a16z has just released the GenAI Consumer Applications Top100 report. Since ChatGPT brought generative AI to the public eye just over a year ago, we've seen the creation of thousands of new consumer products that incorporate the magic of AI—from video generators to workflow hacks , from creativity tools to virtual companions.

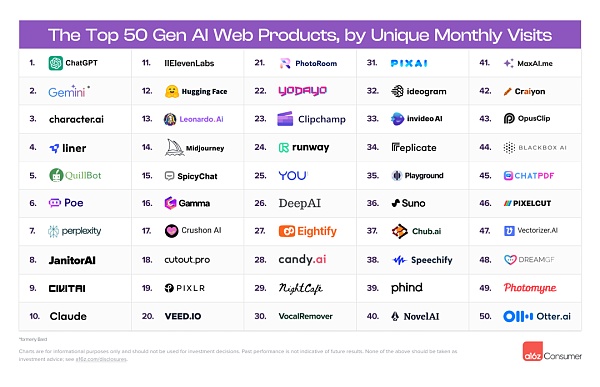

Six months ago, a16z took a deep dive into network traffic data to separate important information from noise. a16z ranked the most popular generative AI web products based on monthly visits and discovered patterns in how consumers actually use the technology.

While there are a few early “winners” that have attracted widespread attention — notably ChatGPT and Midjourney — there are new AI-native companies emerging every month The emergence has stimulated a dynamic and competitive market.

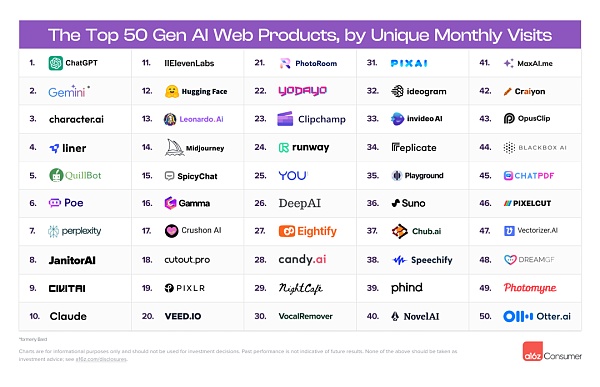

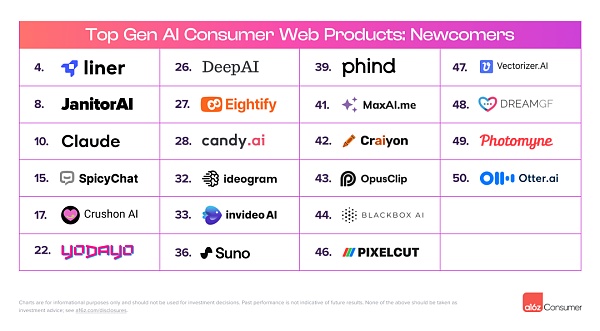

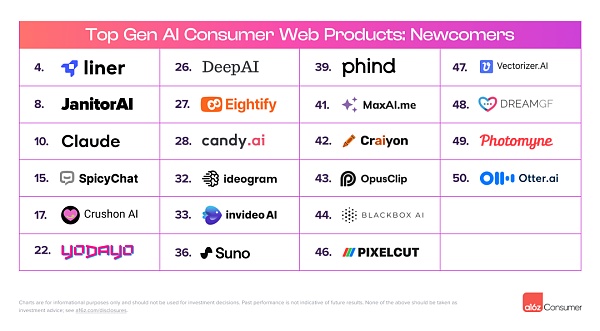

Now, six months later, a16z is back in the data to update a16z's analysis, again based on SimilarWeb data (as of January 2024) of the top 50 Ranking of AI-first network products. What a16z found is surprising: More than 40% of the companies on the list are new compared to a16z’s original September 2023 report.

