a16z: Decentralizing the Grid

The 21st century’s shift in power generation from a “hub and spoke” model to a distributed network requires a decentralized grid.

JinseFinance

JinseFinance

Author: LUCA PROSPERI; Compiler: Block unicorn

I remember some rare moments of personal revelation when studying principal components and factors in econometrics, which can be used in the context of huge practical benefits. Appreciate the elegance of mathematical structures below. In principal component analysis (PCA), the covariance matrix of a data set (which contains most of the information about the relationships between variables) is compressed into abstract, recombined components that are organized in terms of the information they carry about the data set itself. Sort by amount of information. It was found that a small number of recombined components carried most of the information in the data set. These components are the eigenvectors of the covariance matrix, and their corresponding eigenvalues are a measure of the amount of variability in the data set that can be extracted by that component. This linear transformation works so beautifully that we spend most of our time not doing calculations but naming the identified principal components.

As our team often does, we want to block out the useless noise from a large number of Extract valuable parts from data or information. Often, one is contained within the other. ——Block unicorn notes: The process of principal component analysis (PCA). In this process, the covariance matrix of the data set (which contains most of the information about the interrelationships between variables) is compressed into structural, recombined components).

But for EigenLayer, what is noise? How does EigenLayer define itself? According to its white paper, EigenLayer is a re-staking aggregation – which is indeed a very simple yet powerful feature in the crypto market. But what exactly does it mean to rehypothecate an aggregate? In the pursuit of simplification, I ask technical experts to forgive me for inaccuracies.

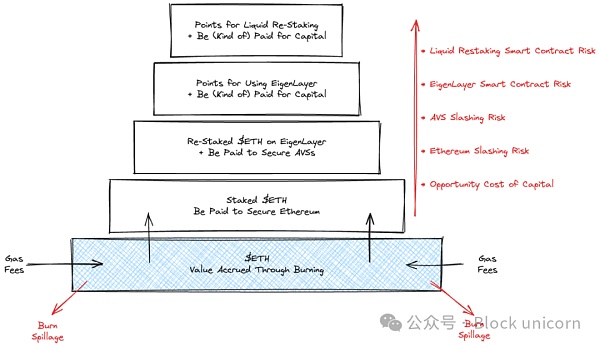

In short, EigenLayer enables Ethereum validators to opt-in to new modules built on EigenLayer by pointing their beacon chain withdrawal credentials to the EigenLayer smart contract. Essentially, modules built on EigenLayer can be funded by leveraging the secure staking currently available on the Ethereum mainnet. Introduce additional temporary penalty conditions (because nodes are down or do evil and need to be punished). Therefore, Ethereum validators (validation nodes) can gain additional revenue streams by lending out their pledged capital in some form for other uses, while on the other hand, security modules built on EigenLayer can leverage existing Ethereum validator pool (stETH and other pledge certificates). Naturally, these additional modules must provide appropriate incentives for Ethereum validators to provide this added security, which is known as the re-staking process.

What everyone knows is that the team emphasized the ability to effectively unlock staked ETH pools and highlighted clear advantages - we have restated the views of the white paper below and tentatively followed its Taken at face value:

For those modules built on Ethereum, there is no need for additional layers of security, nor the need for another digital asset (tokens) as security collateral.

Fees overflow can be reduced for users who no longer interact with dedicated modules (but only indirectly with Ethereum).

For stakers, there is a reduction in capital (opportunity) cost - this is the cost associated with needing to lock up capital to (purchase and) lock up a specific security token. Block unicorn note: For those who stake, they can reduce the cost of capital required to lock up capital to purchase and lock up a specific security token (stETH). The "capital (opportunity) cost" here means that in order to purchase and lock a specific security token, stakers need to lock their capital in the process, which means they cannot use this capital for other potentially profitable purposes. investment, this is the so-called opportunity cost. Through EigenLayer, stakers can use their pledged capital for other purposes, thereby reducing this part of the opportunity cost.

For DApps, the (security) start-up costs can be reduced - considering that the initial risk capital in the pledged tokens can be significantly reduced.

