Author: Thor, Modern Eremite Source: onchaintimes Translation: Shan Oppa, Golden Finance

Today, we will delve deeper An ecosystem that has kept a low profile since its inception, and in this article I try to answer why.

Created by Mysten Labs, Sui is said to be a next-generation blockchain designed to meet the growing demand for blockchain adoption. You may ask, who is adopting blockchain? The Web2 world that is slowly being integrated into Web3 is slowly finding its way and transitioning into the Web3 realm as the Web3 realm offers new lands to conquer in marketing, user acquisition, and network effects.

Domains relevant to mainstream usage like the metaverse, gaming, social layer, and even commerce all require a specific blockchain to serve their needs - we all remember Ethereum whenever interest surges How expensive will it become. Remember when over $150 million in ETH gas fees were burned during the Otherside NFT minting?

Indeed, this is why in recent months, even during the last bull market, we have seen demand for fast and cheap Layer 1 blockchains that will satisfy the upcoming Mainstream adoption is needed - or at least mainstream hype is needed (if adoption is still too early).

But what about Layer 2 ecosystems like Arbitrum or Optimism? Aren’t they the solution to Ethereum’s high gas fees?

Yes, but there is still a lot to do in terms of Layer 2 adoption - so this is another topic to study in depth, and if we are to meet the huge demand from the TradFi world, we must provide some immediately Stuff, this is where a monolithic blockchain can be most effective.

Key Points

Understanding Sui: the world of parallel chains

Sui and Aptos are often compared because both projects are based on Released during a bear market, and all related to Facebook's long-shelved Diem project. The Diem project was originally designed to handle lightweight payment traffic between a small number of wallets, but due to the public not being ready to accept blockchain technology and the US government not allowing giants like Facebook to introduce payment processing infrastructure, the project was eventually called stop. It’s no surprise, then, that both Sui and Aptos are Layer 1 blockchains based on the Proof-of-Stake (PoS) consensus mechanism, and both employ parallel execution to meet upcoming mainstream adoption needs. Although there are many technical differences between the two, such as differences in consensus mechanisms or data architecture, these details are irrelevant to our discussion today, so we will not delve into them for now.

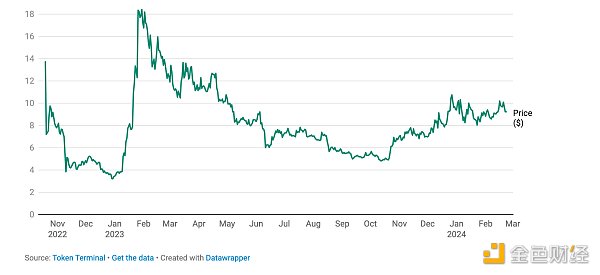

What is really relevant is that both Aptos and Sui are considered to be projects heavily influenced by venture capital institutions, which has led to the broader cryptocurrency community not being very friendly to them since their listing. This can also be seen in early price action.

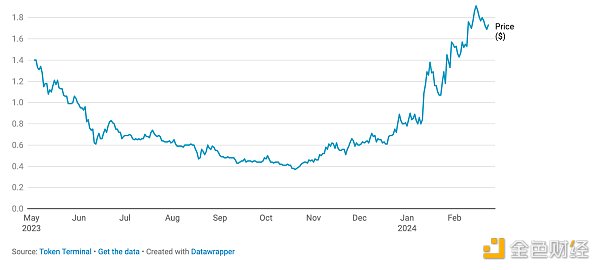

SUI Price Performance

< /p>

< /p>

APTOS Price Performance

Another similarity is that both blockchains use the Move programming language, but the language is used in slightly different ways. On the one hand, Aptos adopted the way Move is used in Diem, while Sui decided to change some concepts and adopt object-oriented アプローチ to make it more suitable for mass adoption - which is why it is in line with the development trend of parallel Layer 1 blockchains.

Over the next few months we will witness another round of Layer 1 wars, similar to the dominant narrative of the 2020/21 cycle. However, this time we will see new contenders joining the arena in the form of Aptos, Sui, Sei, Solana and the yet to be launched highly anticipated Monad. These are all monolithic chains, all support parallel execution, and all aim to compete for market share in the same market segment.