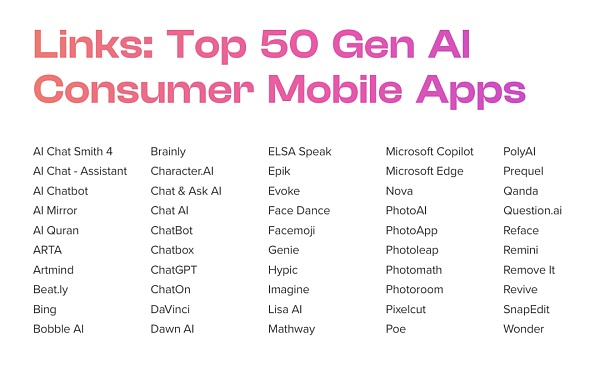

However, unlike a16z’s original analysis—where it first ranked companies based on web traffic and then added mobile app data to those companies—this time, a16z has split its web and mobile generative AI products into two a separate list.

Similar to web rankings, mobile apps are ranked based on monthly active users, with data from Sensor Tower (as of January 2024). This distinction allows a16z to examine the complete universe of top AI mobile applications for the first time. As a16z will discuss, there are significant differences in how consumers interact with generative AI on mobile devices compared to the web.

Beyond the inherent interest of these rankings themselves, the data revealed several noteworthy trends, including emerging and expanding categories, AI investment, and engagement patterns. Here are some of a16z’s key takeaways:

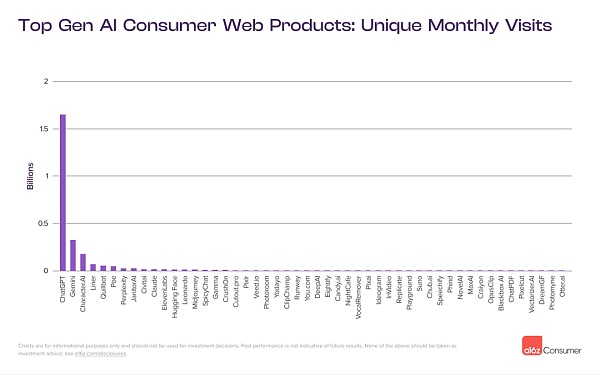

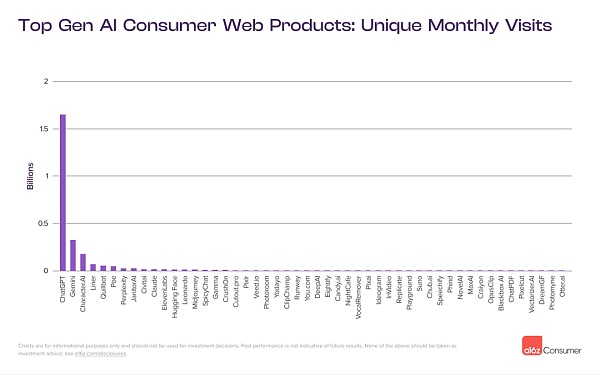

In view of the early stage of ChatGPT Following its impressive growth - it was already the 24th most visited website in the world when analyzed six months ago - a16z expects the groundbreaking chatbot to maintain its position at the top of the list.

In fact, ChatGPT has nearly 2 billion monthly web visits, roughly five times that of the next-ranked company, Bard (now Gemini). Along with Gemini, companion creator Character.AI and writing assistant Quillbot retained their spots within the top five. However, this does not mean that the list has remained unchanged over the past six months: 22 companies are new faces to the web traffic rankings.

Among the so-called newcomers, the top ones include Liner, an AI research co-pilot; Anthropic's universal assistant Claude; and three uncensored AI companion apps: JanitorAI, Spicychat, and CrushOn. (For more on the proliferation of AI companions, see below.)

