Author: Regan Bozman, Partner at Lattice Capital; Translation: Jinse Finance xiaozou

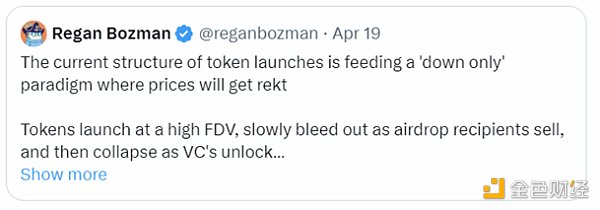

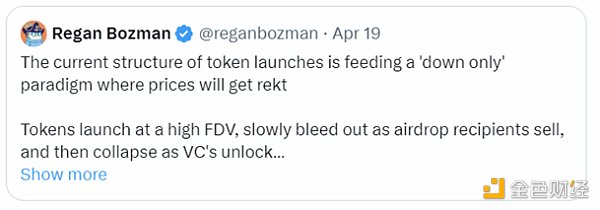

Why is this cycle so painful and everyone is so distressed? We can attribute all the problems to the fact that retail investors can no longer make any money under the current market structure. This article will bring some unsystematic ideas around returning to the basics.

Why is it difficult for retail investors in this cycle? The answer is very simple: because "transactions" like infrastructure tokens will no longer increase 500 times in the crypto market. And now there is a more interesting playground not far from us, with better memes.

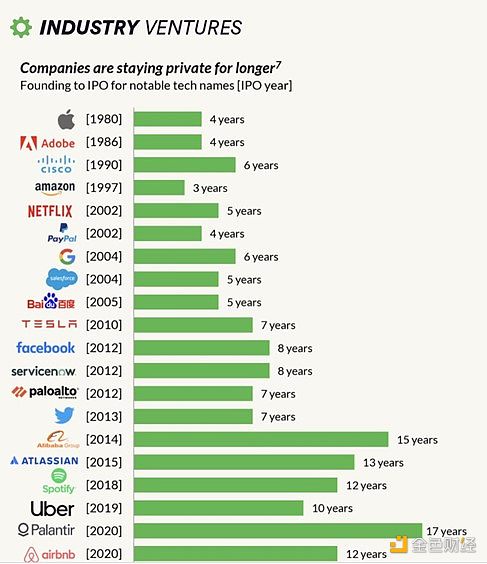

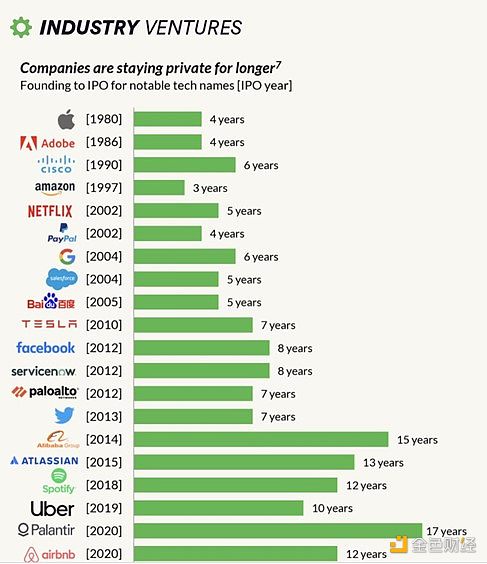

We are actually reproducing what happened in the VC/IPO market.

In these markets, companies stay private longer, which means that more of the upside is "private" (such as VC funds) and retail investors can't touch it at all.