Contrarian Consensus: Recent Growth

As mentioned previously, Sui’s post-listing price action is not surprising as the main trading CTA decided to open a short position and hold it for several months - which It turned out to be very profitable. However, in October 2023, when Bitcoin began to climb and eventually broke above $30,000, SUI also believed that the bottom had arrived and began to rise.

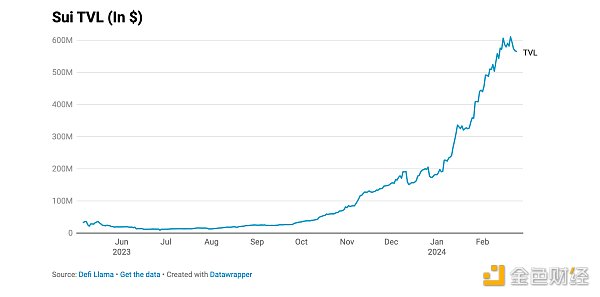

However, price is not the only indicator that is starting to rise, TVL on Sui is also rising. From approximately $80 million in October 2023 to $567 million today, the Sui ecosystem is attracting more funding, but the question arises - how and with what?

The latest reason may be is speculation on the upcoming Wormhole airdrop, which will drive the use of bridging and increase TVL on various chains. Needless to say, this liquidity will not stick around once the airdrop snapshot is complete, but the portion of the recent TVL surge related to Wormhole speculation remains a mystery.

What about Sui’s DeFi ecosystem? Currently, we see major DeFi protocols offering liquidity staking (NAVI), lending and borrowing (Scallop), decentralized exchanges, and perpetual contracts (Cetus and BlueFin), building the core infrastructure for a growing ecosystem. To further emphasize this idea, we can say that incentivizing DeFi protocols can be a way to attract users and liquidity; however, this must go hand in hand with attracting developers to build a variety of different dApps and protocols. It’s also worth mentioning that BlueFin recently partnered with Elixir – a protocol designed to increase liquidity in DEX order books. This caused BlueFin's TVL to surge by approximately 50%, from nearly $9 million to $13.1 million today. Whether this is the beginning of cross-chain integration or simply an Elixir influence-spreading event is hard to say at this point, so it’s worth keeping an eye on the Sui ecosystem for further integrations that may occur in the near future.

Another selling point that could be Sui’s trump card when it comes to attracting users and stirring up sentiment is the lack of tokens for ecosystem projects. If there's one marketing trick a crypto project can do, it's to whet the appetite of users with an upcoming airdrop as a reward for using the project. It would be even better if the airdrop campaign spread across the entire ecosystem, which is the case with Sui It's entirely possible.

On top of that, we also saw the launch of Stardust, which brings a wallet-as-a-service infrastructure designed to attract GameFi builders who will take advantage of all the features Sui has to offer. Building on this, we see an interesting collaboration between MystenLabs (the creators of Sui) and Team Liquid (one of the most well-known esports teams in Europe). In other words, Sui is trying to enter the GameFi world, but why are we seeing this shift?

It has to be said that in the fiercely competitive parallel L1, each ecosystem must find its own market segment to attract users and TVL, rather than competing for the same overly general audience. Solana seems to have found a selling point of its own in crypto culture with its NFTs and memecoins, while Sui doesn't seem to be copying others' success stories and is moving forward to try to attract GameFi users, thanks to its object-oriented Move language and users experience, the user experience is far better than what we saw on StarkNet.

Facing the Future: Potential Problems

While the above sounds very positive and promising, let us not forget to consider all the potential risks and upcoming unlock events that May affect the price of SUI tokens.

As previously mentioned, the price of SUI has been rising steadily since hitting a bottom of $0.36 in October 2023, rising nearly 100% since the beginning of 2024 to almost $2.00, before paralleling The ecosystem narrative slows down and falls back. This goes to show that there is indeed money to be made from it for those who dare to take risks, and there are always big gains to be made by exploring the ecosystem and betting on its projects and memecoins if their prices increase. However, this is not the case for Sui.