Three of the four main advantages highlighted in the white paper are financial, not technical. These advantages primarily relate to the structural costs associated with ensuring minimum viable security for decentralized application users. Given the financial tone of these statements, I think it would be beneficial to look at them from the perspective of the company's (or indeed the agreement's) financials.

From a corporate or agreement financial perspective, these advantages can help reduce operating costs and improve capital efficiency, thereby improving the company's financial performance. For example, reducing the capital (opportunity) cost of locking up capital required to purchase and lock up a specific security token can allow companies to use their capital more efficiently, thereby increasing return on capital.

In addition, the reduced (security) startup costs for DApps mean that they can start and operate their applications with lower initial investment, which may attract more entrepreneurs to enter this field , thereby promoting the development of the entire ecosystem.

Taken together, these financial advantages can not only improve a company’s financial performance, but also drive the development of the entire cryptocurrency and blockchain ecosystem.

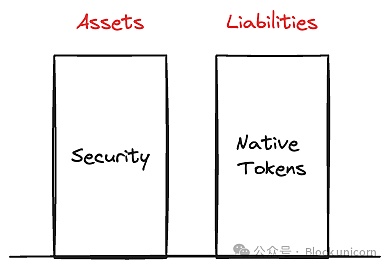

Blockchain works by providing a common computing layer , significantly reducing the cost of building, launching, and maintaining/developing applications. If we ignore these costs and simply view the computing layer as a public good, we can conceptualize that projects require financial resources to create and control an asset commonly known as security. Typically, security in DApps is achieved by requiring external parties to invest in protocol-specific tokens, which must be put at risk to ensure incentive alignment. To attract these investors, tokens offer some yield and, in the best case scenario, some residual claim to the protocol economy.

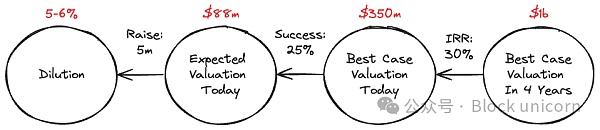

In protocol finance terms, it is fair to say that the protocol uses proxy equity To fund their security, these instruments can be of pure or preferred type, depending on the type of financial mechanism attached to them. From the perspective of protocol finance, when the market operates relatively efficiently, equity financing is actually the highest cost source of company financing; If a venture investor is willing to invest in your startup, and Even if the project fails, he will not come back to you for the money you have invested, and you can rest assured that a good investor has embedded in the valuation of such a company that he or she expects to have some form of equity cash. An internal rate of return (or IRR) of 30-50% earned on the stream. This is an extremely dilutive form of financing for the team, even if the probability of success is relatively high.

In the token space, dilution is not only given up through exchange for cash financing Company ownership occursbut also through often highly dilutive incentives to attract capital contributed by security providers (and often users) (equity financing is rarely used in crypto markets). When viewed through the super-simple flowchart above, token incentives further reduce ownership of best-case future valuations, thus further depressing today’s expected valuations. Frankly -- in my personal opinion, if we look at private valuations today, we can infer that those are more of a bet that the public markets are mispriced.

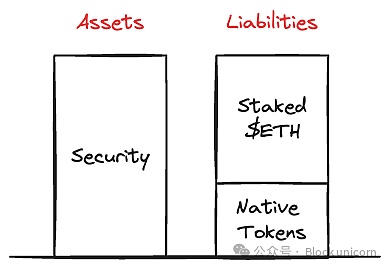

Reduced opportunity cost→ EigenLayer's view is that equity-like instruments are a very expensive form of financing, while some form of rehypothecation of other types of instruments is A more efficient way to fund atomic security for individual protocols, and there is absolutely nothing wrong with that from a financial perspective.

Elegantly speaking, if we think of Ethereum as a sovereign economic system with its own rules and enforcement mechanisms, where investors (or citizens) assess risk directly in $ETH instead of dollars, The process of allowing these investors to stake $ETH for security is then similar to allowing lenders to finance a company’s assets through a less volatile hybrid form of debt. This type of debt, even at the lowest level physically possible, is lower than the cost of equity for a particular project. The effect will be to lower the capital costs of projects and lower the barriers to innovation.

EigenLayer's description of trust execution (i.e. security) is very elegant . The research team identified three sources of trust available to developers:

Economic: The relative amount of risk capital reflects the level of investor confidence in the project.

