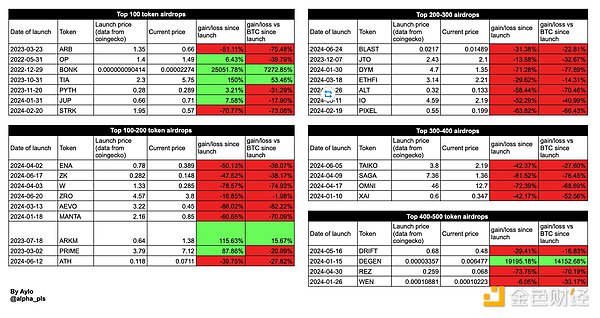

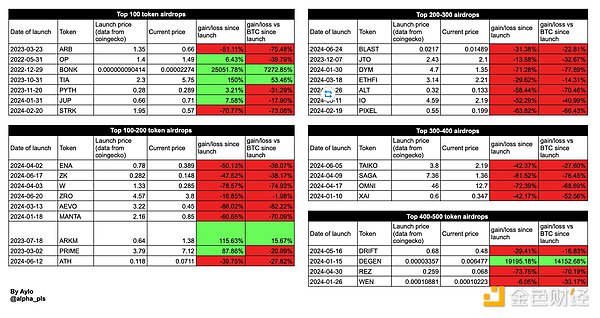

Author: Aylo Source: X, @alpha_pls Translation: Shan Ouba, Golden Finance

Airdrops play a very important role in the recent round of cryptocurrency cycles. I am curious about how many tokens issued through airdrops can be priced higher than their first-day prices. The answer to this question may help us determine whether it is worthwhile to hold airdrop coins (whether it can bring positive expected returns).

I compiled some data, the data source is this morning (may be a little delayed), but it is enough to help you understand the general trend. I only counted the top 500 coins.

Here are the main findings:

Of the 31 airdropped coins, 23 are now below their first day of issuance, some of which have fallen significantly.

Only 4 airdropped coins have been able to outperform Bitcoin since their first day of issuance.

Of the 4 airdropped coins that outperformed Bitcoin, only 1 was launched in 2024.

Two meme-related airdrops (BONK and DEGEN) have been huge successes.

Although TIA is not favored at the moment, its price is still well above the issue price and has outperformed Bitcoin.

It is almost always the right choice to exchange the airdropped coins for US dollars or Bitcoin on the day of issuance. Although occasionally you may catch a wave of rising market after the token is listed (some people call it technical), in general, the longer you hold the airdropped coins, the worse they will perform.

It is true that there are always some exceptions, but the chances of you holding the right airdropped coins are very small, especially relative to holding Bitcoin.

If you really believe in the long-term prospects of a project, there is almost always an opportunity to buy below the offering price. The next bear market may make some of these tokens better investments. There are definitely some good projects on this list.

Airdrops are not the only reason for the decline in the price of these tokens. Many times, the project will work with market makers to set the valuation of the token too high. Users ruthlessly selling airdropped coins is actually a feedback mechanism to quickly find out that the valuation of the project is not reasonable.

Many people have realized in this cycle that fully diluted valuation (FDV) does matter. Holding airdropped coins means that you believe that there is still enough demand to support its price increase in the face of large unlocking and investors shorting.

Liquidity miners will always sell regardless of price because they just want to take the yield and leave. In theory, the token price should be able to recover from these speculators' exits, but in most cases, the data shows that they do not do so. Of course, some of these tokens still have time to turn around. This is just a random snapshot, and things could change quickly for some altcoins.

People often complain that many airdrops are poorly designed, but based on this data, it seems difficult to design a community airdrop that is harmless to the token in the short and medium term (long-term observation).

Two unexpected airdropped memecoins (with no points program) achieved the highest returns at very low launch prices. Both airdropped coins were designed to help grow different ecosystems (Solana and Farcaster).

We have also seen many examples of memecoin airdrops going to zero in an instant in the past, so you certainly can't simply assume that memecoin airdrops will perform better. Surprise + undervaluation may be a better conclusion.

I actually think points programs are here to stay, as they are a very common feature of web2 and can help create a more interesting, positive, and sticky user experience, but I don’t expect airdrops to continue in the form we’ve seen over the next few years.

Based on this data, projects should consider very carefully the form of their airdrops, or even whether they should even be doing one.

JinseFinance

JinseFinance