Source: insights4vc Translation: Shan Ouba, Golden Finance

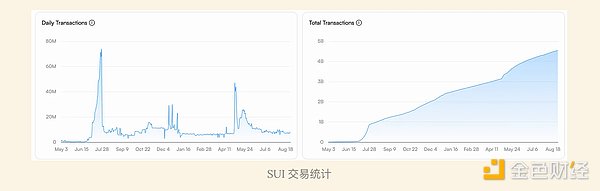

As blockchain technology continues to develop, Layer 1 blockchains are leading the way in enhancing scalability, security, and transaction speed. Among them, Sui stands out as a compelling Layer 1 blockchain designed to provide superior transaction performance and efficiency. In early tests, it achieved 297,000 transactions per second (TPS), significantly better than competitors such as Aptos (founded by Avery Ching and Mo Shaik, who were involved in Diem's Novi wallet) and Solana, both of which have lower TPS. Despite their common origins, Sui is an independent project with no direct connection to Aptos and does not rely on Diem's architecture.

Diem (formerly Libra)

Originally launched by Facebook in 2019 as Libra, Diem is a digital currency project that aims to create a global stable cryptocurrency for fast and low-cost international transactions. The project aims to address financial inclusion issues and provide a stable medium of exchange, especially in developing countries where banking services are limited.

Key Features:

Stablecoin Approach:

Diem is designed as a stablecoin whose value is backed by a reserve of real-world assets, such as a basket of major currencies (USD, EUR, GBP, etc.) to reduce volatility compared to traditional cryptocurrencies such as Bitcoin.

Permissioned Blockchain:

Unlike decentralized cryptocurrencies, Diem is designed to run on a permissioned blockchain where only approved participants (such as businesses or financial institutions) can verify transactions, aiming to enhance security and adhere to regulatory standards.

Governed by the Diem Association:

The project is governed by the Diem Association, an independent consortium based in Switzerland comprised of a variety of member organizations from different industries, including technology companies, financial institutions, and non-profit organizations. Each member has equal voting rights in decision-making.

Diem Payment System:

The Diem network aims to provide a digital payment system that integrates with digital wallets such as Facebook's Novi (formerly known as Calibra) and other financial services to facilitate transactions, remittances, and payments.

Challenges and Changes:

Regulatory Resistance:

Diem has faced intense regulatory scrutiny and opposition around the world due to concerns about financial stability, monetary sovereignty, and data privacy. Many governments have expressed concerns about private companies like Facebook issuing their own currencies.

Rebranding and Repositioning:

In response to regulatory obstacles, the Libra Association changed its name to the Diem Association in December 2020, shifting its focus to a more strictly regulated, dollar-pegged stablecoin.

Project Cancellation:

Despite Diem's efforts to comply with regulatory frameworks, it has struggled to obtain the necessary approvals. In January 2022, the Diem Association announced the sale of its assets and intellectual property to Silvergate Capital Corporation, thus terminating the project.

Sui's Layer 1 Blockchain

Despite previous involvement in Meta's blockchain project, the focus here is on the technical reasons for launching a new Layer 1 blockchain. Sui aims to improve application interoperability, which is often hindered in existing Layer 2 and multi-chain ecosystems. Sam Blackshear, CTO of Mysten Labs, said Sui enhances usability by allowing seamless interaction between applications while ensuring cost-effectiveness, scalability and security.

Sui's success depends on being able to prove these capabilities and demonstrate technological innovation. Sui initially benefited from Meta's reputation and well-known investors, but its long-term viability depends on its unique technical architecture.

Architecture

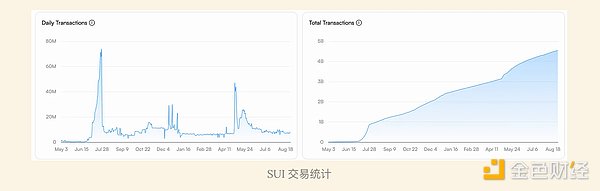

Sui is an evolving layer 1 blockchain that currently uses Narwhal as its transaction pool protocol and Bullshark as its consensus engine, with plans to introduce a new engine, Mysticeti (mainnet launch on July 24, 2024, with plans to unify Mysticeti-owned objects in Q4 2024).

Separation of transaction pool and consensus: Sui separates the transaction pool and consensus, a design derived from the Diem blockchain. Narwhal improves transaction sharing among validators, while Bullshark uses directed acyclic graphs (DAGs) for efficient consensus to handle transaction ordering.

Upcoming Mysticeti Enhancements: To further reduce latency and improve performance, Sui plans to replace Bullshark with Mysticeti, which uses signed blocks and a common commit rule for faster consensus. Despite concerns about security, Mysticeti uses a threshold logic clock to ensure correct block ordering, thus maintaining integrity.

Core Team:

Co-founder and CEO: Evan Cheng- Over a decade of experience at Apple, he led the development of LLVM (Low Level Virtual Machine). LLVM was originally started at the University of Illinois and was heavily promoted by Apple’s backend team to improve the performance of iOS apps. For his work on LLVM, Cheng received the ACM Software Systems Award in 2012, together with Chris Lattner.

Co-founder and CTO: Sam Blackshear - Creator of Move, Sui’s programming language, developed during his time as Chief Engineer at Meta. He played a key role in developing the Diem blockchain and co-authored the Libra blockchain whitepaper. At Sui, Blackshear was responsible for the development of programming languages and blockchain architecture.

Co-founder and Chief Product Officer: Adeniyi Abiodun - Previously worked in software engineering at JPMorgan and HSBC, blockchain design at Oracle, and product management at VMware. Abiodun built a strong foundation in these areas before joining Meta and leading product development.

Co-founder and Chief Cryptographer: Kostas Chalkias - Leads crypto initiatives at Meta and R3. He is a co-author of Sui’s zkLogin framework and has been involved in developing features such as zkSend. His work on zero-knowledge (ZK) technology is often mentioned in discussions about integrated blockchain consensus design.

Co-founder and Chief Scientist: George Danezis - Former Professor of Security and Privacy Engineering at University College London (UCL) for ten years and currently a Fellow at the Alan Turing Institute. He is known for publishing the “Narwhal and Tusk” consensus paper in 2022 and is a co-author of the novel consensus algorithm Mysticeti.

Sui Financing Insights - Total Funding: $385.37 million

Financing Rounds:

Series A: Date: December 6, 2021 | Funding Amount: $36 million

Selected Investors:Andreessen Horowitz (a16z) (lead),Lightspeed Venture Partners, Electric Capital, SamsungNext, Slow Ventures, Standard Crypto, Redpoint, Hack VC

Series B Round: Date: September 8, 2022 | Raised: $300M

Selected Investors: Andreessen Horowitz (a16z) (Lead), FTX Ventures (Lead), Coinbase Ventures, Binance Labs (Incubator), Circle, Lightspeed Venture Partners, Jump Crypto, Franklin Templeton, Apollo Global Management

Initial Exchange Offering (IEO) & Launch Pool:

IEO: Date: May 1, 2023 — May 2023 3 days | Raised Amount:$2.82 million |Price:$0.03 | ROI: 27.79x (+2,679%) |Platform: Bybit

Launch Pool:Date: May 1, 2023 — May 3, 2023 |Price: Free | Supply Allocation: 0.40% (40.00M SUI)| Platform: Binance

Launch Pool:Date: May 1, 2023 — May 3, 2023 |Price: Free | Supply Allocation: 0.40% (40.00M SUI) left;">IEO: Date: April 23, 2023 — April 24, 2023 | Amount raised: $22.5 million |Price: $0.100 | ROI: 8.34x (+733.7%) |Platform: KuCoin Spotlight

IEO: Date: April 23, 2023 — April 24, 2023 | Amount raised: $22.5 million |Price: $0.100 | ROI: 8.34x (+733.7%) |Platform: OKX Jumpstart

IEO: Date: April 23, 2023 — April 24, 2023 | Raised Amount: $750,000 |Price: $0.03 | ROI: 27.79x (+2,679%) |Platform: KuCoin Spotlight

left;">IEO: Date: April 23, 2023 — April 24, 2023 | Amount raised: $750,000 |Price: $0.03 | ROI: 27.79x (+2,679%) |Platform: OKX Jumpstart

IEO: Date: April 23, 2023 — April 24, 2023 | Amount raised: $500,000 |Price:$0.100 | ROI: 8.34x (+733.7%) |Platform: Bitforex Turbo Starter

Sui (SUI) Token Economics

Overview (August 29, 2024)

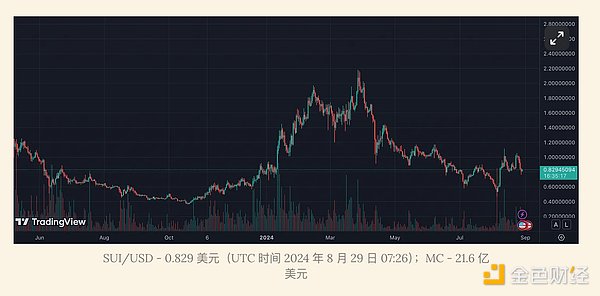

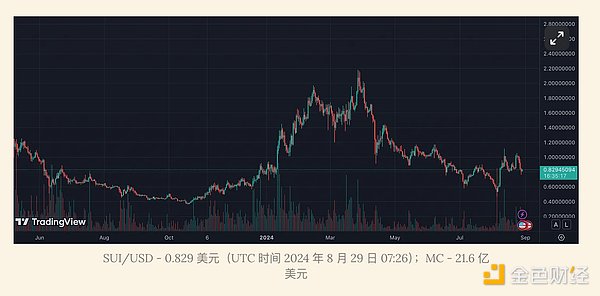

Market Cap (MCap): $2.158 billion

Fully Diluted Value (FDV): $8.314 billion

Circulating Supply: 2,596,086,126.66 SUI

Max Supply: 10,000,000,000.00 SUI

Circulating Supply as % of Max Supply: 25.96%

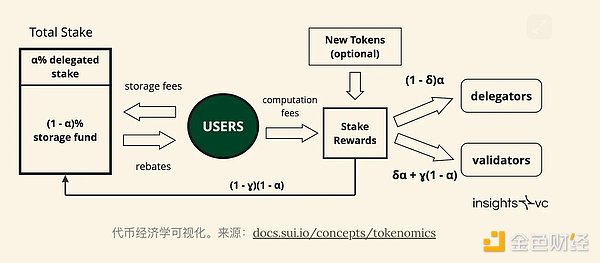

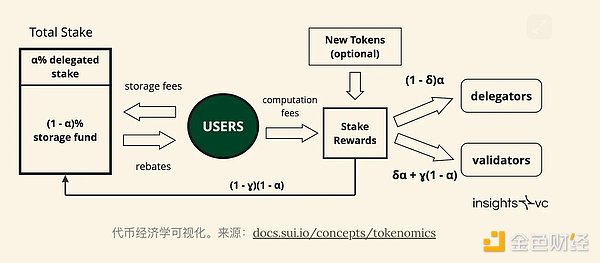

Storage Fund

Purpose: The Storage Fund aims to provide storage rewards to nodes over time, ensuring the long-term sustainability of the Sui network.

Funding Source: Funded in part by transaction fees paid by users. Fees are divided into execution (computation) and storage costs, the latter of which goes into the Storage Fund.

Growth Mechanism: The Storage Foundation grows over time as SUI tokens are incorporated into the stake pool and are rewarded in Sui’s Proof of Stake (PoS) system.

Gas Fees and Rebates: The gas fees paid by users cover both computation and storage costs:

Total Gas Fee Formula: total_gas_fees = computation_units * reference_gas_price + storage_units * storage_price

Users receive rebates when they delete storage objects, reducing the net fee:

Net Gas Fee Formula: net_gas_fees = computation_gas_fee + storage_gas_fee - storage_rebate

Delete Option: Users can delete certain on-chain data (e.g. NFT metadata, expired tickets) and receive a partial refund for storage fees, incentivizing users to delete unnecessary data while not affecting the immutability of the blockchain.

Transaction Fee Calculation

Dynamic Fee Structure: Transaction fees vary with each epoch. Validators set the minimum fee they accept, with a reference cost based on the lower 66.67 percentile and weighted by the amount of SUI staked.

Validator Performance: At the end of each epoch, validators evaluate each other's performance (e.g. response time), which affects rewards. Validators that set higher fees or fail to process transactions receive lower rewards, encouraging competition and driving down fees.

Move

Sui uses a unique version of the Move programming language, which was originally developed by Sam Blackshear during his tenure at Meta. Move is designed for blockchain use, with an emphasis on security and stability. Sui has adapted Move specifically for its needs.

Move's Key Features

Resource-Oriented Programming:

Resources are treated as first-class value, meaning they can be stored and transferred, but cannot be copied, discarded, or moved without authorization.

This approach maintains stability while providing flexibility. Examples of resources include crypto assets, smart contract states, NFTs, and on-chain voting rights.

Data Abstraction:

Hides the complexity of data management, making it easier to work with resources without having to understand the underlying details.

Enhanced security for developers by specifying allowed operations and conditions to control access to resources.

Static Verification:

Uses type assignments and rules to detect errors and vulnerabilities before code is executed.

Features a borrow checker to prevent unexpected data changes and ensure that data references do not outlive the data.

Supports formal verification to verify contract logic.

Differences between Sui Wenjing and Li Shangyin

While the original Move was built for a permissioned blockchain (Diem) with an account-based model, Move on Sui is tailored for Sui's permissionless blockchain and differs in key areas:

In Sui's object-oriented model, data is stored via unique object IDs rather than global addresses, simplifying asset management and transfers. Each object is assigned a unique ID that is stored in a global storage, which makes asset transfers easier without the need for complex logic.

In addition, Move on Sui supports transaction parallelization, allowing multiple transactions to run simultaneously. Unlike the original Move, where transactions are tied to account data and may cause conflicts, Sui's model ensures that transactions affecting different objects do not interfere with each other, allowing for more efficient processing.

Selected Protocols and Projects in the Sui Ecosystem

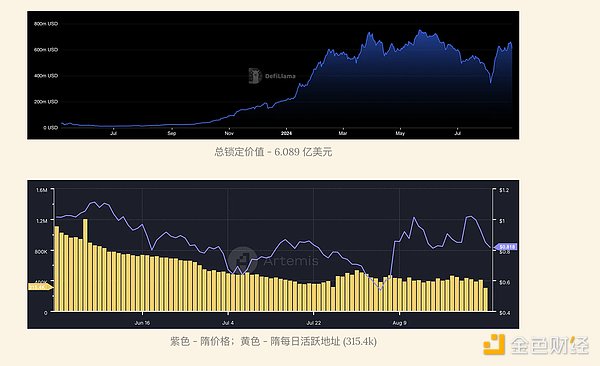

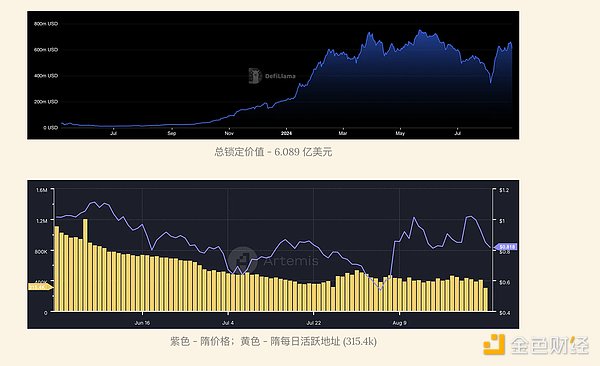

Navi Protocol: The leading liquidity protocol on Sui, providing lending services for native assets, liquidity staking tokens, and stablecoins. The protocol has a market size of $278 million and more than 850,000 users, accounting for more than 50% of the total locked value of lending on the network.

Bluefin: A DEX on Sui, targeting professional and retail traders, with a trading volume of more than $30 billion. Known for its competitive funding rates and efficient liquidation process, it provides a stable trading environment.

Aftermath Finance: A DeFi platform for trading, investing, and yield earning, with a total locked value of more than $50 million. Features smart order router and dynamic gas to optimize user experience and cross-chain functionality.

DeepBook : Provides a central limit order book (CLOB) for high-frequency trading on Sui, with over 21 million transactions. It supports low-cost, high-speed transactions, which is critical to the DeFi ecosystem.

Pyth Network : The main oracle network on Sui, providing real-time market data from more than 90 providers on more than 20 blockchains, widely used for DeFi services on Sui.

Sui Wallet: Created by Mysten Labs, it is a popular wallet with an "Apps" tab for discovering Sui applications. The mobile version enhances user accessibility.

Consumer Adoption of Sui: Driven by features like zkLogin for secure social login, sponsored transactions to reduce user fees, and SuiNS for easy-to-use domains, enhancing the user experience.

FanTV: Leading social streaming platform on Sui with over 3.5 million users and 9 million transactions. Engaging users through a rewards mechanism to drive adoption across the ecosystem.

Wormhole: A bridge protocol connecting Sui to other blockchains, including Ethereum, to increase liquidity and interoperability.

Turbos Finance: DEX on Sui with $7M daily trading volume, leveraging the Move programming language to enable innovative DeFi functionality and ecosystem growth.

Key indicators (August 29, 2024)

JinseFinance

JinseFinance