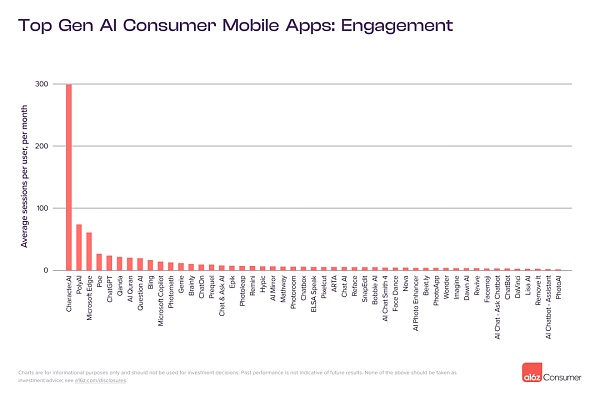

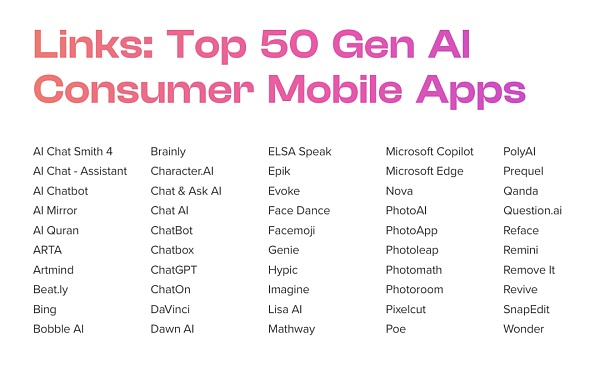

a16z’s mobile list is completely new. ChatGPT leads here too – but by a smaller margin. In terms of monthly active users, ChatGPT is roughly 2.5 times larger than the second and third-place players, Microsoft Edge and Photomath. For mobile products, the top five is completed by Microsoft's search engine Bing (now rebuilt around AI) and photo enhancement and avatar creator Remini.

Interestingly, there are five AI companies that are true "crossovers", with both online products and mobile applications entering the top 50 list: ChatGPT , Character.AI, chatbot aggregator Poe, and image editors Photoroom and Pixelcut.

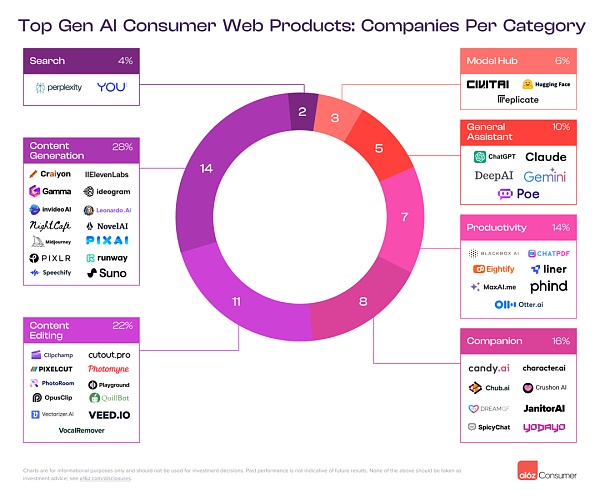

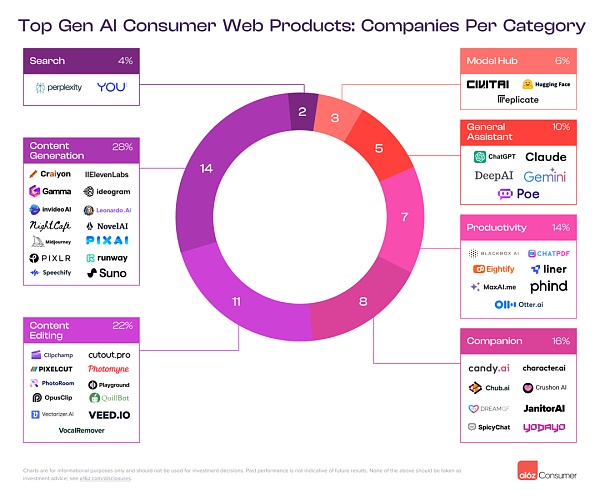

Six months ago, a16z noticed that large language model (LLM)-based general-purpose assistants like ChatGPT accounted for the majority of network traffic. In its updated analysis, a16z saw two new categories join the mix: Music and Productivity (which includes tasks like research, coding help, and document summarization).