The most famous DeFi projects mentioned previously, such as BlueFin, Aftermath or Scallop, currently do not have their own tokens, except for Cetus, which may bring airdrop speculation in the future. However, currently, there are no tokens worthy of speculation or investment, which severely limits the ecosystem’s appeal.

The most obvious example can be the memecoin season on Solana, which produced multiple mini-cycles with short cooling-off periods in between. During these cooling-off periods, the broader market has time to move on to other trends, often associated with memecoins on different chains - Sui has one too. The most anticipated memecoin launch on Sui was the memecoin with the trading symbol $FUD, which followed the most hyped trend at the time, namely dog-themed tokens. However, the price action was lackluster, as after the initial spike, interest waned and liquidity quickly left the chain.

What seemed like a way to attract liquidity to the ecosystem ended up being short-lived as liquidity disappeared within hours of launch. In addition to this we can also see very few market makers, i.e. the number of people buying and selling tokens, around 150 or so for the top 4 memecoins, while $SUI itself is slightly above 250. Needless to say, even on the Solana chain, which is losing steam, we see thousands of market makers every day, so it’s fair to say that interest in the Sui ecosystem is almost non-existent.

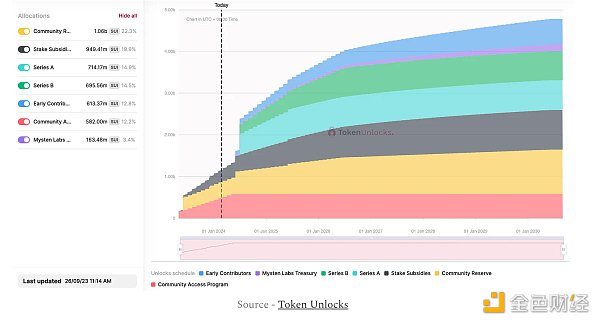

There is also an unanswered question, and that is the unlocking plan. Monthly unlocks will be around 0.65% of the total supply, equivalent to around 5.5% of the current market cap, which is $110 million in USD - these are rough estimates as the price of $SUI is constantly changing as a % of market cap and the dollar value changes accordingly. While monthly supply appears to be priced in by the market, the upcoming unlock in May could severely impact prices.

May 3 , the supply of Sui will increase by 8.27% to approximately $1.4 billion in U.S. dollars, accounting for approximately 71% of the current market capitalization. It’s difficult to predict how the market will react to such a massive unlock. However, we may see a so-called “liquidity cushion” gradually build up, which will offset the released supply to some extent, as is often the case with $DYDX unlocks. On the other hand, given the relatively low interest in the Sui ecosystem at the moment, it may be difficult to attract enough liquidity to build such a safety buffer, and the market will start pricing in weeks before the unlock occurs.

While it’s impossible to predict the future, looking at the market and SUI’s volume-to-cap ratio can tell the story of how the market is trying to cope with the coming unlock.

Conclusion

Blockchain adoption is likely to explode in the coming months and years, not only among mainstream users but also Web2 brands - as we This trend has already been seen taking shape during the 2021 Metaverse craze. With all of this in mind, there is a growing need for fast and cheap blockchains that will be able to help millions of users explore the emerging and exciting field and the multitude of dApps that will come with it.

Sui is not the only contender in this space, there are strong competitors like Solana, Aptos, Sei and the upcoming Monad, all of which will compete for a share of the "mainstream-oriented" segment. market share. Beyond this, we will see a proliferation of Layer 2 ecosystems that may offer similar functionality after a period of lag, which, coupled with Ethereum's overall strength and network effects, may serve as Sui's platform in the same Strong competitors competing for market share on the route.

The dominant theme of the last round was the war between alternative Layer 1 projects. This time we will see a similar scenario play out, but this time what we will see is a war between Layer 1 ecosystems, and instead a war between sub-Layer 1 projects and monolithic chains that will compete to become the “ The go-to place for “Mainstream” dApps.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Weiliang

Weiliang JinseFinance

JinseFinance JinseFinance

JinseFinance Others

Others Cointelegraph

Cointelegraph