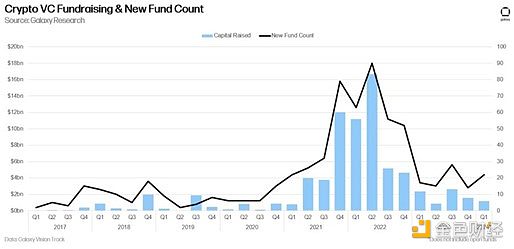

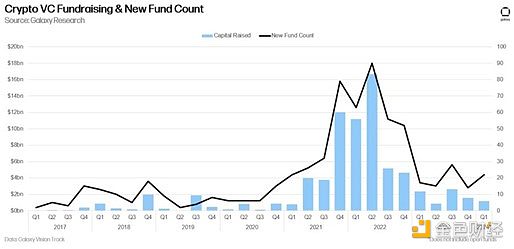

Crypto has been turning this around and democratizing access to asymmetric upside. But now it’s changed! L1 and L2 are raising much more money from VCs! Without public token sales, VCs are making a lot of money and retail investors are suffering. Maybe the collapse of retail investors’ dreams in this cycle is not so surprising.

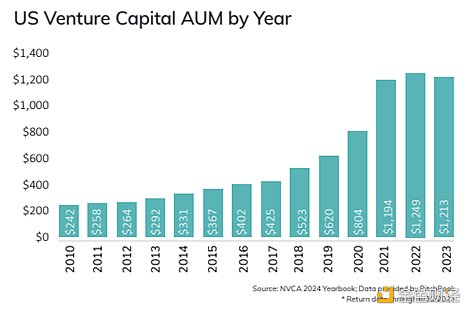

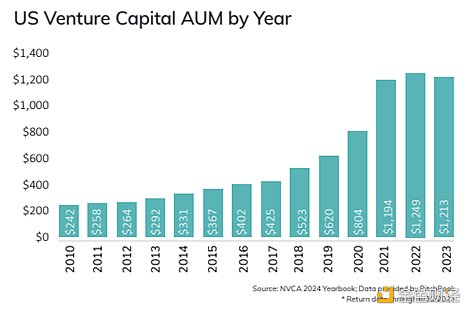

A big reason companies are staying private longer is that VC funds are 5x larger than 10 years ago. Companies can now raise over $1 billion in private markets while avoiding the overhead associated with public markets.

As expected, the same trend is also happening in the crypto VC field - the scale of crypto VC funds is much larger than five years ago.

Crypto should have solved this problem! ICOs were designed to democratize capital formation and thus venture returns. They have completely succeeded in doing that… unless you are lucky enough to have a US passport.

ETH was 30 cents at the time of the 2014 ICO, and is now worth $3,000. That’s a 10,000x return in 10 years, easily beating any venture capital investment during that time. Anyone in the world can participate, which is awesome