Based on decentralization: Inferred from having a sufficiently decentralized independent and isolated operator network.

Related to inclusivity: Ethereum validators’ privileged position creates a sense of trust because they have the power to propose blocks and run consensus software.

Here, given the nature of the research I conducted (and my limited abilities) and the profound significance of this phenomenon, we focus on economic-based trust. Staking incentive alignment is not new to the trading world, providing transparent and observable consistency and the ability to promptly correct misconduct. However, this approach has inherent inefficiencies in the use of capital, as it requires locking up significant resources in an unproductive manner to ensure trust, which is a topic we explored above and something EigenLayer wants to alleviate.

EigenLayer places great emphasis on the ability to significantly reduce the cost of economic security by re-staking $ETH as an alternative to native equity instruments . From a protocol finance perspective, do I agree with this statement? My answer is, it depends on who is asking.

For investors denominated in $ETH, the cost savings of using $ETH instead of similar equity instruments make a lot of sense. But for U.S. dollar-denominated investors, that's less important. For investors who think, evaluate, and price in dollars, replacing native staking tokens with $ETH is less effective in reducing risk and gaining additional returns. Fortunately or unfortunately, 99.99% of investors and builders in this space think, evaluate and price in dollars.

When (When) will new tokens be issued or launched? Realistically speaking, regardless of whether they are in fact securities, project-specific tokens that have some form of governance function, utility, economics, or scarcity claim are viewed by investors as project success or visibility agent. This sentiment exists even without any remaining financial or control claims. In a smaller industry like cryptocurrency, tokens tend to be tied more to narrative or expected changes in liquidity than to cash flow. Regardless of how we look at it, it is clear and demonstrable that in cryptocurrencies the market for representing equity is far from efficient, and that higher than rationally identifiable token prices mean that a project's cost of capital is lower than rationally expected s level. Typically, low-cost capital is reflected in lower dilution rates in venture capital rounds, or higher valuations than in other industries. It can be said that due to the overall market inefficiency of the capital market, the capital cost of using local tokens is lower for project creators than using $ETH (Block unicorn note: Most projects will issue their own tokens, using Own tokens can have lower costs, and re-customized capital allocation can better coordinate with the continued development of the project).

Double staking allows → EigenLayer’s team does not work in isolation from the outside world, but actively understands and participates in the surrounding environment and trends. This is reflected from the end of the white paper Part of it, the part about multi-token arbitration can be seen. In a mechanism that came to be known as double staking, Verifiable Security (AVS) could specify multiple quorums, one based on the staked $ETH and another based on the native token. While EigenLayer cites the project to define a more precise consensus system as a key goal of double staking, we cannot ignore that this mechanism is indeed to satisfy the desire to launch a native token to provide investors and the team with an appropriate exit liquidity window. Ironically, taking this approach could inadvertently exacerbate native token confusion, lead to significant bad selection, and increase the inherent cost of capital for builders—who largely rely on (pre-)sales Tokens to raise funds.

In their whitepaper, the EigenLayer team further describes a marketplace for efficient allocation of $ETH resources, thereby further reducing funding costs and increasing merge security, although this benefit is still unclear to me How to achieve it. The white paper describes how the protocol maximizes re-staking flexibility by providing independent stakers, LST (Liquidity Staking Token) holders or LP token holders with appropriate ways to interact with EigenLayer smart contracts - which They are so-called superfluid stakers (with ultra-high liquidity and returns). While these are various ways to wrap the native benefits of Ethereum and enhance its interoperability, each approach has its own financial and technical risks, and we set aside these differences for now because they are not relevant to the analysis of the EigenLayer protocol itself. D.

