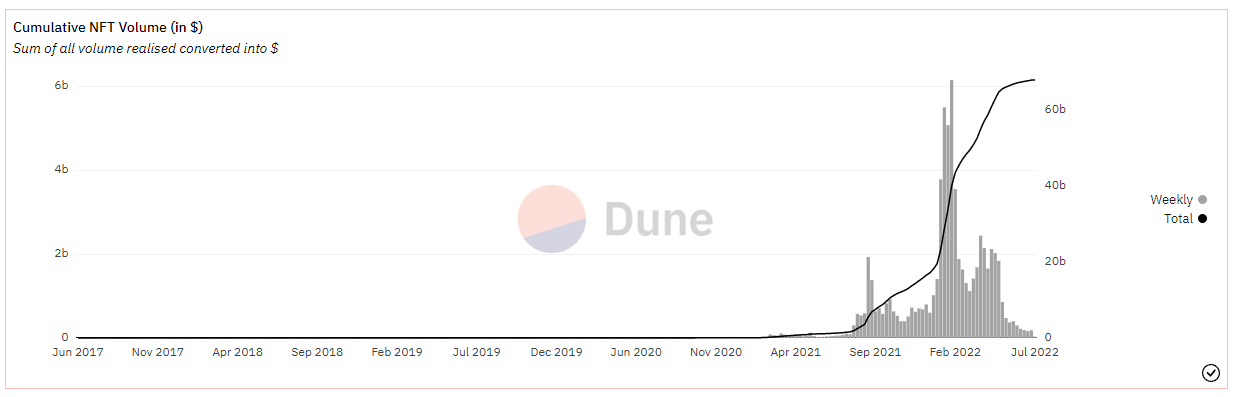

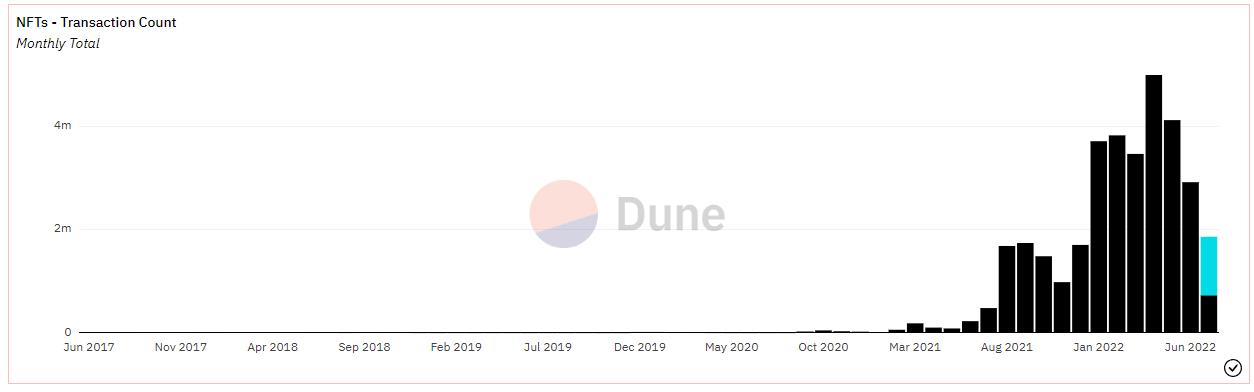

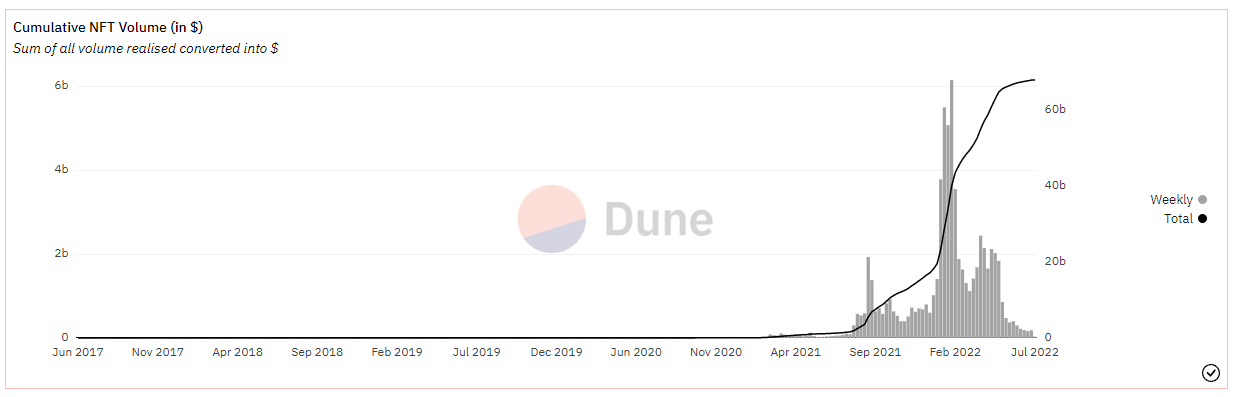

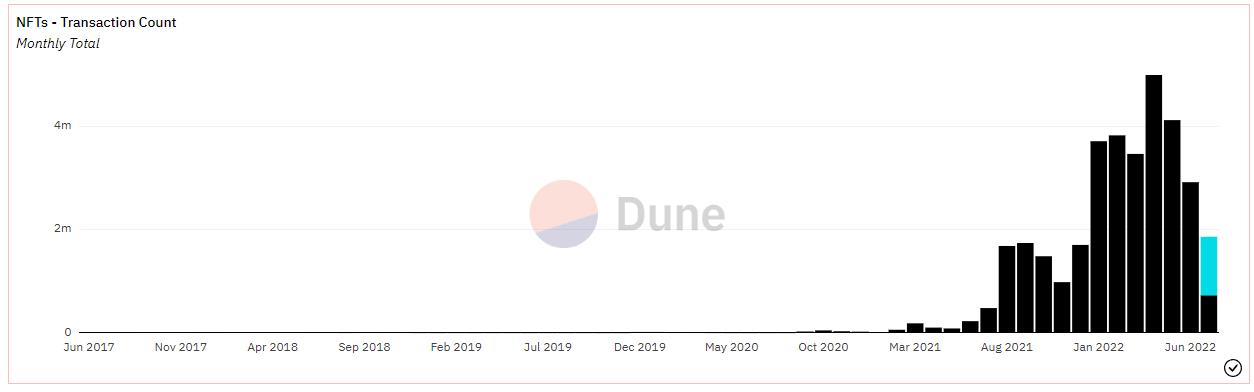

If 2020 is the year when NFTs begin to grow, then 2021 is the year when NFTs truly experience a bull market cycle. What started as an experiment in generating on-chain verifiable, unique pixel avatars and breeding digital cats, NFTs quickly turned into a multi-billion dollar market where market participants put down their mortgage down payments just to join Group of owners of exclusive monkey pictures.

https://dune.com/hildobby/NFTs

With NFT transactions worth tens of billions of dollars, big names and brands have entered the arena to take advantage of this new opportunity to show their audiences that they are young, hip, and tech-savvy. I'm pessimistic on this front, as it would require DAO-like governance, which would require solving multiple problems, a topic that deserves a whole article in itself.

Despite the emergence of different types of NFTs, from avatars to generative algorithmic art, and even 1-1 collections, we have seen many times that all of these are ultimately just risk assets. In fact, when the NFT story seemed to disappear from the avatar collection a few months ago, it quickly returned with the success of Azuki and Moonbirds.

This shows that the uniqueness and sense of belonging associated with a brand or culture is the purest value proposition of NFT.

This value proposition is most similar to that of a luxury brand.

Luxury Brands and Culture in 2022

The luxury industry is a $1.3 trillion industry. Among the top ten richest people in the world, luxury is the only industry other than technology, finance or manufacturing that allows individuals to make the list. In fact, LVMH's Bernard Arnault has repeatedly overtaken Gates, Musk and Bezos as the world's richest man. This shows that the luxury industry has not been "disrupted" by technology, but has been enhanced, because people can now assert their status through digital spaces, not just physical spaces.

