Author: Jake Pahor, crypto researcher; Translation: 0xjs@金财经

It’s only been two months since 2024, and the crypto community has already announced some huge airdrops: JUP, STRK, PIXEL, DYM, ALT ,W.

The number of potential airdrops in 2024 will exceed 1,000. So the crypto airdrops and harvests have just begun.

But only a few airdrops will earn more than 5 figures.

I have spent the past few weeks developing the final airdrop evaluation framework and ranking the airdrops of 100 projects and picking out the top 5 projects, along with the free tools I used.

Airdrop Evaluation Framework

With thousands of airdrops and points programs, it can quickly become overwhelming. To solve this problem, I created a framework to evaluate which airdrops are worth our time. After all, time is our most precious resource.

The following are the 6 indicators I will use:

1. Financing; 2. Points program; 3. TVL; 4. Dilution; 5. Momentum; 6. Effort< /p>

I will explain why I chose these indicators and why they are important.

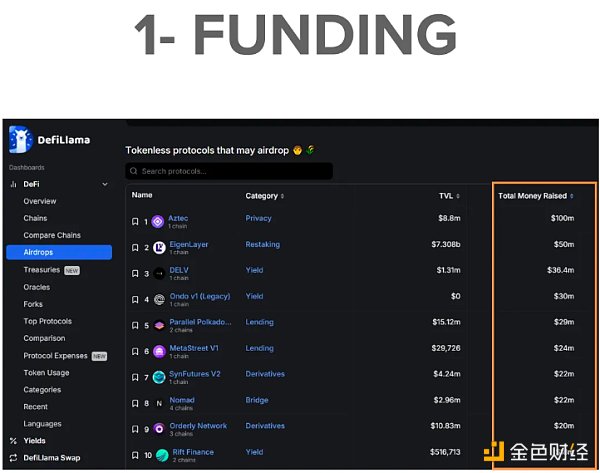

1. Financing situation

Well-funded projects are more likely to launch tokens and receive large airdrops. After all, VCs need a way to cash in on their gains.

DefiLlama has a great tool that lists all the tokenless protocols that may be airdropped. You can then filter by "Total Funds Raised."

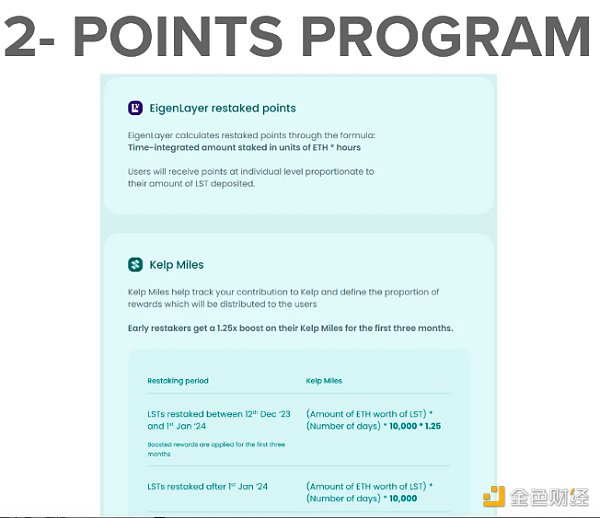

2. Points plan

If a project has a points program, there is a good chance they will do airdrops in the future. Imagine the community backlash and brand damage if they didn't.

It should be noted that not all airdrops are based on points schemes (such as ARB).

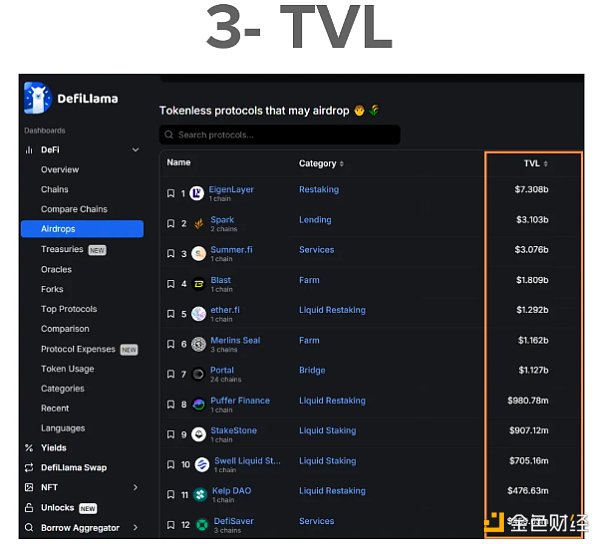

3. TVL

< /p>

< /p>

High TVL can be a double-edged sword. While it increases the chances of receiving a large number of airdrops, it may also lead to dilution due to the participation of a large number of wallets.

Projects often use airdrop levels as a way to manage distribution more fairly.

4. Dilution

If a large number of wallets are already playing for a certain airdrop, then this means that the value of the overall airdrop will be diluted.

General rule of thumb – aim to be in the top 10% of wallets if you can.

Just like investing, if your funds are limited, concentrate your bets.

