Original author: TVBee @blockTVBee, twitter

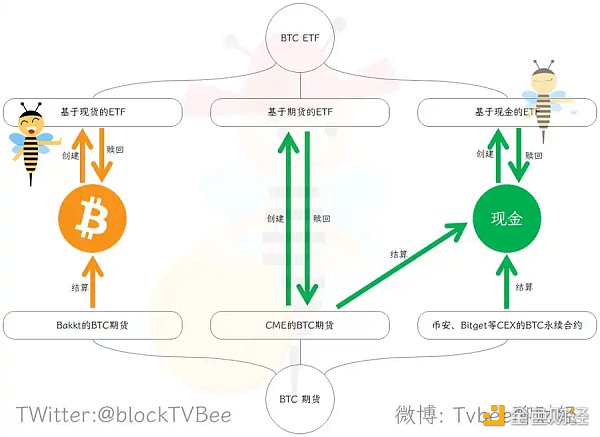

What are the differences between BTC spot ETFs - One picture shows you 3 types of BTC ETFs&3 types of BTC futures

Let’s get some popular science first

About BTC futures

The current mainstream BTC futures include 3 types:< /p>

The first type: Perpetual futures on Binance, Ouyi and other platforms.

The second type: CME (CME Group) BTC futures are settled in cash, so in addition to the settlement cycle, other aspects are the same as the third one. Kind of the same.

The third type: BAKTT’s BTC futures. This BTC futures is settled with spot.

About BTC futures ETF

Currently, most BTC futures ETFs are based on CME BTC futures.

About ETF

ETF (Exchange Traded Fund), exchange-traded fund.

ETF can be created based on a basket of assets or a certain asset. We can call these corresponding baskets of assets or certain assets basic assets or underlying assets. .

ETFs represent a portion of ownership of an underlying asset. This means that the ETF product supports redemption, that is, exchanging the ETF back for an equivalent value of the underlying asset.

Therefore,ETF products cannot be issued in a vacuum. The issuer needs to hold an equal value of the underlying assets in order to issue an ETF.

3 BTC ETFs

ETFs based on BTC spot

Many friends believe that BTC spot ETF is a good thing, and this view is correct.

However, some friends’ understanding is: "Spot ETFs are different from futures ETFs. Futures ETFs can pass, but spot ETFs have never passed because of regulatory reasons. , so when the BTC spot ETF is passed, it means that BTC has been recognized by supervision, so it is good for BTC." This view cannot be said to be wrong, only that it is insufficient.

Spot ETFs from institutions such as BlackRock may be the biggest substantial positive in BTC history.

Because the issuance of ETF products requires holding underlying assets of equal value. To issue a BTC spot ETF, you need to hold an equivalent amount of BTC spot. So:

BTC spot ETF market = BTC spot market

In other words, large-scale global financial institutions like BlackRock are likely to have new BTC investors. These investors do not participate in the existing crypto market. They are more accustomed to, or are subject to regulatory and other restrictions. , you can only purchase ETF products issued by institutions. The greater the market demand for BTC spot ETFs, the more institutions will need to hold BTC spot.

Therefore, large financial institutions issuing BTC spot ETF products can bring incremental funds and a broader international market to BTC spot.

Hong Kong’s BTC spot ETF market can also expand the Asian market for BTC.

ETF based on BTC futures

Currently, many financial institutions issue There are BTC futures ETF products, but these BTC futures ETF products are based on CME's BTC futures, and CME's BTC futures are settled using cash. Therefore, the BTC futures ETF market cannot bring incremental funds to the BTC spot market.

Cash-based BTC

ETF Cash-based BTC, the issuer holds the cash to Issue a BTC ETF and redeem cash upon redemption. Naturally, it will not bring capital flow to the BTC spot market.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Coinlive

Coinlive