The two most important factors that make a luxury brand successful are:

1. Understand the culture

2. Maintain customer relationship and experience

Kering Group understands the culture of the younger generation and decided to make a big move into e-sports and hip-hop culture. Balenciaga is the brand most mentioned in the lyrics of hip-hop songs, and Gucci cooperates with the 100 THIEVES e-sports club. In February 2022, Kering Group also established a team fully dedicated to Web 3.0, and Gucci and Balenciaga also established their own teams. Kering Group CEO François-Henri Pinault said he sees three potential opportunities for luxury in the metaverse:

NFTs associated with physical products

NFTs associated with virtual products

A smart contract that earns revenue through secondary sales

Gucci x 100 Thieves Collection

LVMH understands how to preserve the customer experience and the bonds it has built over decades, so it decided to team up with Prada and Cartier (Richemont Group) to create its own Aura Blockchain Consortium focused on global luxury. Luxury brands like to have full control over the message and narrative they convey to their customers, which is why they came up with their own blockchain. Decentralization purists will argue that this is somewhat antithetical to the notion of the bottom-up decentralized nature of most NFT projects. Ultimately, consumers will make their decisions, and we'll see if bottom-up brands like Moonbirds, BAYP, and Doodles can compete with traditional luxury brands.

Alexandre Arnault turns his CryptoPunk into jewelry

Combining physical and digital experiences

Dolce & Gabbana released its unique 9-piece Collezione Genesi NFT in August 2021, with sales of approximately $5.7 million. Buyers received an NFT and a physical copy of the item, as well as exclusive privileges, including access to future Dolce & Gabbana events. This is a great example of combining physical and digital experiences.

We can also be more creative.

Imagine the Bulgari NFT collection that can bring you the following benefits:

Access to future events and fashion shows.

Early viewing and access to future NFT collections.

Complimentary 2-night stay at Bulgari Resort Bali every year.

Digital rights to use Bulgari products online.

Access to future investment or business opportunities.

If Bulgari launches 10,000 of these NFTs, I wouldn't be surprised if the collection is worth $500 million.

Bulgari Resort Bali

At this point, crypto skeptics might ask:

"Why not just ask for an ordinary premium membership card instead of an NFT?"

good question.

Here are some reasons that may not be obvious at first glance:

Access to the automatically created secondary market

Unlike traditional loyalty cards, NFT itself becomes an "asset" that is fully owned by the owner. The end result is legal rights embedded on the blockchain.

Interoperability with DeFi markets, including lending.

Seamlessly connect with global audiences.

Future integration with the Metaverse project.

So, what do NFT projects need to do?

NFT value proposition: Be part of an exclusive club

NFT collections, whether avatars or generative art, need to develop a roadmap and think "like" a luxury brand - however, it doesn't have to position itself at a super expensive price point, or be the penultimate luxury category form. Any sense of belonging or uniqueness will do. Patagonia is not a "luxury," but it has a unique identity. Supreme isn't a traditional "luxury" brand, but thanks to streetwear culture, its Box Logo T-shirts will sell for $1,000 on the secondary market.

Of course, the premise is that the product can't be bad, but all in all, like how luxury brands can blend with classic and contemporary culture, NFT needs to start building their brands on these basic human instincts, while balancing the financialization aspect. , to ensure that the "experience/bond" created feels real. Focusing on an overly digital experience would be a major strategic mistake for most NFTs. Creating hybrid experiences that combine physical and digital spaces and a relentless focus on delivering what customers want will be key to winning on this track.

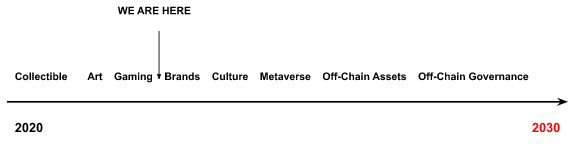

Finally, it’s important to note that the potential of NFTs goes far beyond the luxury industry, but it will be a while before we get there. Concepts such as NFTs for records (healthcare, housing), or copyright/royalties over IP (music NFTs) will face regulatory hurdles in multiple geographies, which we will not go into for now.

JinseFinance

JinseFinance