So far, Suno is the only music company to enter the rankings. This tool generates original songs in the browser based on text prompts - complete with lyrics, covering a variety of styles. Suno initially launched as a Discord-only product, similar to Midjourney, but launched a standalone site and Copilot extension in December 2023. (Read more about the potential a16z sees in the AI music category here).

Several now-major consumer AI products, like Suno, were originally launched on Discord servers—or still primarily run through Discord. This platform provides a testing ground (and community!) without requiring a full front-end product build.

Real traffic to Discord servers is almost impossible to measure, but network traffic to each server's invite page is a proxy for this. According to this metric, as of January 2024, nine AI products or communities are among the top 100 Discord servers in terms of invite traffic, led by Midjourney.

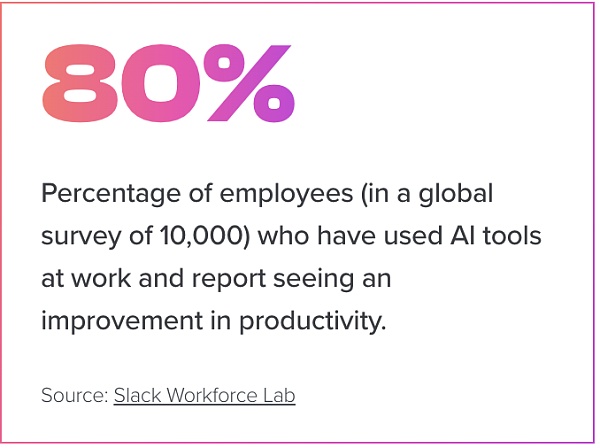

The second noteworthy new category on the list is productivity. AI-native platforms can improve people’s interaction with software, allowing them to delegate routine tasks and reduce time spent on administrative overhead. The productivity category includes seven companies in the ranking: Liner, Eightify, Phind, MaxAI, Blackbox AI, Otter.ai, and ChatPDF.

PS: In a16z September 2023 rankings, when there was no productivity category, ChatPDF was classified as "Other".

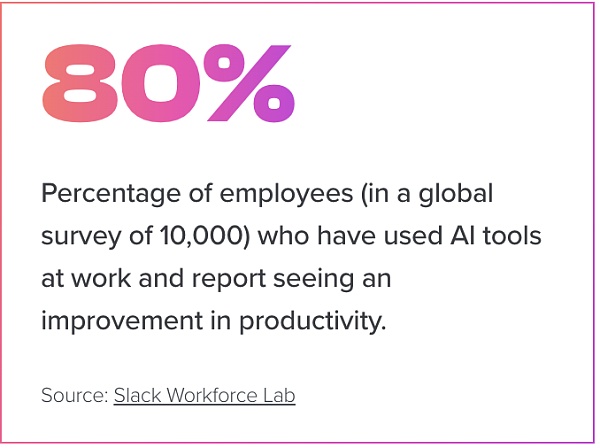

With features like in-process editing and summarization, these companies focus on helping employees, freelancers, and small and medium business (SMB) owners do their jobs more efficiently. For example, Eightify provides summaries of YouTube videos, while Otter.ai can take meeting notes and transcribe them in real time.

Six of the seven productivity apps on this list either offer or operate entirely through Google Chrome extensions.

a16z expects more AI productivity tools to operate "in-process" with what users are already doing, eliminating the need to navigate workspaces and processes like Copying and pasting prompts and output between assistants like ChatGPT is required.

Alternatively, AI productivity companies may invent new end-to-end workflows around the unique capabilities of generative AI. AI workflow products can help users identify what can be improved and then automate those improvements.

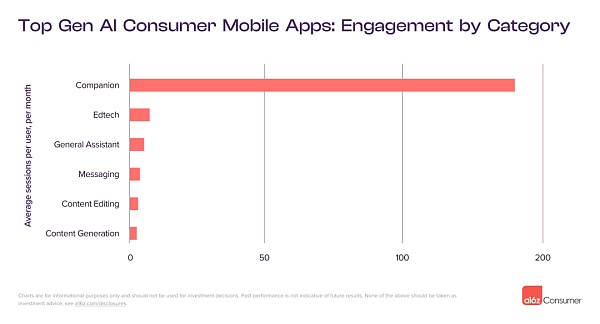

Having an AI companion may seem like a niche area, but this activity has become a major use case for generative AI. Already, millions of people — including a16z himself — have developed relationships with chatbots. Web and mobile data herald a coming social shift here: AI companions are becoming mainstream.

Six months ago, only two AI companion companies made the top 50 list; in this updated analysis, the network has eight , there are two on mobile. Character.AI leads among companion tools on both web and mobile platforms, ranking 3rd for website and 16th for mobile.

Six of these eight online companion products describe themselves as "uncensored," meaning users can have conversations or interactions with them that might be restricted on a platform like ChatGPT. Users access these products primarily via the mobile web, rather than the desktop - although few offer apps. On average, 75% of the traffic to the uncensored companion tool on a16z’s website listings comes from mobile.

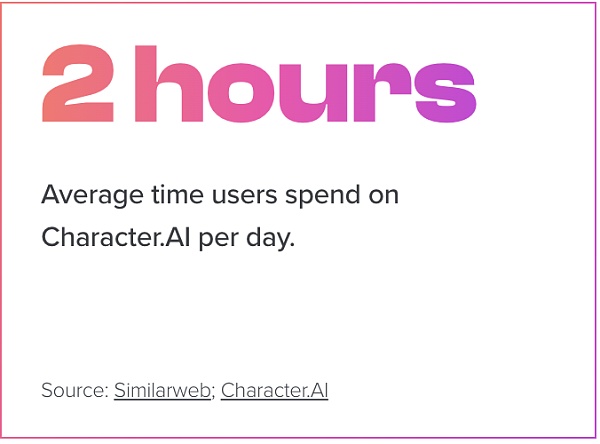

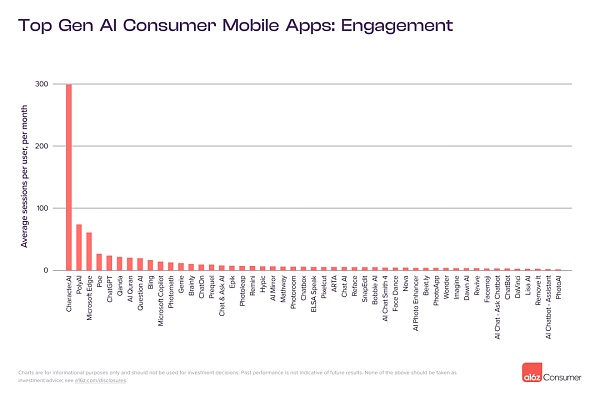

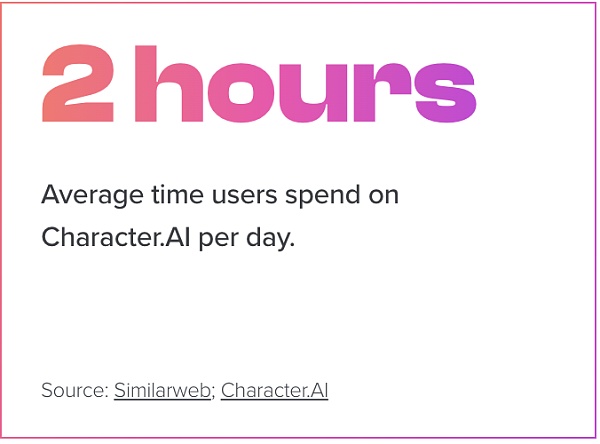

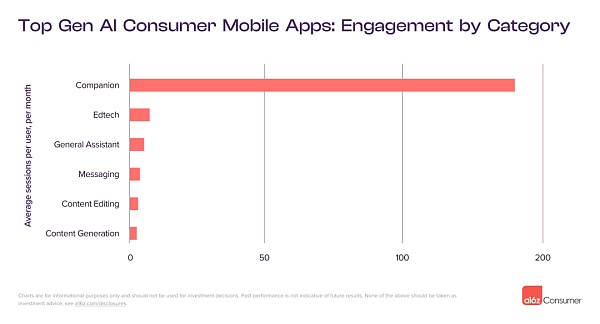

For those companion products that do have mobile apps, user engagement is exceptionally high. The most successful products in this category become a core part of users' daily lives, becoming as ubiquitous as texting friends (if not more so).

As expert consultants, it is important to recognize that a16z's knowledge and understanding is constantly evolving and expanding. In the field of generative AI and AI companions, technological advancements and social acceptance are changing rapidly, presenting new opportunities and challenges for researchers, developers, and users themselves.

The evolution in usage trends and consumer preferences seen by a16z underscores the importance of continued observation and analysis of this rapidly evolving field. As technology matures and society further accepts the role of AI companions, a16z expects to see more innovative applications and services emerge to meet a wide range of user needs.

According to SensorTower data, Character.AI averages 298 sessions per user per month, while Poly.AI averages 74 sessions per user per month.

a16z is starting to see early signs of a broader set of companion applications that go beyond AI "boyfriends" and "girlfriends" to include uses for friendship, guidance, entertainment, and eventually health care.

In fact, early research has shown that AI can outperform real doctors in both diagnostic accuracy and clinical attitude. And many companion products are multifaceted: In a recent Nature study, the Replika chatbot reduced suicidal thoughts among users by 3%.

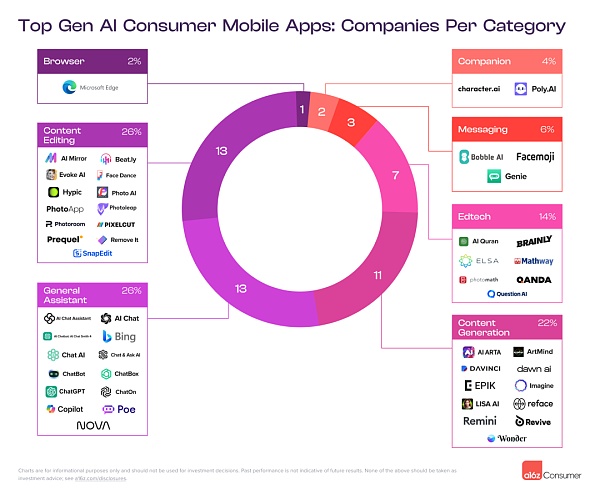

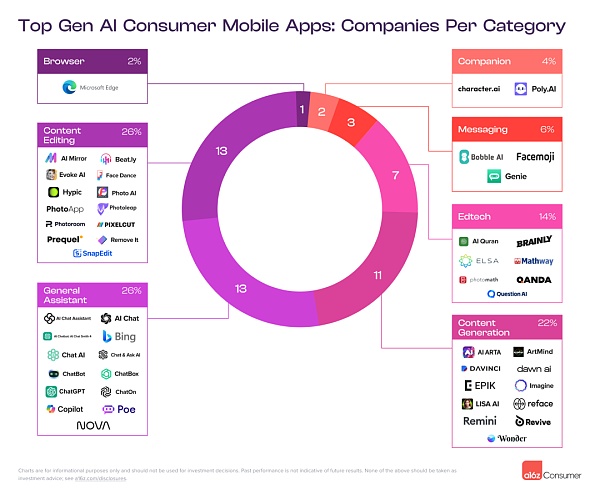

The categories of AI usage differ significantly between mobile apps and the web. In general, web products support more complex, multi-step workflow products around content generation and editing – at least for now! These include products like AI speech toolkit ElevenLabs, AI art generator Leonardo, and AI presentation builder Gamma, all of which rank in the top 20 web-based generative AI products.

This does not mean that complex AI products cannot be built on mobile devices. a16z is optimistic that AI will bring higher-quality photo and video editing tools to mobile apps than ever before, for example.

Meanwhile, mobile app usage is leaning toward universal assistants, many of which mimic ChatGPT. When browsing the list of top mobile apps, you may notice that there are 10 companies with names that are very similar to ChatGPT... This is partly because ChatGPT was relatively slow to launch its own apps, giving copycats quick access to App Store optimization advantages Opportunities are created, especially if they pay for advertising.

