Author: Jason Chen Source: X, @jason_chen998

Binance has recently launched three chain abstraction/full-chain interoperability projects, Axelar, Wormhole and Omni, and LayerZero is likely to be listed on Binance after its coin issuance, as well as a large number of Zeta, Connext, Entangle, DappOS, etc. that have not been listed on Binance... The explosion of modularization has spawned the explosion of chain abstraction, resulting in this year being the "cross-chain year". I have already written separate articles on most of the chain abstraction projects. Many readers asked me to talk about Axelar, a veteran project that has been issuing coins for a long time but has just been listed on Binance.

First of all, I personally think that most of the projects that have been issued for a long time but listed on Binance in the bull market should not be touched for the time being, because many people have waited so long to finally wait for Binance to start selling, such as Metis, TAO and Axelar, so you have to wait for digestion and washing before choosing the opportunity to enter the market to pick up leaks.

I have previously sorted out a project that has been invested by Binance and has issued coins but has not been listed on Binance. Axelar was successfully hit in it. I am also waiting for APX, which is also in the list, to see if this round of bull market can give a surprise.

First of all, Axelar’s recent action that is worth paying attention to is to cooperate with Sui to build a global liquidity layer, and claim that "it is possible to increase the liquidity of all Web3", but more detailed content has not yet been released. The official tweet said that it is necessary to wait for further proposal refinement. The concept of global liquidity layer was first proposed after Osmosis and Axelar cooperated in 2022. Osmosis naturally became the largest cross-chain Dex at present. Yes, Axelar is also a Cosmos ecological project developed based on Cosmos SDK. The Cosmos ecology really won this round.

The cooperation between Axelar and Osmosis, two projects belonging to the Cosmos ecology, has achieved good results. Therefore, Axelar jumped out of the Cosmos ecology and sought to cooperate with other public chains including Sui to replicate the global liquidity layer. The final effect is to help the public chain DEX to connect with other public chains to deepen liquidity, and improve the efficiency of deposits, withdrawals and transactions to achieve the CEX effect as much as possible.

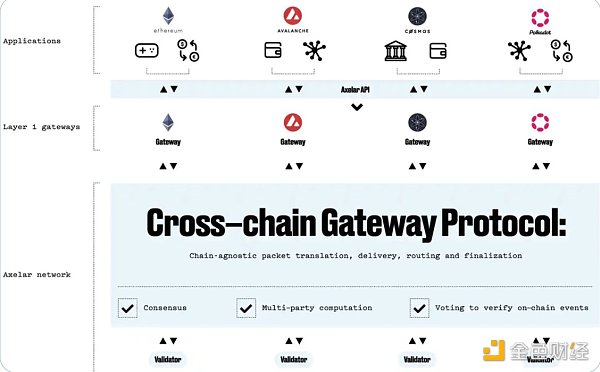

It is worth noting that Axelar itself is a chain, and its structure is shown in the figure below. It is not a cross-chain bridge, so Axelar also has nodes and smart contracts to implement various complex logics, and has its own virtual machine Axelar VM, which can automatically execute complex interactive operations in the cross-chain process. Therefore, Axelar’s official website defines itself as "Ethereum has established programmable currency, and Axelar is building programmable interoperability." Many friends asked me what the difference is between chain abstraction and cross-chain bridges. In fact, chain abstraction is an upgraded version of the cross-chain bridge. The main difference lies in whether it has programmability and scalability, just like the difference between iPhone smartphones and Nokia feature phones.

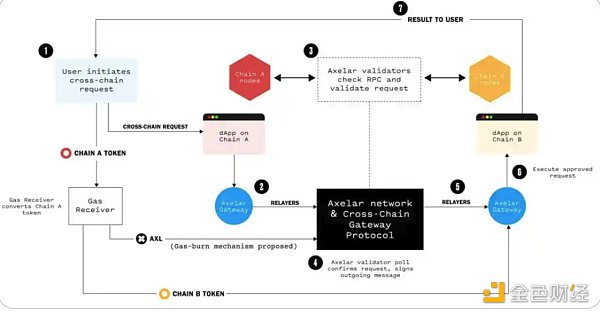

Because Axelar is a chain, its token is used for staking governance as well as paying Gas fees. The specific mechanism is shown in the figure below. According to its official 2024 RoadMap, this year it plans to promote the implementation of the Gas deflation mechanism in two steps:

1. Reduce the rewards for each third-party public chain after joining the Axelar ecosystem, which was previously inflationary.

2. Burn part of the Gas fee originally paid to the validator node to achieve deflation, similar to the state of Ethereum after EIP1559.

Currently, the first step has been completed and the second step is being proposed, so this is an Alpha that needs to be paid attention to. Check the official community from time to time.

Cross-chain interoperability is indeed a very competitive track with many giants. There are Chainlink, LayerZero, Wormhole, Axelar, Zeta, Entangle.... Any one of them is a very powerful unicorn level. Axelar has a relatively solid fundamentals. Axelar has executed more than 1 million transactions with a cumulative transaction volume of nearly US$7 billion. The ecosystem has already integrated

DeFi: dYdX, Frax Finance, Lido, PancakeSwap, Uniswap

Traditional enterprises: Mastercard, Microsoft, JPMorgan Chase

RWA: Centrifuge, Circle, Ondo Finance, Provenance

Wallet: Ledger, MetaMask, TrustWallet.

In summary, Axelar is a project with fundamentals, future expectations (virtual machine opening + economic model deflation), and has been falling since listing on Binance, and has a certain opportunity to pick up bargains.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance YouQuan

YouQuan Xu Lin

Xu Lin Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph