Source: Binance official website Compiled by: Shan Oppa, Golden Finance

At 15:50 on March 6, 2024,Binance announced:Binance New Coin Mining is now online for the 48th phase of the project - < /strong>AEVO (AEVO), a decentralized derivatives trading platform.

Users can register at 08:00 on March 08, 2024. 00 (East Eight District time) After that, put BNB and FDUSD into the AEVO mining pool on the Launchpad website to get AEVO rewards. A total of AEVO can be mined5 days.

New currency listed

Binance will beAt 18:00 on March 13, 2024 (East Eighth District time)List AEVO (AEVO) and open AEVO/BTC , AEVO/USDT, AEVO/BNB, AEVO/FDUSD and AEVO/TRY trading markets, seed tag trading rules apply.

AEVO (AEVO) Introduction

Token name: AEVO (AEVO)

Token maximum supply: 1,000,000,000 AEVO

Initial circulation: 110,000,000 AEVO (11% of the maximum supply of tokens)

Total mining amount: 45,000,000 AEVO (4.5% of the maximum supply of the token)

Smart contract details: Ethereum

Restrictions: KYC required

Personal hourly mining hard cap

BNB mining pool: 30,000 AEVO

FDUSD mining pool: 7,500 AEVO

Mining pool:

BNB mining pool (the website will announce this 2 Within fourteen hours, updated before the mining activity opens): A total of 36,000,000 AEVO can be mined (80%)

FDUSD mining Mining pool (the website will be updated within 24 hours of this announcement before the mining activity opens): A total of 9,000,000 AEVO can be mined (accounting for 20%)

Mining time: East Eighth District time from 08:00 on March 8, 2024 to 07:59 on March 13, 2024

Mining quota stage allocation

Note: The above table is daily UTC time is used, which is converted into East Eighth District time from 08:00:00 am on the current day to 07:59:59 am on the next day.

Aevo (AEVO) project research report

Aevo is a decentralized A professional derivatives trading platform focusing on options and perpetual trading. The decentralized exchange runs on Aevo L2, an Ethereum roll-up based on the OP Stack.

Aevo is a decentralized derivatives exchange focusing on options and perpetual trading , running on Aevo L2, is an Ethereum roll-up based on OP Stack.

Aevo's native token has the following use cases:

Governance: Aevo token holders can contribute to network upgrades, newly listed trading pairs and the DAO Governance to vote

Staking: Users who stake Aevo tokens will receive discounts on trading fees on the Aevo exchange and trade on Aevo Get higher rewards in the developer reward program

The protocol consists of the following main components:

< /li>Aevo L2: Aevo Exchange at Aevo Running on the L2 chain, this is an Ethereum roll-up based on OP Stack

Aevo Exchange: Orders on Aevo Exchange are Sent to off-chain order book but settled on Aevo L2 chain

The project has been in 3 rounds of financing Raised $16.6 million

Seed round: 10% of the total amount, valuation is US$18.5 million

Series A: 4.62% of the total amount , valued at US$130 million

A+ round: 3.5% of the total, valued at US$250 million

< /li>

On March 13, 2024, the maximum supply of AEVO will be 1,000,000,000 tokens, and the circulating supply will be 110,000,000 tokens .

Key indicators

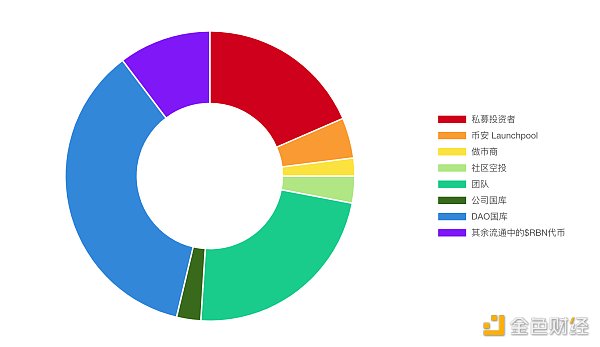

Token distribution

< p style="text-align:center">

Note: AEVO is built by the team that launched Ribbon Finance. $RBN holders are able to convert their $RBN to $AEVO at a 1:1 exchange rate, which requires a 2-month lock-up period. The remaining unlocking period of $RBN proceeds as originally planned.

Token issuance schedule

Private investors (Seed and Series A) and team’s $RBN tokens will be fully unlocked by May 2024

$RBN holders can convert $RBN to $AEVO at an exchange rate of 1:1, with a lock-in period of 2 months

$AEVO is currently not unlocked and released, but the DAO will allocate 16% to future users and ecosystem incentives, which is expected to take more than 4 years

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan JinseFinance

JinseFinance Max Ng

Max Ng Cointelegraph

Cointelegraph