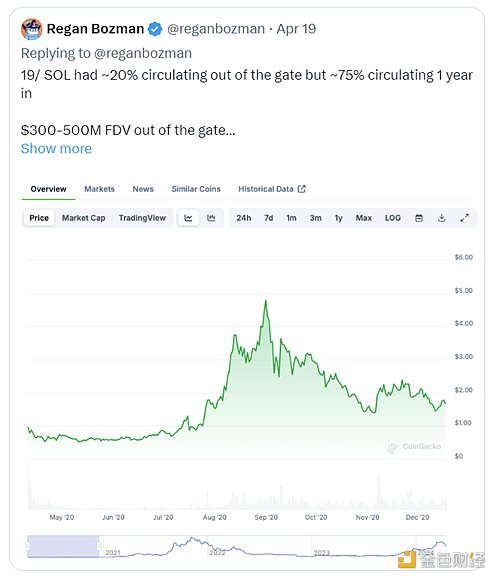

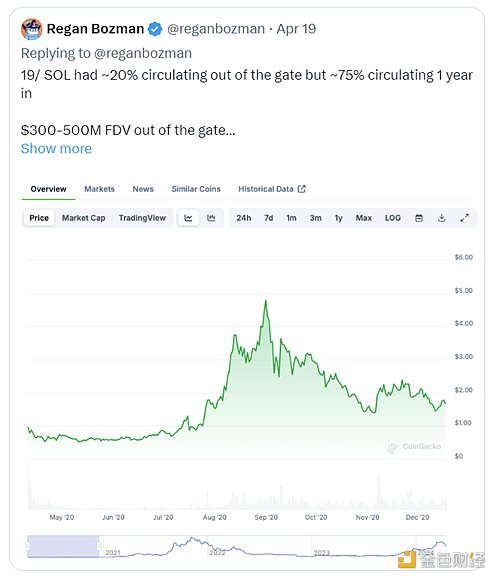

Now that the industry is clearly growing, the entry price has naturally increased, but the opportunity has not disappeared. SOL was launched at $0.22 in 2020, and 4 years later, it’s $140, a 636x return over 4 years, which probably also beats almost all venture capital returns in the past five years.

We have moved away from this market structure this cycle. Now, the chances of retail investors buying pre-launch tokens or buying tokens at low prices on the open market are close to zero.

Airdrops are definitely an improvement over the existing risk model, where early users have no economic advantage. But it is a worse financial transaction than a token sale because you can only make so much from an airdrop.

The original uncapped upward market has brought us to the market cap, and how huge the transactions during this period must be. In the last cycle, the SOL ICO with an investment of $1,000 has now become $636,000. In this cycle, the Eigen with an investment of $1,000 can only become $1,030. Even if it grows 10 times, it is only $10,300.

In the last cycle, you controlled your own destiny, but in this round, you are waiting for the charity of Eigen's father.

Financial anarchism means recognizing that these markets have always been about money. Yes, the money is invested in technology, but it is the money that keeps the wheels of development turning. Without the money, the wheels will fall off.

There are things we can do to improve the current distribution structure. It all comes down to creating unlimited upside for early users and the community.

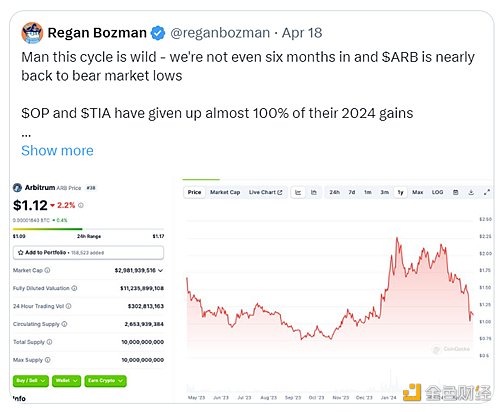

That said, there are bigger structural problems in the market. These massive L1 and L2 rounds have resulted in multi-billion dollar pre-coin valuations. This creates two problems: huge sell-side pressure, and too high FDV.

In my opinion, a large part of the structural problem for most altcoins in this cycle is that VC selling pressure has not been offset by retail inflows. If you raise $500 million before the launch, the final selling pressure will be $500 million (in theory, if the token price rises, the selling pressure will be greater).

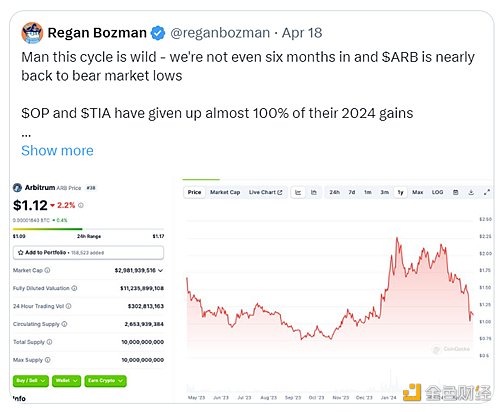

ARB fell back to the bear market low in the bull market due to too much selling pressure

Private fundraising at a higher FDV means that the final FDV will be higher, which will definitely lead to a downward trend.

Price trend of high FDV representative token ICP

The relationship between venture capital and retail investors is not necessarily antagonistic. Everyone has made money through SOL.

But it's even harder if you try to put too much risk money into illiquid markets.

We point fingers and argue about Meme coins, but that's definitely not the point. Meme coins are not the problem, the problem is our current market structure.

We need to break through the current market fog and return to our democratic roots.

JinseFinance

JinseFinance