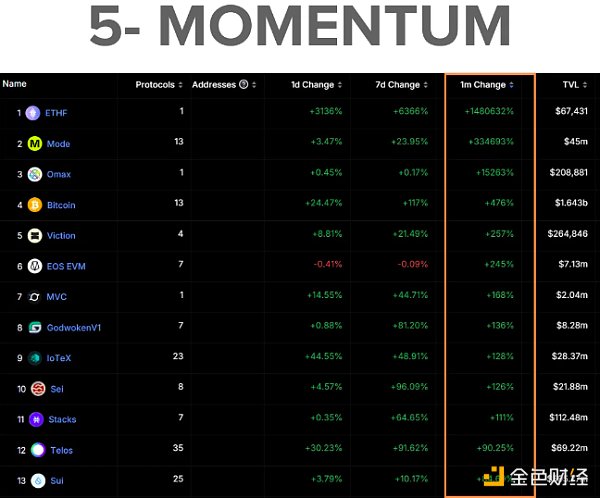

5. Momentum

< /p>

< /p>

Focus on the ecosystem you are optimistic about and the chains you like to use.

Cryptocurrency is an attention game, and the projects with the most attention in a bull market will be the biggest winners.

View TVL inflows on DefiLlama → DeFi → Chains → Sort 1m Change.

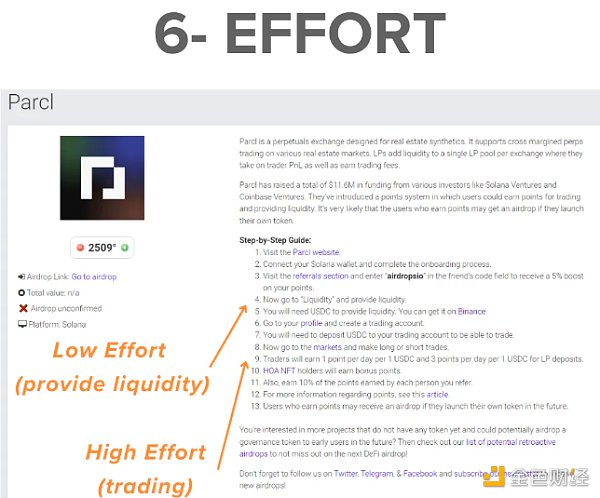

6. Hard work

I am usually a very lazy person. I don't want to expend more effort than I need to.

So I prefer airdrops that have the option of less farming. For example:

Higher effort: Bridges, Dex's

Lower Workload: Staking, LP, re-staking

Sometimes both are required.

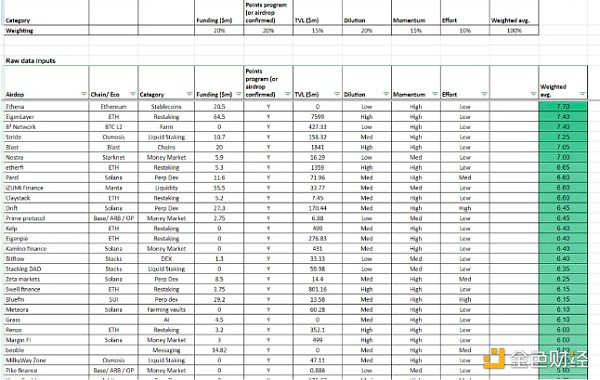

100 project airdrop rankings

This is the airdrop ranking of more than 100 projects in 2024 produced by me. The link is as follows:

https://docs.google.com/spreadsheets/d/177QsKoUP-Jp9hsvlBGhbRQ9HV6GrSaBH4RPAV-oDNFM/edit?usp=sharing

Among the 100 projects listed in the table, I believe there will be a large number of profitable airdrops. There are probably many others that I've overlooked as well.

I will keep updating this table to add new projects and future airdrops.

Top Five Airdrop List

Ethena

Ethena Labs is a synthetic USD protocol based on Ethereum. The stablecoin is USDe.

Just a few days after its launch, it has already attracted huge attention.

Currently 6360 users, not heavily diluted yet, but it won’t be for long. Ethena raised $20.5 million in financing.

Eigenlayer

Eigenlayer is a re-pledge protocol based on Ethereum.

TVL is close to US$8 billion and may be the largest airdrop in 2024. Eigenlayer raised $64.5 million in funding.

B² Network

BSquared Network is a 2-layer Rollup solution on Bitcoin plan.

It recently announced an airdrop for early users and has deposited over 24,000 addresses with over $400 million in TVL.

It completed a seed round of funding in January 2024 for an undisclosed amount (HashKey, OKX, Kucoin).

Stride

Stride is the liquidity staking platform of the IBC blockchain.

Its stTIA airdrop is very popular. You can earn STRD rewards by holding liquid-staking TIA on Stride, Osmos, or Neutron.

Blast

Blast is a layer 2 solution for Ethereum with native yields on ETH and stablecoins.

It has amassed over $1.8 billion in TVL in just a few months and is heavily backed ($20 million in funding).

Similar to EigenLayer, it has a large influx of users into airdrops, but it can still be a lucrative airdrop.

Some other good projects include:

Nostrs finance

-

Ether.fi

Parcl

Drift

Protocol

KelpDAO

Conclusion

Finally, airdrops are speculative in nature and there is no guarantee that we will receive any reward for our efforts.

I want to give a shout out to some of the great resources I used in this article: drakeondigital, Dynamo DeFi, CC2Ventures, Airdrops one, airdrops.io, DefiLlama

Note: None of these are financial Suggest or sponsor content. Always be extremely vigilant when clicking on links/airdrops.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian Catherine

Catherine