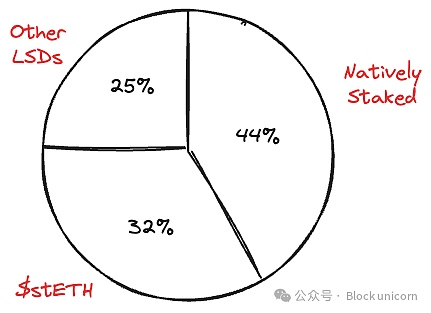

According to the latest data (March 11), there is approximately $12 billion worth of pledged $ETH stored in the EigenLayer contract (or about 3.1 million $ETH), of which about 1.3 million $ETH is staked locally and the rest exists in the form of LST, with Lido having the largest share. Total value locked (TVL) has grown significantly since the protocol’s launch, making EigenLayer the second-largest Ethereum DeFi protocol based on DefiLlama data, behind Lido. The irony of the double counting between Lido’s $stETH and Lido’s restaking $stETH did not escape my notice.

The process of re-staking on the platform depends on the type of re-staking. LSD (Liquid Staking Token, Liquid Staking Certificate) can be easily re-staking by interacting with the front-end. Currently, LSD deposits have reached the upper limit. Local restaking is slightly more complex and involves creating an EigenPod contract and defining a set of validators to withdraw credentials. We do not intend (and cannot) provide a technical overview of EigenLayer, but intend to focus on the financial and incentive implications of the setup.

According to this excellent Dune dashboard, the total $ETH supply is ~$120 million, with ~26% currently staked, with ~2.5% re-staking to ~116,000 deposits on EigenLayer wallet. This is a big number. The demand side (verifiable security and rollups benefiting from restaking pools) is growing, but this is definitely just the beginning.

So why do $ETH stakers participate in the pooled re-staking community? At the peak of the 2020-2022 bull market, the answer was tokens. But today, the answer is points, and that's a big difference.

Points are loyalty measures stored and verified off-chain, theoretically providing the right to participate in future airdrops or digital token distributions. In other words, they are a loose derivative of a digital asset that provides holders with a level of comfort that they will receive the digital asset, most likely in the form of an airdrop, with some financial value further into the future . If tokens are a (usually worse) proxy for equity interests in a project, then points are a proxy for that proxy, with less certainty and rights.

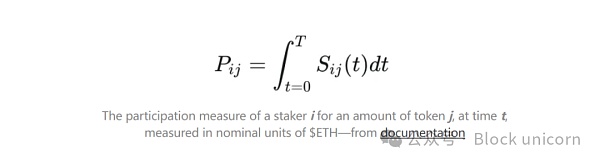

EigenLayer users earn points based on when and how much they re-stake – $ETH re-staking units per hour. For example, staking 1 $stETH for 10 days will generate 240 re-staking points, and approximately 2 billion re-staking points have been issued.

A depositor i participates for a certain number of tokens j at time t A measure of degrees, measured in nominal units of $ETH

While there is no guarantee that points will be converted into tokens through future airdrops, users anticipate that EigenLayer’s Token Generation Event (TGE) will take place in 2024. Occurs sometime between the second and third quarters.

Other protocols soon began to create aggregate structures based on the EigenLayer integration exposure. For example, on Etherfi, users can earn $eETH, a liquid staking token that is restaking natively. Yes, you read it correctly, this is a derivative of a derivative that rehypothesizes digital assets. Users will be able to convert staking rewards and re-staking rewards as well as loyalty points into re-staking points. Swell, Kelp, and StakeWise provide similar functions, and this trend has already emerged.

Let me summarize because there are a lot of factors at play - oh OMG, I might have missed the best part of the bull run: the protocol points gained during the bull run, exposure to promises of future (hypothetical) token airdrops, to accumulate liquidity and provide it to another protocol (EigenLayer) in exchange for another A type of point that promises to provide exposure to future (hypothetical) token airdrops to launch a re-staking pool designed to avoid the creation of project tokens in the first place. If you have memories of the Curve War, you're not alone.

Where do the funds come from? We are not a research place focused on technical or transactional topics, but rather on value analysis, aiming to deepen our understanding of economic designs and hopefully help us improve those designs. Any value analyst should start by asking where the money will come from and the relationship between expected economic returns and capital flows. In a pure system that fully uses $ETH as the economic security tool of AVS (Verifiable Security), the economic value is mainly reflected in (i) the issuance of $ETH (pledge income) and (ii) asset appreciation, through comparison Low supply and/or higher demand to achieve. For reference, currently (thanks to the Ultrasound crowd) Ethereum is offering around $1 billion in profits, or about 500x P/E at current prices, which is an incredible value if we exclude any implied monetary premium. However, we don’t have to estimate the implicit returns of $ETH to assess whether storing value in EigenLayer is reasonably priced – multi-collateralization keeps $ETH stakers from giving up those returns.