Some mobile applications that imitate ChatGPT have been accused of being "sheep-shearing software." They trick users into believing that they are providing access to similar titles and logos as ChatGPT’s premium models, but in fact, they are offering for a fee the same models that ChatGPT provides for free. These apps often change their names or descriptions, making it difficult for app stores to "police" this behavior.

Other popular generative AI mobile app categories are tailored to the unique features of mobile phones. There are seven dedicated avatar products on the app list; the many selfies saved on most people's phones serve as readily available training data. Additionally, three top apps—Facemoji (#9), Bobble (#31), and Genie (#37)—are keyboards designed specifically for mobile devices that allow users to send texts with the help of AI.

Educational technology is another popular category on mobile, where users can use their phones to scan homework questions (like Photomath) or learn a language through real-time conversations (like Elsa). Notably, while most of the top generative AI mobile apps are self-funded startups, meaning they have raised no outside funding, four of the top seven edtech apps have, according to PitchBook data Raised more than $30 million in funding.

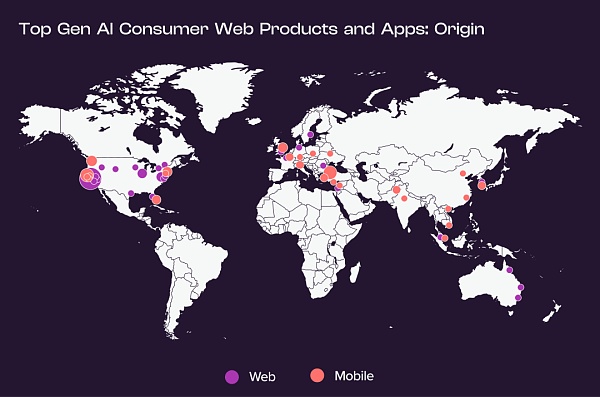

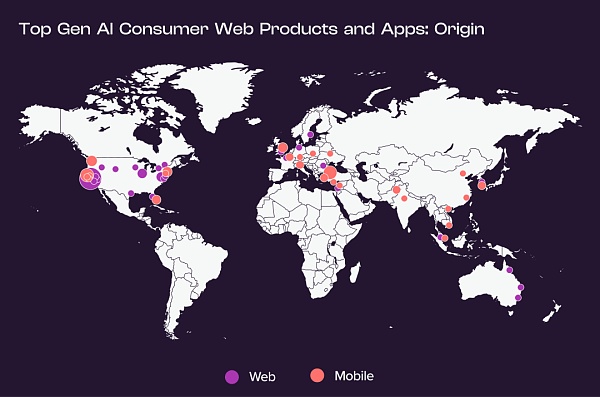

While Cerebral Valley may be the heartland of AI, extremely popular products are being developed all over the world. This is especially true for mobile apps. While more than 30% of the generative AI web products on a16z’s list originated in the Bay Area, only 12% of mobile app developers are based there.

Similarly, while more than half of the top generative AI web products are developed in the United States, less than a third of mobile applications originate within the United States.

Some mobile developers have multiple popular apps: for example , Istanbul-based app studio Codeway, created AI photo animation maker Face Dance, chatbot app Chat & Ask AI, and AI art generator Wonder, which are all on the list of top generative AI mobile apps. HubX, also based in Turkey, develops the Nova chatbot, DaVinci art generator, and PhotoApp enhancer.

These app studios often benefit from shared expertise across products on how to launch, drive traffic, and monetize their apps. Some of them don’t raise any capital and focus on generating revenue as efficiently as possible. Others are pursuing the venture capital route—Bending Spoons, the Milan-based tech company behind video editor Splice and photo enhancer Remini (No. 5 on the mobile list) recently announced the closing of $155 million in equity funding.

Obviously, a new generation of AI-native products and companies are growing at an unprecedented rate and deeply attracting users. a16z believes that over the next decade, AI will become the cornerstone of industry-defining companies.

JinseFinance

JinseFinance