What is the market pricing for the value stored in EigenLayer, and why? KelpDAO tokenizes EigenLayer points at a 1-to-1 ratio via the $KEP token, which aids our (analysts) analysis. At the time of writing, these tokens are trading at around $0.133 each, which means staking another unit of $ETH would earn you 8,760 points or $1,165 a year, or at current (higher) $ETH Price gains of 30%, what would justify this 30% gain?

1. Additional destruction due to increased staking on Ethereum

2. Additional demand for Ethereum as a consensus layer

3. For DApps and AVS The user experience is improved, thus bringing about the effects of (1) and (2)

4. A certain degree of economic capture of the re-pledge of EigenLayer’s future tokens

5. Market dynamics (which I intend to ignore)

Interestingly, even if we take (1), (2) and (3) as reality, EigenLayer is more like a public good with positive externalities, rather than anything else. (4) Hardly enough to justify a 30% return premium on $ETH at current prices. The most likely is (5) – a heuristic that bets on “as the total locked value goes up, the token will go up”. While EigenLayer does have the potential to represent a major innovation by standardizing protocol-safe design and implementation practices for projects to leverage, and I sincerely believe it has that potential, from a values perspective, these data are not An exact match. a16z recently announced a $100 million investment in the company, and interestingly, the announcement mentioned contributions to the public good; for a16z, it makes economic sense to invest in improving the Ethereum ecosystem on a broader level, Because their investment in this area is more extensive. Therefore, EigenLayer's investment should be viewed holistically rather than in isolation.

The nominal return analysis performed above is clearly superficial, does not adjust for risk, and excludes the additional smart contracts faced by re-pledgers Risk, penalty risk at the AVS (Verifiable Security) level, and possible negative return impact from destabilization of the $ETH consensus layer due to integrated re-staking. Re-hypothecation is indeed a dangerous element that increases opacity and systemic risk. I recommend that those who have sleep problems read a 2017 report from the Financial Stability Board on this topic.

So why doesn’t EigenLayer take this approach itself? Why not simply develop a useful, standardized staking framework instead of promoting its adoption through the financialization of the same tokens it aims to partially obsolete? Because this is cryptocurrency, folks, people need to pay their bills, and may the bull market forgive us all.

The 21st century’s shift in power generation from a “hub and spoke” model to a distributed network requires a decentralized grid.

JinseFinance

JinseFinanceOn April 9, 2024, the a16z crypto research and engineering team released a preliminary implementation of Jolt, a new SNARK design approach that is 2x faster than existing techniques, with more improvements to come.

JinseFinance

JinseFinanceEigenLayer has the potential to enable 100x faster innovation in technologies such as consensus mechanisms, new virtual machines, decentralized oracles, bridges and networks with specialized hardware

JinseFinance

JinseFinanceA16Z, Web 3.0, NFT, a16z: NFT ladder - the future of brand marketing Golden Finance, a five-step framework for brand success: NFT ladder.

JinseFinance

JinseFinanceThese overviews are based on the latest news, latest updates, new guidance, ongoing legislation and frameworks issued by regulators/bodies, industry alliances and professional associations, banks, governments and other entities as they impact the crypto industry around the world.

JinseFinance

JinseFinanceMichael Blau, Joseph Bonneau, Noah Citron, Valeria Nikolaenko, Carra Wu, Guy Wuollet and Michael Zhu

a16z

a16z Cointelegraph

Cointelegraph Cointelegraph

CointelegraphWe are in the middle of the 4th cycle of cryptocurrency with new project creation and start-ups, Web3 is far better than Web2 for creators at this stage, cryptocurrency is impacting the real world, Ethereum is a clear frontrunner , but face fierce competition.

链向资讯

链向资讯Web 3 solves the core problem of the centralized web, which is that value is accumulated by one company, and that company is ultimately pitted against its own users and partners.

Cointelegraph

Cointelegraph

Please enter the verification code sent to